Making sense of the rise in Singapore's private property prices

Prices of private residential properties staged a remarkable turnaround in the second quarter of 2019, rising 1.5 per cent quarter-on-quarter to hit a five-year high. What may have caused this increase? Has there been a change in fundamentals in the property market? Let’s sieve out the noise and focus on three angles: policy, demand and supply.

Prices of private residential properties staged a remarkable turnaround in the second quarter of 2019, rising 1.5 per cent quarter-on-quarter to hit a five-year high.

This upturn has caught many by surprise given that:

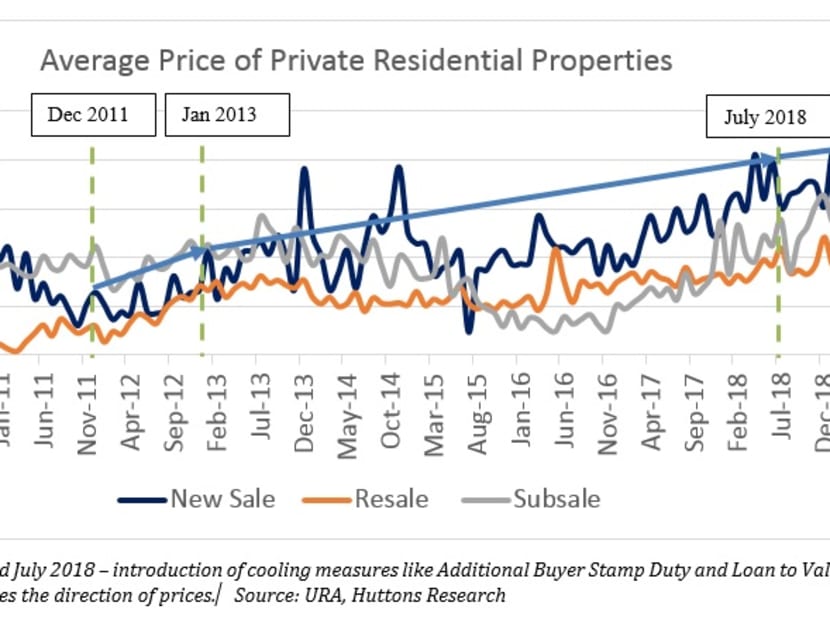

New cooling measures were imposed in July 2018;

Property prices eased for two consecutive quarters subsequently; and

There is a rising inventory of unsold private residential homes

What may have caused this increase? Has there been a change in fundamentals in the property market? Let’s sieve out the noise and focus on three angles: Policy, demand and supply.

POLICY: EFFECTS OF COOLING MEASURES TAPERING OFF

One of the oft-cited reasons for cooling measures is to prevent property bubbles and to achieve a stable property market.

The problem with policy control is that it can be a double-edged sword. Yes, it weeds out speculators and marginal buyers in the short term. But those who are forced to sit out can contribute to pent-up demand that can be formidable when it is unleashed.

Policy control also creates the psychological fear of missing out. Some may be tempted to move into the market because of the fear of new cooling measures pricing them out again.

Past experience with cooling measures shows that it takes about six months for the effects to taper off. It is no different this time round.

HIGHER DEMAND AFTER CHINESE NEW YEAR

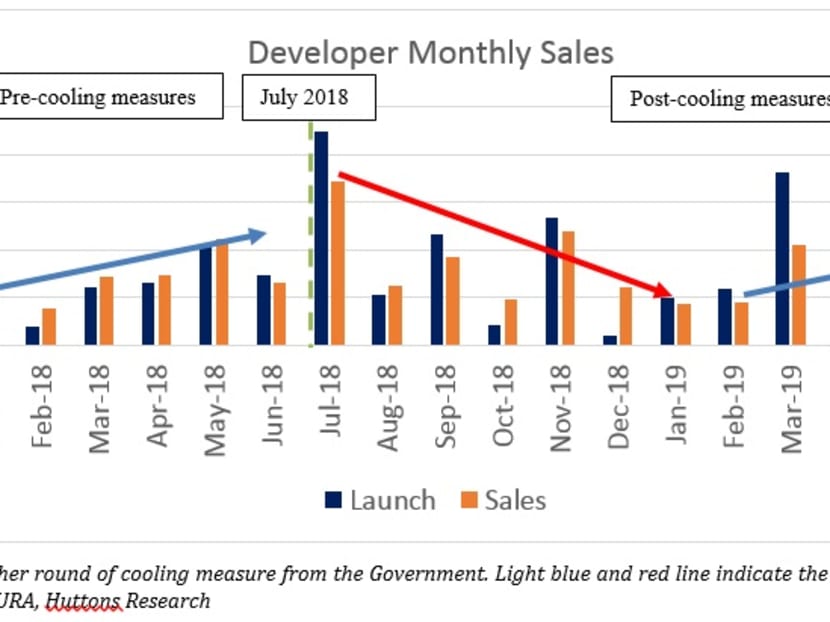

Sales volume of new private homes by developers stabilised in February 2019 before picking up from March to June 2019 to a level even higher than pre-cooling measures.

In the first half of 2018, developers sold a total of 3,947 units or 658 units on average per month. In the first half of 2019, the average monthly developer sales volume improved to 698 units for a total of 4,188 units over six months.

This momentum has carried into July with One Pearl Bank in the prime Outram-Chinatown district reporting solid sales of 160 units of 200 units in one weekend.

Within less than two weeks of its launch, One Pearl Bank has sold almost all of its launched units at an estimated S$2,400 per sqf. This makes it the best-selling project in 2019 based on units sold versus units launched.

In the resale market, even though the 2,371 transactions in April and June were about 50 per cent lower than the same period last year, the volume was notably higher than the 1,858 transacted in the first quarter.

In short, buying sentiment improved in the second quarter, with a sharper increase in the volume of new homes sold compared to resale.

The pickup in demand shows the underlying strength of the market and a return in confidence of property as a good store of value against uncertainty and inflation in the mid to long term

UNSOLD SUPPLY EASING

With demand returning to the property market, the number of unsold private residential units also eased from a high of 37,799 units in the first quarter to 34,486 units in the second quarter, a decrease of almost 10 per cent.

Units unsold after five years have financial implications for their developers, as the Additional Buyer Stamp Duty (ABSD) penalty kicks in.

These developers will therefore be hoping that sales of new homes can average around 9,000 units a year for the next four to five years so that they can clear their inventory and avoid the penalty, bearing in mind that the unsold stock will also have to compete with a few thousand additional new units that will be put on the market following Government land sales and en bloc deals.

PROFILE OF BUYERS

Who exactly then are the buyers who have grabbed the new homes in the first half of 2019? More than 80 per cent are Singaporeans with Permanent Residents (PRs) and foreigners making up 12 per cent and 6 per cent, respectively.

Quite a number among these buyers would have been beneficiaries of collective sales in the last couple of years. The recent en-bloc fever from 2016 to 2018 had injected more than S$20 billion into the bank accounts of some 7,000 owners with each receiving an average of almost S$3 million.

If each of them decides to invest just S$1.5 million back into the property market, they can absorb 7,000 of the unsold units without loans.

Another factor that has been cited for the increase in prices and the number of foreign buyers is Singapore’s status as a safe haven in light of uncertainties elsewhere in the world. British billionaire James Dyson for instance has reportedly forked out almost S$120 million recently for the priciest penthouse in Singapore and a Good Class Bungalow.

An analysis of caveats revealed that the majority of transactions for both new and resale private homes are between S$1 and S$1.5 million whereas five years ago, the bulk of purchases were below S$1 million.

MARKET OUTLOOK

So how will the market be like in the second half of 2019?

For one thing, the slowing economy and the uncertain economy outlook will be on the minds of buyers, even though Singapore’s leaders have said that they do not expect Singapore to go into a recession this year.

The property market and the economy are closely linked. When the global financial crisis struck more than 10 years ago and the Singapore economy contracted, prices in the property market also declined. Since a recession is unlikely in 2019; property prices will likely hold firm.

Furthermore, the US Federal Reserve has cut its interest rate by 25 basis points on July 31, its first rate cut in a decade. This will have knock-on effects on local borrowing rates and favour property purchases.

The 4,188 new private homes sold in the first half of 2019 were out of 5,491 units launched by developers. While new launches will slow down during the Lunar Seventh Month because of the Hungry Ghost Festival (Aug 1 to 29), buyers will be looking out for the upcoming sales launches for Parc Clematis, Avenue South Residences, The Antares, Meyer Mansion and Guoco Midtown.

If the sales momentum in the first half continues for the rest of the year, total developer’s sales in 2019 look set to break 2018’s level and hit 9,000 units. We could see prices increase up to 5 per cent for 2019, compared to a rise of 7.9 per cent in 2018.

A big question on buyers’ minds that will be whether the Government will introduce further cooling measures to curb market exuberance.

At this stage, this seems unlikely, given the projected price increases in 2019 will be lower than in 2018.

ABOUT THE AUTHOR:

Lee Sze Teck is director of research at Huttons Asia.