Budget 2023: Baby Bonus cash gift to go up by S$3,000, paid paternity leave doubled to help couples start or grow families

SINGAPORE — Young couples looking to start or expand their families are getting help in Budget 2023 to defray the additional expenses involved.

- In Budget 2023, Deputy Prime Minister and Finance Minister Lawrence Wong announced several enhancements to existing schemes to help young parents grow their families

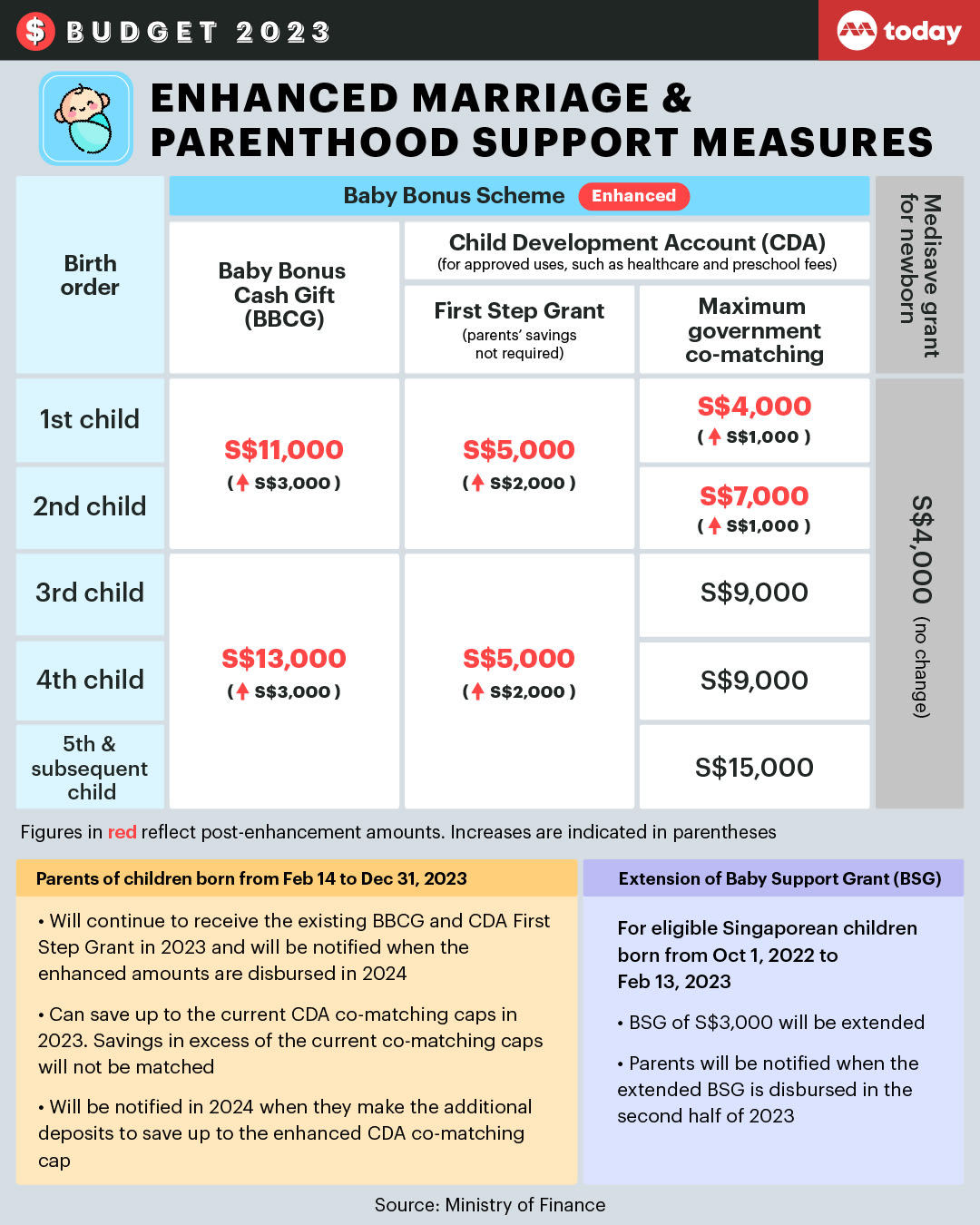

- The Baby Bonus cash gift will go up by S$3,000 for all children born from Tuesday (Feb 14) onwards

- The Government will also increase its contributions to the Child Development Account which offsets the preschool and healthcare expenses of children

- The one-off S$3,000 Baby Support Grant introduced last year will now be available to parents who had children between Oct 1, 2022 and Feb 13, 2023

- The Government-paid paternity leave will be doubled from two to four weeks, although the additional period will be voluntary for employers for a start

SINGAPORE — Young couples looking to start or expand their families are getting help in Budget 2023 to defray the additional expenses involved.

The measures include an enhanced Baby Bonus cash gift, higher Government contributions to Child Development Accounts (CDAs) and a doubling of paid paternity leave.

The moves are to support parents with the costs of raising their children, with a view to supporting those with greater needs, said Deputy Prime Minister and Finance Minister Lawrence Wong on Tuesday (Feb 14).

The enhancements to the schemes supporting children as well as increased leave provisions will cost the Government an additional S$240 million for each birth cohort of children.

“I hope that this will provide greater assurance to parents, and parents-to-be as they think about starting and raising their families in Singapore,” said Mr Wong.

In a statement on Tuesday, a spokesperson from the Public Service Division (PSD) said that the Public Service will take the lead to increase paid paternity leave from next year.

Mr Wong also announced on Tuesday that Government will increase Unpaid Infant Care Leave for each parents from next year.

The PSD spokesperson added that the Public Service already provides for public officers to take additional unpaid infant care leave of up to four weeks in the child's first two years.

In recent years, the Government has been offering measures to encourage Singaporeans to have children amid a low fertility rate here that is well below the level needed to replace the current population.

INCREASE IN BABY BONUS CASH AMOUNTS

The cash payout from the Baby Bonus cash gift will go up by S$3,000 for all Singaporean children born from Tuesday onwards.

The cash payout for the first and second child in a family will now be S$11,000, up from S$8,000.

The cash payout from the third child onwards will go up from S$10,000 to S$13,000.

There will also be a longer payout period for the cash gift, said Mr Wong.

Currently, the cash is paid out by the Government in five instalments over one-and-a-half years from the birth of a child. This is to help defray the child-raising costs during infancy.

With the change, parents will receive S$9,000 in payouts during the first one-and-a-half years of their child’s life. They will receive S$400 every six months from when the child is aged two, until the child turns six-and-a-half years old.

“This way, parents can receive continuous support all the way until their child enters primary school,” said Mr Wong.

“This way, parents can receive continuous support all the way until their child enters primary school.Deputy Prime Minister and Finance Minister Lawrence Wong”

HIGHER GOVERNMENT CONTRIBUTIONS TO CHILD DEVELOPMENT ACCOUNT

The Government will increase its contributions to the CDA, which is a co-savings scheme with the Government that is used to offset the preschool and healthcare expenses of children.

The CDA is opened when a child is born and has two components.

The first component is the First Step Grant, which is the initial deposit that the Government makes to the account. The second component involves the Government matching the savings that parents put into the account.

With the changes, the First Step Grant will go up from S$3,000 to S$5,000 for each child.

The Government will also increase the cap in which they match the savings of parents’ under the CDA. This will apply to a family's first and second child.

The co-matching cap for the first child, which is currently S$3,000, will go up to S$4,000.

The co-matching cap for the second child will go up from S$6,000 to S$7,000.

To cater for the required legislative and system changes, the actual enhancements to the Baby Bonus Cash Gift, CDA First Step Grant and CDA co-matching caps will be made available from early next year, said Mr Wong.

He added that parents will be notified when they can make additional deposits in to their child’s CDA so that they can save up to the increased cap.

EXTENSION OF BABY SUPPORT GRANT

The Baby Support Grant, which was a one-off payment for eligible Singaporean children born during the Covid-19 pandemic, will also be extended to parents who had children after the originally stipulated period.

It was previously eligible to parents who had children between Oct 1, 2020 to Sept 30 last year.

Parents of babies born from Oct 1 last year to Feb 13 this year will now receive the S$3,000 grant as well.

“So to all young married couples, whether you already have a newborn or you are expecting a baby, or plan to have a baby, we have something to help you in your parenthood journey,” said Mr Wong.

The grant will be disbursed in the second half of this year.

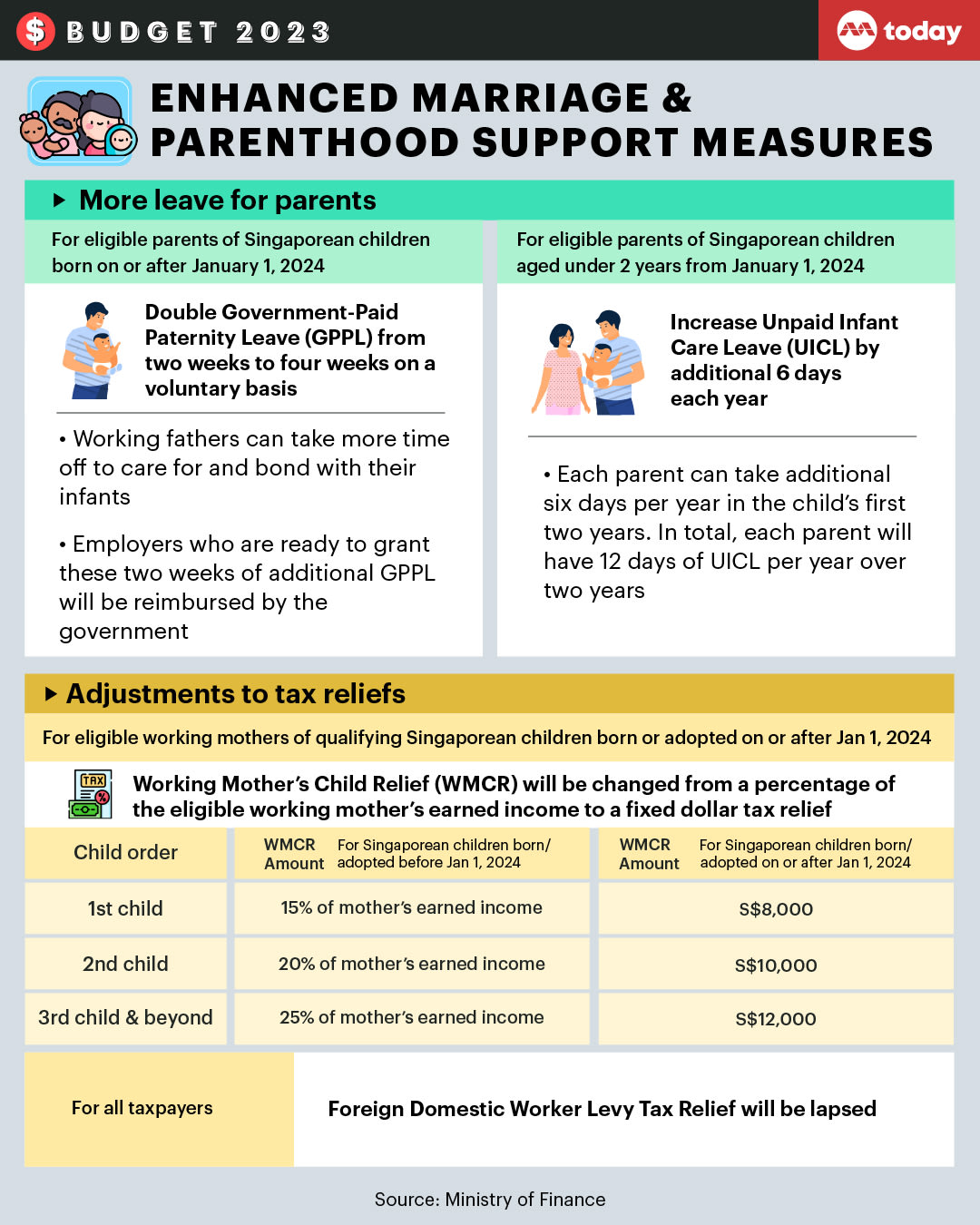

TAX RELIEF FOR WORKING MOTHERS

The tax relief for working mothers to encourage them to continue working after having children, will move from a percentage of the mother’s earned income to a fixed dollar relief system.

The change to the Working Mother's Child Relief will apply to eligible mothers who have qualifying Singaporean children born or adopted from next year onwards.

Eligible working mothers will be able to claim S$8,000 in annual relief for their first child, S$10,000 for their second child, and S$12,000 each for their third and subsequent children.

Currently, the tax relief for the first child is pegged at 15 per cent of a mother’s annual earned income, 20 per cent for her second child and 25 per cent each for her third and subsequent children.

The move means that lower and middle-income working mothers will receive more support, said Mr Wong.

MORE PATERNITY LEAVE

The Government-paid paternity leave for fathers will be doubled from two to four weeks. It will apply to parents who have children born next year.

However, the additional two weeks will not be mandatory for employers to provide and will be on a voluntary basis instead.

This means that employers who are ready to grant the additional leave will be reimbursed by the Government.

“This is also to give more time for employers to adjust, especially taking into account the existing economic conditions and manpower and operational challenges that many employers face,” said Mr Wong.

The Government currently reimburses employers a maximum of S$5,000 for two weeks of paternity leave taken by their employees.

Mr Wong added that the Government plans to make the additional paternity leave mandatory in due course.

Self-employed persons who have been engaged in a particular business, trade, profession or vocation for a continuous period of at least three months before their child is born, will also be eligible for the additional leave.

Mr Wong said that the move is aimed at making paternal involvement in their children the norm in society. The Government also wants to support fathers who want to play a bigger role in raising their children.

Unpaid Infant Care Leave, which can be taken up until the child turns two years old, will also be increased from six days to 12 days a year for each parent.

The increase will take effect from next year onwards for working parents with Singaporean children aged under two, and who have worked for a continuous period of at least three months with their employer.

This will give parents more to time to bond with and care for their newborn, or to settle caregiving arrangements, said Mr Wong.