Gross says China shares likely to fall up to 6% on Friday

LOS ANGELES — Bill Gross says China’s stock markets are likely to drop 5 per cent to 6 per cent when they open today (Jan 8), after trading was stopped for the second day this week because falling shares tripped a circuit breaker.

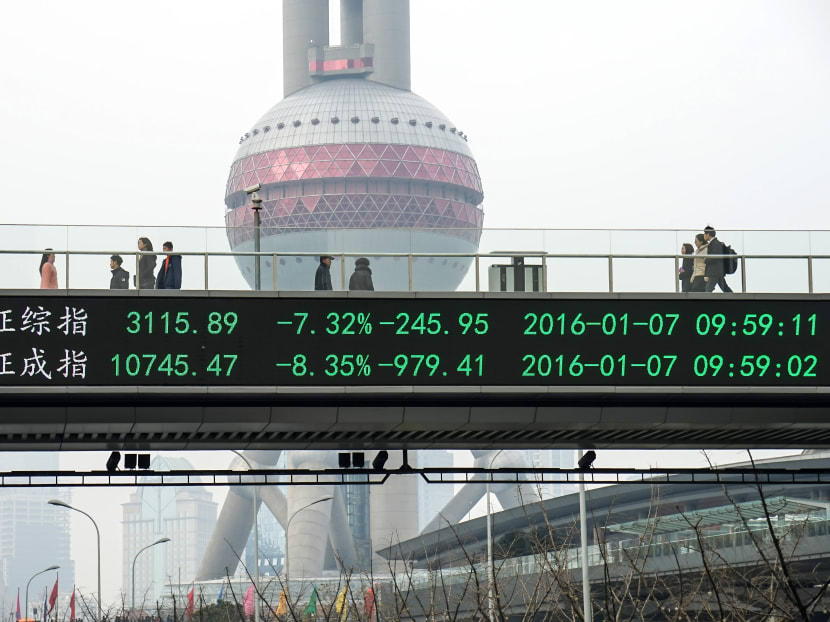

China shares expected to fall today (Jan 8). Photo: AP

LOS ANGELES — Bill Gross says China’s stock markets are likely to drop 5 per cent to 6 per cent when they open today (Jan 8), after trading was stopped for the second day this week because falling shares tripped a circuit breaker.

“Based on the ETF in the United States, China is expected to be down 5 or 6 per cent,” Mr Gross, co-manager of the US$1.3 billion Janus Global Unconstrained Bond Fund, said in an interview on Bloomberg Television with Tom Keene, echoing comments on China’s volatility from Allianz SE’s Mohamed El- Erian. “It depends on whether the Chinese are good to their word. China is an artificial market.”

Chinese regulators suspended a rule that forced local stock exchanges to shut yesterday. The move added to worry that policy makers are struggling with how to contain the months-long turmoil in its financial markets as growth slows for the world’s second-largest economy.

Global stocks headed for their worst start to a year in at least 28 years, with the Dow Jones Industrial Average dropping almost 400 points yesterday, as turmoil emanating from China spread around the world and billionaire George Soros warned that a larger crisis may be brewing. Comments by Mr Soros exacerbated market jitters after he told an economic forum in Sri Lanka that global markets are facing a crisis and investors need to be very cautious.

Central banks, especially in places like China, have been manipulating economies, artificially driving up asset prices and setting up markets for a fall, according to Mr Gross. Investors should probably seek safe havens, such as Treasuries, to ride out the current turmoil, and expect long-term low returns with global economies headed for protracted slow growth, he said.

More Turmoil

Other analysts also expect further turmoil when Chinese markets reopen as investors race to preserve their money and regulators seek stability.

“We should tighten our seat belt,” El-Erian, who is chief economic adviser at Allianz and also a columnist for Bloomberg View, said on Bloomberg TV earlier in the day. “I expect tomorrow is going to be a very volatile day in the Chinese markets, as the retail sector tries to exit and government entities try to buy.”

Pressure to get out of Chinese markets probably is coming from insiders who were prohibited from selling under a ban imposed in July by the China Securities Regulatory Commission, according to Scott Minerd, global chief investment officer at Guggenheim Partners.

“Chinese regulators are likely to extend the ban beyond this week in response to the current selloff,” Minerd, who oversees about US$240 billion, said in an e-mail response to questions. “But as expiring restrictions enable market participants to finally escape unwanted positions, a selloff is inevitable. Until China’s market is free from political interference, these kinds of swings are to be expected.” BLOOMBERG