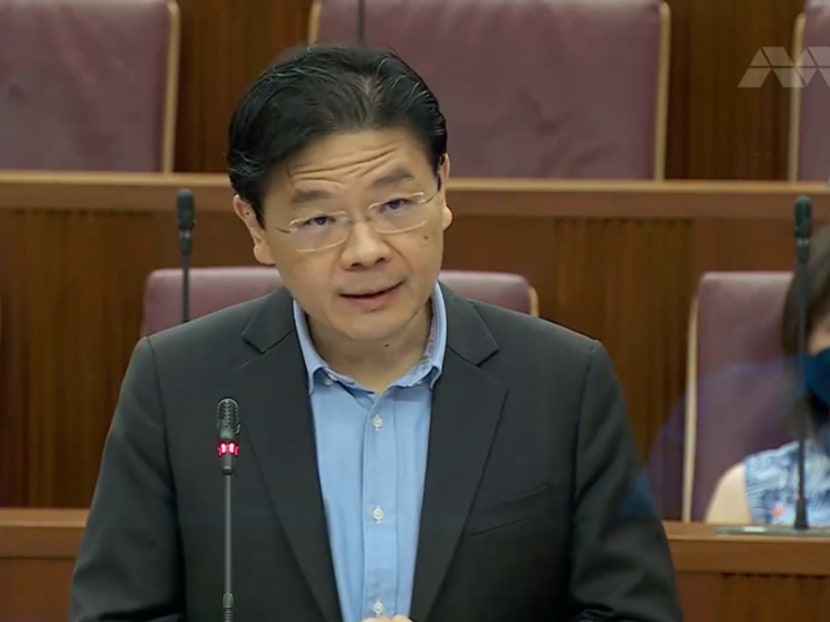

Govt needs to raise revenue to do more for S'poreans, says Lawrence Wong who rejects claim GST hike hurts poor

SINGAPORE — The Government has frequently heard calls for it to spend more on Singaporeans, but this will not be possible without raising sources of revenue such as increasing the Goods and Services Tax (GST), Finance Minister Lawrence Wong said in Parliament on Wednesday (March 2).

- Finance Minister Lawrence Wong said the Government cannot be expected to do more for the country without raising revenues

- He said relying on the reserves alone could lead to a downward fiscal spiral

- Mr Wong also said that claims that the GST hike will hurt the poor are “unfounded”

- He said the enhanced permanent GST Voucher scheme neutralises the impact of the increase in GST for low-income families

SINGAPORE — The Government has frequently heard calls for it to spend more on Singaporeans, but this will not be possible without raising sources of revenue such as increasing the Goods and Services Tax (GST), Finance Minister Lawrence Wong said in Parliament on Wednesday (March 2).

“You can't have it both ways. If we want the Government to do more, then let us be upfront and explain to Singaporeans why additional revenues and tax increases are needed,” Mr Wong said at the end of three days of debate over this year’s Budget announcements.

He also added that claims made by some opposition members, such as Progress Singapore Party’s Leong Mun Wai, that the GST hike will hurt the poor are “completely unfounded”.

“Such misguided claims ignore the way we have implemented GST in Singapore,” said Mr Wong.

During his Budget speech on Feb 18, Mr Wong announced that the GST will be raised progressively, rising to 8 per cent with effect from Jan 1, 2023, and going up again to 9 per cent in 2024.

Members of the opposition have raised their objections to the GST hike and offered their alternatives to it.

On Wednesday, Mr Wong said that while he appreciated the proposals, his ministry had already studied every possible tax option and found that the sums do not add up in some cases.

“In many countries, the tendency is for politicians to focus only on the spending side, because it is inconvenient to talk about taxes.Finance Minister Lawrence Wong”

“In many countries, the tendency is for politicians to focus only on the spending side, because it is inconvenient to talk about taxes,” said Mr Wong.

“As a result, these governments spend beyond their means, they run up unfunded obligations and debt, and they kick the fiscal can down the road. We are not immune to such pressures.”

Mr Wong said some increases in government spending are necessary in areas such as healthcare, a key driver of social spending.

“The key reason why healthcare spending will rise is our rapidly ageing population; as everyone in this House understands, we are living longer.”

Mr Wong said members of the opposition had suggested using reserves to fund such expenditure, an action he said reflected a “cavalier mindset” — one of spending whatever we can today, without caring sufficiently for tomorrow.

He said that as some countries become more affluent, they feel they have arrived and they get tempted by easy money.

“It begins with something small. (They) allow standards to slide a little… tweak the parameters a little, what harm does it do?

“But over time these small things add up, then it becomes politically very challenging to roll back any benefits, raise taxes or even talk about it and the country quickly ends up in a downward fiscal spiral.”

As such, he said fiscal rules had been enshrined within Singapore’s Constitution to “instil discipline” pertaining to the usage of the reserves to ensure this will not happen.

On suggestions raised such as placing a higher tax burden on the wealthy or larger corporations, Mr Wong said this will not be ideal either.

For one thing, he said it may lead to a divisive society and more problems, where a bulk of the economic burden is borne by a small group of people while the rest get to “piggyback” on their contributions and enjoy the benefits.

Mr Wong also noted that members of the opposition had claimed that any GST offsets are temporary, and increasing the GST is regressive and disproportionately impacts the poor.

He reiterated that when the enhanced permanent GST voucher scheme is taken into consideration, even after the GST rate has been raised to 9 per cent, the effective GST rate for the first three deciles, that is those in the bottom 30 per cent of income earners, remains unchanged.

“For them the enhanced permanent GST Voucher neutralises the impact of the increase in GST. So, it is not true that the GST increase hurts the poor. Not in the way we have designed it.”

GOVERNMENT 'COMMITTED' TO PROVIDE MORE INFORMATION

Seeking clarification from Mr Wong after his speech, Workers’ Party chief Pritam Singh asked if the Government would be able to provide projections of how much it would need financially for future expenditure, and how much it intends to collect from the public.

Having this information at hand, said Mr Singh, would result in more fruitful debates.

“Somehow when the opposition asks questions about revenue and expenditure projections, these are red herrings, but it can't be so.”

During his speech, Mr Wong had characterised persistent requests by the opposition for more information as a “red herring” that served as distractions to key problems at hand.

Mr Singh had also raised a question about the Base Erosion and Profit Shifting (BEPS 2.0) initiative, an agreement by 130 jurisdictions worldwide to reform international corporate tax rules.

Given that the initiative must be implemented by 2023, Mr Singh asked for the range of estimates of the net impact of pillar one and pillar two on Singapore’s corporate income tax revenues.

The first pillar under BEPS 2.0 seeks to reallocate profit of the most profitable multinational corporations from where activities are conducted to where consumers are located.

The second introduces a global minimum effective tax rate of 15 per cent for such corporations with annual global revenues of at least 750 million euros (S$1.13 billion).

In response to Mr Singh’s first question, Mr Wong said he accepted Mr Singh’s point and was not attempting to characterise it unfairly.

“I was sharing my feelings about these repeated requests for information as perhaps distracting us from the real issues,” he said.

In any case, Mr Wong said the Government is committed to putting out more information, as much as possible, in order to provide for more informed debates.

“I hope he also takes what he said seriously that the opposition will also exercise leeway in recognising that these projections in the outer years are inherently fraught with a great deal of uncertainty,” said Mr Wong.

This is particularly so for a “small little open economy like Singapore” where there are many external events that can never be predicted with any degree of certainty.

On BEPS 2.0, Mr Wong said the rules are still being discussed.

Hence, he said this is why he “hesitates to put out any figures at this stage”.

But in the spirit of providing more information, he said the Government will see if it is possible to provide a range of estimates about what the impact of BEPS 2.0 might be for both pillars one and two.

Yet, even if both pillars yield additional revenue, he said it will likely have to be reinvested to ensure Singapore remains competitive and attracts a fair share of investments.

“Why? Because the reality is competition for investments is not going to go away just because of BEPS 2.0. In fact, it will get even more intense and it will intensify in other non-taxed areas, which we will therefore have to fund and have resources ready for.”

In opposing the GST hike and Budget 2022 on Monday, the Workers' Party had put forward various alternatives to the GST increase, including extra revenue likely to be reaped from the introduction of BEPS.