Commentary: Don’t panic about CPF changes — take time to evaluate investment options

Come 2025, a slew of changes will be made to Singapore’s Central Provident Fund (CPF) scheme. Of these, two changes have generated significant interest: The increase in the Enhanced Retirement Sum (ERS) and the closure of the CPF Special Account (SA) for those aged 55 and above.

This audio is AI-generated.

Come 2025, a slew of changes will be made to Singapore’s Central Provident Fund (CPF) scheme. Of these, two changes have generated significant interest: The increase in the Enhanced Retirement Sum (ERS) and the closure of the CPF Special Account (SA) for those aged 55 and above.

While these announcements threw up several requests from Singaporeans for more information and clarifications, some question marks remain unanswered.

WHAT IS THE IMPACT OF THE INCREASED ERS?

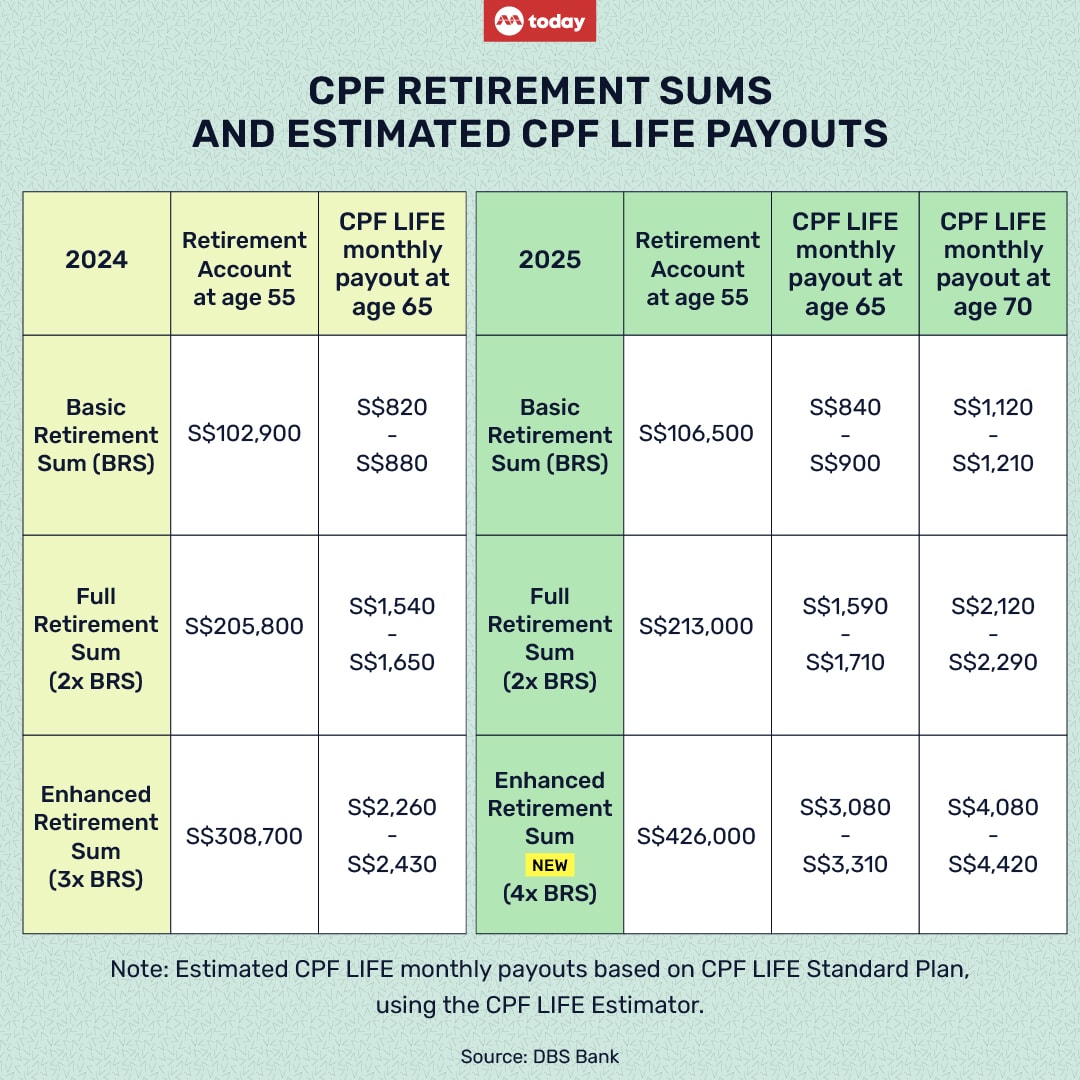

From 2025, the ERS will be increased from three times the Basic Retirement Sum (BRS) to four times. This means the ERS next year will be S$426,000 (4x BRS) instead of S$319,500 (3x BRS).

To enjoy higher monthly payouts in retirement, you can choose to top up your Retirement Account (RA) up to the prevailing ERS. The first S$30,000 in your RA enjoys 6 per cent interest, the next S$30,000 attracts 5 per cent, while the balance earns at least 4 per cent, which is the same as the SA.

The increased ERS offers an opportunity for members to set aside a higher amount in the RA, which translates to higher CPF LIFE payouts in retirement.

If you choose to delay your CPF LIFE payouts to start at age 70 instead of 65 — thereby allowing your RA savings a few extra years to grow — you could attain a CPF LIFE monthly payout of up to S$4,420. For each year that you defer, your payouts can increase by up to 7 per cent per annum.

If a couple can attain the ERS amount each, they could receive up to about S$8,500 in monthly payouts for life, which would make a comfortable retirement for most people.

When deciding to enhance your RA via CPF transfer or cash top-up, it’s important to consider the following:

- The amount of CPF LIFE payout you wish to have

- The amount of liquidity (that is, cash) you need as part of your assets, as topping up your RA is not reversible.

If you are already receiving monthly payouts, your payouts will increase if some or all your SA savings are transferred to your RA when your SA is closed.

You will be notified to check your monthly payouts after the transfer and closure of your SA in early 2025.

INVESTING YOUR CPF FUNDS

Before you invest your OA, consider the following:

- Your need for liquidity, as some investment options have lock-in periods

- Risk of the investment product

- Your risk profile

- Time horizon

Take your time to evaluate your investment options as the SA closure only happens in early 2025. Even if you choose to do nothing, they yield a stable 2.5 per cent return and can be withdrawn on demand.

If there is no need for you to take additional risk, leaving your funds untouched could be a suitable option for you as well.

For those aged 55 and above who have invested their SA savings, you can still hold your existing CPFIS-SA investments until you decide to sell them or until they mature.

Upon the sale or maturity of these investments after the SA is closed, the proceeds will go to the RA up to your FRS, and the remaining balance to the OA.

WORK CONTRIBUTIONS AND WITHDRAWING FROM CPF

For members who are 55 and above, from Jan 1, 2025, CPF contributions that used to go into the SA will go to their RA (up to the FRS) to boost retirement payouts. Once the FRS is met, the CPF contributions will go into the OA and can be withdrawn anytime.

After the closure of your SA, you can continue to withdraw any amount from your OA, after setting aside your FRS in your RA.

You can also apply to withdraw your RA savings down to your BRS if you own a property in Singapore with a remaining lease that lasts until you are 95 or older. However, any voluntary top-ups and government grants to your RA cannot be withdrawn.

Here’s another avenue: Generally, when you turn 55, you can withdraw at least S$5,000 or any amount in excess after setting aside your FRS.

For those born in 1958 and after, when you turn 65, you can withdraw an additional amount of up to 20 per cent of your retirement savings.

The additional withdrawable savings is computed based on 20 per cent of your RA savings excluding any cash top-ups, CPF transfers and government grants, less the unconditional S$5,000 which you can withdraw from 55.

This ensures that you do not deplete your retirement savings further, so that you will have a stream of monthly payouts for your living expenses in old age.

As for CPF members below 55, consider using the SA — which generates attractive risk-free interest — as a viable long-term investing avenue to build your nest egg. You can top up your SA via CPF transfers or cash top-ups, up to the prevailing FRS, and reap the benefits of compounding.

ABOUT THE AUTHOR:

Shawn Lee is a financial planning literacy specialist at DBS Bank.