Insurance portal goes live, lets consumers compare 200 offerings

SINGAPORE — The insurance Web portal compareFIRST went live yesterday, allowing consumers to compare about 200 life insurance products from a dozen insurers, so they can make informed purchase decisions. Yesterday also saw the launch of Direct Purchase Insurance (DPI), a commission-free life insurance policy to meet individuals’ basic protection needs.

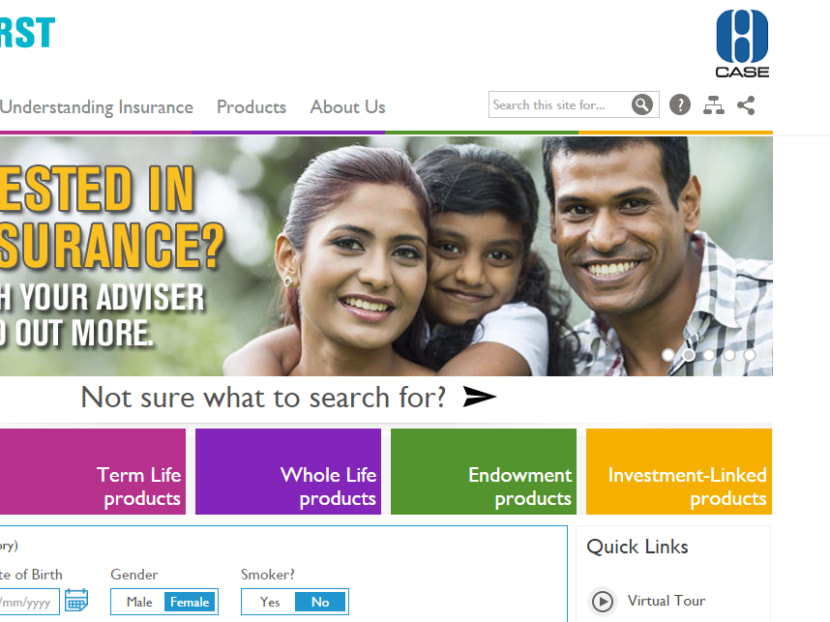

The insurance Web portal compareFIRST went live yesterday, allowing consumers to compare about 200 life insurance products from a dozen insurers. Photo: Screengrab from compareFIRST website

SINGAPORE — The insurance Web portal compareFIRST went live yesterday, allowing consumers to compare about 200 life insurance products from a dozen insurers, so they can make informed purchase decisions. Yesterday also saw the launch of Direct Purchase Insurance (DPI), a commission-free life insurance policy to meet individuals’ basic protection needs.

Listing offerings from 12 insurance companies, such as AIA Singapore, Aviva, Great Eastern Life Assurance, NTUC Income and Prudential, compareFIRST (http://www.comparefirst.sg) features five categories of insurance products: Term life insurance, whole life insurance, endowment policies, DPIs as well as investment-linked life insurance policies (ILP).

Pricing is indicated for all categories except ILPs, allowing for comparisons to be made between the various offerings. For ILPs, only general information is provided. About 10 per cent, or 20, of the insurance products are DPIs. There are about 50 whole life insurance offerings and 60 term life insurance offerings in all, including DPIs.

The snazzy compareFIRST website takes the visitor on a virtual tour: After filling in basic information such as age, gender and smoker status, among others, the visitor is taken to a customised selection of policies available from the various insurance companies. Cruising through the user-friendly website, he or she can do an apple-to-apple comparison on features such as premiums, death benefits and surrender values at different years, among others.

As the website does not have a cart-out purchase function, buyers who wish to purchase life insurance products should approach their financial advisory representative or insurance company. The premiums shown on compareFIRST are estimates, and rates charged by an insurance company may differ from what is displayed in the portal, due to factors such as underwriting.

Consumers, especially the more sophisticated ones who know what coverage they need, welcomed the arrival of compareFIRST, which allows them to find out what is on the market at a glance. However, some still prefer to have an adviser whom they can consult to help them decide on what is best for them.

“It is good to compare, but purchasing insurance is all about trust. It is better to have a go-to person who is just a call away,” said Ms Teh Shi Wei, an educator of visual arts who is in her 20s.

“I believe the pricing for insurance should depend on the individual, as every individual has his or her own health situation. But of course, it is good to have a general guide to know what the price plans are,” said Ms Grace Ng, an editor of an online magazine.

Those who need only basic protection at a lower cost can turn to the newly-launched DPIs, a class of simple life insurance products that is sold without financial advice and commission. DPIs comprise term life insurance products with total and permanent disability (TPD) cover; whole life insurance products with TPD cover; and optional critical illness rider attached to term life or whole life insurance products. An individual can buy DPI coverage up to S$400,000, with a maximum of S$200,000 for whole life DPI per insurer.