Explainer: After 5 years of Do Not Call Registry, can more be done to stop persistent nuisance calls, messages?

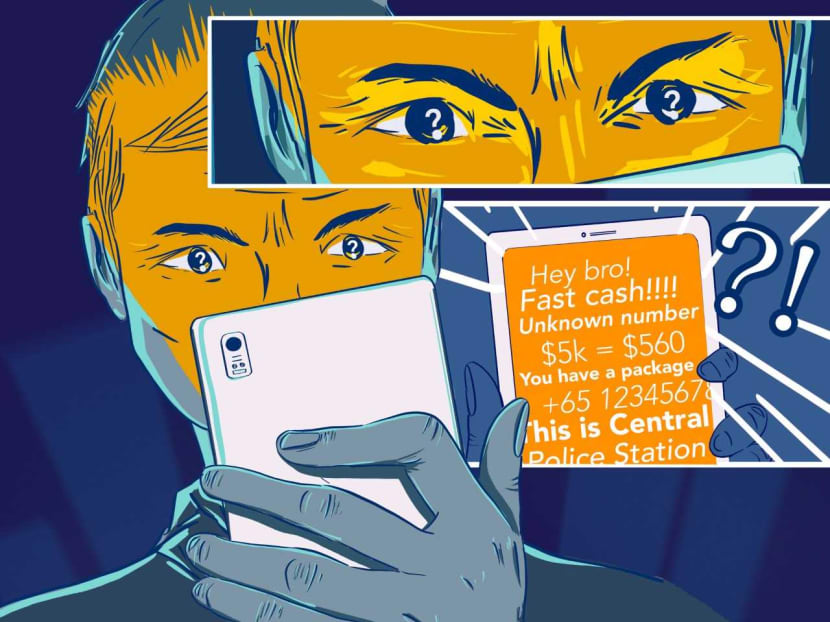

SINGAPORE — The phone vibrates and a text message comes in. The number is unfamiliar, but the sender adopts a jaunty, decidedly familiar tone.

The Do Not Call registry has been in operation for more than five years but many Singaporeans still receive unsolicited marketing calls.

SINGAPORE — The phone vibrates and a text message comes in. The number is unfamiliar, but the sender adopts a jaunty, decidedly familiar tone.

“Hi bro, heard you are interested!” it reads. “Sports betting/ live casino/horse racing. 5 – 10 per cent welcome bonus. 5 – 10 per cent weekly rebate.” It ends with a number for interested parties to call back.

It may have been more than five years since the Do Not Call (DNC) Registry came into force to try to stem the tide of unsolicited marketing messages, but it appears that it has done little to protect Singaporeans from being harassed by text messages related to unlicensed loans or online gambling.

TODAY looks at why Singaporeans are still receiving these annoying messages, and whether anything can be done to put an end to it.

WHAT IS THE DNC REGISTRY?

The DNC Registry came into effect on Jan 2, 2014 with the intention of allowing people to opt out of telemarketing messages or messages of a commercial nature addressed to their Singapore telephone number. Anyone wishing to do so can register online, by SMS or by phone.

According to the website of the Personal Data Protection Commission, which administers the registry, it does not include: Messages for pure market survey or research; messages that promote charitable or religious causes; personal messages sent by individuals; public messages sent by government agencies; and political messages.

Under the PDPC’s frequently asked questions section, it states that it will investigate all complaints regarding unsolicited telemarketing SMSes or calls “seriously”.

However, it said that unlicensed moneylending and illegal gambling “are serious criminal offences in Singapore where the police are the relevant authority to investigate such offences”.

HOW MANY COMPLAINTS HAVE BEEN MADE SO FAR?

In October, Mr Melvin Yong, Member of Parliament for Tanjong Pagar Group Representation Constituency (GRC), filed parliamentary questions regarding the performance of the DNC Registry.

Communications and Information Minister S Iswaran responded that since 2017, the PDPC has received about 46,600 complaints on unsolicited calls and text messages.

Around 90 per cent of these complaints relate to serious crimes such as unlicensed moneylending and illegal gambling, and they are referred to the police, he added.

Of the remaining 10 per cent of the complaints, 400 have been classified as “repeat cases” involving the same complainants.

“The PDPC has taken action against more than 1,000 organisations since 2017. These actions range from issuing advisory notices and warnings to prosecution,” said Mr Iswaran.

WHERE ARE THESE MESSAGES COMING FROM?

In response to queries from TODAY, a police spokesperson said that the “majority” of these messages originate from overseas, and were sent via foreign-based SMS broadcasting companies utilising “text messaging spoofing”.

This means that they masquerade as messages with local origins by adding Singapore’s ‘+65’ country code before the phone number to try to give the message the appearance of legitimacy.

But some of these messages originate from Singapore, said Mr Kevin Shepherdson, the chief executive officer of Straits Interactive, a data privacy specialist.

“Unlicensed moneylenders and illegal gambling organisations simply buy SIM cards from foreign workers who are leaving Singapore,” he said. “(They) use them for a day or two before moving onto different numbers.”

DOES THE LAW STILL APPLY TO THOSE OPERATING OVERSEAS?

Yes, it does. “It’s not to say that if you are operating from outside of Singapore that the laws do not apply to you,” said Mr Bryan Tan, the head of the technology, media and telecommunications practice at the law firm Pinsent Masons.

*TODAY's WhatsApp news service will cease from November 30, 2019.

Under Singapore’s Spam Control Act, the law is applicable as long as there is a “Singapore link”. In other words, it applies to anyone operating outside of Singapore as long as the recipient is “physically present in Singapore” when the message is accessed.

He added that anyone caught flouting these laws is likely to face multiple charges.

The nature of the message will form the basis of one set of charges.

For example, anyone found guilty of running or assisting in a business of unlicensed moneylending may be fined between S$30,000 and S$300,000, jailed for up to four years and caned.

“The basic act of offering bets or lending money without a licence, those are crimes in themselves,” said Mr Tan. He added it does not matter if it is done over the phone, in person or by email.

Additional charges may apply if the message in question reaches someone on the DNC Registry.

“Regardless of whether your acts are legitimate or not, if you call someone on the DNC Registry, that would be a breach (of the law) because it is unsolicited,” he said.

Any organisation that breaches the DNC provisions in the Personal Data Protection Act is liable to a fine of up to S$10,000 per offence.

Still, while there are such laws in place to punish these perpetrators, Mr Tan said that the “problem is enforcing it”.

“How do you go after somebody outside (of Singapore) when you have no resources to chase that?”

ENFORCEMENT CHALLENGES

The police spokesperson said that cross-border enforcement “remains a challenge as technology has enabled off-shore criminal syndicates to overcome geographical limitations and extend reach to local victims”.

While the spokesperson did not elaborate in detail, Mr Shepherdson said just “finding and identifying” these operators is difficult.

“Any action that could be taken against them would likely be a waste of time and money,” he added. “If they are stopped somehow in one ‘identity’, they will simply pop up again in a different identity. Such is the nature of their operations.”

WHAT CAN BE DONE THEN?

With regards to illegal organisations buying SIM cards from foreign workers, Mr Shepherdson said that one option open to regulatory authorities might be to “prosecute people who sell their SIM cards”.

However, he concedes that this may not be feasible especially if the sellers are already outside of Singapore.

“Here the option for people receiving these messages is simply not to engage with illegal operations,” said Mr Shepherdson.

Agreeing, Mr Tan said: “The spoils from unlicensed money lending and illegal gambling are so huge that people will take the risks for that.”

He added that people “feed” these operations by borrowing money from unlicensed moneylenders and illegal gambling operators, which only serves to encourage them.

Mr Tan said he was also particularly worried for the elderly who are more prone to falling victim to scam “robocalls” in Chinese.

One possible way to tackle this, he suggests, is to install mobile applications that filter out nuisance calls.

Otherwise, he says, “very little can be done except for education”.

The police advise members of the public to ignore unsolicited nuisance messages, especially from unknown parties.

“Do not reply to these messages,” said the spokesperson. “Instead, block or report the number as spam on WhatsApp or through third party applications.”

The spokesperson also reminded Singaporeans that they should not give out personal information, such as their NRIC, contact numbers and bank details to anyone.

Recipients of unlicensed moneylending and illegal gambling messages or calls can also lodge police report by calling their hotline at 1800-255-0000, or submitting the information online at www.police.gov.sg/iwitness.