Jack Ma, the former teacher with a petulant streak

Mr Jack Ma may, at first glance, look like a slightly geeky retailer. But in his native China, the 49-year-old founder of the Alibaba Group enjoys the status of a rock star, as the symbol of a generation on the move.

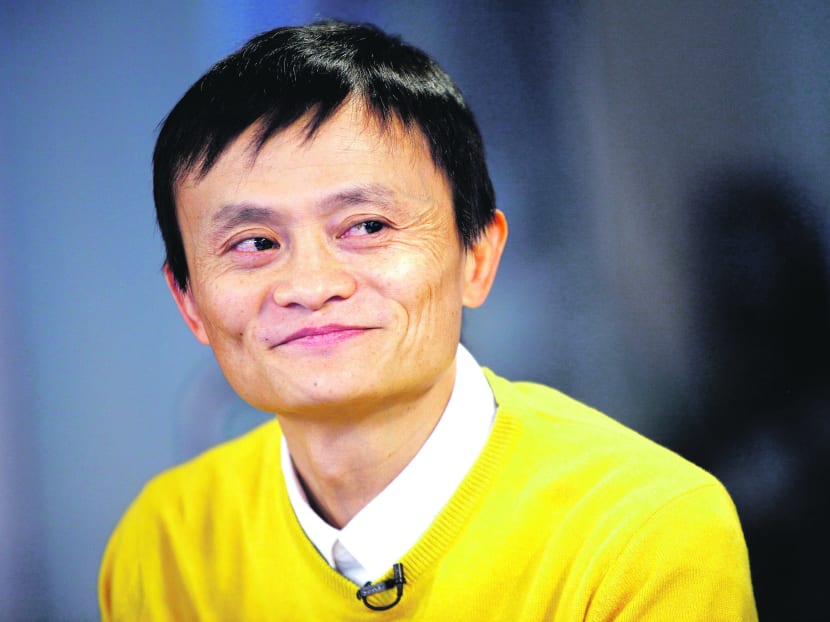

Founder of the Alibaba Group Jack Ma failed university entrance exams twice, but is now seen as the symbol of a generation on the move. Photo: Reuters

Mr Jack Ma may, at first glance, look like a slightly geeky retailer. But in his native China, the 49-year-old founder of the Alibaba Group enjoys the status of a rock star, as the symbol of a generation on the move.

And like many rock stars, Mr Ma is prone to bouts of petulance — something the former English teacher proved again last week when he picked a fight with Hong Kong’s stock-market authorities. The world’s largest e-commerce marketplace wants to sell shares in an initial public offering in Hong Kong that bankers say could raise US$15 billion (S$18.7 billion) and value at up to US$120 billion.

But after Hong Kong regulators refused to agree to its terms, Alibaba quit the stage and started the process of listing in the United States instead.

STUFF OF LEGEND

Despite his diminutive stature, Mr Ma is a huge figure in the world’s biggest Internet market. His rise from language teacher to Internet mogul mirrors the rise of the Chinese Internet; his battles with some of the most powerful names in Silicon Valley have become the stuff of legend.

Analysts say such conflicts could herald a future where China’s Internet giants dominate the world.

Alibaba’s various e-commerce sites account for 60 per cent of parcels delivered in China; just two of its portals handled more sales globally last year than eBay and Amazon combined.

Half of all online payments in China go through its online-payment processor, Alipay.

“People say China hasn’t created a Steve Jobs, but I think they have — I think it’s Jack Ma,” says Mr Paul Gillis of Peking University’s Guanghua School of Management.

“And he doesn’t want to make the same mistake Steve Jobs did, which is to give other people control over his company.”

This is where Mr Ma has run into trouble with the Hong Kong authorities. They do not like Alibaba’s executive partnership shareholding structure.

This gives Mr Ma and a group of 27 other top executives — who together own just over 10 per cent of Alibaba —the perpetual right to nominate who sits on its board.

The regulators say this is against the principle of treating all shareholders equally and violates a market ban on dual-class share structures, which have been used by the likes of Google and Facebook when they went public in the US.

To Alibaba, which fosters the quasi-religious culture seen in some US technology companies, such questioning is seen as an impertinent affront by box-ticking dullards.

A person familiar with the matter says the partnership arrangement came about a few years ago, when senior executives explored the secrets of institutional longevity.

They learnt about the fall of the Roman empire and the founding of the US Congress.

In London, they visited Buckingham Palace and sat on the grass near the Houses of Parliament, devising the structure that is now causing them difficulties.

CROCODILE IN THE YANGTZE

With a creation myth like that, it is unsurprising Mr Ma is annoyed by the inability of regulators to appreciate his vision of transforming Alibaba from “a structured commercial enterprise into an ecosystem-based social enterprise”.

Dissent has never featured highly at the group. If a company president makes a decision Mr Ma does not like, “I will see whether I can tolerate it. And if it’s wrong, well, I think it is stupid and (I) change it,” he told the Financial Times in 2009.

Mr Ma is a formidable adversary for outsiders, as competitors such as eBay, and even partners like Yahoo!, have learnt when they sought to establish themselves in China.

Speaking in 2004, Mr Ma did not mince his words when considering the challenge from Western rivals.

“eBay may be a shark in the ocean, but I am a crocodile in the Yangtze River. If we fight in the ocean, we lose but, if we fight in the river, we win.”

A year later, Yahoo! handed its China operations and US$1 billion over to Alibaba in return for 40 per cent of a combined entity.

In 2006, eBay — the model for Mr Ma’s Taobao e-commerce site — quit China in the face of Alibaba’s superior knowledge of the market and the unwillingness of Chinese customers to pay for online services.

FAILED ENTRANCE EXAMS

A sense of showmanship came early to Mr Ma, who lives a quiet private life with his wife Cathy Zhang, a former Alibaba employee.

He was born in 1964 on the eve of the Cultural Revolution in the eastern city of Hangzhou, and his parents made their living as performers of ping tan — a traditional form of storytelling.

Mr Ma twice failed the tough university entrance exams before finally being accepted by Hangzhou Normal College in 1984.

After graduating in 1988, Mr Ma taught English for five years before setting up a translation agency. This took him on a trip to the US in 1995, when he first came in contact with the Internet.

Back in Hangzhou, Mr Ma set up China Yellow Pages, an online business directory, at a time when state-controlled media were not even allowed to mention the Internet.

He sold that business to a state-owned telecommunications provider and then worked briefly for the Trade Ministry, an experience that gave him contact with the regulators as well as the masters of the Chinese Internet.

In 1999, Mr Ma pooled US$60,000 with 17 friends and founded Alibaba in his flat in Hangzhou, quickly picking up investments from Goldman Sachs and Japan’s SoftBank.

Now worth much more, Alibaba’s history of acrimonious relationships is likely to give international investors pause for thought.

A particular concern will be a restructuring in 2010 to remove the online-payment service from the group, a move Mr Ma insisted was necessary to comply with Chinese regulations, but which led Yahoo! to accuse him of stripping assets.

Mr Ma emerged the victor again last year when Yahoo! finally agreed to sell down its stake and withdraw from the company after the IPO.

Analysts reckon Yahoo!’s eventual profit from the venture could add up to as much as US$20 billion, compared with the US$1 billion it invested in 2005.

With returns like those, most investors will probably be betting that this Yangtze river crocodile will do just fine — even if it has to cross the Pacific and do an IPO in the shark pool of Wall Street.

THE FINANCIAL TIMES LIMITED