The Big Read: Trouble ahead for stores as e-shopping bug bites

SINGAPORE — These days, Mr Jonathan Ng, 37, buys just about everything for himself and his household online —from engine oil and LED lights to diapers and baby snacks.

“I don’t really visit the retail shops that often anymore. Of course, I can’t avoid them totally if I need something on the spot. But most of the time, I plan in advance; for instance, I order online a couple of weeks before the baby wipes are going to run out,” said the human resources manager.

He estimates that he saves at least half of what it would cost if he paid for goods and services the traditional way. For instance, he gets his engine oil for US$25 (S$34.60) online and pays another S$30 to a workshop to change the oil. In comparison, a service package at a workshop would set him back about S$128.

On the rare occasion that Mr Ng steps into retail shops, it is usually to check the prices and he would then go online to buy the same items online. “I use the Amazon app that can scan the barcode of the product in Singapore, and it will tell me if it has the item, as well as the price. I can decide on the spot whether to buy it from Amazon,” he said.

Mr Ng is among a fast-growing number of consumers here that have flocked to e-commerce.

The rise of the Internet has disrupted businesses worldwide. The retail sector has not been spared and, in Singapore, traditional retailers have been hit hard. While local retail online start-ups — or blog shops as they are commonly called — are thriving, the e-commerce space is currently dominated by overseas merchants and this could spell trouble for the Republic’s retail sector, and its economy, in the long run.

The issue received an airing earlier this month in Parliament, during the Committee of Supply debate. Minister of State (Trade and Industry) Teo Ser Luck noted how Singapore is lagging behind in e-commerce compared to other Asian territories such as South Korea and Hong Kong. The Government has taken steps to give retailers a stronger push in this area, he said.

Some big-name retailers here have successfully ventured online such as Watson’s, Charles and Keith and Uniqlo. Supermarkets such as NTUC Fairprice and Cold Storage have also built online stores with wide range of offerings, with the latter even launching a mobile app in 2013.

But by and large, hamstrung by licensing issues and worries of cannibalising their physical store sales, major departmental stores here have been slow in adapting to the changing consumer habits and could run the risk of being swallowed up by the e-commerce tide, analysts said.

For example, Robinsons and Takashimaya do not have online stores at all, while Isetan and Tangs offer a limited selection of their products online.

The retail sector is a major contributor to Singapore’s gross domestic product, and the rise of e-commerce have also resulted in more money flowing out of the Republic, and a loss of tax revenue.

Mr Chia Seng Chye, Partner (Tax Services) for Ernst & Young Solutions, said: “In general, overseas online retailers are not taxed in Singapore on their income generated from Singapore consumers. On the other hand, local brick-and-mortar stores and businesses will have to pay income tax on their revenue earned.”

Mr Japnit Singh, senior director at Spire Research and Consulting, noted that of an approximate S$4.5 billion generated in e-commerce revenue here, about 55 per cent involve cross border transactions.

According to the Inland Revenue Authority of Singapore website, goods and services tax (GST) need not be paid for imported items bought online, except for dutiable products, if the cost, and insurance and freight charges amount to S$400 or less. Noting that many consumers would spread out their purchases to avoid paying GST, Mr Singh said: “This is an estimated revenue impact of S$100 million to S$175 Million in 2013, and likely to grow if there is aggressive migration of shoppers online.”

For the consumers, the benefits of online shopping are obvious: Apart from saving on GST, the products bought online are usually cheaper than in brick-and-mortar stores here, due to the relative strength of the Singapore dollar and the lower business costs in other countries, among other factors. Mr Chia said: “All things being equal, there is a greater incentive for consumers to transact with overseas retailers.”

Singapore is not the only country having to deal with the challenges of rising e-commerce, he added. The Organisation for Economic Co-operation and Development (OECD) has identified profits shifting across borders in the digital economy as an area of concern.

The retail sector contributed a fifth of the Republic’s GDP last year, said Mr Ram Sethi, Principal Advisor, Management Consulting (Digital Transformation) at KPMG Singapore. “If the retail sector suffers, Singapore’s GDP will definitely be affected,” he said.

Faced with a triple whammy of a manpower crunch, rising rentals and stiff competition including from e-commerce, traditional retailers here are feeling the heat. Dubai-based Al-Futtaim Group, which manages several big-name retailers, was the first major casualty: It recently announced that the John Little stores in Marina Square and Tiong Bahru Plaza, as well as the Marks & Spencer outlet in The Centrepoint will close this year. In an interview with TODAY earlier this week, Mr Kesri Kapur, the conglomerate’s head of business in Asia, cast doubts on the long-term sustainability of the Singapore retail sector.

Retailers here recognise the impact of e-commerce on their traditional business. However, they cited several stumbling blocks to revamp the business model. Mr Christophe Cann, managing director for Robinsons, described e-commerce as “an inevitable step we will need to eventually take”.

But he pointed out: “Our store is made of different brands from different partners and suppliers. We will need to take calculated and strategic steps when it comes to including e-commerce into our business.” Nevertheless, the company is in talks with the various stakeholders “to see how we can make it happen”, he said.

Mr Sethi said that franchisees cannot afford to “sit back and wait to be told what to do”. “They have big investments in retail space, stock, staff, warehousing and more. This is a lot of financial exposure when you have very little control over brand. They should lead the charge to help the parent company redefine the role they play,” he said.

Ms Jocelyn Teo, assistant vice president of communications for TANGS, said the company started its online store in 2013. By early next year, the selection of items will be expanded, and the online store will be more user-friendly, she said.

On why it did not venture into e-commerce earlier, Ms Teo said: “Our resources were all focused on our store in Orchard Road, where it was undergoing renovations. And brick and mortar is still our focus, but we know that mobile shopping is what customers want now.”

She noted that for some consumers, shopping at malls is a social activity even as they turn to online retailers for “functional shopping”.

The numbers are not looking good for traditional retail stores: Isetan, for example, recently reported a net loss of S$3.1 million last year. In 2013, the company posted a net profit of S$6.5million, down from S$9.6million in 2012. In 2011, it was S$12million.

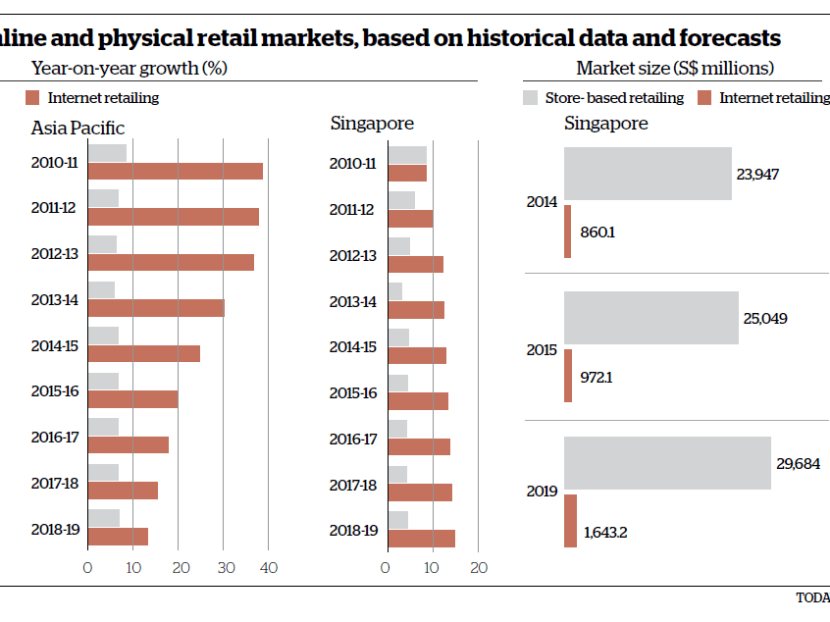

In contrast, e-commerce has been growing steadily. Figures from market intelligence firm Euromonitor showed that in Singapore, the size of the online retail market grew from S$717 million in 2010 to about $1.08 billion last year. Over the same period, online retail market accounted for a growing proportion of the total retail market - from about 2.8 per cent to about 3.4 per cent. In 2019, the e-commerce market here is projected to reach S$2.06 billion, or more than 5 per cent of the total retail market.

But the pace of growth pales in comparison to the region and the rest of the world. In Asia Pacific, Internet retail market is expected to grow 24.9 per cent between last year and this year alone. Worldwide, it is projected to grow 18.4 per cent over the same period.

While the big boys have been struggling to come to grips with e-commerce, local blog shops are thriving. Some have even started brick and mortar stores as they expanded their business. Online apparel store Love & Bravery, for example, was founded in 2008. It opened its first physical store in 2011. It now has three. Ms Joanna Lam, Love & Bravery co-founder, said that while sales have been encouraging at the brick and mortar stores, the online shop is still doing better. “Our main focus has always been online because our base of loyal customers still mainly shops online for the convenience it affords them,” she added.

While it is easy for blog shops to expand and set up physical shops, it does not work the same way for big retailers trying to move into the online space, analysts said.

For one, the big retailers would have to price their products more competitively online, and this would cannibalise their brick and mortar business.

Mr Singh suggested that the stores offer exclusive products online. “This is a strategy commonly followed by smaller retailers who offer products online along with a shop front,” he said. “While retailers would still have to resolve issues regarding supply chain, this should not be too difficult given the geographic size of Singapore and a mature third party logistics provider sector.”

He noted that the large retailers are also tapping on loyalty programs and credit card-linked promotions. Tangs, for instance, allows loyalty points accumulated from its online store, to be used at its Orchard Road store.

A recent survey by CBRE Research found that a majority of shoppers here still value the experience of shopping in brick and mortar stores.

Among about 1,000 respondents, more than half said they most often bought non-food items in retail stores, compared to other methods of shopping.

More than eight in 10 said they visited a physical store at least once a month. In comparison, half said they shopped online at least once a month.

The Singapore survey is part of a larger CBRE Asia Pacific consumer survey where 11,000 consumers in 11 major cities were interviewed about their shopping habits, among other things. The respondents were between 18 and 64 years old.

CBRE said: “The Singapore results indicate that consumers are more comfortable with the traditional shopping format where they can touch and feel the products before purchasing.”

Nevertheless, CBRE said the survey showed that Singapore-based retailers “should not neglect the online space or discount the importance of the physical store”. It added: “It is imperative that retailers offer consumers a multi-channel platform in which shopping online and offline becomes one integrated seamless experience.”

It suggested, for example, that physical stores give customers an option to collect, exchange, or return online purchases and allow them to opt for delivery of an in-store purchase.

SPRING Singapore said it has taken steps to support retail small and medium enterprises (SMEs) in leveraging e-commerce platforms.

Together with the Infocomm Development Authority and other agencies, it is also working with industry partners to create a common platform for integrated warehouse functions, inventory management and order fulfillment capability. “This helps to lower the entry barriers to eCommerce, defray part of the initial outlay for the SME retailers and hopefully, encourage more to come forward to stay competitive,” said SPRING director (lifestyle) Yeo Meow Ling.

Ms Yeo noted that e-commerce offers retailers here to reach out to overseas customers without the high capital investment associated with physical overseas expansion.

On the inertia of big retailers to move into the online space, Mr Singh said: “The larger brick and mortar retailers mostly target recreational shoppers, offering a complete experience where customers also get to socialise, dine and entertain.”

He added: “This differentiates them from the online retailers and will continue to sustain then as long as the shopping experience is maintained. They also see a healthy stream of business from tourists, which again does not compete with the online retail.”

However, with retail revenue from tourists here also being threatened by stiffer competition from cities such as Dubai, Bangkok and Jakarta, retailers are feeling the heat. The rise of budget airlines, the resulting loss of pass-through traffic and the higher cost of shopping here have contributed to Singapore losing its lustre as a top shopping destination.

Mr Sethi said: “The value (which) department stores used to bring to their customers was clear. Customers could gain access to a large variety of goods in a one-stop shopping experience. With technology however, customers can shop anywhere, anytime, at their own convenience and with just their smartphones... Department stores need to ask themselves how they can remain a key part of this new buying behaviour.”