Phantom EC applicants, phantom households

Certain housing market figures are puzzling. Let us consider two cases. First, while there are many headlines about the high rate of e-applications for executive condominiums (ECs), the large queue numbers dished out have not translated into many such hybrid private-public homes sold. Second, despite the slowing population growth and low foreigner employment growth, the increase in the number of occupied residential units has far exceeded the number of new households.

Certain housing market figures are puzzling. Let us consider two cases. First, while there are many headlines about the high rate of e-applications for executive condominiums (ECs), the large queue numbers dished out have not translated into many such hybrid private-public homes sold. Second, despite the slowing population growth and low foreigner employment growth, the increase in the number of occupied residential units has far exceeded the number of new households.

PUZZLE 1: PHANTOM APPLICANTS IN NEWLY LAUNCHED ECs

The process of launching an EC begins with a few weeks of product preview and getting prospective buyers to submit their applications online. Before the booking day, developers and property agents helping buyers submit the e-applications diligently check the submissions to ensure that the applicants meet all the eligibility conditions.

It is common to see developers and property agents engage the mainstream and social media to keep the public updated on the number of e-applications received. The market is kept excited about the increasing demand prior to the first day of sales, or the booking day.

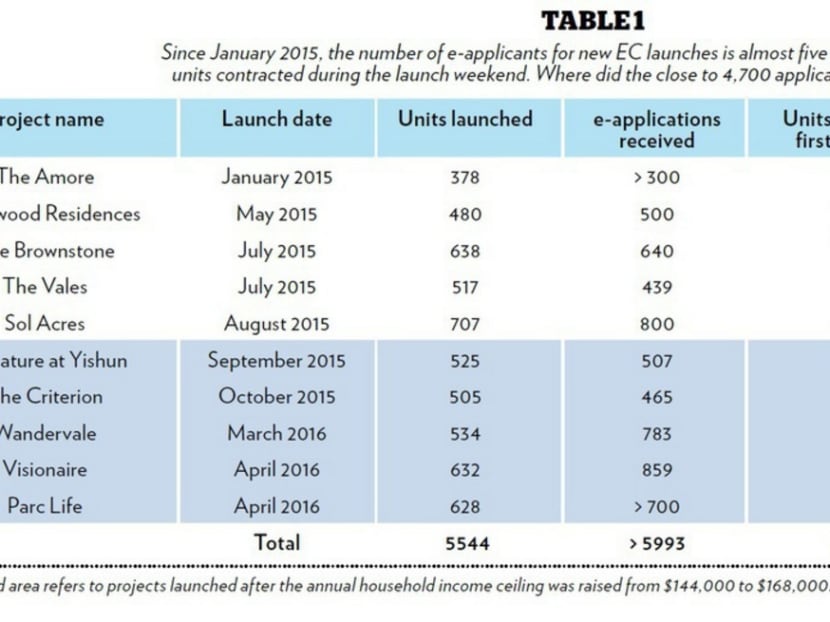

For the 10 EC projects launched since January 2015, a total of 5,544 units available for sale attracted more than 5,993 e-applications, a very healthy over-subscription rate of 10 per cent. However, in the first weekend that the ECs were open for booking, only 24 per cent of the launched units were sold!

What happened to the 84 per cent, or more than 4,683, of the applicants who backed out? Some of these applicants have taken the extra trouble to verify their eligibility, consult with their bankers and submit documents such as proof of income as well as marriage certificates. How many are repeat applicants who submitted applications across several projects? What motivated them to do so?

What about the buyers who had rushed to commit on the booking day? Did their sense of urgency turn into disappointment after they realised that the high e-application numbers did not translate into many sales? I guess the agents and developers of each project are just as befuddled about these phantom applicants. We will not get any answers unless we are able to analyse in detail all the applications submitted for all these 10 projects.

PUZZLE 2: WHO is LIVING IN THESE RESIDENCES?

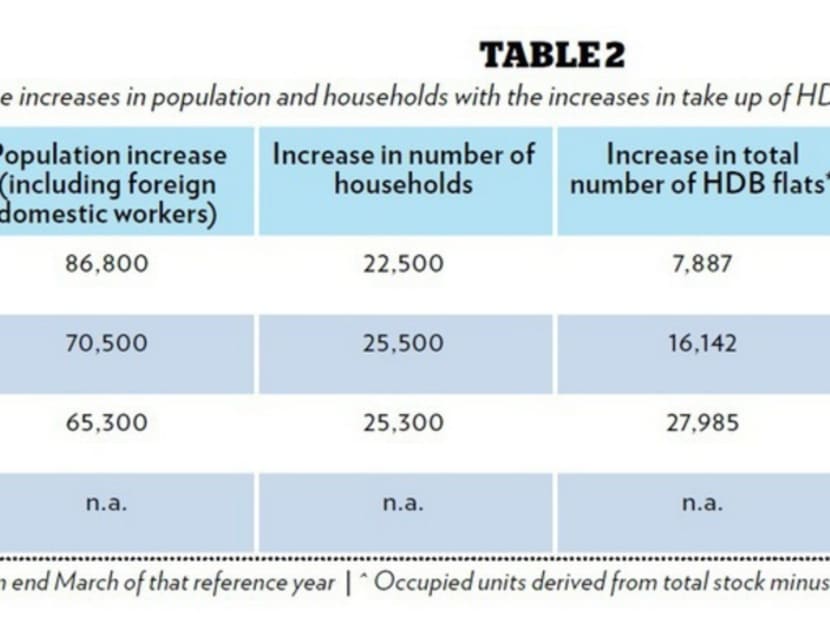

In the 12 months ended June 2013, Singapore had a population growth of 86,800, including foreign domestic workers (who do not need an additional housing unit). That same period saw an increase in 22,500 households, including singles as well as young couples, moving into new HDB flats, ECs and private residences. Newly married couples who continued to stay with their parents also added to the household count.

The increase in population and households was accommodated through an additional 17,654 dwelling units, which included 7,887 HDB flats and an increased take-up of close to 10,000 ECs and private residences.

For 2013, the increase in the number of occupied units seems reasonable when viewed against the population and household growth, since we have yet to account for the full range of accommodation types, such as student hostels, dormitories and serviced apartments. Fluctuations in vacancies are also not accounted for, and I have further assumed that almost all new additions to the stock of HDB flats are occupied, as new HDB flats fall under the required five-year minimum occupation period.

The number of dwelling units occupied jumped by 27,597 in 2014, even as population growth slowed to 70,500 people and the number of resident households increased by 25,500. A bigger jump happened in 2015. The population increased by a smaller amount of 65,300 (including about 9,000 foreign domestic workers) and the number of households grew by 25,300. However, these increases were accommodated by an additional 27,985 HDB flats and close to 20,000 more occupied ECs and private residences.

A total of 47,407 dwelling units to accommodate the population growth of 65,300 and a household growth of 25,300? Pent-up demand from splitting families to spawn new households is already accounted for here. Where are these occupiers coming from? As a property agent helping landlords to secure tenants for their investment apartments, it seems to me that the number of vacant residences is rising rapidly, which is why competition for tenants is very stiff and rentals are dropping.

Furthermore, as reported by the Ministry of Manpower, more foreigners are losing their jobs and leaving Singapore. Given weak job growth, tight foreign worker policies and a focus on restructuring our economy into a “labour-lean” one, the proportion of new housing supply seems to outstrip the potential demand. However, from the third quarter of 2015 to the first quarter of 2016, an additional 14,868 ECs and private residences were occupied.

While having more than 4,683 missing EC applicants may seem odd, the big increase in the number of occupied residences seems bizarre, especially when viewed against a backdrop of weaker population and jobs growth.

ABOUT THE AUTHOR: Ku Swee Yong is a licensed real estate agent and the CEO of property agency Century 21 Singapore. His fourth book “Weathering a Property Downturn” is available in the bookstores.