Twitter surges 73.5% on debut as investors pile in

NEW YORK — Twitter shares skyrocketed 73.5 per cent in the social networking giant’s debut on the New York Stock Exchange (NYSE) yesterday and continued to climb after it raised US$1.82 billion (S$2.2 billion) in the most highly-anticipated initial public offering (IPO) since Facebook in May last year.

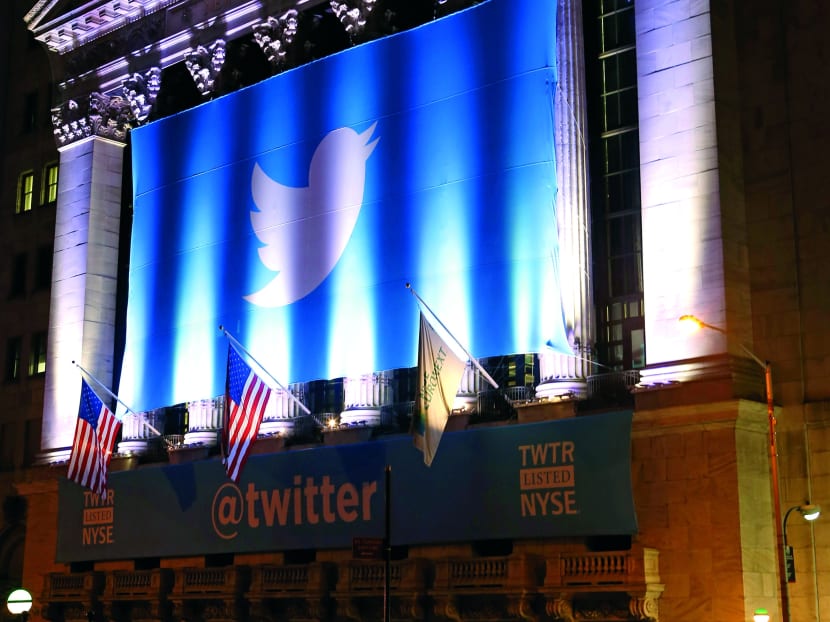

A banner adorns the facade of the New York Stock Exchange in advance of Twiiter’s initial public offering Thursday, Nov. 7, 2013, in New York. Twitter shares, valued at $26 per share, are set to begin trading on the stock exchange Thursday. The company is valued at $18.1 billion. (AP Photo/Kathy Willens)

NEW YORK — Twitter shares skyrocketed 73.5 per cent in the social networking giant’s debut on the New York Stock Exchange (NYSE) yesterday and continued to climb after it raised US$1.82 billion (S$2.2 billion) in the most highly-anticipated initial public offering (IPO) since Facebook in May last year.

Twitter stock, under the ticker TWTR, opened trading at US$45.10 a share 83 minutes after the opening bell on the NYSE. It was changing hands at US$45.98 in early afternoon trade after hitting as high as US$50. Twitter had been priced at US$26 for the 70-million share IPO, after being repeatedly raised as demand exceeded supply during book-building.

“Phew!” tweeted banker Anthony Noto at Goldman Sachs, Twitter’s IPO manager, seconds after the opening surge.

Twitter’s IPO price values the micro-blogging service at 12.4 times its estimated 2014 sales of US$1.14 billion, according to analyst projections compiled by Bloomberg — higher than the 11.6 times that Facebook was trading at yesterday and similar to LinkedIn’s multiple of 12.2 times sales.

Twitter’s IPO makes it the largest by a United States technology company since Facebook’s and puts its market capitalisation at US$14.2 billion. At the last done price, its market value had climbed to US$25.1 billion.

The rich valuation puts the onus on its management to deliver on its promises of fast growth. Chief Executive Officer Dick Costolo has rallied investor interest in Twitter’s rapid sales curve — with revenue more than doubling annually — even with no clear path to making a profit.

“People are really looking all the way out to their 2015 and 2016 revenue estimates to price this. The risk to buying Twitter is if Twitter does not achieve its very lofty growth estimates,” said Mr Larry Levine, a partner in financial advisory firm McGladrey in Chicago. “

Twitter had sought to avoid the hype that surrounded Facebook’s initial share sale last year that led bankers to overestimate demand for the latter’s shares. Twitter filed for an IPO confidentially with the US Securities and Exchange Commission earlier this year and originally set an offering price range at a discount from its Internet peers.

But demand for the stock exceeded the supply even before bankers started formally asking for orders. On Monday, Twitter raised the proposed price range for the 70 million shares sold in the IPO to between US$23 and $25 each, up from the earlier range of US$17 to US$20.

Twitter will have 544.7 million shares of common stock outstanding after the IPO, its regulatory filings show. It will have about 694.8 million shares, including restricted stock and options.

The company, whose website and applications let people post 140-character messages to friends and online followers, still needs to deliver on its business model.

Its loss widened to US$64.6 million in the September quarter from US$21.6 million a year earlier and it is unlikely to be profitable until 2015, according to the average estimate of analysts surveyed by Bloomberg.

In contrast, LinkedIn and Facebook were both profitable at the time of their IPOs.

While Twitter’s revenue has surged, reaching US$534.5 million in the 12 months that ended Sept 30, user growth is slowing, its filings show. The service had 231.7 million monthly users in the quarter that ended in September, up 39 per cent from a year earlier. That compares with 65 per cent growth in the prior year.

Twitter has been touting its engagement with mobile users, where other Web companies have struggled. About three-fourths of Twitter’s active users accessed the service from mobile devices in the three months ended in September, compared with 69 per cent in the year-earlier period. More than 70 per cent of advertising revenue comes from those devices. AGENCIES