Common errors in estimating housing demand

A common error in estimating housing demand repeatedly surfaces in research reports, news commentaries, property brochures and even academic papers.

HDB flats and resident households

A common error in estimating housing demand repeatedly surfaces in research reports, news commentaries, property brochures and even academic papers.

In the commentary “Predicting the sun will rise in the east” published in TODAY on June 21, 2013, I highlighted the error of taking the 5.3 million total population, divided by the 1.2 million dwelling units — Housing and Development Board (HDB) flats and private homes — to derive an average household size of 4.4. When working on total population data and relating these figures to housing, we need to take into account the number of serviced apartments, hostels and worker dormitories in the total stock for accommodation.

In a similar vein, but coming from the opposite direction, property agents or analysts may say that since the Singapore population increased from 5,399,200 in 2013 to 5,469,700 in 2014, the additional 70,500 people would require 23,500 additional housing units on the assumption of an average household size of three people. This is also erroneous.

Resident households

First, let us discuss the resident population, defined as Singapore Citizens (SCs) and Singapore Permanent Residents (SPRs). A resident household would be defined as a family cluster headed up by an SC or an SPR.

According to the Yearbook of Statistics 2015 released in July, the average size of resident households is 3.43 people in 2014. The total number of single-person resident households increased from 124,400 to 134,800 and two-person resident households increased from 234,100 to 252,200 respectively from 2013 to 2014.

This is good evidence that household sizes are shrinking. Young married couples without children or friends living together contribute to the increase in two-person households. Individuals who prefer to live on their own, as well as empty nesters who have lost their spouses, contribute to the increase in single-person households.

However, the data above does not tell us whether more people are living alone or in pairs under one roof. A five-room HDB flat, for example, may be home to a young couple and their children, living with the grandparents. If these two family clusters do not share the same essential living arrangements and meals, they would be counted as two households.

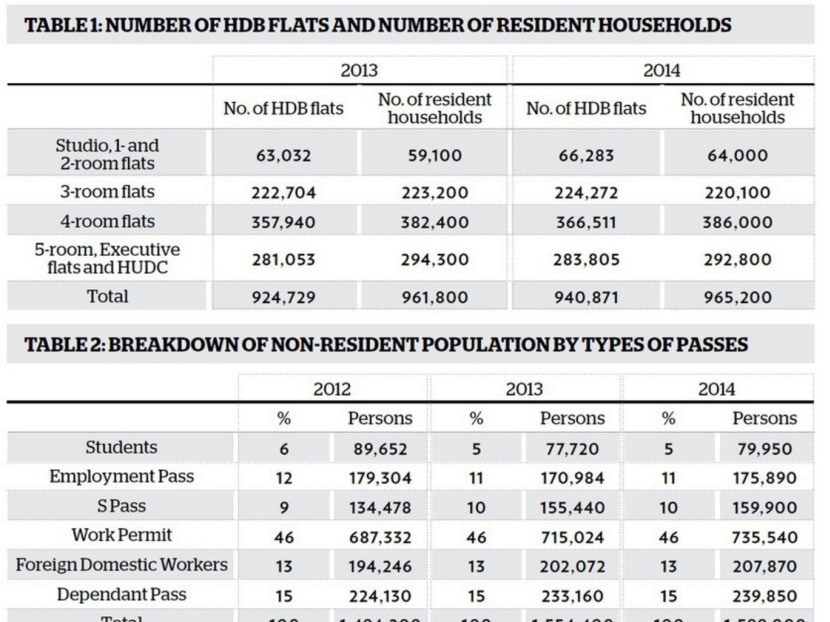

As we can see from the total tally in Table 1, there are more households in Singapore living in HDB flats than there are HDB flat units. Breaking down the numbers further, we see that for four-room and five-room flats, the total number of households exceeds the total number of flats.

On the contrary, the total number of households living in Studio, one-room and two-room flats are fewer than the total number of flats. The reason is because the HDB holds a stock of about 50,000 units of one-room and two-room flats for renting to families who need assistance. From Table 1, we can surmise that the demand for these small rental flats falls just below the total number of available flats. To me, it is positive news if we have fewer households needing assistance for small rental flats.

As at June 30 last year, there were a total of 47,015 HDB flats that were approved for “whole flat subletting”. While a small fraction of these flats may be rented to residents, especially new SPRs who are not eligible to buy resale HDB flats, most are rented out to foreigners. Therefore the total number of HDB flats occupied by 965,200 resident households may be 900,000 units or fewer, way below the 940,871 units of total stock. We can safely conclude that more than 65,000 households are sharing a roof with at least one other household.

As for private non-landed residences, there were 226,687 units of total stock at the end of June last year. Subtract the vacant stock of 18,761 units and we get 207,926 units occupied by 161,800 resident households and foreigner households, the number of which we do not know. There were also 71,311 units of landed properties with 2,507 vacant units at the end of June 2014. Therefore, we had 69,400 resident households and an unknown number of foreigner households living in 68,804 landed properties.

We also do not have data on the number of households living in Executive Condominium (EC) units but we do know that the total stock of ECs was 13,448 units and 1,634 of them were vacant. Regarding the lack of data, we are also not clear about HDB shophouses that come with living quarters on the upper floor.

By now, it is clear that we can’t put the average household size together with the population growth numbers to estimate the number of housing units required. Lacking is “the number of persons living under one roof”.

Non-residents, i.e. foreigners with passes

As for the foreigners in our population, how many housing units are required to house all 1.599 million (see Table 2)? Agents, analysts, academics and commentators have at various times used a simple average of three or four people per dwelling unit to estimate the number of units. This estimate is too far off: A ratio of seven to nine people to one housing unit is probably a better estimate.

Table 2 shows the breakdown of non-residents by the types of passes they hold. The Ministry of Manpower and the Department of Statistics have published the annual total non-resident number and the breakdown by types of passes in percentage terms.

The number of people holding each type of pass is derived from multiplying the total non-resident number by the published percentage figure.

Since the percentage figure is rounded to the nearest integer, instead of a more precise tenth or hundredth of a per cent, the fluctuations in the Students and S Pass categories are more obvious.

We can see that there is an increase of 44,600 foreigners in 2014 and if we erroneously divided it by three, we would assume a requirement of 14,867 dwelling units. If we examine the details of the few categories that contributed to the increase, we would see that Foreign Domestic Workers and Dependant Pass holders do not require additional housing units. We may assign a factor of zero requirement for additional housing units to these two categories.

Most Work Permit (WP) holders in the manufacturing, sanitation, construction, marine and ship building sectors stay in purpose-built workers’ dormitories or temporary dormitories on worksites. WP and S Pass holders, especially those from Johor, may even live in Malaysia and commute to work every day. If WP and S Pass holders do stay in rented HDB flats or private residences, they usually share a unit with more than half a dozen workers.

Similar considerations apply to Student Pass holders, where a fraction may stay in student hostels and homecare services in landed houses and private homes. Some may rent bedrooms in HDB flats and private residences and some may share a single residential unit. A few, mainly those in post-graduate courses, may rent apartments for themselves but, by and large, the number of students who require whole residential units is very small.

That leaves us with Employment Pass (EP) holders. Married couples with one EP each only require one residential unit per couple. Younger EP holders at the lower end of the salary scale from S$4,000 a month might share an apartment. There are also high-flying EP holders with global responsibilities who may choose to stay in hotels or serviced apartments when they visit Singapore. So, for every 100 EP holders in Singapore, perhaps we might need about 50 residential units to house them.

All the categories above, save for Foreign Domestic Workers and Dependant Pass holders, may rent bedrooms in HDB flats, ECs and private residences. However, there is no published data on the total number of rooms rented in Singapore. Furthermore, we do not have data on the number of pass holders who commute daily from Malaysia and Indonesia to work in Singapore, and who do not need any residential units.

Based on the review of each category of pass holders and reading the tea leaves, the increase of 44,600 foreigners in 2014 will probably require an additional 5,000 dwelling units, well below the 14,867 units estimated using the simple average of three people per dwelling unit. What does this all mean?

As I said in the commentary “Enough home supply for up to 2030” published in TODAY on Jan 16, the 10‑year period between 2005 and last year saw our population increase by 1.3 million and the total number of housing units increase by 151,475 units.

This implies that we only require one housing unit for every 8.6 new people in Singapore. Therefore, increasing our population to 6.9 million people from the current 5.47 million (as at June 2014) would require about 166,000 housing units. Perhaps the authorities have overestimated when they say “sufficient land for homes has been set aside for an additional 700,000 homes from today” (Population White Paper, Jan 2013).

According to the Ministry of National Development, the pipeline of residential units that will be completed from 2015 to 2018 is 182,506. Therefore, Singapore has more than sufficient homes for our population growth targets, especially if we take into account the current number of vacant residential units of more than 22,000.

And we have not even considered the competition from more than 300,000 new homes in Iskandar.

Readers should be careful when reading market forecasts related to housing demand versus population growth.

ABOUT THE AUTHOR: Ku Swee Yong is a licensed real estate agent and the CEO of Century 21 Singapore. He recently published his third book “Real Estate Realities – Accommodating the Investment Needs of Today’s Society”.