The Big Read: Cryptocurrency crash offers industry the reality check it needs

SINGAPORE — A firm believer of XRP, Mr Ken Tan continued pumping money into the cryptocurrency over the course of this year — even after the prices of cryptocurrencies have fallen from its peak between last December and January this year.

A very niche investment instrument in their early years since Bitcoin was invented and released as an open-source software in 2009, cryptocurrencies — a form of virtual currency — caught the attention of mainstream investors at the end of last year when their value soared.

SINGAPORE — A firm believer of XRP, Mr Ken Tan continued pumping money into the cryptocurrency over the course of this year — even after the prices of cryptocurrencies have fallen from its peak between last December and January this year.

Thus far, the 36-year-old businessman has poured about S$100,000 into cryptocurrencies, including the S$15,000 that he invested in November last year when prices skyrocketed.

“When we saw it (prices) went up to the peak, (my wife and I) were like really FOMO-ing (fear of missing out),” he said.

As he entered the market during the cryptocurrency bull run, his portfolio grew by S$100,000 within eight weeks.

But he decided not to cash out as his intention was to invest for the long term.

With the value of XRP down 90 per cent since its peak of US$3.40 in January, Mr Tan’s portfolio has shrunk to over S$30,000, resulting in a paper loss of about S$70,000.

“Of course I look back, I regret it, but there is no way for me to undo that,” he added.

Another investor, who only wanted to be known as Vanessa, also did not cash out her S$70,000 profit when Bitcoin prices shot up, partly due to the withdrawal limits imposed by cryptocurrency exchanges.

After intensive research, the 31-year-old banker traded her Bitcoins for another cryptocurrency, Ripple, and pumped in extra money to buy other digital coins, bringing her total investments to S$40,000.

Her portfolio has since dwindled in value, and is now worth about S$10,000.

Vanessa is “frustrated” that she will make a loss if she moves her money out to other types of investment.

“Crypto is already so cheap. It doesn’t make sense to sell something so cheap and buy something else,” she said.

A very niche investment instrument in their early years since Bitcoin was invented and released as an open-source software in 2009, cryptocurrencies — a form of virtual currency — caught the attention of mainstream investors at the end of last year when their value soared.

Bitcoin — the most well-known cryptocurrency — began its exponential climb in November last year, surging by 200 per cent over the next one-and-a-half months to hit its peak value of close to US$20,000 per coin on Dec 17, based on data from CoinMarketCap, a website that tracks the prices of cryptocurrencies.

But the dramatic ascent was short-lived.

Bitcoin’s spectacular rise was followed by an equally spectacular fall, with its price dropping drastically throughout 2018. As of Friday (Dec 7), one Bitcoin is valued at US$3,428 — an 80 per cent drop from its peak.

Besides Bitcoin, other popular cryptocurrencies such as XRP and Ethereum also saw a similar crash. Almost US$700 billion has been wiped off from global cryptocurrency markets since their peak.

WHAT GOES UP MUST COME DOWN

The crash in cryptocurrency prices should not have come as a big surprise, given the earlier warnings issued by some well-known investors and financial experts.

Billionaire investor Warren Buffett famously called Bitcoin “rat poison”, while Nobel Prize-winning economist Robert Shiller called the craze last year a “fad”. Both said that Bitcoin was in a bubble, which would eventually pop at some point.

The lack of a good explanation for Bitcoin’s meteoric rise — along with the risks that come with investing in it — is not lost on some retail investors such as 26-year-old George Varghees.

The logistics operations executive, who believes in the long-term potential of cryptocurrencies, told TODAY that the fall was something that he had expected.

“The spike to US$20,000 is not a conventional spike. … A lot of it is from speculation. It’s normal that the price has to come down much more to a normal stabilised rate,” he said.

While Mr Varghees’ portfolio has decreased in value by 50 per cent to about S$3,000, he was one of those who decided to cash out his profits when cryptocurrency prices soared at the end of last year.

He made a profit of about S$9,000 last year from his initial investment of S$9,000, which partly explains his indifference to his paper loss.

“I went into it understanding that… (there is a) chance that (it) may not work. I was prepared to lose whatever I put in,” he added.

Observers have cited several factors that could have contributed to the downward pressure on cryptocurrency prices.

A Business Insider report that Goldman Sachs has scrapped plans to open a trading desk for cryptocurrencies due to unclear regulatory framework surrounding them could have caused confidence in Bitcoin and the like to have fallen.

Regulators around the world are also increasingly scrutinising crypto-related businesses.

In June, Japan’s financial regulator, the Financial Services Agency, slapped six exchange operators with business improvement orders, after it found that measures to prevent money laundering and know-your-customer processes were inadequate.

In September, a federal judge in New York allowed a United States securities law to be used to prosecute fraud cases involving cryptocurrency. The Securities Exchange Commission also issued fines to two cryptocurrency firms.

The security of cryptocurrency transactions is also questioned, after South Korea-based cryptocurrency exchange Coinrail got hacked and lost about 30 per cent of coins traded on its exchange in June. In the same month, another South Korea-based exchange Bithumb was also hacked and lost US$30 million worth of cryptocurrencies.

Some analysts expect the downtrend in cryptocurrencies to continue.

Bloomberg intelligence analyst Mike McGlone said on Thursday (Dec 6) that Bitcoin prices are likely to fall to around US$1,500.

Santa Clara University professor of finance Atulya Sarin wrote in a column for financial news site MarketWatch that Bitcoin will be “worthless” when its price falls below the cost of mining it, leading miners to exit.

He argued that without mining, Bitcoin is “just a set of encrypted numbers with no value”.

Mining is a peer-to-peer computer process, where miners solve mathematical problems to verify the transactions or payments, from one user to another on a decentralised network, to obtain Bitcoins.

In Singapore, some miners have indeed shut down their mining rigs in light of the fall in cryptocurrency prices.

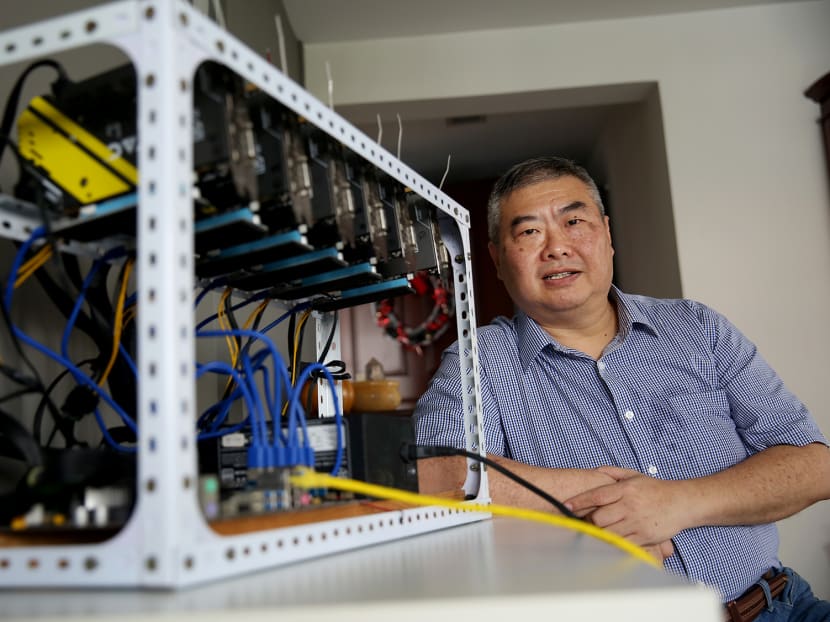

Mr Ian Chan, 52, used to make about S$270 on average a month for each rig — after taking into account electricity costs — when he started mining a digital currency called ZCash in June last year.

After some experimentation, he switched to mining for Bitcoin Gold in June this year as he realised that the latter yielded higher returns.

Even then, his returns started turning negative in July, losing about S$8 to $$10 per rig each month. He decided to power down his rigs in Singapore and Malaysia in September as he realised that the downtrend would not end anytime soon.

The IT specialist has left his rigs in Mongolia and Brunei running as he is still able to make a profit of about S$10 to S$20 per rig each month due to the lower electricity costs in these countries.

Mr Chan did not want to reveal how many rigs he has.

END OF A VIRTUAL CRAZE?

It’s not just cryptocurrency investors who have been hit by the drop in prices. Cryptocurrency-related businesses are affected as well.

Cryptocurrency exchanges based in Singapore, which are one of the main platforms investors use to buy cryptocurrencies and trade in them, said that trading activity has shrunk.

Mr Liu Yusho, co-founder of an exchange called CoinHako, said trading volume has declined by five times throughout this year’s “down market”, although he claimed that the exchange “continues to experience steady growth”.

Mr Rune Evensen, the co-founder of another exchange, Coss, said that compared to the peak at the end of last year, the average number of new membership sign-ups per day has dropped by around 75 per cent in the current bear market.

“It’s completely (like) day and night,” Mr Evensen said, adding that such a drastic drop is a “logical consequence” once the market turns for the worse.

“When it’s a bull market, everybody wanted to jump into Bitcoin. Now, they are not so eager to get in because they don’t know where the market is going.”

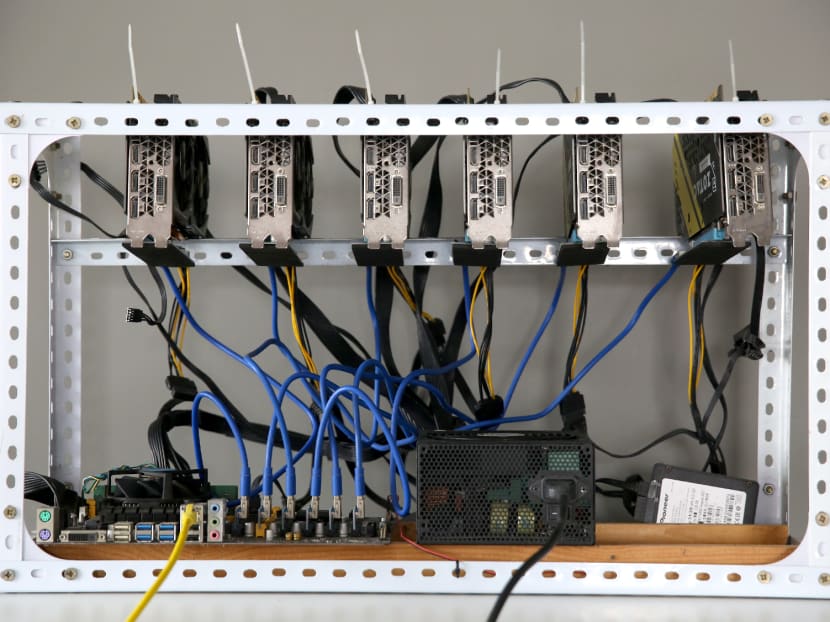

The decrease in the popularity of mining cryptocurrencies can also be seen at Sim Lim Square, with the “crazy buying” of mining rigs at the end of last year to earlier this year having all but ended.

These “mining rigs” are composed of gaming computer components such as graphics processing unit (GPU) cards, a motherboard and cables.

A shopowner at one of the higher floors of the shopping mall, who only wanted to be known as Glen, declared that the “market is dead”.

Staff and shopowners told TODAY that the buying frenzy began to taper off between March and April, when Bitcoin prices dropped below US$10,000, and they have seen almost zero orders for the mining rigs since then.

Mr Kenny Tan, 60, a part-timer at Video-Pro, said the shop was earning S$300,000 to S$400,000 every month in November and December last year from the sales of these rigs.

Now, some of its previous customers have dismantled the rigs and offered to sell back the parts to the shop, which it doesn’t accept, Mr Tan added.

A staff at Dynacore, Mr Ansari Abdul Pari, 34, said he used to sell five to 10 sets every day.

Both Dynacore and Video-Pro, which earlier were grappling with the shortage of GPU cards, are now selling them at a 30 to 50 per cent loss as demand had dwindled before they were able to clear their inventories.

For example, a Nvidia Geforce 1080 Ti GPU used to retail for over S$1,000. But Video-Pro is now selling it for only S$700.

Although another shop Bizgram does not have the problem of unsold GPUs, it still has 40 to 50 metal frames waiting for buyers since January, said its 36-year-old manager, Niraj Agarwal.

He has not been able to sell them even after lowering the price from S$120 to S$60, which is near the cost price. The shop also has a few mining motherboards that have not been cleared.

Mining Rig Club, whose main business “heavily depends” on revenue from hosting mining rigs for its customers, had to change its business model in the face of the decreasing popularity of cryptocurrency-mining.

Mr Leon Lim, the chief executive officer of the company, told TODAY that about 70 to 80 per cent of his customers had shut down their rigs.

His team took three months to come up with a new business strategy. Instead of mining new cryptocurrencies through the rig, users can supposedly receive digital coins as rewards by running “masternodes”. These are computer wallets within a decentralised network that enables the processing of transactions, similar to mining, except without the hardware equipment.

Mining rigs aside, the long, snaking queues at Bitcoin automated teller machines (ATM) observed during last year’s frenzy are also no longer in sight, said Ms Zann Kwan, founder of Bitcoin Exchange, which owns and operates four ATMs around Singapore.

Despite the drop in interest in Bitcoin, Ms Kwan said it hasn’t affected the company as it is still “growing”. In fact, she calls the present market a “return to normalcy”.

There were reports about the machines crashing or running out of Bitcoins during the peak period in December last year and January, as transactions could take up to three days due to a congested Bitcoin network.

Customers who buy Bitcoins from the ATMs now do it in smaller amounts of between S$50 and S$200, compared with over S$2,000 a year ago.

The profile of customers has also changed, said Ms Kwan.

“(Back then), cryptocurrency buyers were attracted to the market without knowing what it is, without knowing how to deal with the cryptocurrency wallet. Now, the baseline of customers are people who are more well-versed in cryptocurrency,” she added.

“And if you look at price, it’s a lesson for most people. People started to learn about what they’re buying, rather than (follow a) herd mentality.”

It’s a lesson for the cryptocurrency industry too, said Singapore University of Social Sciences (SUSS) Professor David Lee.

“Prices coming down is a very good thing for the industry,” he added, as stakeholders are now “re-focusing” on the technology underpinning cryptocurrencies, i.e. blockchain.

Bitcoin was the first application of blockchain technology — an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way.

The ledger itself can also be programmed to trigger transactions automatically.

“(We should not) focus on the price. It’s always a cycle… People need to refocus on how much can this technology do, and the answer is a lot,” Professor Lee added.

The chief executive officer of cryptocurrency advisory firm XSQ, Mr Lim Hong Zhuang, added: “Revenues of blockchain companies have fallen, and many once speculative investors or businesses that were started during the hype have also seen closure with people exiting the industry.

“We are seeing the real technology companies survive and building up their products at the moment.”

Mr Anson Zeall, the chairman for Singapore’s Cryptocurrency and Blockchain Industry Association, agrees.

“The new projects coming out are much more solid in this particular time compared to the ones in last November when everyone is raising ICOs for the sake of raising,” he said.

Initial coin offerings (ICOs) are used by startups to raise funds for new cryptocurrency ventures by issuing their own digital tokens.

AN UNCERTAIN FUTURE AWAITS

Despite the cryptocurrency crash this year, the investors interviewed by TODAY — Mr Chan, Mr Tan, Vanessa and Mr Varghees — said they are not quitting the market yet.

In fact, some of them are still pouring more money into cryptocurrencies as a way of lowering their average cost of investment as prices continue to fall.

Vanessa, for example, said she has not lost confidence in cryptocurrencies even after losing 75 per cent of her investment.

Part of these investors’ bullishness stems from their belief in the blockchain technology and its increasing adoption by traditional financial institutions.

Reports and studies have concluded that the technology could eliminate back-office roles in financial services and bank businesses — such as clearing and settlement of trades, financing, as well as tax and regulatory reporting.

For example, DBS announced in November that it had set up a blockchain trade platform to supply commodities across borders.

Developed with agri-commodity company Agrocorp International, the platform is able to provide real-time updates on commodity prices and delivery information, helping all those in the supply chain save costs and increase efficiency and transparency, said the bank.

Outside of Singapore, more relevant applications of blockchain-based platforms have also started emerging, in areas of ticketing systems, retirement plans and payments.

For example, the Netherlands-based GET Protocol has come up with a blockchain-based ticketing system that aims to prevent identity fraud.

Once a consumer buys a ticket through this ticketing system, it can be linked to a verified owner through a QR code, which can’t be viewed until just before the event starts. The QR code will also disappear once it has been scanned to prevent identity fraud.

Virtual coins that are backed by regulators, such as Paxos, have also emerged.

Approved by the New York Department of Financial Services, the Paxos token is designed to function as a liquid alternative to cash that can be used for instantaneous settlement in financial transactions globally.

Despite these developments in the cryptocurrency space, Mr Zeall said retail investors still need to fully understand what the founders behind the digital coins are doing before taking the plunge.

“It’s not just about believing in the technology. Know what the token is doing, know the tech, know what they are trying to solve, then consider,” he added.

So while the token economy of the blockchain, represented by its various cryptocurrencies, has been touted to have huge potential, the chairman of the Token Economy Association, Mr Chia Hock Lai, cautioned that cryptocurrencies and their underlying blockchain technology are still in the nascent stage of development.

“The end-user usability has more room for improvement, as the failure rate of blockchain firms continues to be high,” he added.

Besides the high failure rate, Mr Zeall also warned that there is a lot of misinformation where people are unaware that they may be buying tokens issued by cryptocurrency startups that have folded.

“Especially those that ICO when Ethereum was US$600, and it is now US$89? Definitely some companies will not be around. But the coin, the token is still around, it doesn’t die. You have to know what the coin is about, is the management still there, is there a foundation still running their operations,” he added.

“There will be people that try to trick (retail investors) in moving the (prices) of (those) coins but actually there is no (business) activity. … If no one is running the coin, from that sense, it’s still worthless because no one is supporting it.”

Mr Zeall said the industry still needs to “weed out” these “bad actors”.

While investors TODAY spoke to are hoping to see growth in the sector, as well as the recovery in the prices of the cryptocurrencies they are holding in the next three to five years, Mr Evensen warned that nobody knows how much further cryptocurrency prices will fall.

According to Mr Chia, for those who are still interested in cryptocurrencies despite the uncertainties, a prudent approach would be to stick to the top five cryptocurrencies.

“Invest no more than 5 per cent of their total investment portfolio. Most importantly, never buy more than what they can afford to lose,” he added.

Mr Zeall was a lot more absolute. “The whole point is… don’t speculate.”