ABSD rates doubled for foreign buyers to achieve 'effective dampener', smaller spikes suffice for 'price sensitive' locals: Desmond Lee

SINGAPORE — To have an effective dampener on investments from abroad, the recalibration of the Additional Buyers’ Stamp Duty (ABSD) from 30 per cent to 60 per cent is necessary because such demand is coming from people from overseas who see Singapore's residential property as an "attractive investment class”, National Development Minister Desmond Lee said.

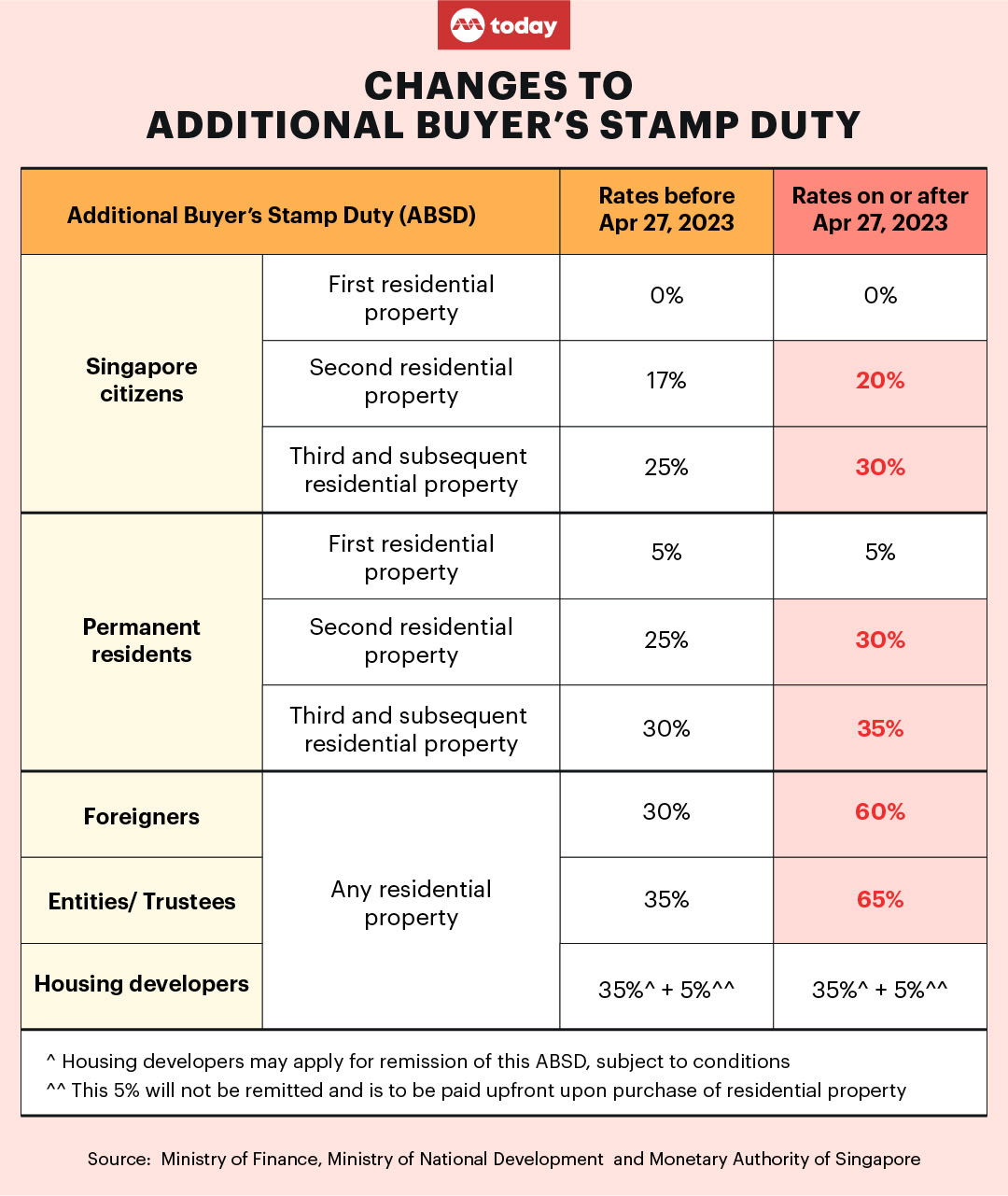

The changes, which take effect on Thursday, will now see Singaporeans buying their second residential property having to pay 20 per cent in ABSD, up from 17 per cent.

- Data has shown that property investors in Singapore are “very sensitive” to adjustments in the Additional Buyers’ Stamp Duty (ABSD)

- Therefore, smaller increments are enough to dampen their demand as compared to investors from overseas, National Development Minister Desmond Lee said

- Foreigners are thus expected to pay double the prevailing duty when buying property here

- The latest round of cooling measures for the property market kicked in on April 27

- Mr Lee said the measures were calibrated to achieve the twin goals of prioritising residents who want to own and live in the homes they buy, while curbing growth in property investors

SINGAPORE — To have an effective dampener on investments from abroad, the recalibration of the Additional Buyers’ Stamp Duty (ABSD) from 30 per cent to 60 per cent is necessary because such demand is coming from people from overseas who see Singapore's residential property as an "attractive investment class”, National Development Minister Desmond Lee said.

Data has shown, however, that property investors from Singapore are “very sensitive” to adjustments in the ABSD, so smaller increments are enough to dampen their demand as compared to investors from overseas, he added.

Speaking to the media on Thursday (April 27) after the announcement of the latest market cooling measures that took effect on Thursday, Mr Lee said that the Government had to calibrate these measures to ensure that it could achieve two goals that it had set out to achieve.

“One being to prioritise Singaporeans or locals who are looking to buy homes for owner-occupation. And two, in order to achieve that, you do a pre-emptive move as you start to see investment interest both by locals and foreigners start to grow,” he added.

The changes will see Singaporeans buying their second residential property having to pay ABSD of 20 per cent of the property purchase price, up from 17 per cent, while those buying their third and subsequent property, as well as permanent residents getting their second home, have to pay an ABSD rate of 30 per cent, up from 25 per cent.

Foreigners will see their ABSD rates double from 30 per cent to 60 per cent.

Responding to a query by the media on the disparity between the increments in ABSD, Mr Lee said: "For locals, data has shown that they are very price-sensitive to ABSD moves and so we make adjustments of 3 to 5 per cent."

These increments, he said, "should suffice" to dampen domestic investment demand.

In the joint announcement on Wednesday night, the authorities said that about 10 per cent of residential property transactions will be affected by the ABSD rate increases, based on last year's figures.

Asked if the impact on 10 per cent of transactions would be big enough to affect the broader market, Mr Lee said that this figure will likely rise because the number of Singapore and foreign buyers who buy property for investment purposes may grow further.

“It's likely to rise and therefore this is a pre-emptive measure, to crimp it, to dampen it so that it ensures that the market remains stable and that we prioritise Singaporeans who are buying for owner-occupation,” he said.

The media has asked for the breakdown of property purchases by residents and foreigners, the demographic of foreigners buying property, as well as the breakdown of property types transacted.

Mr Lee said that past rounds of property market cooling measures have had an effect on the market, with foreign investment as a proportion of property transactions falling from 20 per cent in 2011 to an average of 6 per cent from 2017 to 2019.

Over the past few years, the proportion was between 3 and 4 per cent.

He added that these figures were also affected by the broader economic environment.

Foreign interest has started to come back into the market in the first quarter of this year.

“For example, in the first quarter of 2023, foreign purchases of residential property made up about 7 per cent of all transactions.

"Investment interest in property, both local and foreign, continues to be resilient because of the fundamentals in our economy and because of the fundamentals in our property market.”

IMPACT ON WORKING FOREIGNERS, DOMESTIC UPGRADERS

Asked how the jump in ABSD would affect foreigners who are interested in staying here to work, Mr Lee said that they would not be affected because the “vast majority” of them rent instead of buy.

On how the recent move would affect residents with aspirations to upgrade their property and on property prices, Mr Lee said that the Government “still continues to see Singaporeans upgrading” and “selling off first property in order to get the resources to buy the second property”.

Replying to TODAY's queries, Mr Lee also said that he does not see the latest adjustments in ABSD having much spillover effect on rental markets.

He drew attention to the expected increase in supply for residential properties that is expected to cool down demand since some tenants are expected to exit the rental markets to buy their own property.

The Monetary Authority of Singapore in its bi-annual macroeconomic review on Wednesday said that the pace of residential rent increase should moderate in the second half of this year given that 40,000 new public and private homes are set to be completed.

This number is the highest in five years, the central bank said in its report.

Asked if a reduction in ABSD rates can be expected in the future when the market normalises, Mr Lee said that the consideration in implementing any measure is to ensure that markets do not run ahead of economic fundamentals and “hurt Singaporeans”.

“As to whether any of these measures can be unwound or relaxed or maybe even to be tightened, I think that is something that we keep a very close eye on. And it really depends on the climate.”