The Big Read in short: What a rapidly shrinking taxi industry means for older drivers, commuters

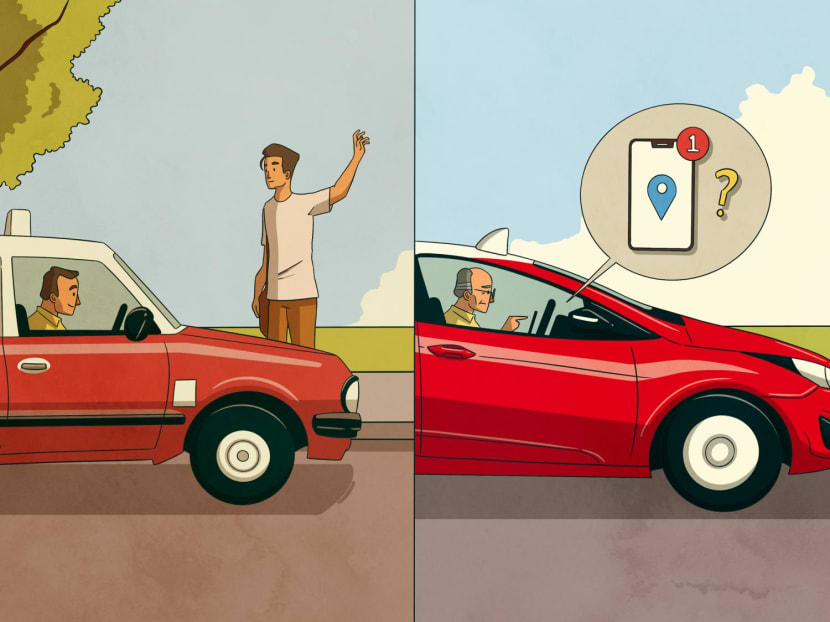

SINGAPORE — Having been a taxi driver for 28 years, 63-year-old Anthony Oh was accustomed to the “traditional” means of picking up passengers — either by waiting at taxi stands, or by picking up riders hailing cabs on the street.

As taxi drivers continue to grapple with falling incomes — amid ever-rising overhead costs, neverending competition from private-hire car services and lingering effects of the pandemic — the future of Singapore’s taxi industry has once again come under the spotlight.

Each week, TODAY’s long-running Big Read series delves into the trends and issues that matter. This week, we examine the state of the rapidly shrinking taxi industry and its impact on older drivers and commuters. This is a shortened version of the full feature, which can be found here.

- The entry of ride-hailing firms such as Grab and Gojek into the Singapore market has meant that competition within the point-to-point sector is now in the digital space

- This has left many older taxi drivers, who are used to picking up passengers at taxi stands and flagdowns, at a disadvantage

- While some have tried to learn and adapt, others are more averse to change and prefer to stick to old ways

- The increasing need to adopt technology comes amid a significant fall in taxi fleet numbers over the past decade

- Analysts said it the onus is on older drivers to upskill but one of them noted that the plight of these drivers need to be looked at in the broader societal context

SINGAPORE — Having been a taxi driver for 28 years, 63-year-old Anthony Oh was accustomed to the “traditional” means of picking up passengers — either by waiting at taxi stands, or by picking up riders hailing cabs on the street.

The entrance of ride-hailing applications such as Uber and Grab back in 2013 and 2014 respectively was met with derision by many taxi drivers like Mr Oh, who felt they had lost business to the new entrants.

“Initially when (the ride-hailing firms) came in, they were actually making us taxi drivers lose out, because the rides they were offering were very cheap, so we found that we (taxi drivers) were working more and earning less,” he said.

But come the pandemic, Mr Oh saw a tremendous fall in his income as more people stayed at home. He was earning as little as about S$50 a day after plying the roads for eight hours.

It was in November last year when Mr Oh cast his prejudices aside and signed up with a ride-hailing application. Since then, he has seen an increase in earnings and passenger pick-ups.

While he used to pick up only about seven passengers a day before using the application, he now picks up about 12 passengers a day.

Now, he can pick up passengers with his taxi off the streets, while also depending on the application for additional bookings.

“Now I rarely do flag downs, maybe only one to two trips a day will be like that, nowadays 90 per cent of my jobs are from the (ride-hailing application)... it’s convenient for everybody, both the driver and the passenger.”

But not all senior taxi drivers whom TODAY spoke to were as open as Mr Oh to adapting to new technology.

One taxi driver who has shunned away from the ride-hailing applications is Mr Vincent Goh.

The 60-year-old, who has been a taxi driver since 2005, said that when ride-hailing firms entered the market, he was not tempted to join them as he trusted his taxi company more than these new players when it came to “benefits and security”, such as insurance coverage and vehicle maintenance coverage.

“I think the taxi industry is more protected in that sense, the (new players) are just disruptors,” said Mr Goh.

“Customers always like to have something new, like the taste of taking a private transport as if they have a chauffeur… but for older taxi drivers, who have been driving for over 10 years, they will say that (the new model) is difficult to accept.”

“Customers always like to have something new, like the taste of taking a private transport as if they have a chauffeur… but for older taxi drivers, who have been driving for over 10 years, they will say that (the new model) is difficult to accept.Taxi driver Vincent Goh, 60, who has shunned away from the ride-hailing applications”

Mr Goh estimated that he could be earning more had he switched over to the ride-hailing platforms, or had concurrently used the ride-hailing applications on the job, which taxi drivers are allowed to do. Still, he has no regrets because of his familiarity with driving a taxi without having to depend on the apps.

However, he is still paying the price: Due to increased competition from the other ride-hailing platforms, a drop in passenger demand amid the raging Covid-19 pandemic, as well as increasing fuel and rental costs, Mr Goh said that his recent take-home income is about 35 per cent less compared with pre-pandemic.

Although he has been getting more customers of late due to the increase in transport demand following further relaxation of Covid-19 measures, his income has yet to see an uptick, he said.

As taxi drivers like Mr Goh continue to grapple with falling incomes — amid ever-rising overhead costs, neverending competition from private-hire car services and lingering effects of the pandemic — the future of Singapore’s taxi industry has once again come under the spotlight.

While younger taxi drivers are generally more willing to adapt to new technology such as ride-hailing applications or are willing to accept customers on multiple ride-hailing platforms, older drivers — those aged 60 and above — are generally more accustomed to “old-school” methods such as accepting flagdown rides, or bidding for jobs on their taxi terminals.

TODAY’s checks indicated that the number of drivers with a Taxi Driver's Vocational Licence (TDVL) above the age of 60 is relatively high. Statistics from 2019 show that about 34 per cent of those with a TDVL are 60 and above.

In contrast, only 8.5 per cent of those with a Private Hire Car Driver's Vocational Licence (PDVL) are above the age of 60, as of 2019.

The growing challenges faced by this relatively large proportion of older taxi drivers also come at a time when taxi fleet numbers have been on the decline.

According to data from Statistics Singapore and the Land Transport Authority (LTA) website, the number of taxis here fell by about half between 2014 and 2022. Over the same period, the number of private hire vehicles increased by more than threefold.

While private-hire vehicles have taken on a larger share of the point-to-point (P2P) market here, the total number of P2P vehicles — both taxis and private-hire vehicles — has been tumbling over the course of the pandemic.

Due to the fall in supply, there have been more reported instances of surge pricing on private-hire rides, much to the dismay of commuters.

While commuter demand is on the rise currently as the dust slowly settles, it is still firmly below baseline levels that were observed pre-Covid-19, said transport operators. And the statistics suggest that the taxi industry is taking the brunt of this overall drop in demand.

Still, Singapore University of Social Sciences (SUSS) transport economist Walter Theseira said that it is not the end of the road for the taxi industry — provided it adapts. And the same goes for taxi drivers, regardless of age.

Other than having the unique ability to accept street-hail rides, taxis drivers are also able to tap on all the benefits of ride-hailing firms, such as to use their applications.

"It's a market service that meets a market transport need... As that need evolves, and as street hails continue to decline, then the market model needs to change," said Assoc Prof Theseira.

"Already, the taxi operators themselves recognise that the street hail market is a sunset part of the business and they have placed more emphasis on their app booking system."

As for older taxi drivers struggling to adapt, Assoc Prof Theseira noted that it does not make sense “to manipulate the market model for taxi services just to save these jobs”.

THE POINT-TO-POINT TRANSPORT SECTOR IN NUMBERS

- Proportion of older taxi drivers is relatively high compared to private-hire drivers.

While the taxi and private-hire car firms that TODAY reached out to all declined to reveal the proportion of drivers aged 60 and above, then-Transport Minister Khaw Boon Wan gave a breakdown of these drivers by age group in a parliamentary reply in 2019.

He revealed that as of February 2019, the proportion of TDVL holders that were between 60 and 74 years old was 33.4 per cent, while those between 40 and 59 was 59 per cent.

For PDVL holders, the proportion of those between 60 and 74 of age was 8.5 per cent, those between 40to 59 was 47.1 per cent and those between 20 and 39 was 44.4 per cent.

- Taxi numbers falling, private-hire vehicle numbers on the rise over last decade

The peak fleet size for taxis was in 2014, the same year when ride-hailing company Grab joined the market, with Uber having entered earlier in 2013.

In 2014, there was one taxi for about every 190 people in Singapore.

Since then, taxi numbers had been falling significantly, halving from 28,736 in 2014 to a low of 14,359, as of June this year — which works out to one taxi for about every 380 people in Singapore.

Conversely, the number of private-hire vehicles skyrocketed more than threefold — from 18,847 in 2014 to 67,990 in 2021. While Uber exited from the Singapore market in 2018, new players such as Gojek and Tada also made their entry.

- Pandemic has led to a fall in fleet sizes for both taxis and private-hire vehicles

While the past decade has seen a significant drop in the taxi fleet size and an increase in the number of private-hire vehicles, the pandemic has resulted in a general decline for both categories.

Earlier this month, Transport Minister S Iswaran said that the number of active taxi and private hire car drivers had fallen by 18 per cent over the past two years.

Responding to TODAY’s queries, LTA said that the number of active taxi drivers fell from 24,700 in November 2020, to 21,300 in June 2022.

Meanwhile, the number of active private hire car drivers dropped from 38,000 in November 2020 to 35,700 in June this year.

A similar pattern could be seen for the number of taxis and private-hire vehicles.

In 2019, the number of private-hire vehicles reached its peak of 77,141, but then fell to 67,990 in 2021, about a 11 per cent decline.

For taxis, the figure dropped from 18,542 in 2019, to 14,359 as of June 2022, about a 22 per cent decline.

- Number of rides stable, but falling number of street-hail rides

While vehicle numbers are falling, the number of total rides has remained relatively stable over the last one-and-a-half years.

The average number of daily rides for both taxis and private-hire cars was 576,000 in January 2021, with the figure dropping to about 469,000 in June 2021, during the period of Phase 2 (heightened alert) when there was a spike in Covid-19 cases in the community.

Average daily rides subsequently increased gradually to a peak of 596,000 in April this year, as Covid-19 restrictions were lifted, but then fell slightly to 581,000 in June, nearly the same as the average number of daily rides in January last year.

The number of street-hail trips, available only to taxis which can pick up customers who flag them, has fallen over the past one-and-a-half years.

While there were an average of 129,000 daily street-hail trips in January 2021, this figure had steadily declined to 101,000 for February this year, before inching up slightly to 110,000 for June.

The converse is true for ride-hail trips — those that involve customers calling in, or using the app to book. These are rides by both taxis and private-hire cars.

There were 447,000 such rides on an average day in January 2021, and this increased to a peak of 488,000 rides for April this year, followed by 471,000 rides for June.

WHAT OLDER TAXI DRIVERS SAY

Amid the disruptions to the industry, many taxi drivers have decided to go with the flow, by either crossing over to these ride-hailing platforms, or do both taxi and ride-hailing services concurrently.

However, some older taxi drivers told TODAY that it is harder for them to start using mobile applications as a way to get more customers, as they have been used to years of picking up passengers from flagdowns, a declining practice.

A driver with ComfortDelGro, who wanted to be known only as Mr Yeo, said that when he first started driving taxis about 12 years ago, the predominant mode of getting cabs was by flagging them down.

“Now, it’s different. We are competing on the basis of calls and customers who book us on the application,” said the 65-year-old, referring to the company’s ride-hailing application.

In October 2020, ComfortDelGro was awarded a ride-hailing licence under the Government’s new licensing framework for the P2P transport sector, along with three other P2P companies — Grab, Gojek and Tada Mobility.

The framework also allows taxi drivers to sign up with any ride-hailing firms to provide fixed-fare rides.

While he could have signed up for these new apps, Mr Yeo said in Mandarin that he is already “very familiar” with the ComfortDelGro’s application, which he had only learnt to use just before the pandemic, and is thus not keen to learn using other apps.

He said that compared to pre-pandemic, his take-home income is now 40 per cent less.

Though he could conceivably earn more by diversifying and using more applications, Mr Yeo said that he treats driving a taxi as a “retirement job” and does not mind the opportunity cost.

“But for someone who is younger and needs to raise a family, I don’t think they could afford to sit back and relax, they’ll have to either switch platforms, or look for a new job,” he said.

Then, there are older drivers, such as 65-year-old Tan Kerk Ing, who decided to learn how to use ride-hailing applications as the pandemic raged, in a bid to improve their earnings.

Mr Tan, a taxi driver for 32 years, said that he had initially resisted signing up with any ride-hailing firms and downloading their applications to get more passengers.

It was only when Covid-19 struck that he had a change of heart, after seeing his monthly income fall as low as S$1,000 at the height of the pandemic.

He asked some taxi-driver friends for help, and they taught him how to download and use the Grab application on his smartphone. Soon, he was ferrying passengers in his taxi both the traditional way and based on Grab bookings.

Mr Tan said that his earnings have since increased by about 50 per cent — he currently earns about S$3,000 a month, compared to about S$2,000 pre-pandemic.

SOME ELDERLY COMMUTERS RISK BEING LEFT BEHIND TOO

For older commuters who have not warmed up to using mobile applications to book their rides, the shrinking number of taxis has left them standing on the roadside, literally, as they wait for a passing cab.

Such is the case for 61-year-old Loy Chit See, a manufacturing executive who takes the taxi two to three times a week either to his workplace or to run errands.

Over the past month, whenever he calls for a taxi, said Mr Loy, they are frequently redirected to an automatic telephone message telling him that there are no taxis available.

His efforts to flag a cab at a taxi stand near his house have also been unsuccessful. On weekends, he added, there is often a long queue at the taxi stand, but no taxis.

Even if he were to wait on the roadside, it is hard to find any cabs that are “green”, indicating that they are vacant.

“Last time (before the pandemic), it was quite easy, I could get a taxi within five to 10 minutes,” he said.

Mr Loy said he does not use ride-hailing applications because he is not used to doing so, and has no intention to pick up a new habit.

“I belong to the baby boomer generation, we are not savvy with all this… there’s quite a number of people like me who don’t have these mobile applications.”

He added that when he is unable to get a taxi, he will either take a bus to his destination, or if he is running late, he will call his friend to book a private-hire car ride for him.

Retiree Muhammed Isa, who is wheelchair-bound, also faces a similar problem.

The 70-year-old typically waits for a ride at taxi stands, as it is more convenient for him to board a taxi there, given his condition. While waiting times before the pandemic were 15 minutes at most, he now can wait up to one hour before a taxi comes along.

“I normally call for the cab (using their hotline), I don’t use the applications because I don’t understand how to use them,” he said.

Like Mr Loy, these calls do not necessarily ensure that the retiree can book a ride promptly.

WHAT CAN BE DONE TO HELP OLDER TAXI DRIVERS

Older taxi drivers who are reluctant to use ride-hail applications are putting themselves at a clear disadvantage in a highly contested, increasingly technology-reliant market, said transport analysts.

SUSS’ Assoc Prof Theseira said that while older drivers cannot be seen as a homogenous group, there may be some who are more used to the street-hail and taxi stand business, as well as drivers who have over the years settled into patterns of searching for passengers.

“The problem of course is the pandemic has disrupted many of these commuting patterns, and for substantial periods, eliminated a lot of the street-hail business since people used to prefer, for health reasons, to minimise time spent out of the home,” he said.

Agreeing, Associate Professor Raymond Ong, from the Department of Civil and Environmental Engineering at the National University of Singapore, said that it is expected that flagdowns will be seeing a “slow death”, especially when more users become used to booking a taxi or private-hire cars through apps.

“This makes it even more crucial for older drivers to be upskilled fast,” he said.

Responding to queries from TODAY, the largest taxi operator here said that they have rolled out several initiatives to help drivers, especially the more senior ones, get up to speed with their applications.

Ms Tammy Tan, ComfortDelGro's group chief branding and communications officer, said that for drivers who may be unfamiliar with how to use the technology on the firms in-house CDG Zig application, the operator provides them with training at its headquarters on how to use it.

However, she added that a larger issue for the firm is that when taxi demand plunged during the height of the pandemic, many drivers had left the industry.

"In recent times, high fuel prices have deterred prospective new drivers from joining the P2P sector," said Ms Tan.

"To retain existing drivers and attract new ones, ComfortDelGro Taxi has continued to extend rental rebates and introduced the prolonged medical leave insurance policy to help our drivers," she added.

Transport analyst Terence Fan, from the Singapore Management University, added that these drivers cannot just depend on the applications, but should also see the unique opportunities that driving a taxi can bring.

“Drivers themselves also have to be more adept in terms of scouting or waiting for their next customers,” he said. “They also must be open to take on customers who would otherwise be shunned by private-hire apps.”

Such customers can be those making “circuitous trips” with multiple destinations that exceed the quota of ride-hailing apps, as well as tourists with a set itinerary but who need a designated driver for the day, he said.

“I don't think we want to save the taxi business model, or even older taxi drivers, just for the sake of saving them. Why can't we extend to them more state support, or help them financially transition to another job?Economist Walter Theseira from the Singapore University of Social Sciences”

But where older drivers are concerned, Assoc Prof Theseira said that the conversation should not be about how these workers can upskill to work longer into their sunset years, but perhaps to ask if this is necessary in the first place.

He said: "The question is a societal one — why do persons who are past retirement age have to continue working for a living?"

"I don't think we want to save the taxi business model, or even older taxi drivers, just for the sake of saving them," he added. "Why can't we extend to them more state support, or help them financially transition to another job if it is not yet time to provide them with long term support?"