Why are consumers who go cashless penalised?

I refer to the recent reports on the drive to go cashless when paying public transport fares, and the push for e-payments.

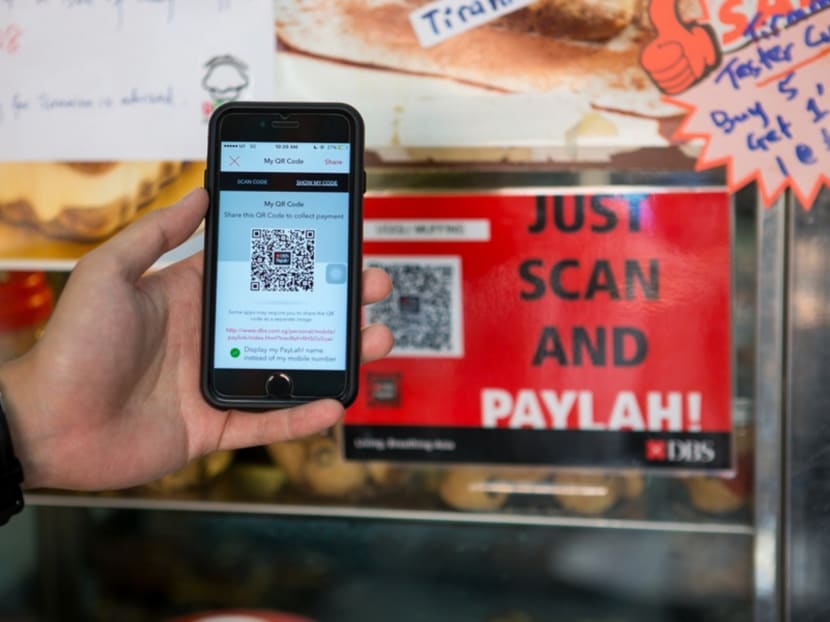

A TODAY reader says that in the face of Singapore's drive to be a cashless society, it is counterproductive to impose extra charges on consumers who support cashless payments. Photo: DBS

I refer to the recent reports on the drive to go cashless when paying public transport fares, and the push for e-payments.

This topic was also addressed by Prime Minister Lee Hsien Loong at the National Day Rally on Sunday, where he talked about the developments of cashless payments within key cities in China.

However, as we work towards making cashless payments a reality, we have to take a look at this issue: Commuters who support cashless payments are being penalised, even now.

For instance, if you opt for EZ-Reload services — which allows one to link an ez-link fare card to a credit or debit card, or bank account for cash top-ups — there is a 15- to 25-cent charge for each transaction.

Making payment by a cashless mode on taxis comes with service charges ranging from 30 cents to 10 per cent of the fare.

I have always found this bewildering, since such extra charges deter commuters from using such services more and supporting the nation’s push towards becoming a cashless society.

Nets, the first cashless payment network in Singapore used by retailers, was launched in 1985 — 32 years ago. At that time, I believe Singapore was among the very early adopters of such forms of payments.

Despite the very early lead, we are nowhere close to becoming a cashless society.

There are still many small businesses here that either do not offer cashless options or impose a minimum spending sum as a condition to accepting cashless payments, even for Nets. There are even some retailers who blatantly impose surcharges.

It has been reported that in some major cities in China, a cashless day out is already a way of life, where consumers may make payments, even at stalls selling street food, through QR codes and smartphones.

Considering that China opened itself up to rapid development after us, we pale in comparison in our efforts to be a cashless society.