16% increase in business deals inked at Airshow

SINGAPORE — This year’s Singapore Airshow saw 51 business deals inked — a 16 per cent increase from its last edition in 2014 — with a growing proportion of these contracts involving aircraft leasing companies and low-cost carriers. However, given the low fuel prices, analysts are expecting fewer aircraft orders this year, where the big money deals usually are.

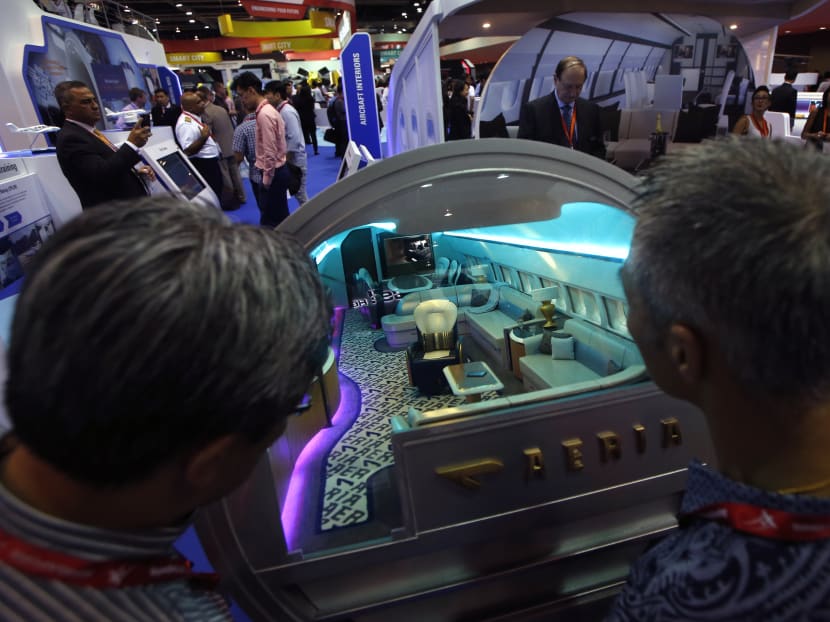

Visitors look into a mock up of a luxury cabin interior on display during the Singapore Airshow at Changi Exhibition Centre, Feb 17, 2016. Photo: Reuters

SINGAPORE — This year’s Singapore Airshow saw 51 business deals inked — a 16 per cent increase from its last edition in 2014 — with a growing proportion of these contracts involving aircraft leasing companies and low-cost carriers. However, given the low fuel prices, analysts are expecting fewer aircraft orders this year, where the big money deals usually are.

The total value of the deals signed at the air show was not disclosed, but 11 of these deals — comprising five for aircraft and two each for maintenance, repair and overhaul (MRO) services, engines, and defence-related acquisitions — raked in US$12.7 billion (S$17.9 billion) in total.

Nearly half (18) of the 40 deals, whose values were undisclosed, were for aerospace MRO services. The remaining include nine for aircraft, nine technology acquisitions, two defence-related acquisitions and two engine contracts.

In contrast, in the previous edition of the biennial air show in 2014, the 20 deals — out of a total of 44 inked — where the values were disclosed, involved a record US$32 billion.

Speaking to reporters on Friday (Feb 19) as the trade element of the six-day show drew to a close, managing director of show organiser Experia Events Leck Chet Lam noted industry big guns’ confidence in the aviation industry of the Asia-Pacific region, even as some analysts see lower fuel prices as a stumbling block.

Mr David Stewart, vice-president of consulting firm ICF International, said the order books were full in tandem with high fuel prices previously, as parties were looking to acquire more fuel-efficient planes.

“Now the fuel price is low, so some airlines will keep their older planes longer and therefore do not need the new. It’s a quiet time for all of us,” he said.

Centre for Asia Pacific Aviation chief analyst Brendan Sobie predicts fewer new aircraft orders this year, as airlines are still absorbing orders placed over the past five years.

Nevertheless, American plane-maker Boeing expects demand for 3,750 new airplanes valued at US$550 billion over the next two decades, as South-east Asia’s air traffic continues to see some 6.5 per cent growth per annum. Its European rival Airbus forecasts demand for 12,810 new planes valued at US$2 trillion over the same time period for the larger Asia-Pacific region, representing 40 per cent of predicted global demand.

Embraer, which specialises in manufacturing smaller aircraft, will deliver 1,570 new 70 to 130-seater jets over the next 20 years, representing a quarter of the global demand for this market segment.

This year’s air show also saw a turnout of 44,000 trade visitors in the first three days, up 10 per cent from 2014. The event also saw a nearly 5 per cent increase in the number of VIP delegations.

More than 1,000 exhibitors from 50 countries participated in this year’s show — the largest edition to date. Of these, 70 per cent have made reservations to return in 2018, said Mr Leck.

Indonesian airline servicing firm GMF AeroAsia and Russia’s United Aircraft Corporation, are among those looking to increase their presence at the next show. Eight memoranda of understanding were signed this year, up from two in 2014.

Giving a glimpse into the next edition of the air show, Mr Leck said emerging technologies such as virtual reality and augmented reality, and capabilities of Asian countries will be among the key focuses.