Swiber wasn't showing signs of distress before implosion: DBS' Gupta

SINGAPORE — Swiber Holdings, the financially troubled Singapore Exchange-listed oilfield services firm, had showed no signs of deep distress before it “imploded” and caught everyone by surprise with its liquidation announcement, DBS’ chief executive Piyush Gupta said on Monday (Aug 8).

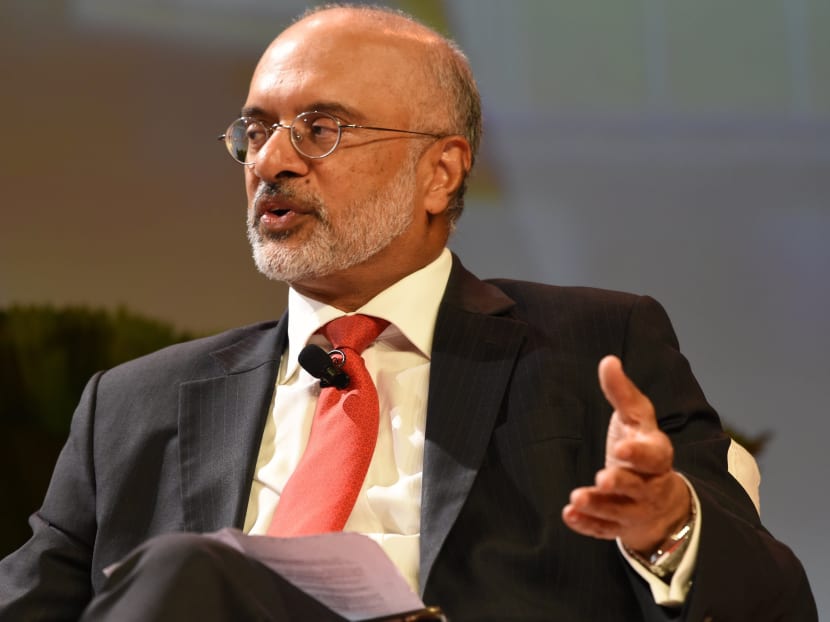

Mr Piyush Gupta, CEO of DBS Group during a conference session at DBS Asia Leadership Dialogue in Singapore on Aug 4, 2016. Photo: AFP

SINGAPORE — Swiber Holdings, the financially troubled Singapore Exchange-listed oilfield services firm, had showed no signs of deep distress before it “imploded” and caught everyone by surprise with its liquidation announcement, DBS’ chief executive Piyush Gupta said on Monday (Aug 8).

DBS’ total exposure to Swiber is S$721 million, of which S$403 million was to finance working capital for two projects. Another S$121 million was for mainly secured term loans and hedging purposes, while the remaining S$197 million was for bond redemptions in June and July.

“The problem is Swiber imploded in six weeks,” said Mr Gupta. “Between the end of May through mid-July, people said you should have known — but none of the indicators were showing.”

“As at the end of June, Swiber had zero overdues with us on any part of the outstanding working loan capital,”

Mr Gupta said, adding that the company was doing well given that it was receiving payments from customers, revenue was growing and was able to win new contracts this year. The two concerns the bank had at the beginning of the year — Swiber’s rising debt-to-equity ratio as well as debt and bonds due for maturity this summer — were also laid to rest as the company made plans to raise equity.

“Based on the fact that they had assets that they could dispose, they could take loans and they had viable plans to raise equity all the way up till April and May, it seemed to us that they would be able to pay their debt for this year and the underlying business growth seemed not to be unreasonable,” said Mr Gupta.

Swiber, which provides construction services to oil and gas firms, filed an application two weeks ago to wind up operations after a US$200 million (S$269 million) payment from UK-based private equity fund AMTC to buy preference shares in a Swiber subsidiary did not come through. It subsequently dropped the application and opted for a judicial management, which allows it to continue operations under court supervision in a bid to turn around its business.