The Big Read in short: What a carbon tax hike means for everyone

Each week, TODAY’s long-running Big Read series delves into the trends and issues that matter. This week, we look at what the impending hike in carbon tax means for Singapore's journey towards sustainability. This is a shortened version of the full feature.

With carbon tax here to stay and rise further, TODAY looks at how effective it is, who bears the brunt of the tax, and what else needs to be done to move the needle on carbon emissions.

Each week, TODAY’s long-running Big Read series delves into the trends and issues that matter. This week, we look at what the impending hike in carbon tax means for Singapore's journey towards sustainability. This is a shortened version of the full feature, which can be found here.

- Singapore will raise its carbon tax five-fold in 2024, and more in subsequent years

- The rise brings Singapore to a “respectable” level on carbon tax globally, say experts

- While the carbon tax is effective, it must be implemented alongside other policies that support a transition to a green economy, they say

- They warn that companies may pass on higher operating costs to consumers if carbon tax is raised without any alternatives for renewable technology

- Environmentalists suggest requiring companies to have a certain percentage of renewable energy in their operations or scale up solar energy deployment as some other ways to spur sustainability

SINGAPORE — Back in 2019, when the Republic became the first South-east Asian country to implement a carbon tax — touted as a cost-effective way to combat global warming — many viewed the rate of S$5 per tonne of carbon emissions as too low.

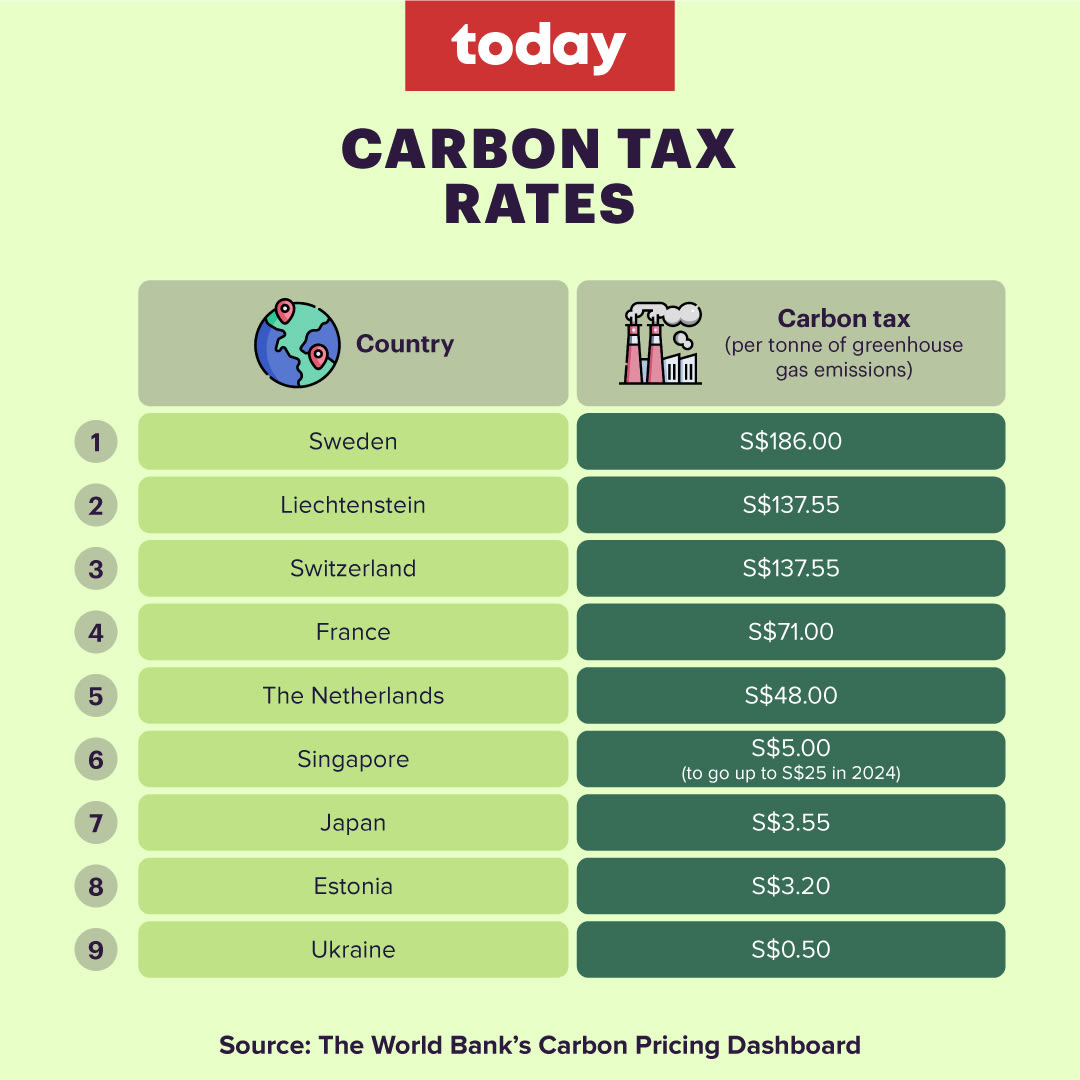

The rate, which currently covers facilities producing about 80 per cent of Singapore’s total carbon emissions, puts the island at the bottom of the carbon tax ladder, far below other countries such as Sweden (S$186) and Switzerland (S$137.55). The low rate is meant to give businesses time to adjust to a carbon tax, the Singapore authorities had said.

Still, the low rate is “alarmingly insufficient and meagre” when compared with global recommendations of S$100 by 2030 for advanced economies, said Mr Shawn Ang, a 23-year-old undergraduate and spokesperson for Students for a Fossil Free Future (S4F), a coalition championing the elimination of fossil fuels.

“Such a low rate indicates policy inertia and has been extremely inconsistent with Singapore’s ambitions to reach net zero, which was previously targeted for ‘as soon as viable’,” added the third-year environmental science and political science undergraduate from Nanyang Technological University (NTU).

However, the impending hike in carbon tax, which will be raised to a more “respectable level” of S$25 per tonne in 2024 and even higher in subsequent years, will give Singapore a seat alongside serious carbon tax users, said Dr Vinod Thomas, a visiting professor at National University of Singapore’s (NUS) Lee Kuan Yew School of Public Policy. Dr Thomas is also an economist and former World Bank vice-president, who oversaw the organisation's flagship reports on climate and the environment.

The tax will be further increased progressively to S$45 per tonne in 2026, with a view to reach S$50 to S$80 per tonne by 2030.

In his Budget speech, Finance Minister Lawrence Wong said that the increase will help Singapore to “move decisively” in achieving its new ambition of achieving net zero emissions by around the mid-century.

Previously, the Republic had aimed to halve its emissions by 2050, before reducing to net zero in the second half of the century.

While many view the impending hike in carbon tax as unavoidable, given the intensified concerns over climate change in recent years, some observers pointed out that consumers and businesses may feel the pinch in the form of higher prices and costs.

With carbon tax here to stay and rise further, TODAY looks at how effective it is, who bears the brunt of the tax, and what else needs to be done to move the needle on carbon emissions.

HOW CARBON TAX BECAME A GLOBAL MOVEMENT

About three decades after Finland became the first country to introduce the carbon tax in 1990, about 30 other countries had implemented a carbon tax system nation-wide as of last year, according to data from the World Bank.

The taxes levied by the different countries, in total, covered 2.93 gigatonnes of carbon dioxide equivalent and represented 5.4 per cent of global greenhouse gas emissions for last year.

The International Monetary Fund (IMF) proposed last year that countries implement a tiered system of carbon pricing based on their income levels by 2030.

Advanced economies should charge US$75 (S$100) per tonne of emissions, high-income emerging-market economies should charge US$50 per tonne of emissions, while lower-income emerging markets should charge US$25 by the coming decade.

These rates will bring emissions in line with keeping global warming below 2°C as targeted by the 2015 Paris Agreement on climate change, said the IMF.

In Singapore, the carbon tax was implemented in 2019 and applies to about 50 facilities producing more than 25,000 tonnes of greenhouse gas emissions or more in a year. These facilities are from the manufacturing, power, waste, and water sectors.

The tax, said former Finance Minister Heng Swee Keat, would be “the most economically efficient and fair way to reduce greenhouse gas emissions” so that emitters take the necessary action.

While the current rate is to help companies transit to the tax regime, the National Climate Change Secretariat (NCCS), which oversees climate change strategies here, said that the revised prices are “critical in enabling the pace of transformation needed to achieve (Singapore’s) raised climate ambition”.

The tax revenue will also support decarbonisation efforts and the transition to a green economy.

“The effectiveness of carbon tax is contingent on its rate, which must be high enough to incentivise companies; the time period given for industries to adapt to the tax; and the availability of green technology for industries to tap, said experts.”

THE CASE FOR CARBON TAX

As nations scramble to fight climate change, carbon tax is expected to incentivise companies to reduce their use of fossil fuels — which release large amounts of carbon dioxide when burned — to avoid paying taxes and turn to renewable energy, said experts.

It is the “most direct and efficient way to price air”, said Dr Thomas. It also provides a substantial source of revenue to be invested in renewable energy, said Dr Thomas.

Nevertheless, the effectiveness of carbon tax is contingent on its rate, which must be high enough to incentivise companies; the time period given for industries to adapt to the tax; and the availability of green technology for industries to tap, said experts.

Dr Thomas said that the experience of other countries has shown that a strong reduction in emissions typically kicks in when the rate goes beyond S$25.

He suggested that Singapore bring forward the revised rates to the mid-2020s rather than 2030, given the “very immediate” cost of climate change such as sea level rise and weather changes.

Professor Euston Quah, who specialises in environmental economics at NTU, however, argued for adjustments to the carbon tax to be spread out over a longer time period, beyond 2030.

He pointed to the constraints facing Singapore in switching to renewable energy. The use of solar energy, for instance, is hampered by limited space, while tapping energy sources through an international grid or pipeline would present energy security issues.

A longer runway with fewer drastic increases in carbon tax prices would give companies time to adjust to the changes, said Prof Quah, who is the Albert Winsemius Chair Professor of Economics.

WHAT COMPANIES ARE DOING

Big emitters which are subject to the carbon tax told TODAY that they have already implemented various decarbonisation measures to reduce their emissions over the last decade.

Ms Geraldine Chin, the chairman and managing director of petroleum company ExxonMobil Asia Pacific, said that the firm has introduced a series of initiatives since 2002, which have led to energy efficiency gains of more than 25 per cent and reduced the carbon emissions of its Singapore facility.

These initiatives include the operation of three cogeneration facilities that produce both electricity and steam at the same time. Cogeneration recovers heat energy after electricity is generated to produce steam. The steam is then used for ExxonMobil’s plant operations in Singapore. This process requires less fuel and emits less carbon emissions than if the steam and electricity were produced separately.

Ms Chin said that ExxonMobil has long supported an explicit price on carbon and added that a stronger carbon price signal from the Government encourages investments in greenhouse gas reduction.

However, given Singapore’s open economy, it is also important that the carbon tax framework safeguards the competitiveness of trade-exposed industries. They are competing with other industrial facilities globally that have either no, or a lower price on carbon domestically or on their exports, said Ms Chin.

Small and medium-sized (SME) companies which are not subject to carbon tax have also taken pains to reduce their energy use, partly spurred by rising business costs, and in the process do their part to reduce their carbon footprint.

Precision engineering company Certact Engineering has been looking for ways to reduce its energy consumption and lower its operational costs ever since its sales took a hit during heightened trade tensions between the United States and China four years ago.

The company’s finance manager, Mr Daryl Chia, said that the company has installed industrial fans in its production site at Kian Teck Drive in Jurong, so that it can switch off air-conditioners during cooler periods of the day and reduce electricity consumption.

The company has also installed 258 solar panels on the rooftop of its production facility. The energy generated from the panels provides about 20 per cent of its monthly electricity usage of 85,480 kWH per month, said Mr Chia.

Based on the current rate of 18 cents per kWH, Mr Chia said that the solar panels help the company save S$3,077 monthly.

The company does not track its carbon emissions as it does not know how to do so. Nevertheless, it is “constantly on the lookout” for hardware or methods to save electricity and energy, he said.

“Prof Euston Quah said that if companies are unable to adapt quickly to the carbon tax by adopting decarbonisation technology, the tax hikes may end up driving inflation.”

WILL CONSUMERS BEAR THE COST?

But even as smaller companies are going green to reduce their operational expenses, the carbon tax is expected to raise such costs for big emitters.

If big emitters generate their own energy with fossil fuels, higher operational costs can come in the form of higher tax if they do not switch to alternative sources of energy which are untaxed.

Carbon intensive sectors, such as power generation companies (gencos), will also feel the squeeze from a higher carbon tax. More than 95 per cent of Singapore’s electricity is now generated by natural gas, a form of fossil fuel.

Facilities in other sectors will indirectly face a carbon price on the electricity they consume as well, as gencos are expected to pass on some degree of their own tax burden through increased electricity tariffs.

Finance Minister Wong had said that the S$25 carbon tax per tonne of emissions will lead to an increase of about S$4 per month in utility bills for an average household living in a four-room Housing and Development Board flat, though additional rebates in the form of GST Vouchers will be provided to cushion the impact.

Prof Quah said that if companies are unable to adapt quickly to the carbon tax by adopting decarbonisation technology, the tax hikes may end up driving inflation.

For example, gencos facing higher production costs may pass them on to retailers, who may eventually pass them on to households. Other expenses such as retail, food and transport may also go up due to higher electricity bills.

Prof Quah said that household electricity bills, for example, will go up if residents do not cut back on their utility usage. While households are largely dependent on electricity and will have to pay the increase in prices, the estimated increase of S$4 a month is “very low”, he added.

Prof Quah felt that consumers will be able to adjust their behaviour and cut back on expenditure for other goods and services such as recreation and food.

Nevertheless, Ms Melissa Low, a research fellow from the Energy Studies Institute at NUS, expressed concern whether households will be able to cope with the trickle-down effect of the carbon tax, alongside other cost increases such as the higher Goods and Services Tax that will be implemented in stages over the next two years.

Consumers that TODAY spoke to said that they do not intend to reduce their electricity usage, as the expected increase for utilities was not significant.

“The additional S$4 to the overall cost of the bill is not much and it doesn't really bother me. I may use less electricity but I won’t go out of my way to reduce my consumption,” said Mr Sivakumar Balamurugan, a 33-year-old marketing manager.

“The National Climate Change Secretariat said that the carbon tax revenue will be used by the Government to cushion the impact of the increase in utility costs for households.”

In a webpage on frequently asked questions about the carbon tax posted since 2019, NCCS addressed the concern of how the Government would ensure that consumers are not over-charged by electricity retailers passing on more than 100 per cent of the carbon tax to them.

NCCS said that the competitive electricity retail market discourages retailers from raising their electricity rates excessively.

Nevertheless, the Energy Market Authority will continue to ensure fair and efficient conduct of market players, said NCCS.

In its response to TODAY on additional safeguards in place to ensure that companies do not pass on the cost of carbon tax to consumers, NCCS said that the carbon tax revenue will be used to cushion the impact of the increase in utility costs for households, such as through additional U-Save rebates for lower and middle-income households.

GOING BEYOND CARBON TAX

Although carbon tax is viewed as key to fighting climate change, it can only be effective if accompanied by other policies that support decarbonisation efforts, experts told TODAY.

Beyond carbon tax, Dr Thomas said that installing more charging points will help increase the adoption of Electric Vehicles, regarded as transportation’s answer to reducing climate change emissions; while the plan for Singapore to quadruple its solar deployment to at least 2 gigawatt-peak (GWp) by 2030 can be scaled up.

Ms Woo Qiyun, 25, who runs the Instagram account The Weird and Wild to educate readers on environmental policy, suggested more robust sustainability reporting so that the environmental impact of corporations will be more visible.

“Public accountability can be one lever to push for emissions reductions. Transparency, traceability and clarity of their disclosed emissions, carbon tax liabilities and the use of offsets would be key markers for observers to assess corporations' progress in emissions reduction,” she said.

Mr Ang of S4F said that while the latest announcements on the carbon tax gives "renewed hope" that Singapore is "prepared to do what it takes" for climate change, Singapore can push further.

Said Mr Ang: "We believe that Singapore, being well-resourced...and being a leader in many industries, technologies and intergovernmental spaces, can and must do more than it currently is, to do our fair share for the world and for our collective futures."