GST increase: As Jan 1 ‘deadline’ approaches, businesses and shoppers make the most of sales pitches, offers

SINGAPORE — Riding on the upcoming increase in the Goods and Services Tax (GST) from Jan 1, along with the year-end festive sales, some businesses are bidding customers to buy what they want now or pay more later, with extended delivery offered where available.

A scene in VivoCity mall.

- The Goods and Services Tax is going up from 7 per cent to 8 per cent from Jan 1, 2023

- Some businesses are trying to get customers to spend before the tax increase

- Consumers looking to get big-ticket items such as furniture and appliances are biting at the offers

- Others are not too bothered about the tax increase because they spend on a need-to basis

SINGAPORE — Riding on the upcoming increase in the Goods and Services Tax (GST) from Jan 1, along with the year-end festive sales, some businesses are bidding customers to buy what they want now or pay more later, with extended delivery offered where available.

Consumers, on the other hand, are responding when they do want big-ticket items, especially those who are expecting to move into new homes and are getting furniture and appliances.

The tax will go up from 7 per cent now to 8 per cent, with the second round of increase set for 2024 when it will go up again to 9 per cent.

Imperial Door, which sells doors and gates, for example, has seen a 30 per cent jump in customers over the past three months who are buying in advance for the next year, compared to the same period in 2021.

Owner Peter Wang, 32, told TODAY that the company has been preparing in advance, buying more raw materials to manufacture doors and gates for the past six months in anticipation of increased demand.

“(We) doubled capacity and rented another warehouse (in April) just to store the materials.”

As for storing items that are sold, he said: “We usually keep orders for six months, but now we keep them for up to 18 months.”

Since mid-October, Imperial Door has printed on customers' invoices that orders would be valid for up to 18 months.

Ms Stephanie Lee, a 48-year-old nurse, is checking off her shopping list before the year ends.

She said that she has taken out S$20,000 from her fixed deposit account to pay for appliances and other furnishings before moving into her new flat in April next year.

“(I’ve either) paid the full amount or put a deposit (on everything),” she said.

She added that for items where she placed a deposit, they are from companies that are not GST-registered.

Mr Norman Ng, a 56-year-old senior executive working in the info-technology sector, is similarly moving into a new flat in March next year.

He would usually buy items on a need-to basis, but said of his latest purchases: "I need to pay before the (tax) increase. We are moving and we need to change appliances and buy things like air-conditioners.”

AOX, a water dispenser company, was not offering any other promotions apart from a year-end sale, but noticed a demand for water filters from shoppers.

It changed its marketing approach in early November, trained its sales crew to focus on the GST increase when handling customers and saw a 35 per cent jump in sales from October to November.

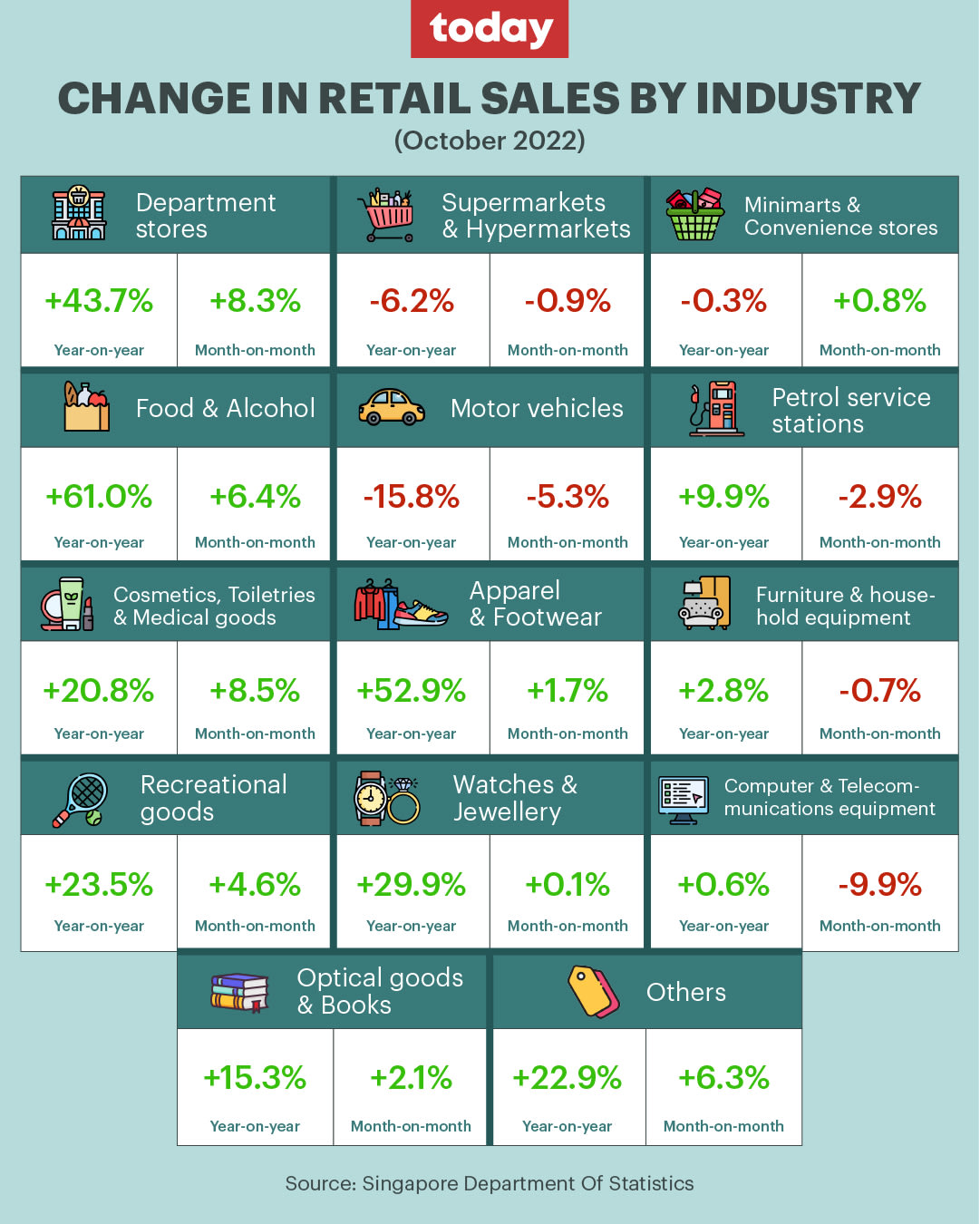

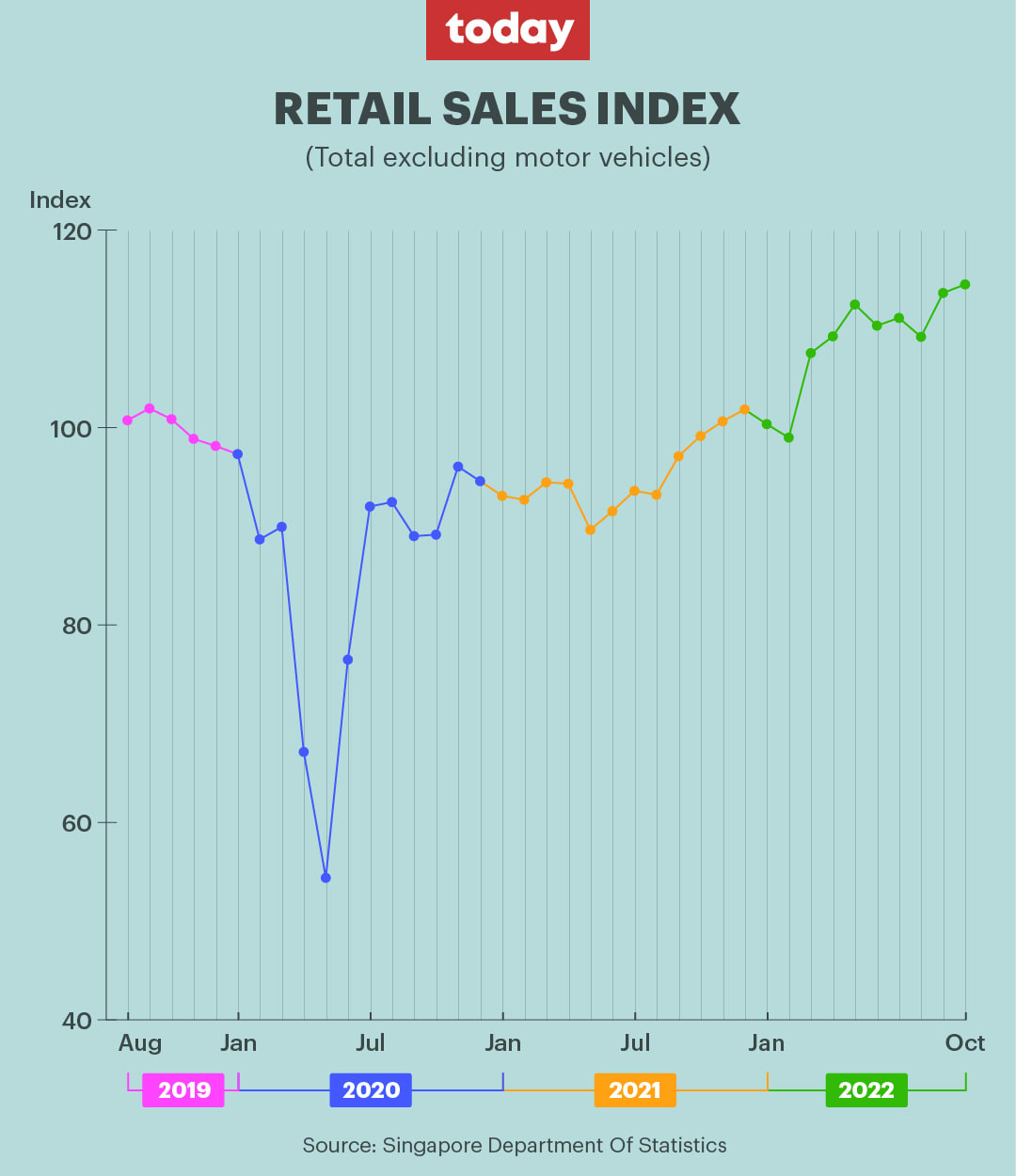

Data in October from the Singapore Department of Statistics showed a 10.4 per cent year-on-year increase on the retail sales index — or a 14.3 per cent year-on-year increase if excluding motor vehicles.

The retail sales index measures the short-term performance of retail sales, based on sales records of retailers.

Sales at department stores saw a year-on-year growth of 43.7 per cent in October, and a growth of 8.3 per cent from September to October.

Watches and jewellery sales went up by about 30 per cent year-on-year, while apparel and footwear sales recorded a year-on-year growth of 52.9 per cent, due mainly to higher demand for bags and footwear.

One of the exceptions is the sales of motor vehicles, which declined 15.8 per cent from October last year to October this year. From September to October this year, sales fell by 5.3 per cent.

Cartimes, a car dealer, now has an entire webpage dedicated to encouraging customers to buy new or second-hand cars, running a line that goes: “Take this opportunity before the GST hike to save money on your dream car before it’s gone.”

Other companies told TODAY that they are just encouraging customers to buy in conjunction with their year-end promotions before the tax increase.

Furniture shop XZQT said that it would inform its customers about upcoming sales and “make them aware of any impending price increases”.

“We’re highlighting how customers may like to plan ahead to take advantage of the extra 1 per cent savings on top of our year-end sales at discounted prices.” Its standard practice is to keep items ordered for customers for six months at most.

For Mr Ray Juan, a 40-year-old who is self-employed, he is looking to save on facials. He goes for these skincare treatments regularly with his wife who uses other services at the same place.

Paying in advance before the year ends for the services, which cost him “thousands of dollars”, will give him more savings, he added.

On the Orchard Road shopping belt, a handful of shoppers approached by TODAY said that they were not thinking about the upcoming GST increase for their buys.

Mr Martin Kinsella, a 63-year-old engineer who knew about the tax increase, said that he is spending more now because it is that time of year for gifting: “(I’m just buying things) to make people happy for Christmas.”

Ms Berlinda Tan, a 56-year-old floral designer, said: “I think that you don’t have to buy on impulse (because of the tax increase). You just buy whatever you need.”