What heightened long-term competition between US and China means for Asean

US-China relations have now entered a new phase of heightened long-term competition. And this means Asean will need greater agility, unity and resolve than it has shown in recent years to navigate a prolonged period of messiness and uncertainty, said retired diplomat Bilahari Kausikan in a speech on Sunday (Oct 7).

Presidents Donald Trump and Xi Jinping at their first summit in Palm Beach, Florida, in April 2017.The US and China are not natural partners, nor are they inevitable enemies, says Mr Kausikan.

United States-China relations have now entered a new phase of heightened long-term competition. And this means Asean will need greater agility, unity and resolve than it has shown in recent years to navigate a prolonged period of messiness and uncertainty, said retired diplomat Bilahari Kausikan in a keynote address on Sunday (Oct 7) at a regional roundtable on Asean's challenges ahead. Below is the transcript of the speech by the former permanent secretary of the Ministry of Foreign Affairs at the event organised by the Economic Research Institute for Asean and East Asia and the S Rajaratnam School of International Studies.

For almost a decade, the basic strategic issue for the Association of South-east Asean Nations (Asean) has been how to position itself as the United States and China grope towards a new modus vivendi.

This is still the main challenge.

But it is not business as usual.

US-China relations have now entered a new phase of heightened long-term competition. Although competition has always been an inherent part of the relationship, from 1972 to circa 2010, the overall emphasis of US-China relations, despite some tense episodes, was on engagement.

The US and China are not natural partners, nor are they inevitable enemies.

Post-Cold War US-China relations are characterised by deep strategic mistrust coexisting with interdependence of a new and historically unprecedented kind.

The US and China simultaneously cooperated, while competing. Engagement and cooperation will not entirely cease. But the overall emphasis has now clearly shifted to competition.

Lest there was any doubt, Vice-President Pence’s speech on October 4 2018 was a clear and unambiguous signal of the new emphasis.

The most obvious manifestation of the new approach is President Donald Trump’s ‘trade war’.

The term is something of a misnomer. Trade is the instrument; the objective, as the Trump administration’s National Security Strategy (NSS 2017) published in December 2017 and its National Defense Strategy (NDS 2018) published in January 2018 make clear, is strategic competition.

China accuses the US of using trade to hamper and constrain its development. China is not wrong, although it conveniently skirts over its own responsibility.

Most attention has focused on the tit-for-tat imposition of tariffs. This must eventually end, although no one can at present predict when, or at what cost, or with what implications for international order.

But the more significant aspect is new US legislation to limit technology transfers to China: FIRRMA (Foreign Investment Risk Review Modernization Act) and the National Defense Authorisation Act passed with strong bipartisan support in August 2018.

The new legislation defines a new statutory framework for US relations with China. This is not going to be easily changed by successor administrations.

How did the relationship get to this point? Both sides must share responsibility.

The key considerations for both the US and China are domestic.

For both, foreign policy is essentially a domestic tool.

This is not just about Trump the individual. His personality adds to uncertainties in US-China relations.

But the roots of the new US approach are far deeper. They lie in the ideological hubris that contaminated US foreign policy after the Cold War starting with the Clinton administration. After 9/11, hubris led to intractable and interminable wars in the Middle East, the longest in American history.

The wars distracted America, discredited the establishments of both parties, leading to the election of first, Mr Barack Obama, and then Mr Trump.

Both are non-establishment types and symptoms of essentially the same political phenomenon.

Mr Trump is not an aberration that will pass with the next administration.

His approach towards China is a correction to the perceived weakness of his predecessors. The perception that the US had been too accommodating towards China is shared by both parties and by diverse interest groups: the security community, human rights and religious freedom advocates, and, most crucially, American business.

Mr Trump’s core supporters believe that China had stolen their jobs. This is untrue.

Job losses have more profound causes. But the belief is a political fact that neither party can ignore.

Mr Trump’s successor may be less abrasive and more predictable. But the probability is that whoever succeeds Mr Trump will represent, at least in some degree, the same political phenomenon and will take a tough approach towards China.

Mr Trump’s America has often been described as being in retreat. This is a distortion of a more complicated reality.

Neither NSS 2017 or NDS 2018 are isolationist documents. These documents and Vice-President Pence’s speech, make clear that the Trump administration believes that this is an era of great power competition and that it is determined to compete, not withdraw.

They represent a narrower and less generous concept of leadership, a preference for bilateralism over multilateralism, and a return to an old approach of peace through strength. One may well have serious reservations about this concept of leadership and the approach. But they cannot be accurately described as a ‘retreat’.

One may also debate whether the new approach is worth the costs, and the final bill has yet to be presented.

But a clinical appraisal must conclude that Mr Trump has, at least so far, got much of what he said he wanted, both internationally and domestically.

We will have to wait and see how, if at all, US policy evolves after the November mid-term elections, and how the various investigations into the Trump administration play out.

But it would be prudent not to expect major substantive changes.

Workers in the body shop of the Ford plant in Hangzhou, China. A prolonged trade war is likely to fundamentally change supply chains, says Mr Kausikan. Photo: The New York Times.

China misread the implications of the global financial crisis of 2008-2009.

It seems to have begun to believe its own propaganda about America being in irrevocable decline.

Beijing over-generalised its experience of the Obama administration’s reluctance to stress the competitive aspects of US-China relations.

It missed completely the steadily souring mood of US business – historically a stabilising factor in US-China relations -- towards China since the Bush ’43 administration, mainly over intellectual property theft and forced transfers of technology.

Towards the end of the Hu Jintao administration and far more insistently under Xi Jinping, Chinese foreign policy took on a triumphalist tone and a far more ambitious and assertive approach.

The new approach found its apogee in the Belt and Road Initiative (BRI) and Xi Jinping’s October 2017 19th Party Congress speech which clearly abandoned Deng Xiaoping’s approach of ‘hiding light and biding time’.

Global ambition and assertiveness were certainly evident in the speech.

But the focus of the 19th Party Congress speech was in fact domestic. The most important point was Mr Xi’s redefinition of the new ‘principal contradiction’ facing China – the contradiction between “unbalanced and inadequate development and the people’s ever-growing needs for a better life” and consequently, on the imperative of revitalising the Chinese Communist Party (CCP) to meet those needs. This prescribes an extremely complex domestic economic, social and political agenda on which, Mr Xi made clear, depends CCP rule.

The agenda encompasses, among other things, moving industry up the value chain, cutting overcapacity, promoting innovation, protecting the environment, revitalising the rural sector, dealing with debt, promoting balanced regional growth, an aging population, healthcare and social security, social mobility, education, housing, food safety, defusing social tensions, continuing the crackdown on corruption, and expanding what Mr Xi called “orderly political participation”.

Each issue is itself a major challenge.

Furthermore, the 19th Party Congress referred only obliquely to a crucial issue left over from the 18th Party Congress in 2012.

The 18th Party Congress had acknowledged a ‘new normal’ of slower growth, and that the Chinese model responsible for the spectacular growth of the 1990s was unsustainable over the long-run.

The 2013 Plenum that followed the 18th Party Congress set out a reform agenda that envisaged a greater role for the market in key sectors to improve economic efficiencies.

But implementation can only be described as modest.

An enhanced role for the market implies a loosening of control. How to improve economic efficiency without risking CCP control?

Yet without improved efficiency and sustainable growth, CCP rule which legitimates itself primarily by economic performance, could also be jeopardised.

What is the appropriate balance between market and Party?

There is no obvious answer. Yet this is a fundamental – perhaps even existential – question for China because there is no practical alternative to CCP rule.

Maintaining CCP rule is the most vital of all China’s core interests.

Dealing with the domestic agenda set out by the 19th Party Congress will take a long time and require immense resources.

China’s resources, while vast, are not infinite or inexhaustible.

Continually replenishing resources on the scale needed to deal with the issues requires sustainable growth.

Sustaining growth requires a new model. A new model requires a new balance between control and efficiency.

It remains to be seen how Mr Xi will deal with this central question. He will have to manage contradictory considerations.

Mr Xi has tried to reassure private entrepreneurs under pressure from new financial and regulatory controls.

But he has also made clear that state-owned enterprises (SOEs) will continue to enjoy a privileged place in the economy.

Where the balance will finally settle is anyone’s guess.

For now, Mr Xi has clearly opted to place the emphasis on Party control. Socialist rhetoric has crept back into the official lexicon.

Mr Xi’s insistence on stronger Party control may have sharpened the core challenge of finding a new model based on a new balance between control and efficiency.

The BRI is as much an attempt to deal with this key domestic challenge as it is a manifestation of global ambition.

The BRI finesses the challenge by externalising and exporting the Chinese growth model – based on heavy reliance on SOE-led infrastructure investment -- that the 18th Party Congress had already in 2012 recognised was unsustainable within China.

The BRI buys time to find a new balance between the market and the Party but does not in itself prescribe a new model.

The BRI and China’s rise rest on the foundation of post-Cold War, American-led globalisation. Can the BRI succeed if the US and China get into a prolonged trade slugfest or the world turns protectionist?

China was the main beneficiary of post-Cold War globalisation; it may well be the main loser if that order frays because America under the Trump administration no longer embraces an open and generous definition of leadership.

China cannot substitute for US leadership. The idea of the universality of the US political model of liberal democracy was always an illusion.

But American openness and generosity allowed economic variants of the American model to develop around the world and attach themselves to the US.

Post-Mao China is itself an example. The US is no longer prepared to be as open or generous. But an open international order cannot be led on the basis of a still largely closed and essentially mercantilist Chinese model.

It is precisely how and how much more China should open up that Beijing has yet to decide.

None of this should be taken as implying that China will fail. The CCP is an adaptable organization, the latest iteration of political and economic experimentation dating from the late Qing Dynasty in the 19th century.

But Mr Trump’s approach to trade has certainly complicated matters for the CCP and made it more difficult to deal with the domestic agenda outlined earlier.

Responses to the issues will likely be sub-optimal improvisations undertaken in the context of a ‘new normal’ of slower though still respectable growth.

Push-back to the BRI is becoming evident internationally, including in South-east Asia.

No one is going to shun working with China. That would be foolish.

But the implementation of the BRI is going to be problematic and patchy.

Some projects will work better than others, some will stall. Of late, small but significant signs of push-back to Mr Xi’s ambitious vision for China have even emerged within China itself, precipitated by the shock of the trade war which caught Beijing on the back foot.

Mr Xi’s position is not under threat. Still, for now, triumphalist rhetoric has eased, ambition down-played, and an effort has been made to improve the atmospherics of relations with Japan, India, Australia and Asean.

China has retaliated against US tariffs, but its response has not been overly harsh.

But fundamental issues remain unresolved and Mr Xi cannot afford to appear weak. These are only tactical adjustments, not definitive new Chinese positions.

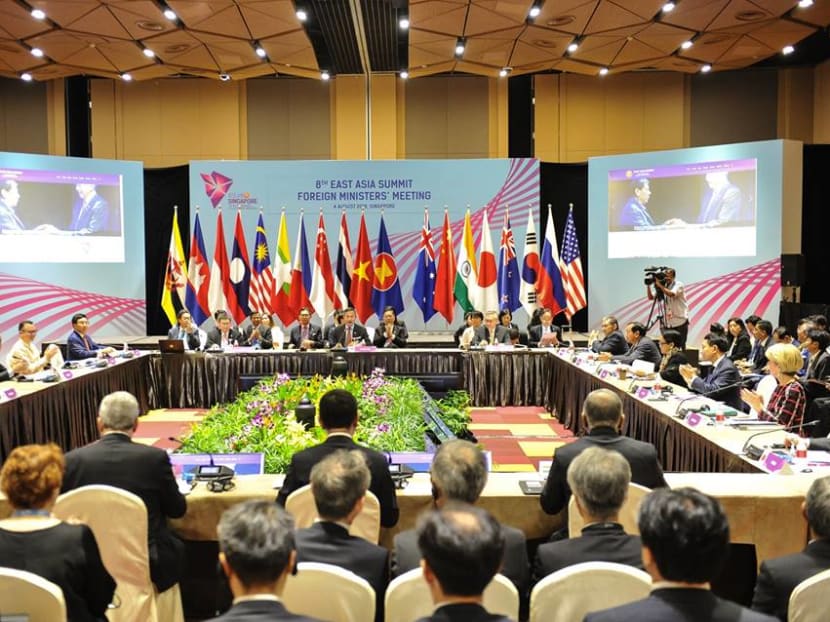

Asean and regional foreign ministers at the recent East Asia Summit Foreign Ministers' Meeting in Singapore. Mr Kausikan says hedging against the long-term uncertainties requires Asean to move boldly on the second phase of economic integration to create a common market and production platform. Photo: Facebook / Asean 2018

On the US side, the belief – not wrong in the short to medium term -- that the trade war is hurting China, gives the Trump administration no incentive to ease the pressures.

The successful renegotiation of the Free Trade Agreement with South Korea, the replacement of North American Free Trade Agreement by the US-Mexico-Canada Agreement which contains a provision that in effect gives the US a veto over its partners’ ability to conclude trade deals with China, and Japan acquiesce to bilateral trade negotiations, reinforce the belief that China is under pressure and risks isolation.

Historically, the period of unquestioned American dominance was exceptional and short: from circa 1989 to circa 2008-2009.

For most of the 20th century, the international system was divided between competing western and communist visions of global order with China a de facto member of the western side from 1972 until the Soviet Union collapsed, leaving Beijing free to assertively pursue its own interests.

We are now in a period of transition to a more historically normal situation of a divided global and regional order and great power competition.

But heightened competition is still something less than a ‘new Cold War’.

That is a misleading metaphor. China is far more integrated into the world economy and interdependent with the US than the Soviet Union ever was.

Herein lies the complexity of the new situation. Much as some in the Trump administration may want to, it will not be easy to ‘decouple’ China unless China decouples itself by pursuing autarchy.

That is very improbable because it would be self-defeating.

The Trump administration has labelled China a ‘revisionist power”.

Elements of revanchism are embedded in the narrative of the ‘Great Rejuvenation’ by which the CCP legitimates its rule.

China is not happy with every aspect of the post-Cold War order based on American-led globalisation. China wants its new status acknowledged.

But China is ambivalent about the current order and not clearly dissatisfied.

To call a China that has greatly benefited from globalisation, ‘revisionist’ is an overstatement. Why should China want to kick over the table? Mr Xi has championed globalisation which can be taken as an indirect expression of concern about what the future of that order may mean for China.

The crucial question is how China will respond to the new pressures. Not responding is not an option for Beijing.

It is now abundantly clear that it is not just a simple matter of China buying more soya-beans or Boeing aircraft from America to ease the trade deficit, as Beijing may have initially thought.

What the Trump administration wants from China is not entirely clear, but will almost certainly require structural changes to the Chinese economy that the CCP was already reluctant to make.

And China has made clear it will not meet US demands under pressure.

China may seek to become more self-sufficient in key areas of technology and probably can do so, given sufficient time.

But the pressures are immediate. Since China imports far less from the US than it exports to the US, the scope for reciprocal imposition of tariffs is limited and may already have been exhausted.

Mr Pence’s speech makes clear that the US is going to act across a broad front and not just on trade.

China will probably respond in kind. But how specifically?

The signals from Beijing are mixed. A visit by Secretary of Defense James Mattis has been cancelled, but not one by Secretary of State Mike Pompeo.

China’s recent White Paper on trade with the US has sought to portray itself as victim, and it has already tried to make common cause with Europe against the Trump administration.

It is not likely to succeed. Europe is unhappy with Trump and his methods, but it has many similar concerns about China.

And Europe cannot deal with a resurgent Russia without the US.

US-China competition in the South China Sea (SCS) has emerged as something of a proxy for US-China competition.

Strategically, the situation in the SCS is a stalemate.

China will not give up its claim to almost the entire SCS. The reclaimed islands and the deployment of military assets on them is a fait accompli.

But neither can China stop the US and its allies operating in, through and over the SCS without risking a war it does not want because it cannot win.

The Trump administration has given the 7th Fleet more latitude to conduct Fonops (freedom of navigation operations) in the SCS.

Japan and other US allies are also beginning to push back against China’s claims. The US has signalled its intention to conduct even larger shows of force in the SCS.

This raises the risk of accidents. Still, that risk does not at present seem unacceptably high.

On September 30 2018, a People's Liberation Army Navy destroyer passed within 45 yards of a US guided missile cruiser conducting a Fonop near the Gaven Reefs and Johnson Reef.

But this is only the second dangerous incident since June 2016 when, after an incident in May 2016, former Pacific Command Commander, Admiral Harry Harris, said that dangerous incidents were in fact rare.

Two incidents in two years does not strike me as the SCS being a tinder-box.

The US and China will not quickly or easily reach a new modus vivendi; neither is likely to get everything they want from each other.

This implies that Asean will have to navigate a prolonged period of more than usual messiness and more than usual uncertainty.

War by design is improbable. China must fight only if the US supports Taiwan independence. This is unlikely.

If an accident should occur in the SCS or elsewhere, both sides will probably try to contain it.

Asean ought to be able to cope with situations short of a US-China war. Asean has managed far more complicated and dangerous circumstances in the past.

But this will require greater agility, unity and resolve than Asean has shown in recent years.

Some analysts have speculated that there may be short to medium term opportunities for Asean if foreign companies shift production out of China into South-east Asia.

This is possible but short-sighted. Shifting production out of China is easier said than done and no one, trade war notwithstanding, will forgo the Chinese market, although new and up-graded investments will probably be postponed.

A prolonged trade war is likely to fundamentally change supply chains. This process could be accelerated if the accusation that China had planted spy microchips in motherboards used by major US companies and the Central Intelligence Agency and Pentagon servers is proved.

Shifts in supply chains could derail or seriously complicate efforts by Asean members to move up the value chain.

Asean members must in any case resist the temptation to act as a back-door into the US for Chinese companies.

Hedging against the long-term uncertainties and taking advantage of whatever opportunities may exist, requires Asean to move boldly on the second phase of economic integration which aims at creating a common market and common production platform in South-east Asia.

Here the key success factors are the domestic politics of Asean member states; that is to say in our own hands and not in the policies of China or the US.