The Big Read: Plump pickings for scammers? Trusting, unsuspecting S’poreans need to raise their guard

SINGAPORE — The scammer struck at just the right time. When the elderly man answered a phone call from an unknown number last month, his usual defences were down.

In recent years, the authorities here have stepped up efforts to stem the scamming tide, from regular public warnings about the latest tricks by fraudsters to awareness campaigns and the establishment of a dedicated Anti-Scam Centre by the police.

SINGAPORE — The scammer struck at just the right time. When the elderly man answered a phone call from an unknown number last month, his usual defences were down.

“Remember, when you say ‘hello’ once, if there is no immediate response, you put down the phone and they won’t call you back anymore… but I couldn’t think straight at the time,” he recounted, adding that he vividly remembered saying “hello” three times.

The person on the other end of the line was impersonating a Singtel staff member. He redirected the elderly man to a purported Singapore police officer, who told him that he was in trouble for money laundering and starting a pornography business.

It took just two hours for the scammer to trick the senior citizen into downloading software that allowed remote access to his computer, and try to persuade him to part with hundreds of thousands of dollars.

The victim counted himself lucky for losing only a few thousand dollars in the end. But it was a harsh lesson for someone who described himself as “quite computer literate” and not usually susceptible to such ruses.

“When you’re not mentally alert, anything can happen. I’ve rejected (such calls) before,” he told reporters during a phone interview arranged by the police on Wednesday (Oct 2), which came on the heels of a warning about a new type of scam, in which scammers pose as technical support employees.

The elderly man did not wish to be named or reveal his age and the exact amount he was swindled out of. But he had already told some of his friends about what happened.

He was lucky as his son got home just in time to jolt him into realising that he had been scammed, which led to an immediate police report. To his relief, DBS Bank managed to block the larger of the two transactions before they were completed.

Another 60-year-old woman whom TODAY spoke to thinks she may have fallen victim to a scam even though it seemed legitimate when she first started investing.

In 2016, she got tangled up in an investment trading scheme which she is still involved in.

The civil servant said she was — and still is — clueless about the financial world. She had gotten a call from someone with a British accent “who wouldn’t let me go” and convinced her to pump in thousands of dollars, in order to get good returns.

This worked for about a year. One of its managers was “very nice” to her, she added, sharing details about his life and making her believe that he was a real professional and that he “understood my feelings”.

However, she said that things soon deteriorated when he “left". She lost US$140,000 (S$193,000) within a few days — half of what was in an account which she set up for the investment scheme.

To this day, she still has US$116,000 in the account, but its managers have told her that she is not allowed to withdraw the sum as it includes bonuses, and she must first conduct large volumes of trades before she is entitled to the money.

She has not reported her case to the authorities here out of embarrassment and fear of losing credibility in her job. She still harbours some hope of getting her money back too, by withdrawing small sums each month.

“It’s a lesson learned. Don’t do this anymore,” she added.

SCAMS ON THE RISE EVERYWHERE

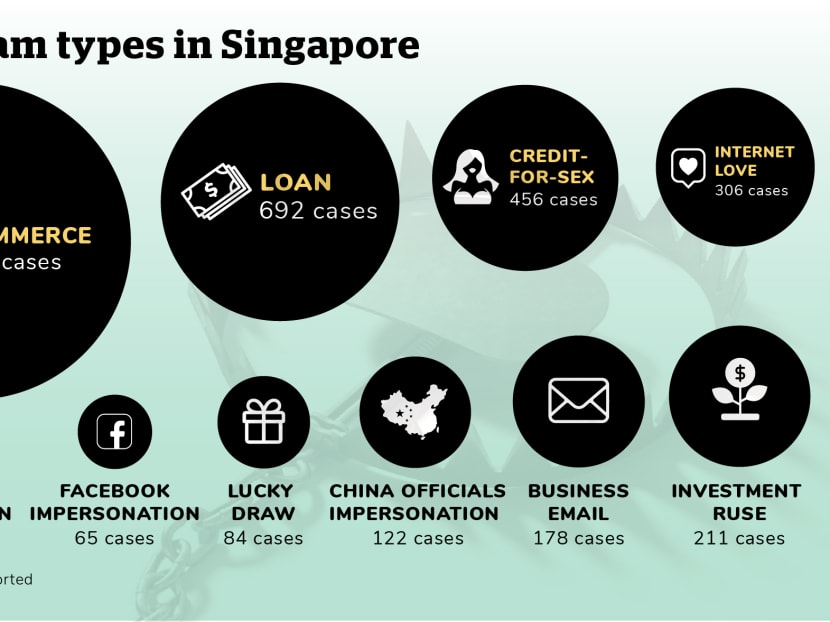

The elderly man and civil servant are among a growing number of Singaporeans who have fallen prey to the scourge of scams, with those involving impersonation, e-commerce, Internet love, credit-for-sex, and loans topping the list.

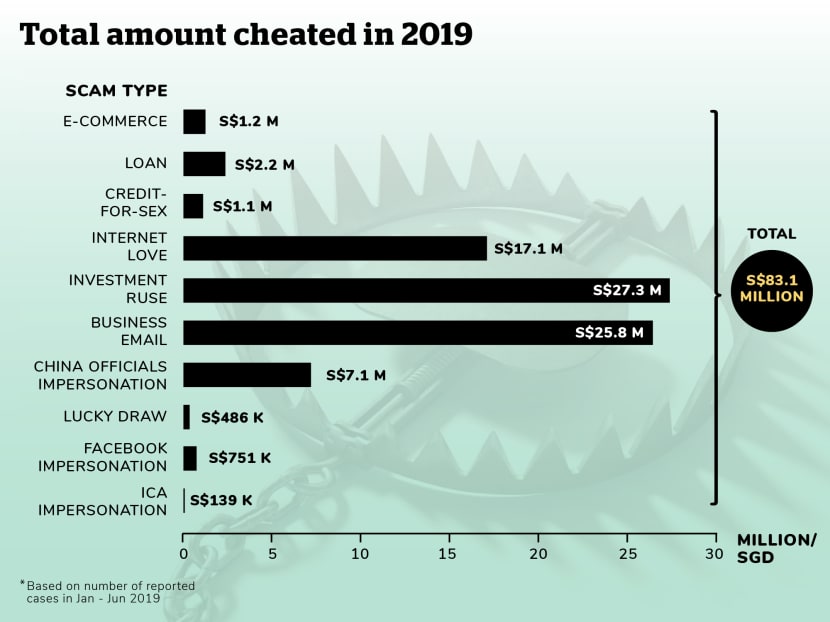

The numbers are staggering. For the top 10 types of scams from January to June this year, 3,591 cases were reported with a total loss of S$83.1 million. The largest sum cheated in a single case this year was S$4.3 million, via an investment ruse.

The continuing surge in scams has contributed to the growing crime rate here this year despite a slowdown in almost all other crimes — and it is not just the Republic which is facing this problem.

Hong Kong authorities have flagged a rise in online and phone scams in the city since last year. Many victims were young people, and 65 per cent of phone scam cases involved conmen posing as “mainland officials”, according to a report in the South China Morning Post (SCMP).

SCMP attributed this to the fact that most youths — as digital natives who prefer online chats to voice calls — would not think of calling the other party to check.

Meanwhile, in China, victims lost an estimated 390 million yuan (S$75.2 million) in Internet scam cases last year. This was a five-year high, with many young people similarly falling for them as they use online payment platforms more frequently.

Australia has also seen an overall rise in scams in recent years. In August, the Australian Competition and Consumer Commission forecast a 56 per cent increase in scam-related losses over the past two years, with an estimated loss of A$532 million (S$495 million) by the end of this year.

Over in the United States, the reported losses from online romance scams increased more than four times from 2015 to last year. The country’s Federal Trade Commission noted that more than 21,000 people were tricked out of US$143 million last year alone through such scams.

ARE S’POREANS ‘TOO TRUSTING AND OBEDIENT’?

In recent years, the authorities here have stepped up efforts to stem the scamming tide, from regular public warnings about the latest tricks by fraudsters to awareness campaigns and the establishment of a dedicated Anti-Scam Centre by the police.

The centre, which was set up in June, is aimed at disrupting scammers’ operations and mitigating victims’ losses.

Yet, people from various walks of life — young and old, working professionals, housewives and retirees — continue to be cheated. Indeed, as the cases here and elsewhere have shown, there is no such thing as anyone being “too smart” to fall for a scam.

In fact, some experts believe scammers are exploiting Singaporeans’ general trust in authority and the fact that they live in a low-crime environment.

They noted that Singaporeans seem to be especially vulnerable to impersonation scams that involve officials. For example, victims here lost S$7.1 million to China official impersonation scams in the first half of this year — up from a S$6 million loss in the same period last year.

“Singapore is a country with low crime, and often we let our guard down and we do not usually have a high level of suspicion. We are also more trusting of authority figures and do not question their identity,” said psychiatrist Dr Lim Boon Leng from Dr BL Lim Centre for Psychological Wellness.

Ms Nur Izyan Ismail, a senior psychologist with the police’s psychological services division, noted that scammers use certain persuasion techniques to hook their victims.

When it comes to impersonation scams, one of the psychological principles in play is obedience to authority.

This means that when scammers pretend to be authority figures, such as police or immigration officers, “we are used to listening to figures of authority and we just obey them”, she said.

Dr Tan Ern Ser, a sociologist from the National University of Singapore (NUS), said he was “reluctant to argue that vulnerability to scam amounts to a Singaporean trait”, given that the number of victims — albeit rising — remains a small proportion of the population.

“But I’d guess the people most at risk of being scammed in the case of impersonation are likely to be quite trusting of others, and quite timid and fearful when encountering someone sounding officious,” he said.

TOP SCAMS

In recent years, several types of scams have emerged and despite extensive media coverage and police public advisories, many Singaporeans continue to fall for them.

TODAY takes a look at the most prevalent types of scams based on the number of reported cases, according to statistics released by the police in August.

E-commerce

Scams involving online purchases remain on top of the list here. There were 1,435 reported cases in the first six months of this year, compared to 1,013 in the same period last year.

Victims lost a total of S$1.2 million, with one case involving S$43,000, between January and June — up from S$870,000 during the same period last year.

Scammers usually target victims on online shopping platforms, the most common one being e-marketplace Carousell, by listing popular items for sale at cheaper prices. These range from popular concert tickets to cheaper stays at hotels like Marina Bay Sands.

When people pay for the items, such as through bank transfers, they either do not receive the items at all or get fake ones. The scammers often become uncontactable or make up excuses about why they cannot deliver on their promises.

Some people even head to the respective venues with the fake tickets before discovering they cannot be used.

Read also:

- 8 months’ jail for man who ran Carousell ‘branded goods’ scam, earning more than S$10,000

- 2 years’ jail for man who ran Carousell concert ticket scam, earning S$38,000

- Carousell cheat banked in S$22,000 from selling hotel packages and Rolex watches

Twenty-one-year-old Elle (not her real name), was one victim who lost S$500 to a Carousell concert ticket cheat. She was desperate to find tickets to American singer-songwriter John Mayer’s gig earlier this year and managed to get one from a legitimate seller, but wanted to buy more.

“I found this guy who was really normal — not super friendly but you couldn’t really tell he was lying. I trusted him because he was selling at the original price, so I thought if anyone wanted to cheat, they would charge more,” Elle added.

When he sent her a PDF copy of the tickets through WhatsApp, alarm bells started ringing in her head. She compared the tickets with the legitimate one she had bought and saw differences.

She made a police report, but the scammer contacted her again a few days later asking if she wanted more tickets. He later deleted the messages when she did not respond.

“It’s funny because I see these scam warnings on television and online, but when you experience it, it becomes very real and hard to believe. I never really knew about the warning signs,” she lamented.

Carousell has introduced several scam-prevention measures, such as flagging “high-risk categories”, which include concert tickets and hotel rentals, within its app, as well as getting sellers looking to list in these categories to use its escrow service.

In order to avoid falling prey to e-commerce scams, Ms Abigail Ng from the National Crime Prevention Council said people should realise that when a deal sounds too good to be true, it probably is.

“It's always good to compare prices, and it’s good to want to save, but if the price that you check out is much, much lower than the market rate, I think that’s a red flag,” she said.

People should also check a seller’s ratings and reviews, and then check if the reviews are genuine. Websites offering escrow services — where money is released only when a buyer confirms the items have been received — are also safer, Ms Ng added.

-

Loans

Bogus loan offerings constituted the second-highest number of scams reported in the first half of this year, more than doubling to 692, from 315 during the same period last year. Victims have lost S$2.2 million so far this year.

Such scammers may claim to work for licensed moneylenders, and send SMS or WhatsApp messages offering loans and loan services to random users. Those interested have to transfer money as a deposit before getting their loans. After doing so, they will no longer be able to contact the “moneylenders”.

Some scammers also ask for personal information such as bank account numbers, then use these details to get their victims to hand over their money.

Similar scams include investment ruses, where victims are offered investment opportunities with extremely attractive returns on social media platforms such as Facebook.

These scammers often pretend to be stockbrokers or working in banks or financial institutions. They would then ask for personal details, like NRIC numbers, and ask the victims to transfer money to banks overseas in order to receive returns and profits.

In lucky draw scams, victims receive a phone call or SMS that they have won a prize in a lucky draw. However, they have to pay administrative fees or taxes to get the prize, or make payment to a foreign bank account to convert the prize into cash.

The authorities have also recently flagged a new variant of the lucky draw scam, where a victim received calls from an unknown overseas number saying she had won a lucky draw.

She was asked to contact a local number through WhatsApp, shown a photograph of a bank cheque with her name on it and asked to provide her bank account number.

When she refused to claim her “winnings”, the scammers threatened to refer her to the police, so she ended up transferring money to pay for “fees and charges”.

-

Credit-for-sex

The number of reported cases also more than doubled from 209 in the first half of last year, to 456 in the first half of this year. The total amount cheated also increased from S$464,400 to S$1.1 million.

Scammers befriend their victims — usually young, tech-savvy males — through dating apps or social media platforms such as WeChat.

They pretend to be attractive women and dupe their victims into buying them items or gift cards, commonly AliPay purchase cards or iTunes cards, in exchange for sexual favours, a date or a meet-up.

They would then ask for more money under the pretext of having to pay a registration fee or admin fee.

Read also

- Lured by sex, saved by a 7-Eleven pamphlet

- Three men with alleged links to credit-for-sex ring face money laundering charges

In a recent interview, a 22-year-old man told reporters about how he almost fell prey to such a scammer, who sent him voice recordings of her whispering sweet nothings on the Line chat app.

She told him she was a foreigner studying at a local university and gave massages to earn money. He agreed to pay for a massage from her.

She told him to transfer S$100 at an AXS machine, but police officers stopped him just in time. He had ignored a scam warning message that flashed on the machine’s screen after he selected the AliPay option, and did not spot scam alert posters on the wall.

“I know about such scams from newspapers, but didn’t think they could be linked to a dating app. Now I am more careful, and have uninstalled all my dating apps (Tinder, OkCupid and Badoo),” he said during the interview.

-

Internet love

The total amount of money lost in these love scams, as well as the number of reported cases, increased in the first half of this year compared to the same period last year. The largest sum cheated in a single case was S$2.4 million.

Love scammers usually pretend to be attractive foreigners and befriend their victims online. After getting the victims to trust them or even fall in love with them, the fraudsters pretend to have fallen into trouble or hard times.

They ask their victims for money as proof of the latter’s love before disappearing once they get the cash.

While many types of people fall prey to these scams, Assistant Superintendent of Police Kristian Kirkwood said that over the years, middle-aged to elderly women had often emerged as the victims.

“(This is) perhaps because they have saved up all this retirement money and the scammers very well know that. We also see individuals who have recently got out of divorces, because when they have done that, they're more emotionally susceptible to falling prey to these scammers,” added the investigation officer in the transnational commercial crime task force.

Ms Izyan, the police psychologist, said that Internet love fraudsters create profiles similar to their targets.

They also use the “reciprocation” principle by initially sending them gifts or showing concern, then getting their victims to return the favour when they are purportedly in trouble.

“What we tend to overlook is that victims of Internet love scams also have to grieve over the loss of a relationship. While it may seem (to be) only online, it is an actual loss, so they do go through the grief of a break-up,” Ms Izyan added.

Read also

- Mandatory treatment order for woman who scammed a fraudster, before being scammed herself

- Two foreigners remanded in Singapore for probe into Internet love scams

One such victim, 43-year-old Alice (not her real name), almost lost US$5,000 (S$6,900) to a man named Francis whom she met on a dating app, after breaking up with her boyfriend.

He sent her love poems every morning and evening, and the pair talked on the phone daily. Warning signs started to pop up not long after, such as when he told her he was actually 44 even though he listed his age as 39 on the app.

Alice’s suspicions grew stronger when Francis told her that he had ordered diamonds from a shipping agent and his package “did not go through” because there was a problem with his bank account, and asked her for help. Still, she transferred US$5,000 to a foreign-based account given by him.

But when Francis kept telling her he did not receive the money, she decided to lodge a police report. Alice later managed to get the bank to return the money to her account.

-

Impersonation of authority figures

These fake officials could say they are from China or Malaysia, the Immigration and Checkpoints Authority, or the Singapore Police Force, to name a few.

Chinese official impersonators typically pretend to be a staff of a courier company, or an officer from some government organisation.

Scammers tell their victims that they have been involved in some illegal activity, then ask for the victims’ personal particulars and bank account details.

The victims would then be asked to provide their personal particulars and bank account details for investigation purposes, such as their Internet banking details and one-time security passwords. The callers then use these details to transfer money out of the victims' bank accounts.

One victim whom TODAY interviewed in September, a 21-year-old Chinese national, transferred S$500,000 in order to clear her name before realising that she had been scammed.

Someone claiming to be a DHL representative had called her, saying that the company had received a suspicious parcel in her name that was being sent to China. The parcel purportedly contained some clothes, fake passports and credit cards.

The phone call was then transferred to a Singaporean “police officer” and some “Chinese authorities”, who accused her of being involved in a money-laundering scheme.

-

Other impersonations

Social media accounts: Fraudsters masquerade as their victims’ relatives or friends, by taking over their Facebook accounts. They contact their victims through the accounts, introduce them to various types of grants, and tell them to provide their personal details and transfer money to bank accounts or remit money overseas. Of late, a similar scam has also surfaced on WhatsApp.

Business email: Scammers hack into business email accounts and monitor their correspondence with others. They then use the other party’s email, or spoof it (create one closely resembling the email), to send emails asking to transfer money for business payments.

‘ANYONE CAN BE CHEATED’

Dr Emily Ortega, who heads the psychology programme at the School of Humanities & Behavioural Sciences at the Singapore University of Social Sciences (SUSS), reiterated that anyone can fall for a scam.

“There is no particular personality type, age group, or demographic that is spared. Scammers use persuasive techniques to influence and some even impersonate or clone emails so well, hoping to trick people to use their gut feelings in their decision making,” she added.

Dr Lim, the psychiatrist in private practice, also noted that those who think they are intelligent and unlikely to be scammed are, in reality, more at risk of being defrauded as they are “less guarded and less likely to cross-check their decisions with others”.

Scammers also exploit vulnerabilities such as making rash decisions under time pressure, or even greed or lust.

“Many a time, victims may suspect that the transaction is a scam but may take the risk and pay up to avoid potential danger or inconvenience, or to obtain something they ordinarily are unable to get, be it an object or love,” Dr Lim added.

Mr Daniel Koh, a psychologist from Insights Mind Centre, pointed out that victims could fear losing out on an opportunity. Scammers could also start with smaller steps that lead to bigger goals, which people tend to lose track of, or be friendly and sympathetic towards their potential victims.

While the authorities constantly give tips on how to avoid being scammed, Dr Tan said public education can help reduce ignorance and carelessness among the general population.

“Perhaps, a simple message that any request for money, personal information, or offers by unknown persons or sources, should be rejected and reported,” added the NUS sociologist.

ANTI-SCAM HOTLINES

-

For scam-related advice, call the anti-scam hotline on 1800 722 6688 or go to www.scamalert.sg.

-

Anyone wishing to provide information on scams should call the police hotline on 1800 255 0000, or submit it online at www.police.gov.sg/iwitness.