Govt will seek to ensure no one is left behind in cashless drive

SINGAPORE — In a bid to create a cashless society as part of the Smart Nation vision, the Government will study ways to make the process inclusive so that some segments of the population, such as the lower-income and the elderly, are not left out.

SINGAPORE — In a bid to create a cashless society as part of the Smart Nation vision, the Government will study ways to make the process inclusive so that some segments of the population, such as the lower-income and the elderly, are not left out.

The Government will assess what barriers are present and address them in a way that “doesn’t stereotype, automatically exclude and make the assumption that people cannot get on board”, said Minister-in-charge of the Government Technology Agency Janil Puthucheary.

His comments Sunday (Aug 27) came in reply to reporters’ questions on whether some groups might fall behind in the electronic payment drive.

Some experts have noted that those in low-income households might not even have bank accounts, while there are elderly people who use cash as their sole mode of payment.

Speaking Sunday on the sidelines of an event that encouraged students to make use of cashless transactions, Dr Puthucheary said: “We should take the assumption that if we get it right, we do it right, everybody can get on board.”

At the National Day Rally, Prime Minister Lee Hsien Loong highlighted that the Republic trailed behind other cities, including those in China, when it came to e-payments.

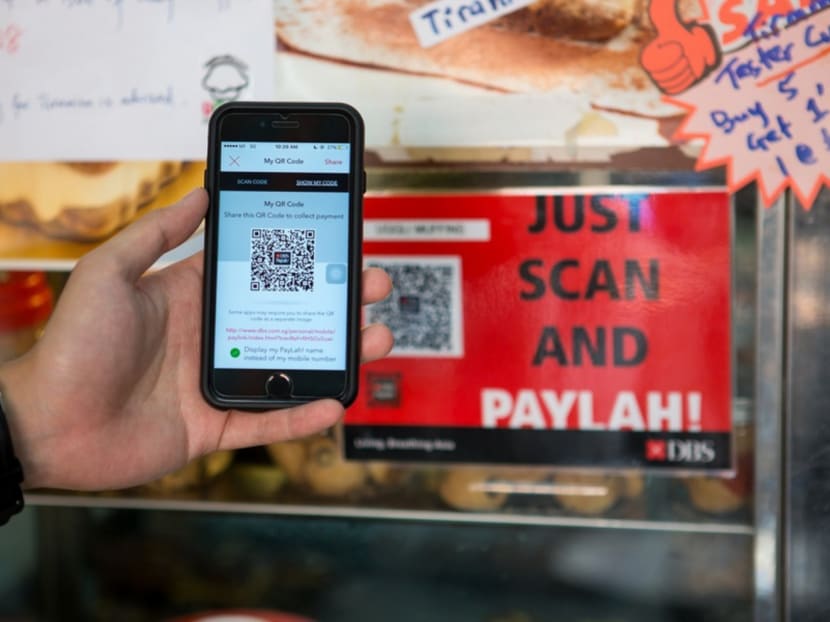

He noted that credit cards and cash have become a rare sight in those places, with the favoured payment modes instead being WeChat Pay and Alipay. Payment through the apps, which are linked to bank accounts, can be made by using a smartphone and scanning a QR code.

The Singapore authorities have since announced that they are looking to introduce cashless payments on a large scale at hawker centres, coffee shops and other heartland businesses.

The Land Transport Authority (LTA) and TransitLink had also announced previously that transactions on public transport would go cashless by 2020.

When asked how the process can be made more inclusive, Dr Puthucheary said the “presumption that the lower-income automatically are unable to go cashless isn’t necessarily correct”.

“You don’t need more money to go cashless. It’s the same transactions that you’re doing anyway and (is about) how to transfer that to a cashless environment,” he added.

The Government is working to ensure that the process is made “cheaper, easier and more convenient” so that those groups will be included.

This would involve collaborating with the private sector to look at issues involving the design of products, delivery of services as well as the underlying infrastructure.

“For example, if you’re going to go with connected solutions, you need connectivity, mobile phone signals. If you’re going to go with wired, you need high-speed broadband,” he said.

The event Sunday was Republic Polytechnic’s Digital Business Challenge, in which participating secondary school students had to incorporate cashless transactions as part of the social entrepreneurship competition, in line with the nation’s push to go cashless.

Now into its 11th edition, the competition, previously known as the National Pushcart Challenge, has been renamed to recognise the growth of e-commerce.

Paya Lebar Methodist Girls’ School (Secondary) student Nur Qistina Puteri Mohamed Zali, 15, was among some 150 students who put on their entrepreneurial caps to come up with business ideas and raise funds for social enterprises.

The Secondary Three student and her schoolmates had sourced electronic items from Chinese online shopping platform Taobao to create music boxes, for instance.

Other items on sale at the students’ booth included coasters which were handmade using leftover wood from their design and technology classes. They raised more than S$1,000 in sales for Deaf ArtsCraftsy, which sells handiwork made by the deaf community.

“The world is changing because of technology. So we’ve to keep up with trends such as e-commerce and cashless payments. If not, we’ll be left behind and lose out,” said Nur Qistina.