Budget 2022: S$500m immediate relief for businesses, including one-off cash payout for SMEs worst hit by Covid-19 curbs

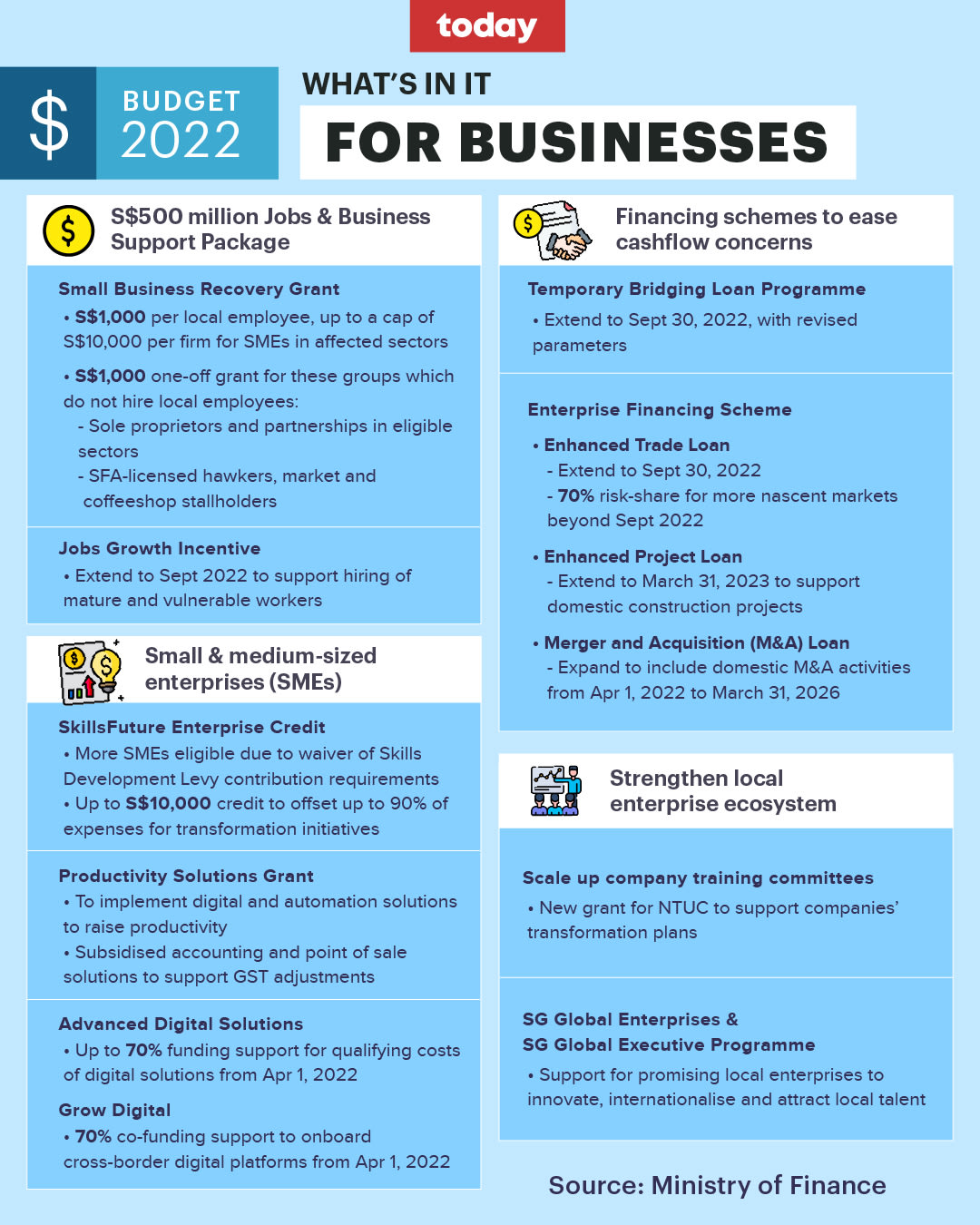

SINGAPORE — A S$500 million Jobs and Business Support Package, which will provide targeted help for workers and firms hard hit by the Covid-19 restrictions pandemic and facing slower recoveries, was announced on Friday (Feb 18).

A new small business recovery grant to help businesses hard-hit by Covid-19 restrictions was announced on Friday (Feb 18).

- A S$500 million Jobs and Business Support Package, which will provide targeted help for workers and firms hit hard by Covid-19 restrictions, will be rolled out this year

- The package will include a new small business grant with eligible companies receiving S$1,000 per local worker, up to S$10,000

- The Jobs Growth Incentive scheme will also be extended for six months but only for companies that hire mature workers, ex-offenders or persons with disabilities

SINGAPORE — A S$500 million Jobs and Business Support Package, which will provide targeted help for workers and firms hit hard by Covid-19 restrictions and facing slower recoveries, was announced on Friday (Feb 18).

During his Budget 2022 speech in Parliament, Finance Minister Lawrence Wong said while the overall outlook is positive, he recognised that there are segments of the economy that are still struggling.

The new package for businesses will include the following:

SMALL BUSINESS RECOVERY GRANT

The new grant, which aims to help businesses with their cashflow concerns, will provide one-off cash support for small- and medium-sized enterprises most affected by Covid-19 restrictions last year.

Eligible firms will receive S$1,000 for each local employee, up to a cap of S$10,000 per firm. These firms will be notified by the Inland Revenue Authority of Singapore (Iras) from June this year.

To qualify for the grant, businesses must be "live" entities that are physically present in Singapore and were registered no later than Dec 31 last year.

They must also have an annual operating revenue of less than S$100 million, filed with Iras for tax year of assessment 2021 by Dec 31 last year, or have fewer than 200 employees as of Dec 31 last year.

They must also be from one of the following sectors:

- Food and beverage

- Hawker centres, markets, coffeeshops, food courts and canteens

- Retail

- Performing arts and arts education

- Sports

- Cinema operators

- Museums, art galleries and historical sites

- Indoor playgrounds and other family entertainment centres

- Tourism, hospitality, conventions and exhibitions

Sole proprietorships and partnerships that are run by at least one local business owner, but do not hire any local employees, will receive a flat payout of S$1,000.

However, he or she must not be earning a net trade income of more than S$100,000 filed with Iras in the Year of Assessment 2021 by Dec 31 last year.

EXTENSION OF THE JOBS GROWTH INCENTIVE

The scheme, which was first announced in August 2020 and is currently set to end in March this year, will be extended by six months to September.

Under the scheme, the Government provides companies with subsidies for the wages of newly hired local workers.

This latest extension of the scheme, however, will only cover mature workers aged 40 and above who have not been employed for six months or more, persons with disabilities and ex-offenders.

More details will be shared by the Ministry of Manpower during the upcoming Committee of Supply debate.

HELP FOR BUSINESSES IN OTHER FORMS

Aside from the Jobs and Business Support Package, Mr Wong also spoke about dealing with the immediate concerns of businesses to help them tide over the current period of high prices, as a spike in the cost of materials and electricity has led to cashflow concerns.

To help them, a number of financing schemes will be extended as follows:

TEMPORARY BRIDGING LOAN PROGRAMME

The programme, which was first introduced in March 2020 to provide companies with access to working capital during the Covid-19 crisis, will be extended for another six months to Sept 30 this year.

The maximum loan quantum, however, has been revised to S$1 million per borrower, down from S$3 million previously, while the cap for the interest rate has been raised to 5.5 per cent, up from 5 per cent previously.

ENTERPRISE FINANCING SCHEMES

- The trade loan scheme will be extended to Sept 30 this year with a maximum loan quantum of S$5 million per borrower or S$20 million per borrower group

- The project loan scheme will be extended to March 31 next year with a maximum loan quantum of S$30 million per borrower or per borrower group for domestic projects

- The merger and acquisition loan scheme will be extended to March 31, 2026 with a maximum loan quantum of S$50 million per borrower or per borrower group

AVIATION SUPPORT PACKAGE

Aside from the package, Mr Wong said that there will be an extension of targeted assistance for the aviation sector. This will include measures to ensure public health and safety at the airport, as well as to “preserve core capabilities” in the sector.

He added that more details will be announced during the Ministry of Transport’s upcoming Committee of Supply debate.