The Big Read: Johor property market remains hot, but Singapore buyers have their work cut out in making the right investment

SINGAPORE — Living in her newly bought three-bedroom condominium in Johor Bahru, Kylie Hung, 27, enjoys all the perks of homeownership as a singleton before hitting 30 — something she is unable to do back in Singapore.

This audio is AI-generated.

- An increasing number of Singaporeans are exploring property options in Johor, motivated by lower costs and lifestyle benefits

- While the current strong demand may be attributed to the relaunch of the RTS Link project and the Special Economic Zone (SEZ) announcement, property experts said it is primarily due to housing costs and inflation in Singapore

- Buyers are snapping up units in Johor Bahru and Iskandar Puteri for various uses, such as a second home, as an investment or to live in

- However, caution is advised, as experiences vary. Some who bought properties in Iskandar Malaysia during the hype 10 years ago have faced losses due to political shifts and oversupply

- Ultimately, prospective buyers are urged to adopt a local mindset rather than that of a Singaporean, and to wait for concrete progress on infrastructure projects before committing to a purchase

SINGAPORE — Living in her newly bought three-bedroom condominium in Johor Bahru, Kylie Hung, 27, enjoys all the perks of homeownership as a singleton before hitting 30 — something she is unable to do back in Singapore.

And her work as a digital entrepreneur allows her to have total control of her time, which means she does not need to contend with the congestion at the Causeway during peak hours.

Ms Hung moved into her Country Garden Danga Bay condominium seven months ago, where she has access to features such as a pool, butler service and a private beach.

Ms Hung said she had wanted to move out of her parents' house as she needed her own quiet space, which she felt would help her better focus at work.

But private property in Singapore was out of her reach, and she could not buy a Housing and Development Board (HDB) flat as the minimum age eligibility for singles is 35.

“If I were to rent a place in Singapore alone, the money would go out of my pocket to something that I don’t own," she said.

“So I looked at Johor Bahru properties and thought that it made better sense for me to buy. My monthly mortgage would be around the same price as renting a room back home."

Ms Hung took out a bank loan to finance her 1,237 sq ft abode, which cost around RM700,000 (S$200,000). She currently pays about RM3,500 (S$1,000) a month for the mortgage and maintenance fees.

While she's happy with her purchase, she acknowledged that moving to Johor Bahru works for her because of her job’s flexibility, and it might not be for everyone.

“For those working 9am to 6pm, I wouldn’t recommend it because the jam on the Causeway can be quite bad.”

Even so, buying property in Johor was all the hype among Singaporeans about a decade ago, when Iskandar Malaysia, the main southern economic corridor in Johor, opened for business.

The draw for those Singaporeans was much the same as for Ms Hung: The ability to own and live in a luxury home at a much lower price than its equivalent in Singapore.

Since then, TODAY has found that there are those who are pleased they made the leap and those who regret it.

Mr Eric Sim, who bought two four-bedroom units of 2,400 sq ft each near JB Sentral in 2014, said the investment had left a bad taste in his mouth until today.

Each unit of four bedrooms and six bathrooms was financed with a bank loan after a 10 per cent down payment.

Although prospects looked good then, driven by economic development and mega infrastructure projects such as the Kuala Lumpur–Singapore high-speed rail (HSR), things subsequently went downhill.

“I bought them as an investment because I thought (Iskandar) would be the next Shenzhen. But it was just an illusion,” the 54-year-old career book author lamented.

“I realised after buying that there were no big companies in Johor Bahru, whereas, in Shenzhen, there are Tencent, Huawei, and Shenzhen Airlines. So, there won’t be any high-salary talent attraction to support the high property prices.”

Three more factors threw Mr Sim’s plans out of kilter: The onslaught of new projects raised supply above demand, the 2018 Malaysian general election culminated in a change in government and policies, such as the cancellation of the HSR project and lastly, the ringgit continued to weaken against the Singapore dollar.

When he invested in his properties in 2014, S$1 was about RM2.60. In February this year, the Singapore dollar rose to a record high of RM3.55.

Mr Sim found it difficult to rent out his properties. Even if he had found tenants, the rental would not have been enough to cover his monthly upkeep due to the exchange rate, he said.

He finally sold both units this year, at a loss. His total investment cost him a little over RM3 million, but he incurred a loss of RM500,000.

“It was the worst investment of my life,” Mr Sim said.

Even so, interest in Johor homes remains high among Singaporeans. In January, for example, there was some hype over properties near Bukit Chagar — where the Johor Bahru-Singapore Rapid Transit System (RTS) Link station is located — after a commemorative ceremony attended by then-Prime Minister Lee Hsien Loong and Malaysian Prime Minister Anwar Ibrahim.

But real estate experts told TODAY that rising inflation and property prices at home are the more important reasons driving Singaporean homebuyers up north.

The RTS Link is slated to start passenger service by the end of 2026. Once operational, it is expected to ease bottlenecks on the Causeway, allowing easier access across the border.

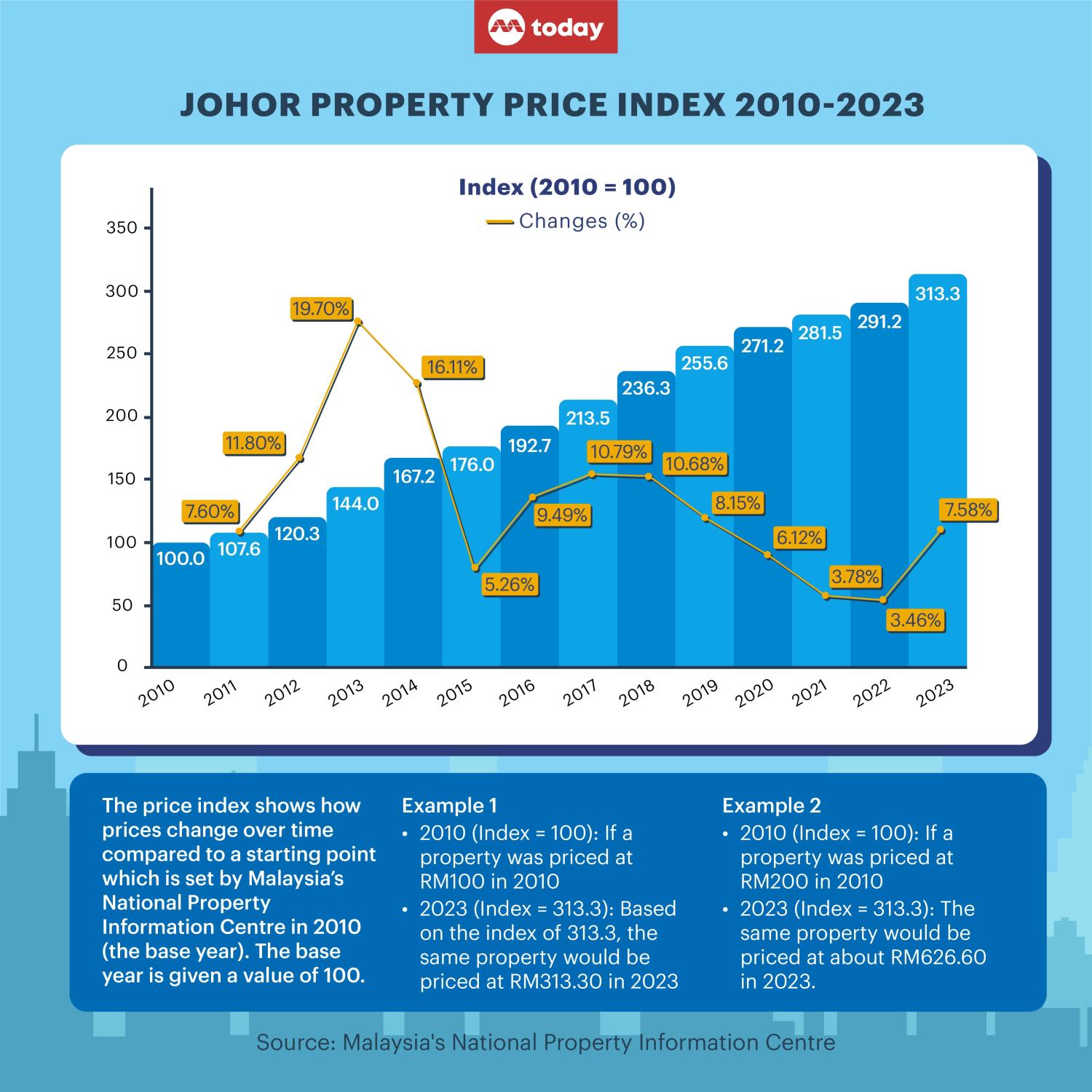

The consistent demand, not just from Singaporeans but investors worldwide too, has buoyed property prices in Johor, which have risen threefold since 2010, according to data from Malaysia’s National Property Information Centre (Napic).

But other news events paint a less rosy picture of the Johor property market.

Last year, Forest City, the flagship US$100 billion (S$135 billion) mega-project by Chinese developer Country Garden, was dubbed a “ghost town” by the media as the housing estates there were reportedly largely unoccupied.

Some buyers, including Singaporeans, were cited by international news outlets expressing disappointment and regret over their investments. A handful said they were fortunate to have sold off their units before the situation took a turn for the worse.

In 2022, over at Country Garden Danga Bay, disgruntled owners from Singapore, Malaysia, and China filed a class-action lawsuit against the developer, alleging that the developer's luxury condominium was not delivered as advertised.

So, for potential investors or homeowners mulling whether to leap into the Johor property market, it can be quite difficult to figure out what the wise decision would be.

TODAY examines the reasons behind the current influx of Singaporean buyers in Johor, what they look for in a Johor property and the key things one should consider before putting money down on a house across the border.

JOHOR: OPEN FOR BUSINESS

When Singaporeans think of Johor, it is typically the Johor Bahru area that comes to mind, but in fact, the state government’s plans to drive Johor’s economic growth extend beyond the city centre.

Iskandar Malaysia comprises the Johor Bahru District, Kulai District and part of the Pontian District. Officially launched in 2006, it encompasses an area of 2,217 sq km, nearly three times the size of Singapore.

Some of the major cities in Iskandar include Johor Bahru city centre, Iskandar Puteri (where Legoland is) and Pasir Gudang, one of the largest industrial areas in Malaysia.

The launch of Iskandar was aimed at attracting international investments that would drive economic growth for the state. And within Iskandar is the township development of Medini, envisioned as Iskandar Puteri’s central business district (CBD). Here, there are no restrictions on foreign homeownership.

Generally, foreigners buying properties in Johor must adhere to a minimum purchase price of RM1 million. However, exemptions are granted to certain projects, especially if they were approved before the threshold was implemented on May 1, 2014.

Until recently, the piece de resistance of Iskandar was supposed to be Forest City, a colossal luxury real estate project on four man-made islands in the Johor Strait, overlooking the Singapore border.

Launched in 2013, Forest City was envisioned as a futuristic, green, and smart city. It is Chinese developer Country Garden's largest overseas project, and was planned to house 700,000 people by 2035.

Despite its ambitious vision, the project encountered several challenges and controversies due to a mix of low sales, Chinese restrictions on capital outflows, border closures during the pandemic and public backlash against China's increasing influence in Malaysia.

Last August, the developer said the project was proceeding as planned despite issues involving "political landscape and interference, economic stability, government policy".

In December 2023, CNA reported that only 15 per cent of the entire project had been completed. According to the developer, a total of 28,000 residential units have been completed, with 80 per cent of these units sold to buyers from over 30 countries.

Around 9,000 residents are said to live in Forest City. TODAY has reached out to Country Garden for the latest figures.

In an attempt to spur economic development and attract investors, Forest City was announced as a Special Financial Zone (SFZ) last August. With this designation, businesses are offered incentives to set up operations here, such as a flat income tax rate of 15 per cent instead of the usual 30 per cent, for skilled foreign workers.

In preparation for the SFZ designation, Country Garden is building a new Customs checkpoint, which is expected to be completed by the end of this year. It also announced that several transportation-related infrastructure projects within the massive enclave are in progress.

Some international media outlets reported in April that talks were being held on opening a casino in Forest City, citing unnamed sources. But Prime Minister Anwar was quick to squash all talk with an “affirmative no” to the idea.

THE DRAW FOR SINGAPOREANS AS A HOME ACROSS THE CAUSEWAY

Despite the negative news around Forest City, the relaunch of the RTS Link project by Singapore and Malaysia may have renewed Singaporeans’ interest in owning property across the border.

Mr Tan Kin Lian, a two-time presidential candidate, is among those who have long appreciated the merits of owning a second home there. In 2018, he purchased a 1,100 sq ft three-bedroom unit in Forest City for about RM1.6 million, paid fully in cash.

He makes the 2.5-hour journey across Tuas Second Link by public transport twice or thrice a month and stays there three days each time.

When this TODAY reporter met the 76-year-old at his Johor abode on May 18, a Saturday, he seemed very much at home. He said he enjoys the peace and tranquillity, as well as the unblocked view of Johor’s greenery from his balcony.

For a place where supposedly 9,000 residents are staying, this reporter found it unusually quiet for a weekend. On Mr Tan’s floor, where there are eight units, he said only his was occupied.

As this TODAY reporter travelled across the vast expanse of Forest City via an hourly shuttle bus, only one other passenger boarded it.

There were some signs of life at Forest City’s transport hub, though, where one can find a good mix of restaurants, retail shops, and a convenience mart open for business. Still, some shop lots were either closed or boarded up, awaiting prospective tenants.

Notwithstanding the controversies and rather muted environment, Mr Tan said he is happy with his decision to buy a Forest City unit as he believes in the project’s potential. He also found himself drawn to the “modern city design”.

Forest City also appeals to Malaysian workers who work in Singapore, as rental prices are reasonable. Among its residents is Mr Afiq Alwi, a 40-year-old truck driver who is currently renting a 600 sq ft unit with two bedrooms for RM1,000.

He said that the rate at Forest City was cheaper compared with units for rent in nearby towns in Iskandar Puteri, such as Gelang Patah: “For the same unit, I’d be paying RM1,600 there.”

“I like working in Singapore, but it’s expensive to live there because one room can cost minimally S$700 to S$800. For less than that price in ringgit, I can comfortably rent an entire unit all to myself here.”

Six property agents TODAY spoke to said that while a significant number of Singaporeans are looking to buy Johor homes for investment, there are also those looking to live there or have a second home.

Operations director Victor Lee, 53, and his wife Crystal Wang, 38, are among the latter. When TODAY met the couple on May 15, they had just collected the keys to their two-bedroom unit at R&F Princess Cove, a condominium project said to be popular among Singaporean buyers.

Mr Lee said they paid for the RM800,000, 834 sq ft unit in full, using cash.

Thanks to a flexi-work arrangement — he can spend one or two days working from home each week — Mr Lee, who is in the energy sector, said he is happy with the purchase.

“R&F is near my workplace in Admiralty West. You can see it from my balcony. So geographically, I’m at an advantage,” he said.

Asked if he would brave the notorious congestion on the Causeway several times a week, Mr Lee said there have been promising improvements, with both governments constantly making efforts to smoothen the travel process, such as the recent implementation of electronic gates.

“There are pros and cons. If you live in Singapore, the major expressways are always jammed, and there’s ERP (Electronic Road Pricing) to consider. It’s a trade-off I can live with.”

Before buying this Johor house, the couple had been renting a studio unit in Singapore for S$2,000 monthly. Mr Lee also owns an HDB flat where his parents live.

“We decided to look to JB and thought, instead of renting, why don’t we put our money into a place we can call our own?” he said.

On safety concerns in Johor Bahru, Mr Lee said he would do his best to take precautions, such as avoiding going out alone at night and in dark alleyways.

A Singaporean father of two, who wanted to be known only as Mr Afiq for privacy reasons (not to be confused with Mr Afiq Alwi above), is looking to buy a property in Johor within the next 12 months.

For the last six months, he has been renting a 1,500 sq ft double-storey terrace house in Horizon Hills, Iskandar Puteri, with his wife and two kids, aged six and nine, for RM3,500 a month, and he likes the lifestyle there.

Mr Afiq, who works in finance, said before moving there, he had been entertaining the thought of relocating to Johor as he can work remotely most of the time.

It was when his wife decided to quit her job as an agricultural scientist to recover from burnout that he mooted the idea and she agreed.

“One main reason that pushed me to move my family here was so that I could send my kids to an international school, where they get to learn Chinese as a required subject and socialise in a melting pot of different nationalities,” he said.

The difference in cost of living was another push factor, as Mr Afiq is currently spending S$20,000 a year on his kids’ education. If he were to do the same in Singapore, he estimated that he would easily be paying twice or thrice that amount.

“At this point, I can confidently say that we plan to move to Johor for the long term. Unless there are big regulatory changes, we'll probably live in Johor for the next two to five years.”

Regarding security, Mr Afiq said every city or state has different security standards in different areas, and the same goes for Johor.

“I know from my Malaysian friends that certain areas in Johor are considerably poorer, where the likelihood of you being robbed or your car being broken into is quite high.

“But that’s why staying in a gated community helps. My family and I are also not flashy people. I own a cheap entry-level local car so that we can get around easily. We try to avoid unsafe areas.”

INVESTORS' HIGH HOPES DASHED BY MARKET REALITIES AND POLITICAL SHIFTS

In contrast to those who bought the apartments to live in, the picture is less rosy for investors including those who entered the Johor property market 10 years ago.

A supply chain manager who wished to be known only as Mr Lee invested in a property the same year as Mr Sim, the author who sold off his units at a loss.

Mr Lee bought an RM1.7 million double-story cluster house in Horizon Hills. The 2,514 sq ft house has five bedrooms and five bathrooms, and he financed the purchase with a bank loan.

“The Johor property market was booming, so my friends also bought properties in Johor as investments. I expected to be able to sell my house within five years and make a profit due to capital appreciation,” said the 40-year-old.

However, things did not go as planned. In his view, the launch of Forest City “killed the property market”.

“There’s an oversupply of units because of the project. We did not expect the developers from China to come in that fast. If I were to sell now, I would be looking at a loss,” said Mr Lee.

“I kind of regret buying the property because I could have put the money to better use. If given a choice, I wouldn’t have done it.”

Mr Lee told TODAY that he is still holding onto his unit. He hopes the newly announced plans, such as the Singapore-Johor Special Economic Zone (SEZ) and RTS Link, would eventually drive up demand and prices.

Mr Sim said most buyers, like himself, tend to get caught up in thinking that buying property in Johor is lucrative simply because “the psf (price per square foot) is so cheap... cheaper than HDB.”

But he said there are other factors to consider. For example, in Singapore condominiums, units typically require “some curtains and lights” before being deemed viable for rental, he noted.

“But in Malaysia, it’s not like that. You need to do up the cabinet and kitchen, not just curtains and lights. So, with everything considered, I would need to spend about RM80,000 for my units just to get them in good condition before renting them out.

“So I thought I might as well not rent them out because it would jeopardise my chances of selling the units off eventually,” he said.

Despite stories like Mr Lee's and Mr Sim's, overall demand for Johor property has stayed strong.

Data from Malaysia’s Napic shows that the property price index for Johor state, which was given a value of 100 in the base year of 2010, soared to 313.3 in 2023, which means prices more than tripled on average.

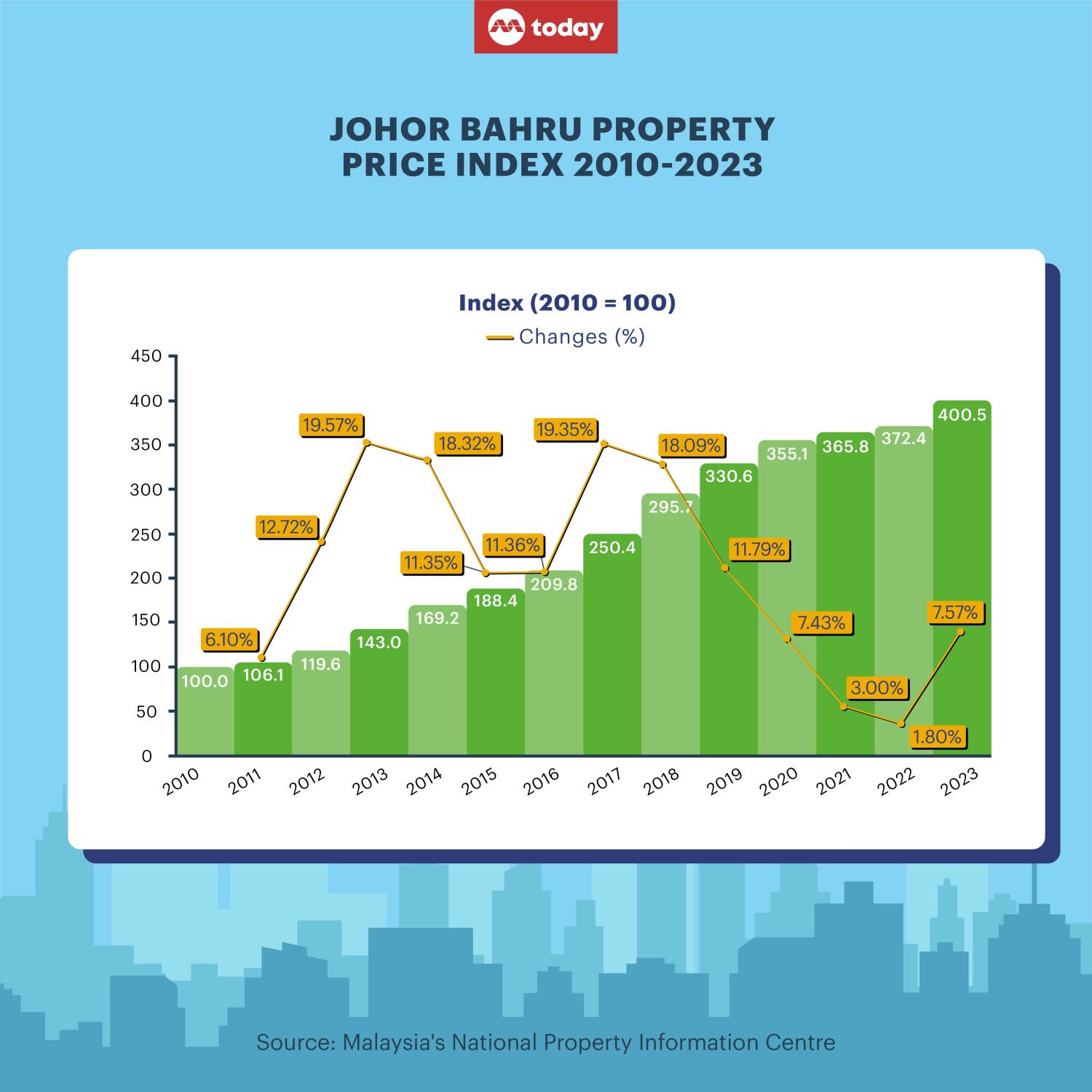

The increase is more drastic for Johor Bahru, as the price index stands at 400 in 2023, from the same base year value of 100.

In Singapore, based on the Urban Redevelopment Authority Realis data, the property price index climbed from 125.1 in the first quarter of 2010 to 204 in the first quarter of this year, a 63 per cent increase.

Meanwhile, PropertyGuru Singapore country manager Dr Tan Tee Khoon said that as of April this year, demand for residential homes in Johor Bahru recorded an increase of “close to three times” since October 2019.

This is based on the firm’s "demand index", which calculates the number of visitors to property listings, weighted by their engagement and search behaviour.

The demand index for residential homes for rent in Johor Bahru also experienced a significant jump after the reopening of the Johor-Singapore border in February 2022, he said, and since then, rental demand has remained largely stable.

Using asking prices for service residences as a proxy for price movement, the median psf was RM488.75 as of April 2024, up from RM397.35 in March 2022, he said, adding that this was also higher than the pre-Covid median price of RM449.07 psf.

“Notably, nearly 44 per cent of property seekers looking for a residential property in Johor Bahru in April 2024 were from Singapore.”

Dr Tan cited several reasons that contributed to this, such as the full reopening of the Republic’s international borders on April 1, 2022, which significantly boosted the demand for homes in Johor Bahru, particularly among Malaysians working in Singapore.

“High rents and a strong Singaporean currency make owning a home in Johor Bahru more attractive. Additionally, the announcement of the SEZ and RTS further drove up rental prices.”

Mr Faizul Ridzuan, chief executive officer of property investment firm Far Capital, agreed.

“In Singapore, property values have gone up by 30 to 40 per cent in 24 months. After Covid, rentals have gone up by 60 per cent,” he told TODAY.

“There’s nothing new or sexy about Johor. It’s been like this for years. This time around, the primary push factors are coming from Singapore, as the cost of living has gone up substantially in the last 12 to 24 months, forcing people to look for cheaper alternatives, along with the devaluation of the Malaysian ringgit against SGD.”

Real estate negotiator Edward Lee said Singapore’s housing policies, which levy a higher stamp duty on second and subsequent properties, also contributed to the increase in demand.

“Once the RTS is completed, I believe property prices will be even higher than today,” he added.

The hot Johor property market has led some to wonder whether there would be any spillover effect on the prices of HDB flats at housing estates near the Woodlands Checkpoint, like Woodlands town itself.

But Ms Wong Siew Ying, head of research and content at PropNex Realty, said she believes that the HDB prices and rental trends in Woodlands generally align with overall market movement in Singapore, rather than specific locational attributes.

“That said, transaction activity, particularly HDB resale and rental activity, has been gaining some traction recently for Woodlands town,” she said.

The HDB resale volume in Woodlands has seen a year-on-year increase since 2021. In 2022, there was a year-on-year increase of 14.2 per cent, while 2023 recorded a 10 per cent jump.

Ms Wong said that this can be attributed to overall improvements in infrastructure and ongoing efforts to transform the estate into a commercial hub, which has helped boost the quality of life and employment opportunities within the area.

“The recent opening of the Thomson-East Coast Line has also greatly improved connectivity... Proximity to well-established amenities such as schools, malls, and the Causeway are all perks that further boost its popularity among residents.”

THINGS TO CONSIDER BEFORE INVESTING

All things considered, is investing in a property in Johor a worthwhile investment? Property experts and homeowners advise prospective buyers to do their homework thoroughly before making a decision.

Mr Sim, the former investment banker, said one should refrain from following investment trends without research.

“If I could turn back time, I would do a little more research on the economic activities in the area. I would also check the housing supply – not the number of units available at that point in time, but the amount of land and whether property developers would build more.

“If I had done my homework back in 2014, I would've found information that other developers had plans to go big,” he said, referring to Forest City.

Real estate agent Ryan Khoo, who deals with properties in Johor, said it's a good idea to look into the developer’s background before making a purchase.

“Look for reputable ones that are publicly listed and have solid track records. For example, they have built existing projects in Johor or other parts of Malaysia that you can visit.”

Mr Faizul of Far Capital stressed the importance of looking at a property in Malaysia through the lens of a local, instead of a Singaporean.

“When you use a Singaporean mindset to buy a property in Johor, it's suicidal,” he said, since the buyer may end up overpaying for their purchase.

Illustrating his point, Mr Faizul said the average property price in Johor 10 years ago, including high-rise and landed units, was about RM300,000.

“When Singaporeans come in, they pay way more than that. Perhaps over RM500,000 to RM1 million, whereas the average local only pays RM300,000. When you overpay, the probability of profit will be greatly reduced.”

When investing based on the potential of future infrastructure and amenities, Mr Faizul advised prospective buyers to be patient and only make the move when there is concrete movement for the projects.

“Like the RTS, when you see movements from both governments, then you know for sure it won’t be cancelled. (Wait until things are) built first, instead of investing during the talking stage.

“I’ll give you an analogy. You commit to someone who is serious about you. Just because your friend comes and tells you about this person who is ideal, rich, and good-looking, it doesn’t mean you stop doing your due diligence, and marry the person straight away, right?”

CORRECTION: An earlier version of this article said that Dr Tan Tee Khoon was the country manager of PropertyGuru Malaysia. He is the country manager of PropertyGuru Singapore. We are sorry for the error.