Retirement and re-employment ages to be raised by 3 years, CPF contribution rates for older workers to go up

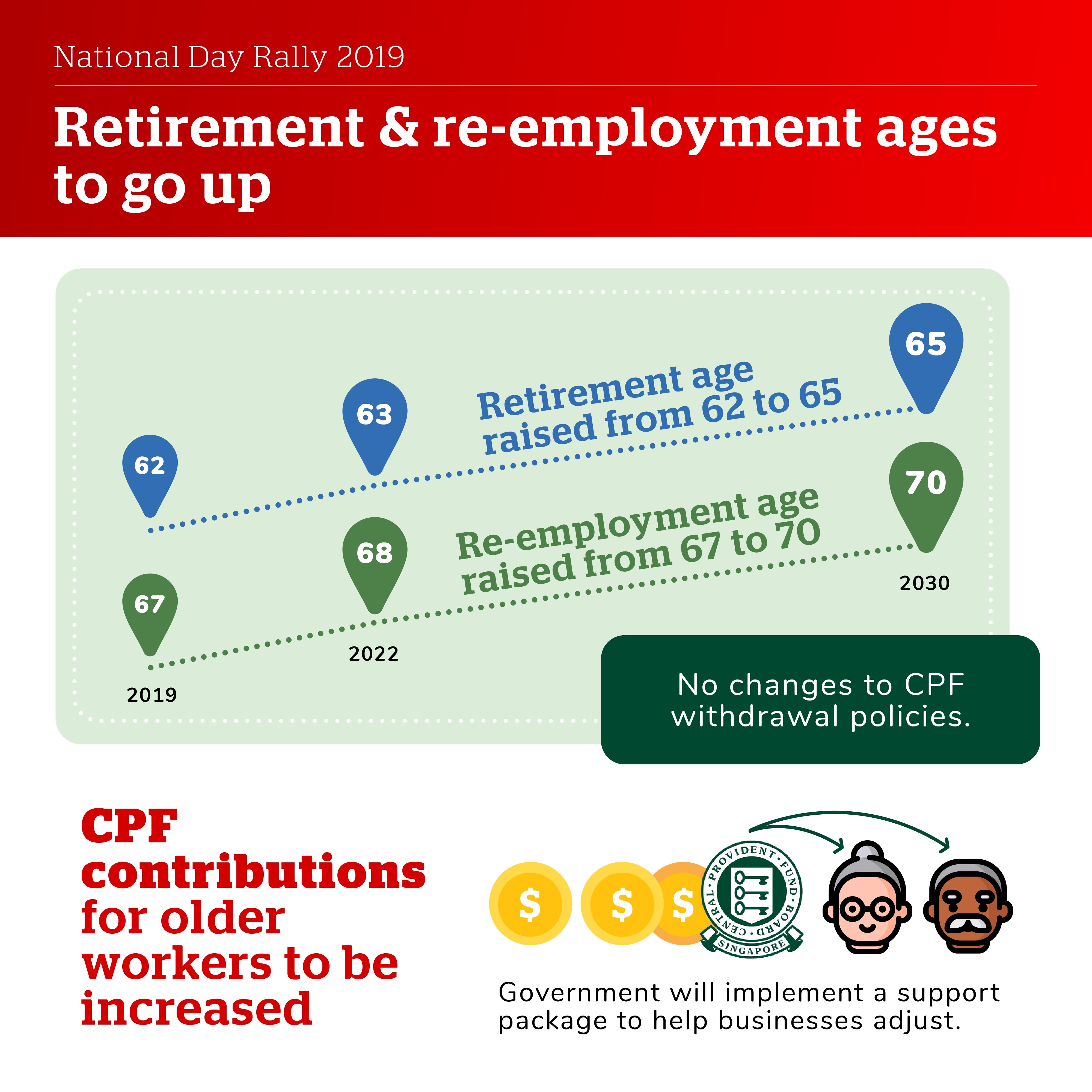

SINGAPORE — Twenty years after the retirement age was last raised to 62, the Government will increase it to 65 by about 2030, while the re-employment age will go up from the current age of 67 to 70, Prime Minister Lee Hsien Loong announced at the National Day Rally on Sunday (Aug 18).

The CPF contribution rates will be raised starting from 2021 over the next 10 years or so “depending on economic conditions”, said Prime Minister Lee Hsien Loong during his National Day Rally on Sunday (Aug 18).

SINGAPORE — Twenty years after the retirement age was last raised to 62, the Government will increase it to 65 by about 2030, while the re-employment age will go up from the current age of 67 to 70, Prime Minister Lee Hsien Loong announced at the National Day Rally on Sunday (Aug 18).

And in a bid to support older workers and boost their retirement savings, Mr Lee also said that the Government will raise their Central Provident Fund (CPF) contribution rates starting from 2021, over the next 10 years or so “depending on economic conditions”.

By the end of that period, the CPF contribution rate for workers aged above 55 to 60 — which currently stands at 26 per cent — will be 37 per cent, the full rate and on a par with younger workers.

“All these changes — to the retirement age, the re-employment age, and the CPF rates — will support older workers to continue working longer and help them be more financially independent,” said Mr Lee.

He noted that as Singaporeans are living longer — with a life-expectancy at birth of 84.8 years which is the longest in the world — many also wish to work longer.

To help businesses adjust to the changes, Mr Lee said that the Government “will implement a support package” for them, with details to be announced by Deputy Prime Minister Heng Swee Keat in next year’s Budget.

The Government, as a major employer, will take the lead in implementing those changes. Mr Lee said that the Public Service Division will raise retirement and re-employment ages of its officers a year earlier — in 2021 instead of 2022.

Raising the retirement and re-employment ages as well as the CPF contribution rates was among the recommendations put forth by a tripartite workgroup comprising representatives from the Government, labour unions and the private sector that has been studying the issue since it was formed in May last year.

The Government, said Mr Lee, accepts those recommendations.

“I think these are sensible recommendations,” he added.

Those proposals were made following “intense discussions”, he said. While older workers wanted to be certain of longer continued employment, employers on the other hand were worried about business costs amid the uncertain economic headwinds.

But in the end, they managed to reach a consensus, Mr Lee said.

HIGHER RETIREMENT AND RE-EMPLOYMENT AGES

Introduced in 1993, the retirement age was last raised in 1999, when it went up from 60 to 62.

Mr Lee said that under the new changes, the retirement age will be raised from 62 to 63 in 2022 and eventually to 65 by 2030. As for the re-employment age, it will be increased from 67 to 68 in 2022 and eventually to 70 by 2030 as well.

The concept of re-employment age — pioneered in Japan — was announced in 2007 and later legislated in 2012. It was seen as a better alternative as opposed to raising the retirement age when the issue was largely debated back in 2005 amid concerns by businesses that a higher retirement age might affect costs and productivity.

The re-employment age was raised from 65 to 67 in 2017. With that change, employers must offer re-employment to eligible employees who turn 62, up to age 67, to continue their employment in the company.

The Ministry of Manpower said that the first raise of the retirement and re-employment ages will take effect on July 1, 2022.

Those born on or after July 1, 1960 will benefit from the higher retirement age of 63, while those born on or after July 1, 1955 will benefit from the higher re-employment age of 68.

RAISING CPF CONTRIBUTION RATES

Mr Lee said a first step will be taken in 2021 to raise CPF contribution rates for those above 55, with “subsequent steps thereafter”.

“The whole process will take 10 years or so, depending on economic conditions,” he added.

When the changes are fully implemented, workers aged above 55 to 60 will enjoy the full 37 per cent CPF rate. The CPF rates will begin to taper down only after 60 and level off after 70, said Mr Lee.

At the end of it, workers aged above 60 to 65 — who currently get 16.5 per cent — will see their CPF contribution rate go up to 26 per cent. The CPF contribution rate for those above the 65 to 70 will go up from 12.5 per cent to 16.5 per cent, while workers aged 70 will see their rate remain unchanged at 12.5 per cent.

In recent months, there have been calls for the Government to raise CPF contribution rates of older workers to be on a par with that for younger workers. This is to ensure that older workers remain employed and to shore up their retirement savings.

NO CHANGES TO CPF WITHDRAWAL POLICIES

Mr Lee also raised the issue of CPF withdrawal policies and ages, stating that he “wants to be absolutely clear” that the Government is not making any changes to them.

“You can still take out some money at age 55. And you can still start your CPF payouts from age 65. All that remains exactly the same,” he added.

“So, please ignore any rumours you may hear about this or messages on WhatsApp because they are fake news!”