HDB resale: Parties must agree on price before valuation

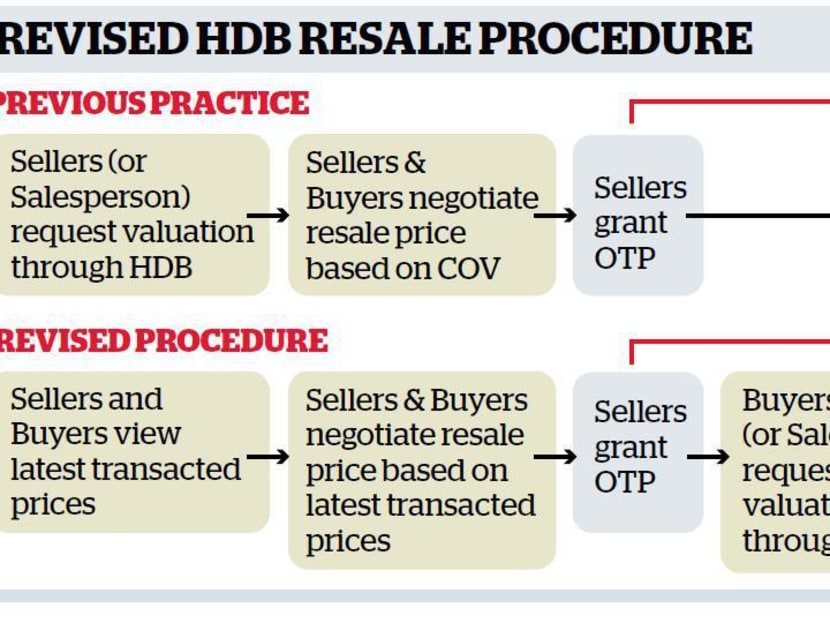

SINGAPORE — With effect from yesterday, buyers and sellers of Housing and Development Board (HDB) resale flats will have to agree on a price before getting an official valuation, in contrast to the previous long-standing practice where negotiations were determined by a unit’s valuation report and how much a buyer was willing to pay above valuation.

SINGAPORE — With effect from yesterday, buyers and sellers of Housing and Development Board (HDB) resale flats will have to agree on a price before getting an official valuation, in contrast to the previous long-standing practice where negotiations were determined by a unit’s valuation report and how much a buyer was willing to pay above valuation.

Analysts described the move, which was announced by National Development Minister Khaw Boon Wan yesterday, as a step towards preventing HDB resale prices from spiralling upwards during a property bull run.

Until recently, when cash-over-valuation (COV) premiums started to fall, there had been calls for the Government to scrap the practice where sellers obtain a valuation report for their flats and use it as a base price to negotiate with buyers on the final amount which the latter is prepared to pay above the valuation. But Mr Khaw had previously pointed out that COV is a decision made between buyer and seller, and scrapping it would only lead to “under-the-counter” deals.

Nevertheless, “with COVs hitting zero or negative, now is a good time to make the adjustment”, Mr Khaw said yesterday during the Ministry of National Development’s (MND) Committee of Supply debate.

Median COV premiums have been falling in recent months. Last month, more than a third of resale transactions were priced below valuation, he said. The property market is at a turning point and there have been opposing views on whether cooling measures should be withdrawn, he noted. “While we have re-tilted the balance between buyers and sellers, we are not yet at the optimal state. We will continue to watch the market closely.”

Under the new process, the HDB will only accept valuation requests from resale flat buyers or their appointed salesperson after the buyers have been granted an Option to Purchase (OTP) by flat sellers. Buyers will then have 21 days, instead of 14 days, to exercise the OTP. The changes will apply to all buyers who were granted the OTP after 5pm yesterday.

The HDB will publish daily prices of resale transactions as soon as they are registered, instead of fortnightly after the resale transactions are approved. This will allow flat buyers and sellers to negotiate based on recent transaction prices and reduce the focus on COV in negotiation, the MND said. “This will improve the long-term stability of the resale market,” it said.

Mr Khaw said the new process — which is in line with the practice in the private property market — would restore the original intention of valuation, which is to help buyers obtain a housing loan. While sellers could still demand a premium — above the recent transacted prices — analysts noted that buyers would now command greater bargaining power. Mr Nicholas Mak, Executive Director for Research and Consultancy at property firm SLP International, said that previously, in periods when COVs were high, sellers and buyers would adjust their COV expectations upwards, which further reinforced the upward price spiral.

Propnex Realty CEO Mohamed Ismail added: “Buyers will become more cautious about their offer price as they enter into a purchase without an indication of how much the property is worth.” Pointing out that buyers in the private property market could get an indicative valuation from banks before entering into an OTP, he warned that a buyer could be required to pay more cash than expected if the agreed price is higher than the valuation price.

Civil servant Jasmine Li, 25, who is looking to buy a resale flat with her fiance, said she would not be comfortable agreeing on a price based on recent transaction data, which could fluctuate due to government cooling measures, for example. It would be helpful if there were some indicative valuation she could refer to, she said.

But Mr Colin Tan, Head of Research and Consultancy at Suntec Real Estate Consultants, pointed out that all parties in a transaction would take into consideration the same attributes of a resale flat and thus the agreed price and valuation price would not be vastly different. Typically, the difference should not be more than 15 per cent higher or lower, he estimated. “Now that the prices are updated daily ... the valuers have more up-to-date data to work with and this should mitigate any gap in the price and valuation,” he said.