MediShield Life panel details premiums, assures affordability

SINGAPORE — The MediShield Life Review Committee has revealed, in its final report, details of the increased premiums Singaporeans will have to pay under the Republic’s new mandatory national insurance scheme, with the committee assuring that premiums will be “affordable” with the help of government subsidies.

SINGAPORE — The MediShield Life Review Committee has revealed, in its final report, details of the increased premiums Singaporeans will have to pay under the Republic’s new mandatory national insurance scheme, with the committee assuring that premiums will be “affordable” with the help of government subsidies.

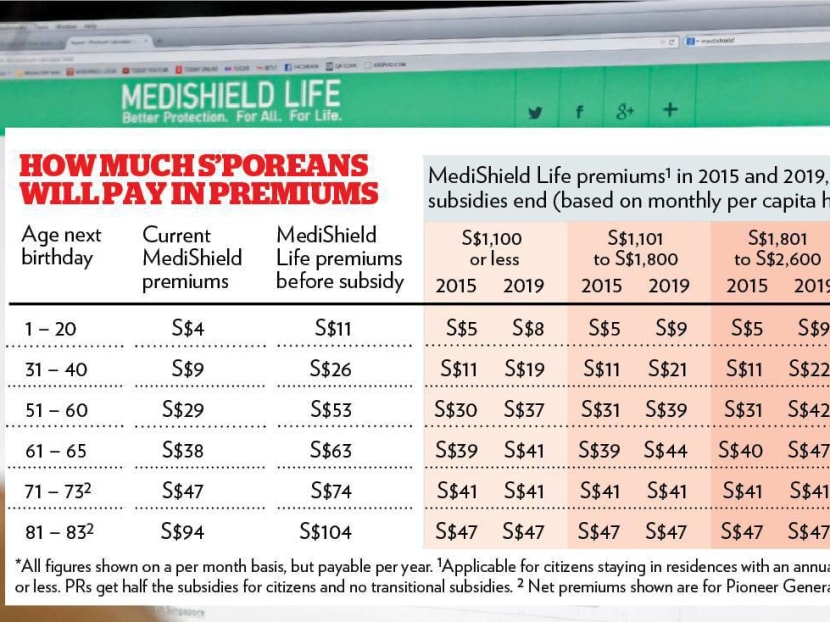

Younger Singaporeans are set to pay almost three times as much in premiums as they do now, in line with the committee’s recommendations to distribute premiums such that people pay more during their working age and premiums rise less in their old age.

This means a lower-middle-income Singaporean aged 31 to 40 who currently pays S$105 a year for MediShield will pay S$310 a year, before permanent and transitional subsidies to be provided by the Government to the tune of S$4 billion over five years. With the permanent and transitional subsidies, the said person will pay S$134 in the first year of MediShield Life.

Older Singaporeans will see premiums rise by a smaller scale. For example, a Singaporean aged 66 to 70 who currently pays S$540 a year in premiums will pay S$815.

If he is in the lower-middle income group, his premium in the first year will be S$546.

The premiums, which were determined by the committee and the Ministry of Health and its actuarial adviser, take into account enhanced protection and benefits — announced earlier this month — and the cost of bringing everyone onto MediShield Life, which will be implemented at the end of next year.

The permanent premium subsidies — available to two-thirds of Singapore households — will be available for both Singaporeans and permanent residents, with PRs to get 50 per cent of the subsidy rates for Singaporeans. Transitional subsidies, which will ease the shift to higher premiums over four years, are available to Singaporeans only, regardless of their income.

Earlier this month, the committee announced its recommendation for enhancing MediShield Life benefits, with increased claim limits for hospital stays and various treatments, and coverage extended to those aged above 90 or with pre-existing conditions.

Yesterday, the Ministry of Health (MOH) said the Government had accepted all the committee’s recommendations on the design of the scheme and would debate it in Parliament next month. In an interview with the Singapore media on his trip to the United States, Prime Minister Lee Hsien Loong commended the committee for its work on the “complex proposal”.

The premiums, he noted, are affordable and payable by Medisave. “I think that is a design feature that we will maintain so, over time, as costs change, as premiums change, we will make sure it can be paid out of Medisave and, therefore, affordability should never be an issue,” he said.

The MOH said it would ensure Medisave withdrawal limits could continue to cover the premiums, while the additional 1 per cent employer’s Medisave contribution that will take effect from next year is expected to cover increases for most households.

Premiums, which are subject to further hikes due to factors such as healthcare inflation costs, are also expected to remain unchanged for at least five years, the committee said yesterday at a media briefing. Currently, they are reviewed every three to five years.

Mr Bobby Chin, chairman of the committee, noted that for the pioneer generation, premiums would actually be lower than what they pay now. The expected higher claims arising from those with pre-existing conditions and the enhanced benefits and raised claim limits would “logically” lead to a higher loss ratio — the ratio of claims to premiums — than that currently, he said.

The current MediShield scheme has reserves of more than a billion dollars and a medical loss ratio of 63 per cent, which some have said should be higher to assume more healthcare costs.

Even with the higher ratio, Mr Chin said the scheme would still be sustainable as all parameters had been given to the actuarialist and the ministry for calculation of the premiums. The committee noted that MediShield Life would also need to set aside reserves and other provisions to meet its current and future expected liabilities.

With the scheme now mandatory, the Government should consider “suitable” enforcement measures and penalties for those who “wilfully default” on premiums, the committee said, adding that other nations with universal insurance schemes have such frameworks.