DBS, OCBC up the ante on digital banking offerings

SINGAPORE — DBS and Oversea-Chinese Banking Corp (OCBC) on Tuesday announced enhancements to their digital banking offerings in their latest push to meet demand from consumers for better on-the-go services as the pace of digital adoption grows in Singapore.

SINGAPORE — DBS and Oversea-Chinese Banking Corp (OCBC) on Tuesday announced enhancements to their digital banking offerings in their latest push to meet demand from consumers for better on-the-go services as the pace of digital adoption grows in Singapore.

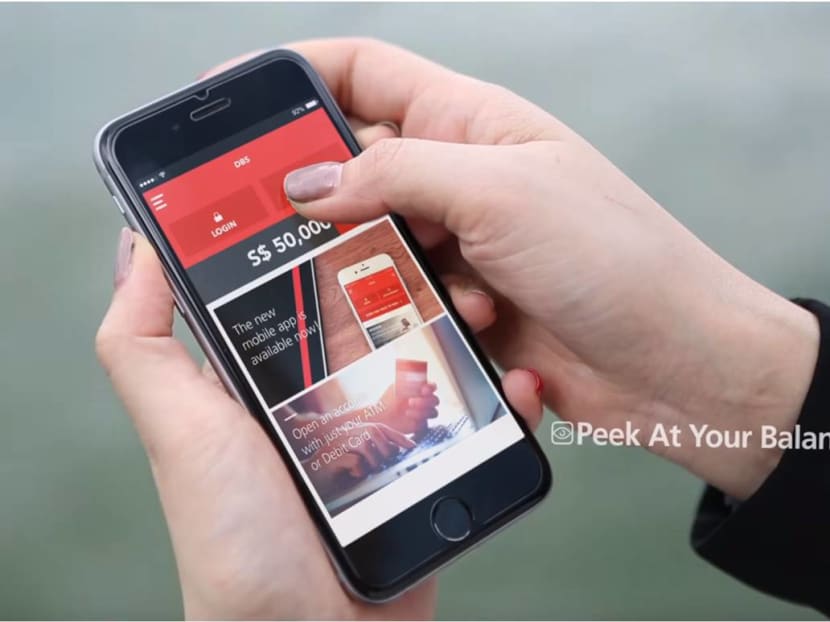

DBS, South-east Asia’s largest bank by assets, launched a mobile app called DBS digibank that allows new customers access to its four existing digital banking services: e-wallet DBS PayLah!, mBanking, SMS Banking and eStatement. Previously, customers would have to register for each of these separately.

The app, part of the S$200 million that DBS committed in 2014 to invest in digital banking, also allows new customers to open savings accounts without having to visit a physical branch. Other new features include the ability to create shortcuts for preferred services for easy access while iPhone users can register their fingerprints as passwords for the app.

With account balance enquiry being the most used-function among its customers across its platforms including ATMs, online and call centre, DBS said customers can now check their DBS or POSB deposit or credit account balances on the new app without logging in. This feature, Peek Balance, must be activated before use and is also available on Apple Watch.

On security concerns over the simplified banking processes on the app, DBS’ deputy group head of consumer banking and wealth management Pearlyn Phau said “risky transactions” such as transfers of funds and payments to third parties still require two-factor authentications using a token or SMS.

Mr Jeremy Soo, DBS’ managing director and head of consumer banking group in Singapore, added: “We have enough back-end controls to detect money launderers, all sorts of activities that are happening, the frequencies of (these activities). All these have to be cleared by the regulators, they have to feel comfortable that DBS has that kind of controls at the back end.”

Meanwhile, rival lender OCBC on Tuesday (March 29) launched an app designed for Apple Watch to ride on the increasing popularity of wearable technology. The app allows OCBC’s customers to check their bank account balances, information about their credit card usage, bank loans, insurance policies and up to five of their most recent transactions.

“Smartwatches represent the next generation of personal mobile devices, and our Apple Watch app will offer the convenience, security and choice that customers demand when it comes to everyday banking on-the-go,” said Mr Aditya Gupta, OCBC’s Singapore head of e-business.

To get started, customers have to perform a one-time activation on their OCBC iPhone mobile banking app. At any one time, the service can only be activated on a single pair of Apple Watch and iPhone. All account numbers displayed on the Apple Watch are partially masked with only the last four digits revealed. No information is stored on the phone or watch, and for increased security, customers can choose to set a passcode on their Apple Watch.

DBS and OCBC’s latest moves underline the continuing efforts by Singapore’s three banks to capitalize on the expanding digital space in finance. Last year, United Overseas Bank (UOB) launched its mobile app, UOB Mighty, with features that allow customers to make contactless payments in Singapore and globally.