Budget 2015: Higher income taxes for Singapore’s top 5%

SINGAPORE — Top income earners will have to pay more personal income taxes starting 2017, announced Deputy Prime Minister and Finance Minister Tharman Shanmugaratnam in his Budget address today (Feb 23).

SINGAPORE — Top income earners will have to pay more personal income taxes starting 2017, announced Deputy Prime Minister and Finance Minister Tharman Shanmugaratnam in his Budget address today (Feb 23).

This move will affect the top five per cent of income earners, who earn at least S$160,000. But it will hit highest income earners the hardest, said Mr Tharman, as marginal income tax rates rise significantly towards the top end of incomes.

Noting that support for the low-income has been enhanced over the years, Mr Tharman said it is fair that this support should come from revenues contributed by the high-income group. “Those with higher incomes have also been seeing stronger growth in incomes than the average Singaporean in recent years,” he noted.

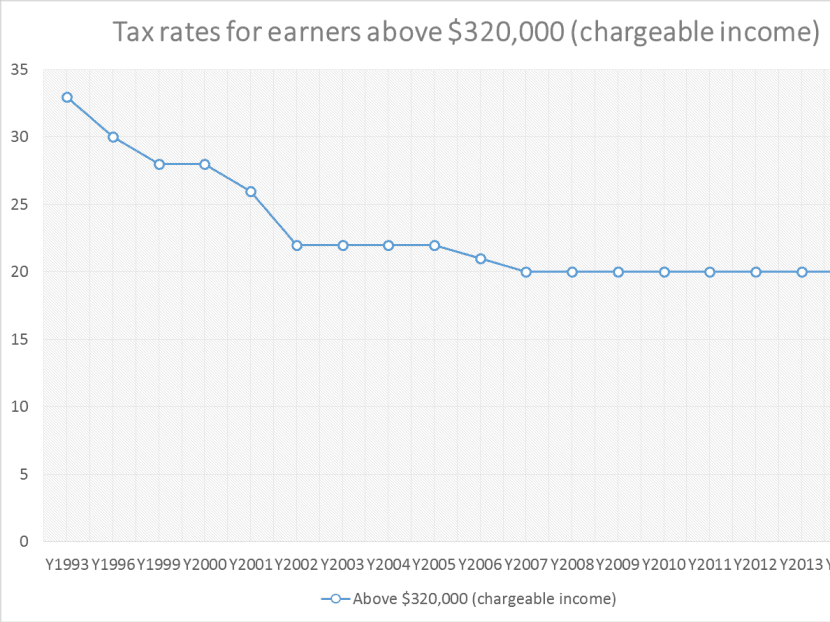

Marginal tax rates for the highest income earners will increase by two percentage points, to 22 per cent. This applies to those earning above S$320,000.

Read more about personal income tax changes over the years: BUDGET 2015: Personal income tax

(click to expand)

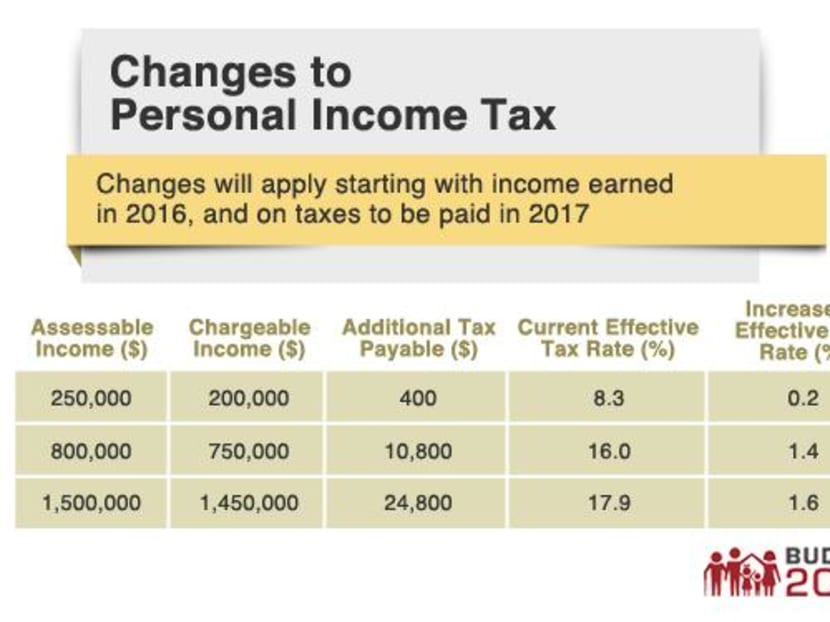

Smaller increments will also be made to income tax rates for others in the top five per cent. For instance, someone who earns S$250,000 annually will see his income tax rate increasing from 8.3 per cent to 8.5 per cent, thus paying S$400 more in taxes.

Meanwhile, a top income earner bringing in S$1.5 million annually have to pay S$24,800 more in taxes, when his income tax rate rises from 17.9 per cent to 19.5 per cent.

These changes — intended to enhance progressivity and strengthen future revenues — will kick in for income earned in 2016, with the taxes payable in 2017. They are expected to bring in an additional revenue of S$400 million a year.

“This is a calibrated move. We have assessed that it should not significantly dent Singapore’s competitiveness. We cannot take tax competitiveness lightly,” said Mr Tharman. “…it would be naive to think that we can keep raising tax rates without affecting our competitiveness. We must remain an attractive place for world-class teams to be in Singapore with Singaporeans at the core, and to keep our place in the world.”

READ THE FULL BUDGET STATEMENT HERE.

Other documents on Budget 2015 available on the Budget 2015 website.

Read more about personal income tax changes over the years: BUDGET 2015: Personal income tax.