Freehold HDB flats: Here’s how it may work, with strings attached

Freehold HDB flat is a no-go, but what about selling a freehold HDB flat with strings attached? For example, the Government could launch a new scheme to sell Freehold HDB flats with an Embedded Call Option (Feco) to allow a buyback clause at the end of 99 years.

Freehold HDB flats with an Embedded Call Option (Feco) gives the Government the right, but not the obligation, to acquire the flats back any time after 99 years by paying freehold market value, says the author.

The Voluntary Early Redevelopment Scheme (Vers) which will allow home owners to vote on whether to sell their Housing and Development Board (HDB) flats to the Government once their leases near their end was arguably the most significant policy announced in 2018.

Vers provides owners of older HDB flats some peace of mind, as it helps to boost liquidity for these flats with decaying leases.

But as it will not be rolled out until 20 years later, and with details yet to be unveiled by the Government, there are lingering concerns over Vers in terms of the payout and execution.

What is clear is that it will be different from the Selective En Bloc Redevelopment Scheme (Sers), where the Government identifies selected HDB blocks or precincts with high redevelopment value and takes them back for redevelopment.

Homeowners subjected to such a compulsory acquisition get duly compensated and a new flat with a fresh 99-year lease in a nearby location.

In the case of Vers, it is apparent that most sites will not have very high redevelopment potential, and flat owners should not expect a windfall, unlike in the case of Sers or in the private en bloc market.

Another issue is what is the threshold of homeowners required to vote in favour of Vers for it to go ahead?

A 100 per cent vote threshold — as favoured by some — will make it too prohibitive for Vers to take place, given the large number of residents in any HDB precinct.

But if the consensus requirement is below 100 per cent, we are bound to see tensions between neighbours whichever way the result goes, a scenario we have already witnessed in the private en bloc market where the threshold is 80 per cent.

At this juncture, Vers is probably still the best stop-gap option to preserve the market value for existing 99-year leasehold flats, but I believe that we can have a more permanent solution for future Build-To-Order (BTO) flats to tackle the decaying lease issue.

In announcing Vers during last year’s National Day Rally, Prime Minister Lee Hsien Loong explained why the HDB cannot sell flats on freehold tenure.

In such a scenario, flats will be bequeathed to home owners’ descendants in perpetuity. Over time, our society will split into property owners and those who cannot afford a property.

The Government will also have limited option to take back the freehold flats for redevelopment and Singapore will run out of land for future generations.

Freehold HDB flat is a no-go, but what about selling freehold HDB flats with strings attached?

For example, the Government could launch a new scheme to sell Freehold HDB flats with an Embedded Call Option (Feco) to allow a buyback clause at the end of 99 years.

Let me elaborate.

Feco flats give the Government the right, but not the obligation, to acquire the flats back any time after 99 years by paying freehold market value.

In practice, the Government will always acquire Feco flats at the end of the 99th year. This will serve the same purpose as the current 99-year BTO flats, where leases run out and flats are returned to the state at the end of the lease term.

Feco flats will also be priced slightly higher to account for the freehold tenure.

Using the Singapore Land Authority’s leasehold table as a guide, the freehold value will be about 4.2 per cent higher than current BTO flats sold under a 99-year leasehold tenure.

Feco flats will still be highly-subsidised as it has always been the Government’s intent to make public housing affordable for the masses.

The Government will then inject the full sum received from Feco sales into GIC to be invested. After a holding period of 99 years, GIC will have accumulated enough reserves for the Government to pay for the acquisition of the flats (see chart below).

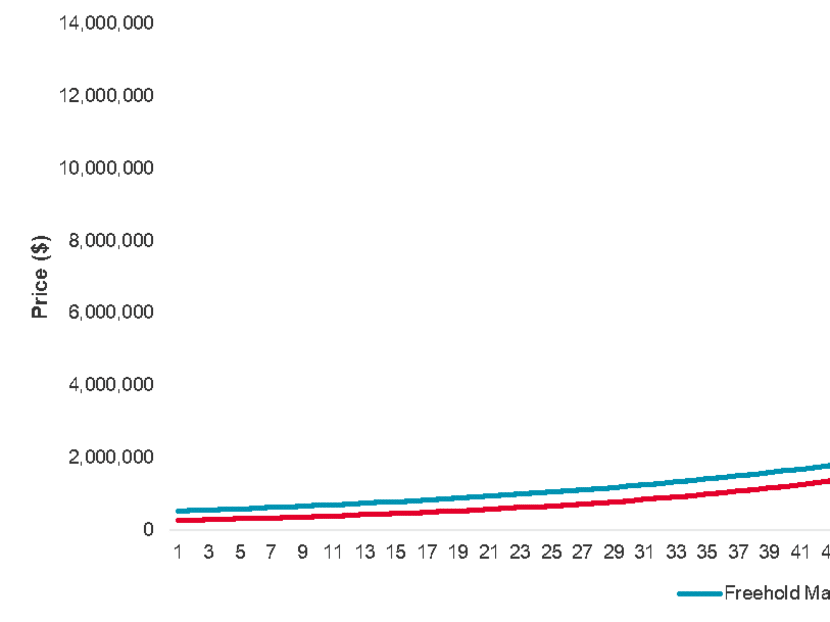

Value of Freehold HDB with Embedded Call Option flats versus GIC investments over 99 years

Note: Initial free market value and initial GIC investment quantum are S$500,000 and S$250,000 respectively. Source: Cushman & Wakefield Research.

This scheme is like how our Central Provident Fund (CPF) has worked for our retirement needs.

Historically, annual price appreciation of HDB flats averages 2.8 per cent, based on holding periods ranging from five to 25 years.

GIC, on the other hand, has achieved annualised returns ranging between 4.3 and 5.7 per cent, also based on holding periods ranging from five to 20 years.

Let us assume a new Feco flat with a market value of S$500,000 is sold today at a subsidised rate of S$250,000.

Based on an assumption of a 3 per cent historical appreciation of the HDB flat and a 4 per cent annualised return on GIC investment portfolio, at the end of 99 years, the initial investment quantum of S$250,000 would have ballooned to S$12.1 million.

This will exceed the freehold market value of the flat at S$9.3 million. The financials are made feasible due to the extremely long investment horizon of 99 years.

Do you agree with the author?

YOUR SAY: Tell us what you think

Is a 4 per cent annualised return by GIC too optimistic?

No, if you consider that the current floor interest rate for CPF Special Account is also 4 per cent.

How does this scheme compare to the 99-year leasehold BTO flats?

Feco flats will have the benefit of preserving the resale and market value of older flats since they are still deemed freehold. This is very much in line with Government’s asset enhancement policy.

The call option will allow the Government to acquire HDB flats to make way for future generations’ housing needs if the population continues to grow.

It is also self-funded from the returns of the sovereign wealth fund, which eliminates the strain on the Government’s budget.

Most importantly, it minimises the risk of having social divisiveness due to voting.

For the Feco scheme to work, GIC’s annualised return must exceed the HDB’s annual price appreciation in the long run.

This can be achieved as the Government has much control over the price appreciation of HDB flats through supply and demand side measures to ensure the sustainability of the property market.

Additional stress tests may be needed to ensure the scheme can withstand external shocks during a financial crisis.

ABOUT THE AUTHOR:

Christine Li is the senior director and head of research for Singapore at property consultancy Cushman & Wakefield.