HDB to roll out housing grant with higher income ceiling, no restriction on flat type and location

SINGAPORE — From Wednesday (Sept 11), a new housing grant with a higher wage ceiling will kick in to streamline two existing grants.

To be eligible for the Enhanced CPF Housing Grant, applicants or their spouses must have been employed continuously for at least 12 months, as with other HDB schemes including the Special CPF Housing Grant.

SINGAPORE — From Wednesday (Sept 11), a new housing grant with a higher wage ceiling will kick in to streamline two existing grants.

The Enhanced Central Provident Fund (CPF) Housing Grant, announced by National Development Minister Lawrence Wong on Tuesday, will also remove restrictions on the type and location of flats being bought.

The grant will replace the current Additional and Special CPF Housing Grants, as part of moves to make public housing more affordable.

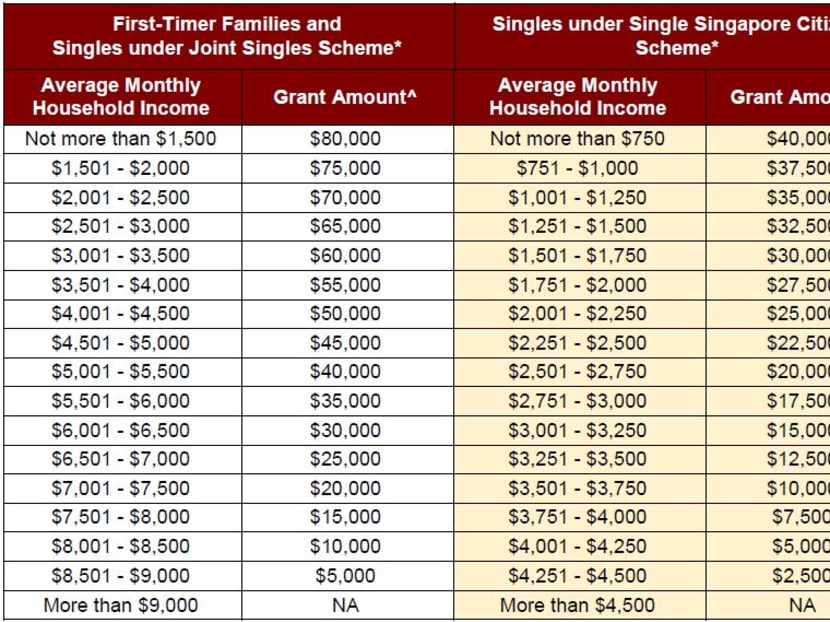

Under the new grant — which is for households with incomes of up to S$9,000 — first-time flat buyers, be they families or singles under the Joint Singles Scheme, could receive subsidies of between S$5,000 and S$80,000.

The amounts disbursed will depend on household incomes, with families subsisting on lower wages getting higher grants, even for resale flats in mature estates.

Right now, the Special CPF Housing Grant, which disburses subsidies of up to S$40,000, is for first-time buyers with household incomes of up to S$8,500 who wish to buy four-room or smaller new flats in non-mature estates.

To be eligible for the Enhanced CPF Housing Grant, applicants or their spouses must have been employed continuously for at least 12 months, as with other HDB schemes including the Special CPF Housing Grant.

They must also buy flats that they can call home until age 95. Those whose flats fail to meet this condition will have subsidies prorated based on the extent that the flat’s remaining lease can cover them until that age.

On how many more flat buyers will benefit from the enhanced grant, the Housing and Development Board (HDB) could not provide estimates as it said this would depend on “whether they meet the eligibility conditions”.

Mr Wong made the announcement in a speech at the HDB Awards 2019 ceremony, which was held at Marina Bay Sands. He said more young couples may wish to buy Build-to-Order (BTO) flats with the enhanced grant and the Government would likely have to release more units next year. This year, HDB is on track to launch 15,000 units.

Prime Minister Lee Hsien Loong alluded to the changes in his National Day Rally speech last month, saying that his younger ministers had devised some ideas to keep flats affordable.

Other changes announced by Mr Wong on Tuesday include higher income ceilings for couples and singles for various HDB schemes. The income ceiling for executive condominiums will also be raised from S$14,000 to S$16,000.

HDB also hopes to roll out a new one-stop portal by the end of next year to allow buyers and sellers to transact HDB flats, said Mr Wong. It will build on HDB’s resale portal, which streamlines transactions for resale units. The new website will offer a flat-listing service with details about ongoing and future BTO launches, and allow buyers to compare between their preferred options. It will also allow sellers to list and advertise flats.

Here are the changes at a glance:

FOR FIRST-TIMER FAMILIES BUYING NEW FLATS

Before: Families buying their first new HDB flat could receive up to S$80,000 in grants. This comprises a S$40,000 Additional CPF Housing Grant (household incomes must be S$5,000 or below) and a S$40,000 Special CPF Housing Grant if they are buying a four-room or smaller flat in a non-mature estate (household monthly incomes must not exceed S$8,500).

After: They could receive twice the amount in subsidies — up to S$80,000 — under the Enhanced CPF Housing Grant (household monthly incomes must not exceed S$9,000) when buying a new flat of any type and in any estate.

Example: A couple with a household monthly income of S$4,800 is looking to buy a four-room BTO flat in Tampines, a mature estate. With the changes, they could enjoy an extra S$40,000 in housing grants.

Previously, the couple would be eligible only for a S$5,000 Additional CPF Housing Grant. They would not qualify for the Special CPF Housing Grant, which is for new flats in non-mature estates.

The enhanced grant will give them S$45,000 in subsidies.

FOR FIRST-TIMER FAMILIES BUYING RESALE FLATS

Before: They could receive up to S$120,000 in grants. This comprises a S$50,000 CPF Housing Grant (household monthly incomes must not exceed S$12,000), a S$40,000 Additional CPF Housing Grant (household monthly incomes at S$5,000 or below), and a S$30,000 Proximity Housing Grant if they live with or near their parents.

After: They could qualify for up to S$160,000 in grants, bumped up by the S$80,000 Enhanced CPF Housing Grant. The amounts disbursed under the other two grants remain unchanged, although the income ceiling to qualify for the standard CPF Housing Grant will be raised to S$14,000.

Example: A couple, both aged 30, earning S$4,800 a month is looking to buy a four-room resale flat with a 70-year lease left. They will receive an extra S$40,000 in grants.

Previously, they would be eligible for S$55,000 in grants, comprising the S$50,000 CPF Housing Grant and a S$5,000 Additional CPF Housing Grant.

After the changes, they would qualify for S$95,000 in grants, comprising a S$45,000 enhanced housing grant and the CPF Housing Grant.

FOR FIRST-TIMER SINGLES BUYING NEW FLATS

Before: Singles buying new flats for the first time received up to S$40,000 in grants — S$20,000 from the Additional CPF Housing Grant (household monthly incomes not exceeding S$2,500) and S$20,000 from the Special CPF Housing Grant (household monthly incomes of up to S$4,250).

After: The amount of grants remains the same under the Enhanced CPF Housing Grant, though the household monthly income ceiling will be raised to S$4,500.

FOR FIRST-TIMER SINGLES BUYING RESALE FLATS

Before: Singles buying resale units for the first time received up to S$60,000 in grants — S$25,000 from the CPF Housing Grant (household monthly incomes of up to S$6,000), S$20,000 from the Additional CPF Housing Grant (household monthly incomes not more than S$2,500), and S$15,000 from the Proximity Housing Grant.

After: The total grant climbs to S$80,000 because they could receive up to S$40,000 from the Enhanced CPF Housing Grant. This is on top of the standard CPF Housing Grant and Proximity Housing Grant, which remain unchanged, although the income ceiling for the standard grant will be raised to S$7,000.

HIGHER HOUSEHOLD-INCOME CEILINGS

Families. The HDB will also raise the monthly household-income ceiling from S$12,000 to S$14,000 for eligible families to get:

-

An HDB flat.

-

A resale flat on the open market with a CPF Housing Grant.

-

An HDB housing loan for new or resale flats.

This is to give more citizen households access to affordable public housing. No specific numbers were available on how many more families will benefit from the higher income ceiling.

Singles. The monthly household-income ceiling for first-time flat buyers who are singles aged 35 and older will also be raised from S$6,000 to S$7,000. With this, eligible singles may choose to buy new two-room flexi flats or resale flats with the CPF Housing Grant for Singles on the open market.

HDB said the number of singles who will benefit from the higher income ceiling depends on many factors, such as market conditions and individual preferences.

Buyers of executive condominiums (ECs). Citizen households with a monthly income of S$16,000 will qualify to buy an EC, compared with the S$14,000 cap now.

OTHER CHANGES

-

Eligible families who are buying their second HDB flat will also stand to gain. The monthly household-income ceiling for the Fresh Start Housing Scheme and Step-Up CPF Housing Grant will go up from S$6,000 to S$7,000. The Fresh Start scheme helps vulnerable families own a two-room unit, while the Step-Up grant helps families living in subsidised two-room flats buy three-room units in non-mature estates.

-

Eligible seniors will benefit, too. The monthly household-income ceiling will go up from S$12,000 to S$14,000, allowing them to qualify for schemes such as the Silver Housing Bonus after they right-size to a two-room or three-room flat.