DBS to recruit 1,000 ambassadors to promote mobile payments at hawker centres, neighbourhood shops

SINGAPORE – Pay for your char kway teow, mee rebus or roti prata by scanning a QR code with your mobile phone. That’s what DBS hopes will become more common in the near future as it steps up efforts to promote the widespread adoption of mobile payments, in line with Singapore’s vision to transform itself into a Smart Nation.

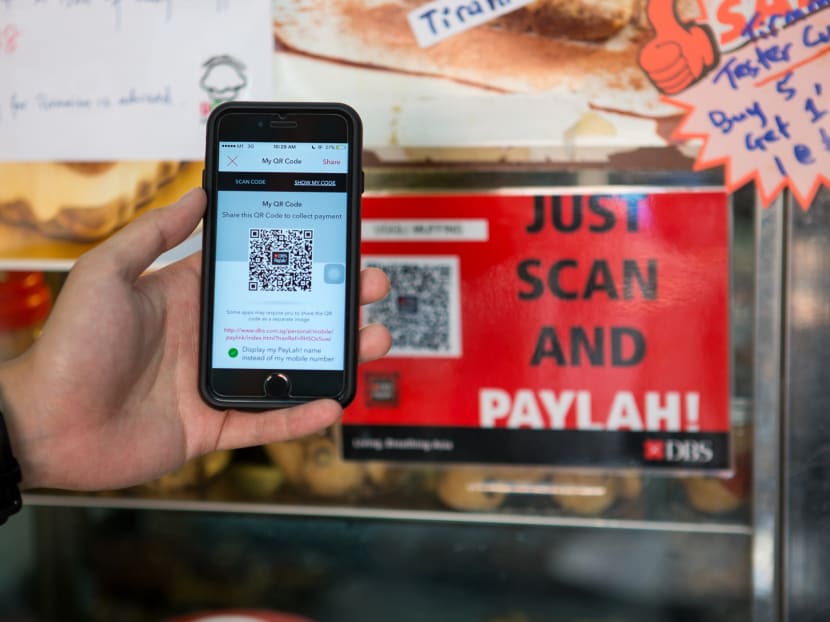

Consumers can now pay for meals by scanning a QR code with the DBS PayLah! app. Photo: DBS

SINGAPORE – Pay for your char kway teow, mee rebus or roti prata by scanning a QR code with your mobile phone. That’s what DBS hopes will become more common in the near future as it steps up efforts to promote the widespread adoption of mobile payments, in line with Singapore’s vision to transform itself into a Smart Nation.

On Friday, DBS, Singapore’s largest bank, announced its Smart Nation Ambassador Programme (SNAP) which will recruit up to 1,000 ambassadors who will fan out across the island to encourage small, cash-based merchants to adopt DBS PayLah! QR codes as a payment method. The announcement was made during the DBS Paylah! X *SCAPE Palooza event – Southeast Asia’s first QR code payment-led bazaar which features about 100 youth vendors setting up shop at *SCAPE from today to Sunday. All vendors at the event will be able to accept payment for purchases via DBS PayLah!’s QR code.

DBS hopes the ambassadors will be able to convince small businesses – primarily hawker stalls, wet market vendors and neighbourhood stores – about the benefits of going cashless and encourage them to adopt the QR code payment method. In conjunction with the SNAP initiative, the bank will also partner ComfortDelGro to implement QR code payments in its fleet of 16,300 taxis by the third quarter of this year. DBS hopes to have more than 30,000 QR code payment acceptance points available to customers by the end of the year.

DBS’ decision to focus on small businesses with SNAP is driven by the fact that small businesses in Singapore still overwhelmingly prefer the use of cash despite a national drive encouraging businesses to go cashless. As a result, around 60 per cent of consumer payments in Singapore are made in cash, according to a report last year by the Monetary Authority of Singapore (MAS) and business consultancy KPMG. For taxi and car hire services, around 75 per cent of consumer payments are made in cash. Cash accounts for more than 80 per cent of payments at small shops, and 90 per cent at hawker centres and wet markets.

Mr Jeremy Soo, Head of Consumer Banking Group (Singapore) at DBS, said: “One of the obstacles to widespread cashless payment adoption we have identified is that there are still various myths circulating around cashless payments – that high costs are involved in setting up the infrastructure to process payments; it is unsafe; it is complicated to use for both merchant & consumers, etc.”

“We set up SNAP as an outreach programme so we can help debunk these myths and demonstrate to businesses how going cashless can be low-cost, easy and raise business productivity, taking us one step closer to our vision of a Smart Nation,” he added.

DBS PayLah!, the nation’s top mobile wallet with about 500,000 users, is the first in Singapore to give users – including non DBS/POSB customers – the ability to generate their own QR codes to receive funds as well as pay via QR codes.

DBS says the payment method is highly convenient and there is no need to carry cash, credit or debit cards, or even queue up for cash withdrawals. Consumers and merchants only need a Singapore bank account to send or receive funds via DBS PayLah!’s QR codes at no cost, and transactions can be tracked. If the mobile phone is lost or stolen, DBS PayLah! can be blocked remotely. DBS PayLah! is also password-protected or secured using biometric ID.