Banks to charge between S$0.75 and S$3 for use of Singdollar cheques from Nov 1

SINGAPORE — Are you still using cheques for your bills or other purchases? If so, you will have to start paying a fee from Nov 1.

SINGAPORE — Are you still using cheques for your bills or other purchases? If so, you will have to start paying a fee from Nov 1.

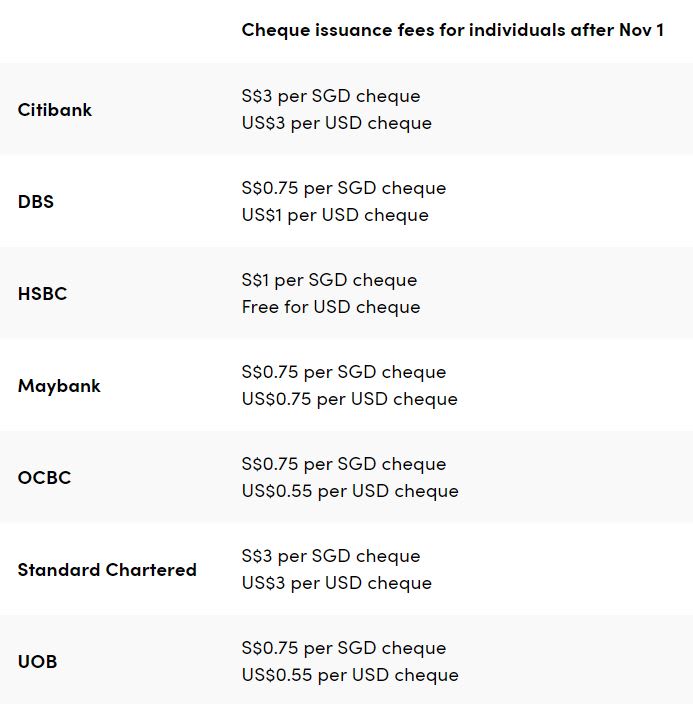

The new fee ranges from S$0.75 to S$3 for each Singapore dollar-denominated cheque, according to the websites of seven banks as of Friday (Oct 20). These banks are DBS, UOB, OCBC, Citibank, HSBC, Maybank and Standard Chartered.

Fees will also be imposed on US dollar-denominated cheques, starting from US$0.55 to US$3.

But the banks will be waiving these charges for individual customers aged 60 and above until Dec 31, 2025.

DBS, for one, said it is doing so as “some customers may require more time to transition to digital payments”. Standard Chartered also noted that it will consider exceptions “for certain clients in exceptional circumstances” on a case-by-case basis.

The move for at least seven banks to start charging customers — both corporates and individuals — for issuing Singdollar-denominated cheques was first announced by the Monetary Authority of Singapore (MAS) and the Association of Banks in Singapore (ABS) in July.

Currently, some banks already have fees for the issuance of corporate cheques, but not for individuals.

The change comes amid rising cheque-processing costs as usage declines, said MAS and ABS.

The average cost of clearing a cheque has quadrupled since 2016 to S$0.40 in 2021. This is set to increase to between S$2 and S$6 by 2025, if cheque volumes fall by another 70 per cent.

MAS and ABS noted that most banks have been subsidising the cost of cheque processing but given the expected increase, they are no longer able to continue doing so.

As such, it will allow seven banks to make the first move with the new fees, while other banks will follow suit by next July.

Apart from cheque issuers, those who deposit cheques will also have to pay a fee down the road.

Most banks have yet to share details on deposit charges, except UOB and Maybank which said cheque deposits will remain free for at least six months after Nov 1 as “various government agencies and organisations progressively adopt alternative payment methods, such as PayNow”.

Customers will be informed should there be changes, both banks said.

Singapore has announced plans to do away with paper cheques, starting with corporate cheques by end-2025.

Individuals will still be able to use cheques “for a period” beyond 2025, MAS and ABS said in July without providing details.

MAS also said it will further study the use of cheques by individuals and develop “appropriate initiatives” to assist remaining users in their transition to alternative payment methods, such as PayNow, Fast and Giro.

It will conduct a second public consultation next year to set out these initiatives and a timeline for the elimination of individual cheques and the termination of the Cheque Truncation System. CNA

For more reports like this, visit cna.asia.