US maps 1MDB fraud trail from Kuala Lumpur to Hollywood

NEW YORK/WASHINGTON — More than US$3.5 billion (S$4.75 billion) travelled a trail of fraud from Malaysia through a web of shell companies, with some fuelling a spending binge on Monet paintings and luxury real estate and at least US$700 million flowing back into accounts controlled by Malaysia’s prime minister.

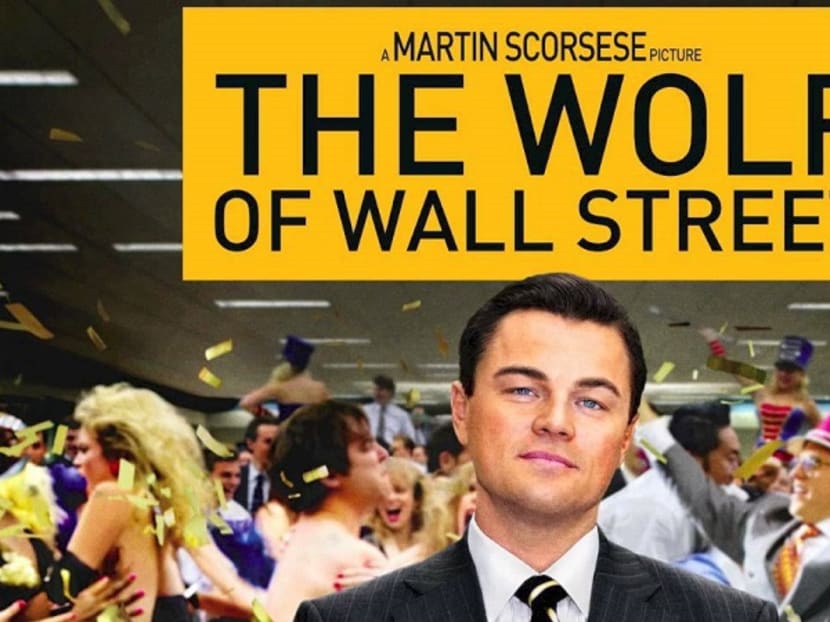

Wolf of Wall Street (above) was financed by Red Granite Pictures, a company allegedly linked to real estate purchases in the US. Photo: The Malaysian Insider

NEW YORK/WASHINGTON — More than US$3.5 billion (S$4.75 billion) travelled a trail of fraud from Malaysia through a web of shell companies, with some fuelling a spending binge on Monet paintings and luxury real estate and at least US$700 million flowing back into accounts controlled by Malaysia’s prime minister.

Some of the money was handled by international banks including Goldman Sachs Group, JPMorgan Chase, Standard Chartered and Deutsche Bank AG. A chunk of it funded a Hollywood blockbuster The Wolf of Wall Street. More than US$13 million of it was wired to an account at a Las Vegas casino by a stepson of Malaysia’s prime minister who gambled with an unidentified actor whose description matches that of Leonardo DiCaprio.

It’s all laid out in a dozen filings on Wednesday (July 20) by US prosecutors who detailed an alleged scheme of international money laundering and misappropriation stretching from 2009 to 2015. The Justice Department is seeking to seize more than US$1 billion worth of assets it says went through US banks from Malaysian development fund 1Malaysia Development Berhad, known as 1MDB, and was ultimately used to illegally acquire assets.

TIMELINE: MALAYSIA’S SPIRALLING 1MDB STATE FUND CONTROVERSY

The US complaints lays the groundwork for tension with Malaysia, a longtime ally on issues including counterterrorism and trade. Prosecutors refer to a top Malaysian official who controlled accounts that received hundreds of millions of dollars — an anonymous description that lines up with that of Prime Minister Najib Razak, who until a few months ago served as the chairman of 1MDB’s advisory board.

It’s unclear how local law enforcement will respond in Malaysia, where officials have taken pains to keep criticisms from surfacing, have cleared Mr Najib of any wrongdoing and closed its own investigations. Prosecutors, who don’t accuse Mr Najib of wrongdoing, sought to recover assets they linked to Mr Najib’s stepson, Riza Aziz, and other associates.

The prime minister didn’t immediately respond to a request for comment. He has consistently denied wrongdoing.

“Unfortunately and tragically, a number of corrupt officials treated this public trust as a personal bank account,” Attorney General Loretta Lynch said at a news conference in Washington. The civil action and asset seizures represent the “largest single action ever brought” by the Justice Department’s six-year-old Kleptocracy Asset Initiative, she said.

Lynch declined to comment on the identity of the unnamed top Malaysian official.

QUICKTAKE Q&A: MALAYSIA'S 1MDB FUND SPAWNS WORLDWIDE PROBES

1MDB said in a statement that it will fully cooperate with investigators and had not been contacted by the Justice Department. It said it “is not a party to the civil suit, does not have any assets in the United States of America, nor has it benefited from the various transactions described in the civil suit.”

Also on Wednesday, Swiss authorities said US prosecutors had sent them a request in May for information about bank accounts that might have been used to move money from the fund.

WEB OF COMPANIES

The US complaints also lay out how a handful of global banks, while not accused of wrongdoing, were ensnared as hundreds of millions bounced between a web of shell companies. Money was pilfered from the government fund based on false representations made by 1MDB officials and representatives of the shell companies, prosecutors said. Even when bank officials raised questions about the beneficiaries of various accounts, compliance departments were unable to detect or halt the alleged fraud.

The diverted cash was used to purchase a breathtaking catalogue of loot that prosecutors moved on Wednesday to seize. There’s a stake in the Viceroy L’Ermitage Beverly Hills Hotel as well as homes, condos and penthouses from Los Angeles and Beverly Hills to Manhattan’s Central Park South to London’s Belgravia. There’s a US$35 million Bombardier jet, as well as more than US$200 million worth of art — a pen-and-ink drawing by Vincent Van Gogh (“La Maison de Vincent a Arles”) and two Claude Monet paintings, including a pastel study of water lilies, “Nympheas Avec Reflets de Hautes Herbes”.

HOLLYWOOD LINK

And in a twist worthy of Hollywood, the US is also laying claim to profits and royalties from a movie about wealthy abandon: It says that more than US$100 million in funds from 1MDB went to finance 2013’s The Wolf of Wall Street, by Red Granite Pictures — a production company co-founded by Mr Najib’s stepson, Riza.

1MDB in April said it had “never invested in nor transferred funds to Red Granite Pictures, whether directly or via intermediaries,” and has denied wrongdoing more broadly over its finances. Red Granite said in May that all money it received had been proper and from a variety of sources including top-tier US commercial and investment banks.

JHO LOW COTERIE

At the heart of the scheme, the U.S. alleges, was a small coterie of Malaysians led by a Malaysian financier named Low Taek Jho. They diverted money from 1MDB into personal accounts disguised to look like legitimate businesses, the US said, and kicked back some of those funds to officials. Mr Low, who has been linked socially with Paris Hilton and is a close friend of Mr Riza, has said he provided consulting to 1MDB that didn’t break any laws.

In one of the complaints filed in federal court in California, running 136 pages, federal prosecutors alleged the unnamed top official whose description matches Mr Najib’s received payments of US$20 million in 2011, US$30 million in late 2012 and then US$681 million in March 2013. In August 2013, prosecutors said, some US$620 million was transferred out of his account and back into an account controlled by another defendant in the US actions.

Mr Najib stepped down from his role as chairman of 1MDB’s advisory board when it was dissolved in May. He is also the country’s finance minister. The Ministry of Finance is the sole shareholder of 1MDB.

The Malaysian attorney general said this year that the US$681 million that appeared in Mr Najib’s accounts before the 2013 election was a personal contribution from the Saudi royal family and that most was later returned. He cleared Mr Najib of wrongdoing. Saudi Foreign Minister Adel Al-Jubeir said in April that the large donation to Mr Najib was “genuine”, and Saudi authorities were aware of the gift which came without strings.

The Justice Department account contradicts that statement. The US$681 million came from Tanore, an entity controlled by a friend and associate of Mr Low’s. Mr Najib paid the money back to Tanore, according to the complaint.

THREE PHASES

The Malaysia fund is at the centre of several international investigations into alleged corruption and money laundering by public officials. Prosecutors in at least four countries — Singapore, Switzerland, Luxembourg and the US — are looking into money flows from the investment vehicle, which was established for national development.

The suspected fraud occurred in three phases in which money was laundered through bank accounts in Singapore, Switzerland, Luxembourg and the US, prosecutors said.

In 2009, after 1MDB was set up to pursue development projects, officials of 1MDB and others, under the pretence of investing in a joint venture between 1MDB and a Saudi oil company, transferred more than US$1 billion to a Swiss bank account, according to the Justice Department.

In 2012, 1MDB officials and others diverted proceeds raised through two separate bond offerings arranged by Goldman Sachs Group, according to the Justice Department. More than 40 per cent of the proceeds, or US$1.4 billion, were transferred to a Swiss bank account belonging to a British Virgin Islands entity. More than US$1 billion was diverted from another bond offering arranged by Goldman Sachs in 2013.

GOLDMAN TIES

Goldman Sachs, which enjoyed a lucrative relationship with 1MDB, did the bidding for fund officials even as many Goldman employees questioned whether Mr Low was involved, prosecutors said. The bank also circulated misleading offering statements when raising money for 1MDB, though the complaint doesn’t indicate that Goldman employees were aware of whether the statements were misleading.

Goldman Sachs said in a statement: “We helped raise money for a sovereign wealth fund that was designed to invest in Malaysia. We had no visibility into whether some of those funds may have been subsequently diverted to other purposes.”

COMPLIANCE ‘OVERKILL;

E-mails and recorded phone calls between 1MDB and several banks show how billions of dollars were siphoned out of 1MDB accounts under false pretences, according to the complaints, underscoring the weaknesses of bank compliance systems.

A handful of global banks were used to shift money improperly without confirming who the recipients were, other than information provided by 1MDB, according to the complaint. At times, when compliance officers raised questions, they were brushed aside and the transfers were eventually approved.

In one phone call cited in the documents, prosecutors say a 1MDB employee pressed a Deutsche Bank supervisor to approve transfers into Swiss accounts, complaining he was “under tremendous pressure” to get the deal done.

“Let me must convince my compliance person,” the Deutsche Bank employee said, according to prosecutors. “It’s a little bit sticky with this.”

“They cannot wait for this, you know,” the 1MDB official added. “If they’re going to overkill on the compliance thing, uh, they have to be responsible, you know.”

The transaction went through.

Deutsche Bank declined to comment as did JPMorgan, which was also mentioned in the documents. Standard Chartered said it is cooperating with all relevant investigations and declined to comment further.

ART PURCHASES Mr Low or his associates used some of the misappropriated funds to buy artworks, the complaint alleges. Low then used part of his collection — which he valued at more than YS$300 million, according to an e-mail cited in the complaint — as collateral for a loan from Sotheby’s Financial Services, a unit of Sotheby’s.

He used 17 pieces, including the two Monets and the Van Gogh, to secure a loan of US$107 million loan that went to a company owned by Mr Low, according to the complaint.

By May 2016, Sotheby’s had recovered enough from the sale of several works pledged as collateral to cover the outstanding balance of the loan, according to the complaint. Then Sotheby’s released its security interest in the artwork, it said. As of June 7, Sotheby’s still had the three works in its possession, according to the complaint.

Sotheby spokeswoman Lauren Gioia said the company always cooperates with government investigations. “As set forth in the complaint, Sotheby’s has no continuing security interest or relationship to the three works that are the subject of the action, and is not in a position to comment on any potential seizure,” she said.

VEGAS TRIP

Mr Low and Mr Riza were also at the centre of a gambling spree in Las Vegas in July 2012, using money that had come through 1MDB, according to prosecutors. A few weeks after Mr Riza wired US$41 million from a Red Granite account to one controlled by an associate, Mr Eric Tan, the two of them went to Vegas, where over several days they wired US$13 million into an account maintained by Las Vegas Sands, the parent of the Venetian Casino.

Sands, which hasn’t been accused of wrongdoing, declined to comment.

The two of them — joined by Mr Low and a producer of the Wolf of Wall Street — gambled at the Venetian for three days. They were joined on July 15 by what the complaint identifies as a lead actor in the film, who it noted ultimately won a Golden Globe award for his performance.

That actor is DiCaprio, who isn’t accused of wrongdoing. His publicist, Shawn Sachs, didn’t immediately respond to a request for comment. BLOOMBERG