Explainer: How discontinuing the S$1,000 note will affect the currency collectors’ market

SINGAPORE — Market interest in the S$1,000 note has increased, after the Monetary Authority of Singapore (MAS) announced on Tuesday (Nov 3) that it will stop issuing the banknotes from January next year.

One currency dealer estimated that there are more than 40 million pieces of the S$1,000 notes from the portrait series in circulation.

- Singapore will no longer issue the S$1,000 note from January 2021

- The announcement has stirred the market, with currency dealers seeing increasing interest from customers

- They predict that the price is unlikely to skyrocket though

- This is because large denomination notes are less accessible and the market price depends on their rarity and condition

SINGAPORE — Market interest in the S$1,000 note has increased, after the Monetary Authority of Singapore (MAS) announced on Tuesday (Nov 3) that it will stop issuing the banknotes from January next year.

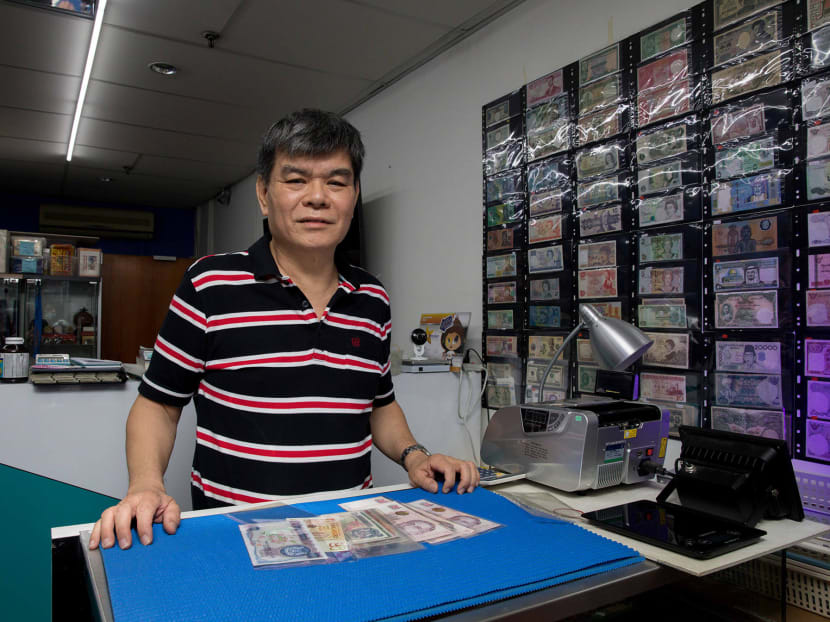

Mr Laurence Lau, 64, who works at Coins & Coins, which buys back banknotes and coins, said. “Generally, we can say that there is a strong interest expressed after the announcement for such notes.

“It created a sense of, ‘Am I missing something?’, and everybody starts searching for it.”

Mr Vincent Tan, 56, of Mr Banknotes, which deals in the same business, said that interest in the S$1,000 note is stronger because it is within the realm of affordability for more people compared with the S$10,000 note, which was discontinued in 2014.

Based on the number of prefixes issued, Mr Lau estimated that there are more than 40 million pieces of S$1,000 notes in circulation. The note is part of the portrait series of banknotes, which was first released in 1999, and is the only note with the national anthem micro-printed on the back.

PRICE UNLIKELY TO SHOOT UP

Currency dealers and collectors interviewed by TODAY said that a number of people have approached them to ask about the S$1,000 note following Tuesday’s announcement.

They acknowledged that the selling price will likely appreciate due to the soon-to-be-limited supply, but predicted that it will not increase drastically.

Notes of such large denominations were not very accessible anyway, and so, the demand should not increase significantly, they said.

Mr Zhang Zhi Min, 55, owner of Fang Zheng Trading, said: “While the announcement will heighten collectors’ interest in the short-term, it should not cause large repercussions.”

He added that most people tend to collect notes of smaller denominations, so the premium for larger notes is usually lower. For instance, a S$1,000 note from the orchid series —issued from 1967 to 1976 — is worth about S$2,000, but a bundle of 1,000 $1 notes from the same series is worth around S$12,000.

FACTORS AFFECTING VALUE

Mr Zhang also said that the selling price depends on the rarity and condition of the note.

Mr Lau of Coins & Coins said, for example, that there are one to two million pieces of the S$1,000 note issued from each of the past orchid, bird and ship series of banknotes.

They are rarer than the 40 million of the current portrait series and would usually fetch a higher price.

Mr William Ng, 68, of William Ng Collections estimated that the S$1,000 portrait series note could be priced up to S$1,200, whereas a S$1,000 orchid series note retails at his shop for S$3,000.

Since the soon-to-be-discontinued note is not particularly hard to find, Mr Tan of Mr Banknotes said that those who wish to sell their S$1,000 notes “must have a special selling point”.

“Personally, I think the price won’t rise too much if there’s nothing special about the note. Not all notes are worth collecting.”

Unique serial numbers, such as a string of repeated numbers or running numbers, will sell for a higher price.

The condition of the note also matters, he said. Once a note has been circulated, its value drops. Creases and wrinkles diminish the value of the note for collectors.

However, Mr Lau said that it is hard to make definitive predictions for now, because the notes will continue to be issued until the end of 2020.

“We will only see the real situation next year.”

ILLICIT ACTIVITIES

MAS said on Tuesday that a limited quantity of S$1,000 notes will still be available from now until next month, and those in circulation will remain legal tender.

Large denomination notes allow individuals to carry a lot of money anonymously. Such notes are often the preferred payment methods for those engaging in illicit activities such as money laundering or terrorism financing, since there are no transaction records when using cash and there is the ease of transportation.

MAS noted that most major jurisdictions have discontinued large denomination notes due to similar reasons. Singapore’s move is a “pre-emptive measure” that is “aligned with international norms”, it added.

Singapore is one of the few jurisdictions, alongside Brunei and Switzerland, that still circulates notes of such high denominations.

For example, the United States issues bills of up to US$100 (S$135). China’s largest note is 100 yuan (S$20), and Thailand’s is 1000 baht (S$44).