Gen Y Speaks: I just started working. This is why 25% of my pay goes to my dad

“What did you do with your first pay?” Many of my friends have asked me since I started my first full-time job a few months back after completing my full-time National Service.

“What did you do with your first pay?” Many of my friends have asked me since I started my first full-time job a few months back after completing my full-time National Service.

I did not splurge on any expensive toys or gadgets.Instead, I decided to set aside about a quarter of my take-home pay to pay back a S$5,000 loan I had taken from my father’s Central Provident Fund (CPF) account for my diploma course at Ngee Ann Polytechnic.

So why did I choose to prioritise paying off the loan with a 12-month instalment plan?

First, it makes sense financially to pare down the debt as soon as possible to save on the interest cost. The longer I take to pay off the loan, the higher the amount of interest I will have to pay.

Second, I have a moral obligation to my dad to pay back the money and it is only right that I do so.

In fact, the day I enrolled in my diploma course five years back, I had decided that I would try to return the money to my father as soon as I could.

This is his retirement fund after all.

I believe this is why CPF calls this an education loan and requires those who have used their parents’ and relatives’ CPF monies for education to repay the loans either in one lump sum or via monthly instalments over a maximum of 12 years.

At the same time, I did have a choice not to pay back the full sum of S$5,000 to my father.

This is because CPF also allows members who are 55 and above, and have set aside the Full Retirement Sum in their Retirement Account, to waive their children’s education loan.

My dad will meet his condition when he turns 55 in two years’ time. I could have opted to make a minimum monthly payment of S$100 till then and ask my father to apply for a waiver if I wanted to pay back as little as possible.

But that would not be the right thing to do. My father does not earn a lot as a restaurant manager and my mother does not have much CPF savings as a hawker. Returning the money to his CPF account for his nest egg is the responsible thing to do.

My dad has never expected me to return the S$5,000 I used for my education, but he respects my decision to pay back the loan in full.

With hindsight, my decision to do so when I started my diploma course has benefited me as it drove me to study extremely hard and not to slacken, knowing that I am bearing the full costs of my own education.

But that’s the way it should be, isn’t it?

Nothing is free in life and we should not have a sense of entitlement.

Currently, after I get my monthly salary, I will immediately set aside one quarter of it for savings, another one quarter for the CPF repayment and the rest for my daily expenses.

Transport and food are my biggest recurring expenses and I have tried to keep them low by modifying my lifestyle.

For example, I will go to hawker centres for lunch and prepare my own dinner at home during the week using ingredients purchased in bulk.During weekends, I will help out at my mum’s fish soup stall, where my meals will be taken care of.

When I go out, I always take public transport and avoid using ride hailing services and taxis unless absolutely necessary.Hence, I don't spend all the money which has been set aside for my living expenses. What I don’t spend, I save.

I currently do not give my parents an allowance. They are very understanding about my tight financial situation. As soon as I have cleared the CPF loan and build up my savings, I will start giving an allowance to my parents.

I have read about and heard of other parents waiving the CPF education loans for their children, though I do not know any of them.

Some of my own friends who are still studying have mixed views on the issue.One feels that it is not necessary for children to repay back the money if their parents agree to fully fund their education. Others think the children have an obligation to do so.

I guess this is a case of to each his own. I am not here to pass judgement. I fully respect a decision to take a different path.

What I am sharing here today is a path which I find to be beneficial.

ABOUT THE AUTHOR:

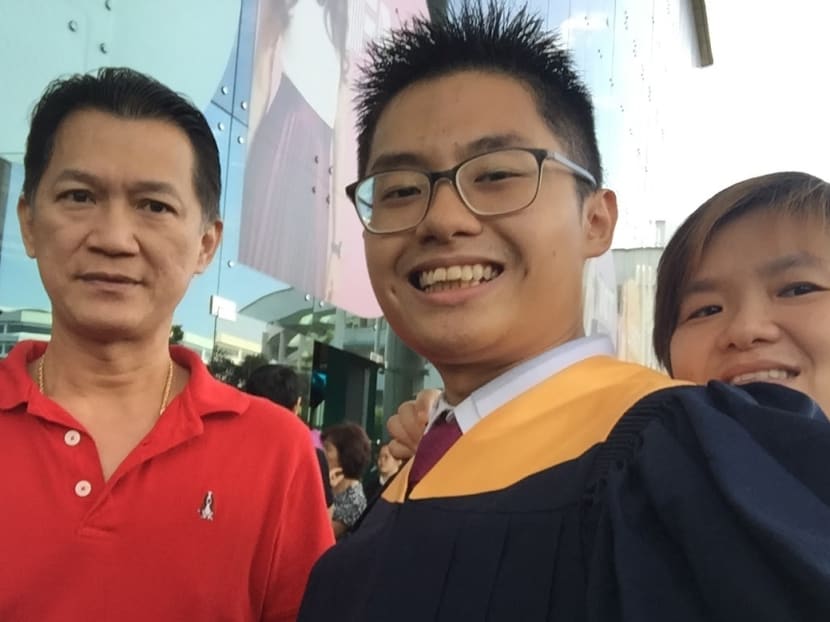

Maa Zhi Hong is an accounting graduate of Ngee Ann Polytechnic. He is looking to build a career in public speaking and writing.