Enhanced benefits proposed for MediShield Life

SINGAPORE — After months of dialogues and discussions, the MediShield Life Review Committee yesterday recommended substantial increases in benefits for the insurance scheme that will cover all Singaporeans for large hospital bills from the end of next year.

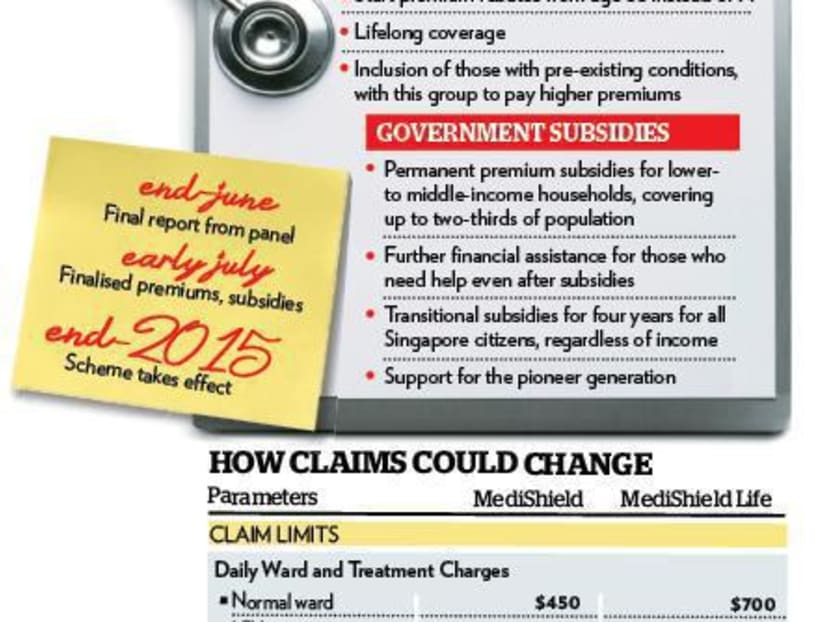

Many of the claim limits will go up: Besides the removal of the S$300,000 lifetime claim limit, the committee recommended higher daily claim limits for normal and intensive-care wards in acute hospitals and for community hospitals.

Outpatient cancer chemotherapy and radiotherapy treatments could also have higher claim limits, as could surgical procedures. Premium rebates will start earlier at the age of 66 if the committee has its way.

Under MediShield Life, nearly six in 10 B2 and C Class patients with large bills exceeding S$10,000 will pay less than S$3,000, in Medisave and cash, from only one in 10 today.

Coverage will also be extended to those aged above 90 or with pre-existing conditions.

Premium details are still being fine-tuned and will probably be released in the panel’s final report at the end of this month. However, premiums for some households could more than double, from indicative examples shown yesterday.

The Government will provide subsidies for the bottom two-thirds of households here, as well as transitional subsidies for the first four years of MediShield Life. The additional 1 per cent in Medisave contributions by employers from next year will also be sufficient to cover premium increases for most people, the committee said yesterday.

Trade-offs in deriving a balance between enhanced benefits and affordable premiums were the subject of intense discussion, committee chairman Bobby Chin revealed.

After deliberation, the recommendation was made to raise claim limits and reduce co-insurance rates, as well as leave deductibles — the amount patients have to pay before insurance kicks in — untouched.

All three elements have significant impact on premium levels, said Mr Chin. Many people said they preferred to protect themselves against very large bills, which would be addressed by lower co-insurance and higher claim limits.

They also preferred to pay lower premiums on a regular basis, rather than lower deductibles, which would be felt only if they are hospitalised.

Asked why there were no premium rebates recommended for those who maintain good health, Mr Chin said this would result in higher premiums. The committee also did not want people to forgo necessary medical treatment just to get a no-claim bonus. “We want to encourage good lifestyles… but not through the MediShield framework,” said Mr Chin.

For those with pre-existing conditions, the committee is recommending that they pay 30 per cent more in premiums for 10 years. Other policyholders will pay no more than 3 per cent from current premiums for the purpose of bringing those with pre-existing conditions into MediShield Life. The Government will bear the bulk of costs of universal coverage.

Another reason for higher premiums is the need to pay more while one is still working to keep premiums affordable in old age.

Mr Chin said his committee would make some observations on portable medical benefits and Integrated Shield plans — private insurance offering benefits in addition to MediShield — in the final report.

The Ministry of Health said it would finalise government subsidies and provide details at a later date. It will ensure Medisave withdrawal limits are sufficient for all MediShield Life premiums.

Healthcare policy expert Phua Kai Hong of the Lee Kuan Yew School of Public Policy said the higher-middle-income households, especially those with younger grandparents, could be concerned about the increase in premiums as they could receive a lower level of subsidies.

Dr Jeremy Lim, partner and head of Asia Pacific Region, Health & Life Sciences at Oliver Wyman, said although the percentage rise in premiums is large, the public should not be unduly alarmed if the increases are justified. “For those of us unfortunate enough to be hospitalised or need healthcare, we know the out-of-pocket will be smaller because of improved benefits,” he said.

Mrs Lee Siu Hong, an exam lecturer in her 50s, welcomed the recommended changes. “When you want an upgrade, you have to be prepared to pay for it,” she said of the increasing premiums. “We should look at the long-term effect instead of worrying about what we have to pay now, and I think we’ll be fine.” ADDITIONAL REPORTING BY KOK XING HUI AND JORDAN SKADIANG