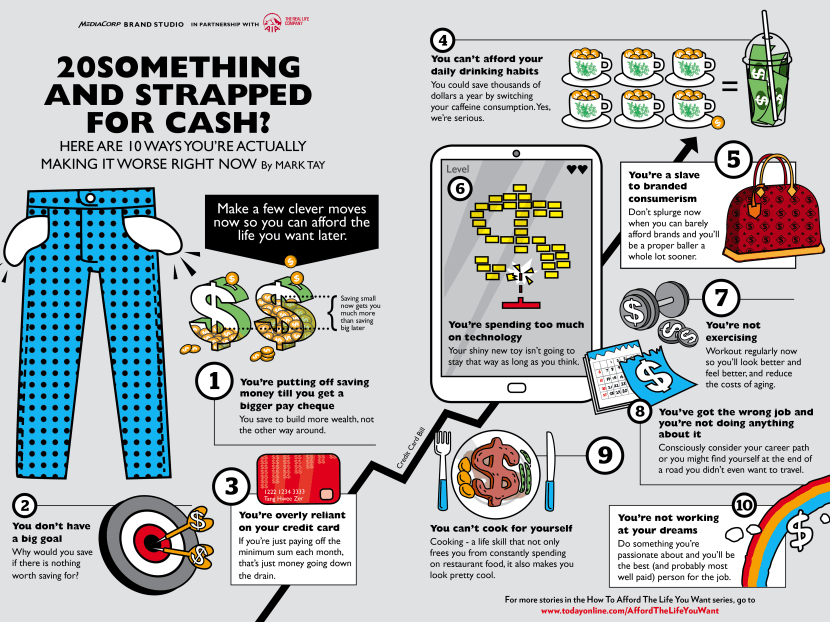

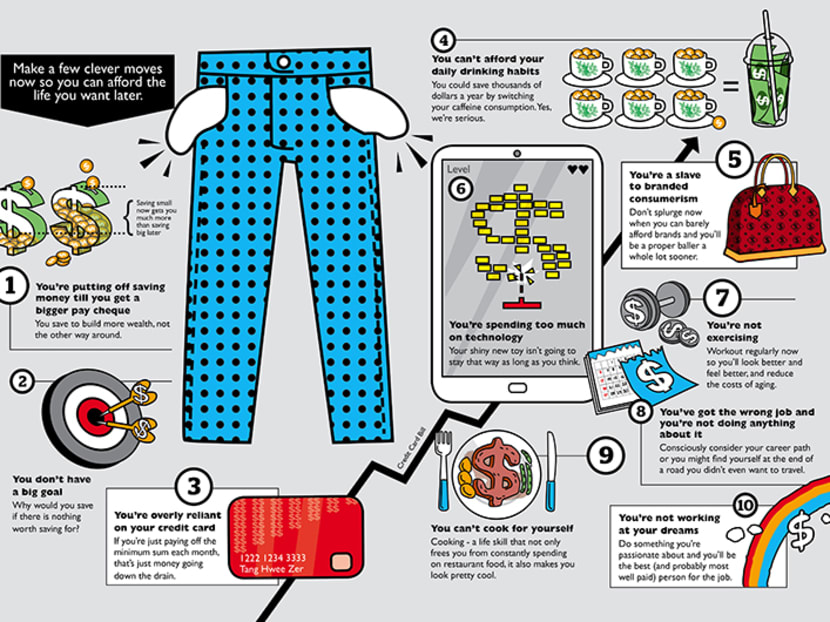

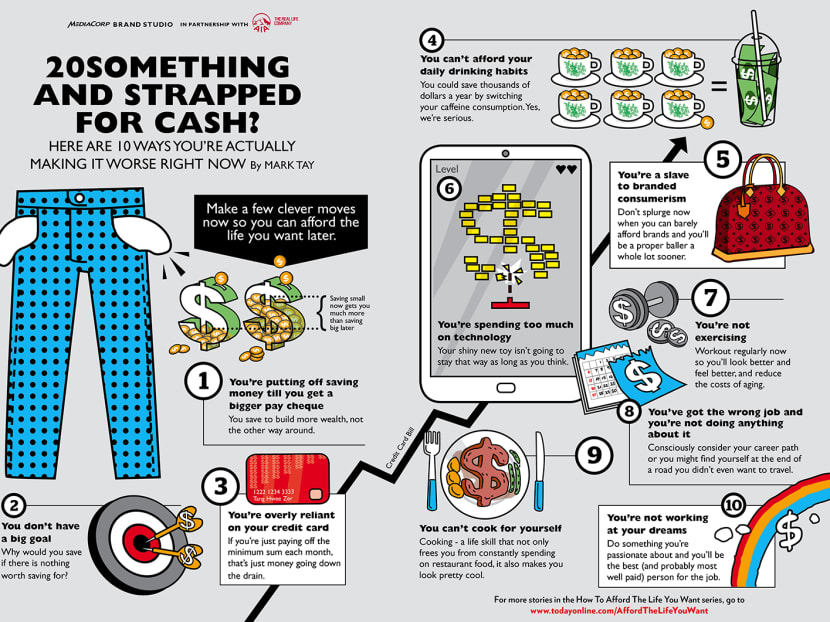

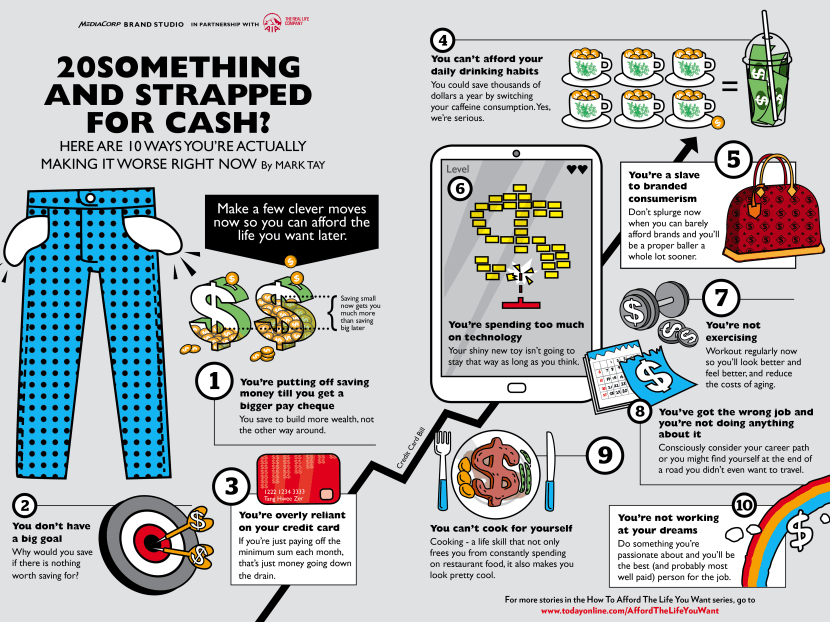

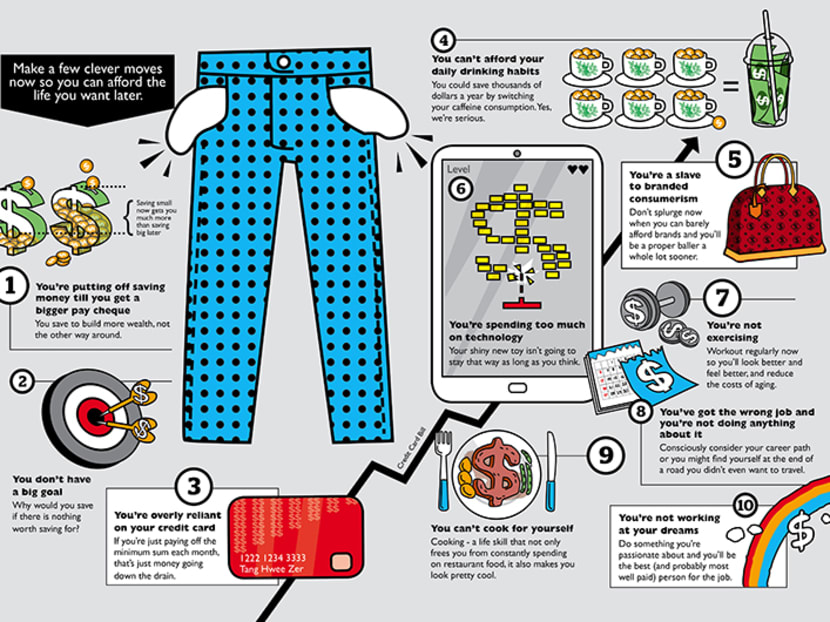

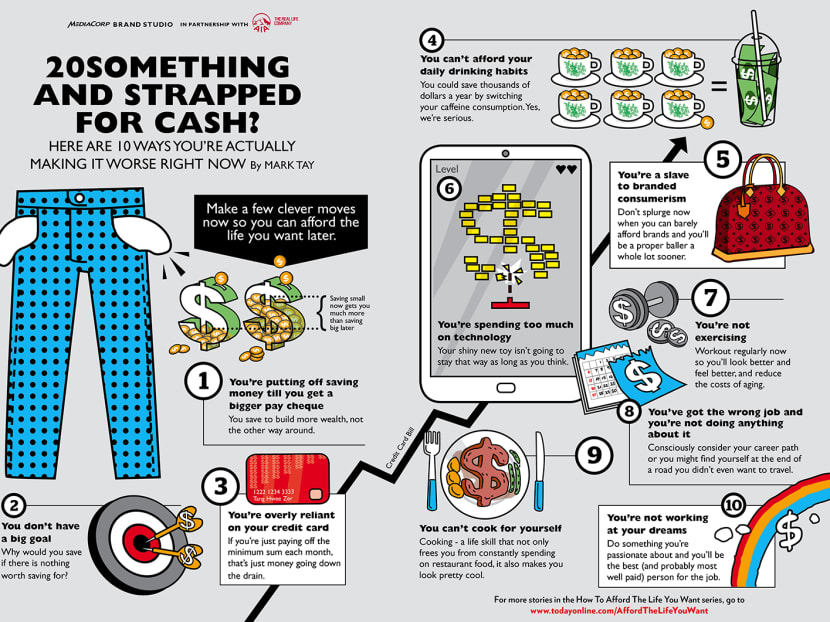

20something and strapped for cash? Here are 10 ways you’re actually making it worse right now

We know it's a hassle to switch browsers but we want your experience with TODAY to be fast, secure and the best it can possibly be.

To continue, upgrade to a supported browser or, for the finest experience, download the mobile app.

Upgraded but still having issues? Contact us