Analysts expect gentler HDB resale price rises in 2022 as record number of flats reach minimum occupation period

SINGAPORE — With a record number of flats reaching their minimum occupation period this year, the recent spike in resale prices of Housing and Development Board (HDB) flats is expected to be gentler in 2022, property analysts said.

- More than 31,000 flats will be reaching their minimum occupation period this year, the highest number since 2007 when records began

- Property analysts said the increase in HDB resale prices is expected to be gentler in 2022

- They predict a rise of 4 to 8 per cent in 2022, easing from the 12.7 per cent increase in 2021

- Reasons include a greater supply of resale flats in the market, a higher number of BTO projects to absorb the demand for resale flats and easing of construction bottlenecks

SINGAPORE — With a record number of flats reaching their minimum occupation period this year, the recent spike in resale prices of Housing and Development Board (HDB) flats is expected to be gentler in 2022, property analysts said.

They expect resale prices to increase by 4 to 8 per cent, which is still significant by historical standards, though well down from the sizzling increase of 12.7 per cent in 2021.

Homeowners are required to occupy their flats for a five-year minimum occupation period before they are permitted to sell them on the open market.

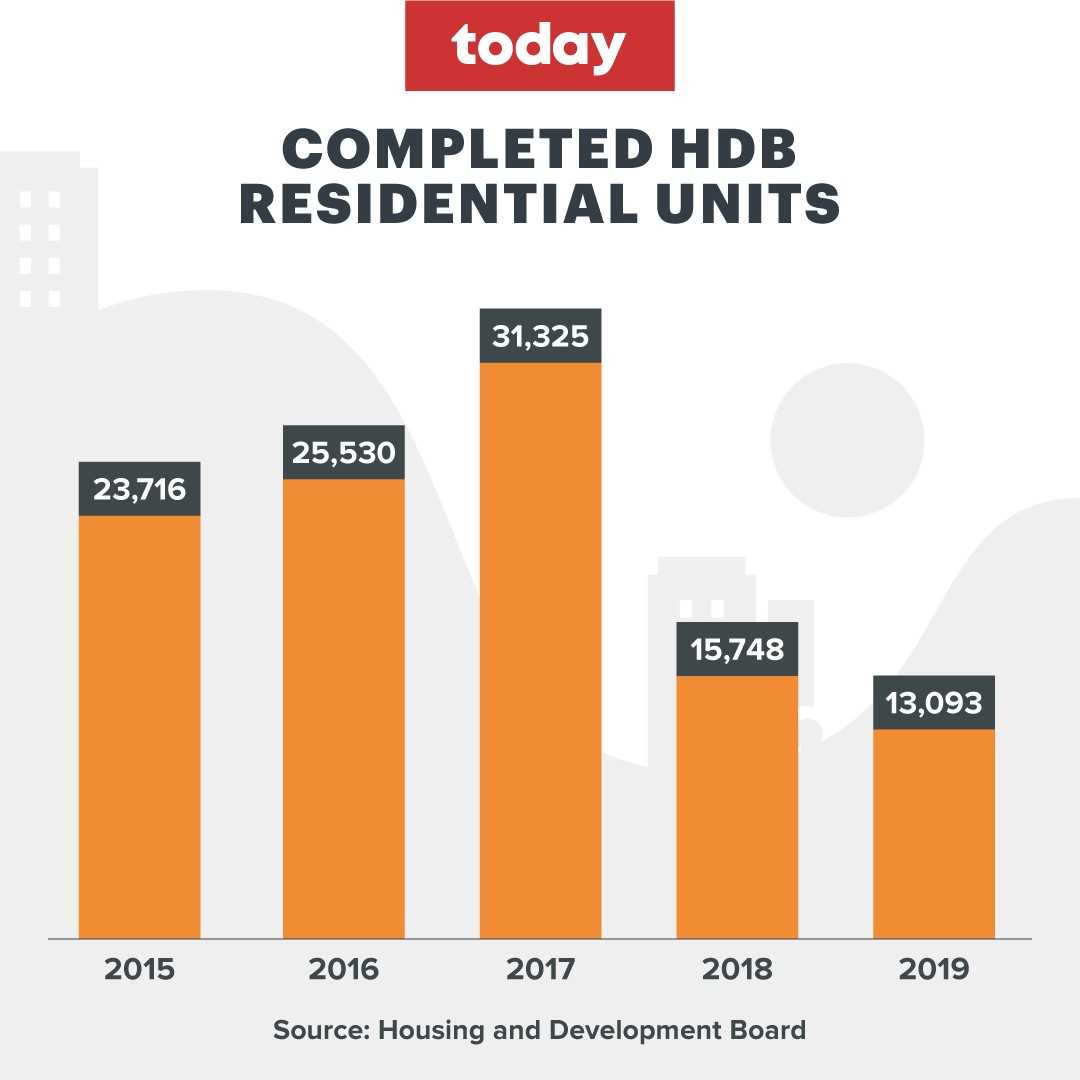

Flats completed in 2017 will reach their minimum occupation period in 2022. That year, 31,325 HDB residential units were completed, HDB data showed.

This is the highest number since 2007 when records began. It is also well above the nine-year average of 16,667 flats that have reached minimum occupation period from 2013 to 2021.

The five-year minimum occupation period applies to both Build-To-Order (BTO) and resale HDB flats.

The reasons analysts gave for the slower increase in prices in 2022 include a greater supply of resale flats in the market, a higher number of BTO projects to absorb the demand for resale flats and the easing of construction bottlenecks.

“The spike in housing supply may exert some downward pressure on prices ... Therefore, some areas may see prices rising at a much slower pace this year.Property analyst Christine Sun”

Ms Christine Sun, senior vice-president of research and analytics at property firm OrangeTee and Tie, said that the highest number of flats that are past minimum occupation period for 2021 will be located in Bukit Batok, Punggol, Sembawang, Woodlands and Bukit Merah.

“The spike in housing supply may exert some downward pressure on prices in these locations. Therefore, some areas may see prices rising at a much slower pace this year,” she said.

Mr Nicholas Mak, the head of research and consultancy department at ERA Realty Network, said though, that flats that have just reached their minimum occupation period may contribute to the increase in resale prices as they are more attractive and able to command higher prices.

“These HDB flats tend to be newer, have longer leases and better designs such as more privacy and integrated car parks, compared to older ones,” he said.

Mr Mak also noted that the ample supply of BTO flats over two years and the Government’s assurance of sufficient supply would “reduce the fomo (fear of missing out)” or “kiasu-ism (fear of losing out)” among homebuyers.

As a result, some buyers who could delay their home purchase may do so, leading to a moderation of demand for BTO flats and resale flats.

However, Ms Wong Siew Ying, head of research and content at PropNex Realty, said that the ramping up of new BTO flat supply may not immediately temper demand for HDB resale units.

Buyers with more pressing house needs may prefer buying from the resale market, rather than waiting for a BTO project to be completed in the next few years, she said.

The construction industry has been affected by supply chain bottlenecks due to Covid-19 in terms of a lack of manpower and materials, which may cause BTO projects to be completed at a slower pace.

In a report published by property website 99.co and SRX Property on Thursday (Feb 10), it was stated that HDB resale prices rose 1.1 per cent last month compared to December 2021, up for the 19th straight month. In year-on-year terms, the hike was 12.9 per cent.

Prices for all room types increased last month year-on-year, with three-room flats jumping by 14.7 per cent, four-room ones by 13.1 per cent, five-room flats by 13.2 per cent and executive condominiums by 14.1 per cent.

There were 2,442 HDB resale transactions last month, representing a 0.6 per cent increase from December 2021.

The highest transacted price for a resale flat this month was at $1,338,888, for a five-room Design, Build and Sell Scheme (DBSS) flat at Natura Loft.

Prices for resale flats have gone up, despite measures implemented by the Government two months ago to cool the property market. These include tightening of the loan-to-value limits from 90 per cent to 85 per cent.

This means that the maximum loan amount HDB will lend to buyers will be 85 per cent of the property purchase price.

Analysts explained that reducing the loan-to-value limits had “minimal impact” because many Singapore buyers opt for private loans from banks, which are offered at a much lower rate than the 2.6 per cent a year imposed by HDB.

They predict that the Government will see how the market fares before making a decision on whether to put out more cooling measures this year.