Govt’s S$300 million injection into deep-tech scheme will benefit Singapore. But some concerns remain

Among the many announcements in Budget 2020, one which slipped under the radar was the S$300 million injection by the Government into Startup SG Equity for deep-tech startups. Under the scheme, the Government will co-invest up to S$4 million with qualified third-party investors into eligible Singapore-based deep technology startups.

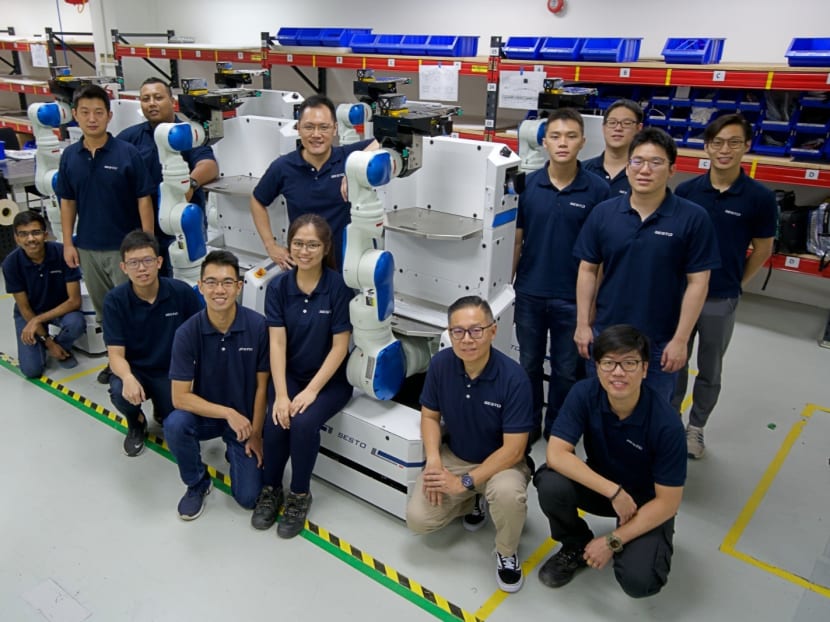

The management and staff of Sesto Robotics, an autonomous mobile robot fleet management startup which benefitted from the Startup SG Equity programme.

Among the many announcements in Budget 2020, one which slipped under the radar was the S$300 million injection by the Government into Startup SG Equity for deep-technology startups.

Under the scheme, the Government will co-invest up to S$4 million with qualified third-party investors into eligible Singapore-based deep technology startups.

As a deep-tech venture capitalist in Singapore’s startup scene, the announcement by Deputy Prime Minister Heng Swee Keat last Tues (Feb 18) was music to my ears.

This is a timely injection to support the rise of new emerging deep technology companies in areas such as urban solutions and sustainability, health and medical biosciences, advanced manufacturing and agri-food.

Deep technologies are essentially those that can bring about substantial scientific-based inventions or high tech engineering innovations that will significantly improve standards and our lives.

Artificial intelligence, the internet-of-things, alternative proteins and material sciences are some examples of deep technologies.

One might ask why public funds are used for such investments or question if the S$300 million injection was necessary. Let me explain three key benefits of such a scheme and the latest injection, before I discuss some concerns I have and how they can be addressed.

First, it’s about capital and risks.

Funding a deep technology startup usually involves an Series A investment of S$2 million to S$5 million. Series A is the stage where startups start to expand and scale operations. This is two to three times more than what internet economy startups require.

This is because deep technology startups require more capital to hire qualified Stem (science, technology, engineering and mathematics) talents to build up the proprietary technology and purchase the technical infrastructure.

Deep technology startups are also likely business-to-business in nature, which makes for longer sales cycles. This means the need for capital to maintain cashflows is greater than a typical startup.

With these higher risk factors, investors generally will lower their exposure to deeptech by investing less. However, this will not be sufficient for startups which need more capital to grow.

Case-in-point: My firm Trive was offered to invest in home-grown Sesto Robotics, an autonomous mobile robot fleet management startup. But we hesitated as the funding required was more than what we would like to commit to.

The turning point came when the Government co-invested with Trive through the Startup SG Equity programme. This gave Sesto much needed capital to proceed with its overseas expansion plans.

Without Startup SG Equity, Sesto would likely have needed more time to seek capital, instead of focusing on building the company’s fundamentals.

I believe Sesto’s case is similar to a number of other early-stage deep tech companies which have benefited from the SG Equity programme.

Second, Startup SG Equity supports long-term national initiatives, such as the Smart Nation initiative, which will require new deep technologies to transform Singapore.

Another example: Singapore has a “30 by 30” food security policy that aims to produce 30 per cent of its food by 2030. This too requires greater innovation in urban farming and fast-yielding food.

On the sustainability front, Singapore has a Climate Action Plan to build a low-carbon and climate resistant future by reducing emission across all sectors.

To do so, Singapore will again need to adopt more efficient technologies in its industries, in households as well as in transport and buildings.

The boost to the Startup SG Equity funding will support upcoming new startups that will help to drive such innovative solutions.

Third, Southeast Asia’s investment scene is getting very competitive. Research house Preqin showed some 66 per cent of all venture investments in Southeast Asia from 2016 to 2018 originated in Singapore.

However, this fell to 54 per cent in 2019. Going forward, as regional countries like Indonesia and Vietnam expand their startup ecosystems, one can see more venture investments flowing into these countries directly than through Singapore, whose share of such investments will likely fall further.

A scheme such as Startup SG Equity will support early stage investments and solidify Singapore’s status as a deep technology hub, which is still one of Singapore’s key strength.

Assuming a S$1 million co-investment per startup, we could expect up to 300 potential startups birthing through this latest injection.

Last but not least, the S$300 million injection will have positive spillover impact for the economy.

In his Budget speech, DPM Heng noted that through co-investment schemes like Startup SG Equity, the Government has facilitated some S$560 million in private-sector funding over the past four years.

He added that the latest injection is expected to attract at least S$800 million in private funding for deep-tech startups over the next decade.

The investment flows into deep technology companies will draw top Stem talents into Singapore, increasing our human capital. Singaporeans will benefit from the knowledge transfers and be inspired to develop new tech inventions on our own.

Beyond the benefits, I do have some concerns regarding the effectiveness of this programme.

First, while S$300 million is no small beer, it is also not exactly a huge sum given the vast array of deep technologies and how fast they can change.

The Government should prioritise co-investing in deep technologies that supports national initiatives such as the “30 by 30” food security goal or the Climate Action Plan.

Another concern is whether there are sufficient Singaporeans qualified in both deep technology skills and entrepreneurship to participate in this programme.

It is likely that Singapore-based foreign entrepreneurs will take the majority of the funding. This naturally leads to questions whether these entrepreneurs are deeply rooted in Singapore and will continue investing in the economy here.

The trickle down benefits to Singaporeans will only come about if entrepreneurs in the Startup SG Equity programme are committed to hiring and training Singaporeans in key positions.

Perhaps some conditions can be attached to the co-investments to ensure that the companies involved do their part in these areas.

All in, having the Government to co-invest in deep technology startups is an essential strategy to Singapore’s economic prosperity. However, how beneficial this is for Singaporeans will greatly depend on these startup founders having the willingness to give back to Singapore by including Singaporeans in the journey.

After all, it is taxpayers’ monies which are funding this programme.

ABOUT THE AUTHOR:

Christopher Quek is Managing Partner of Trive, an early-stage venture capitalist focusing on sustainable deep technologies that solve problems of Southeast Asian cities. These are his own views.