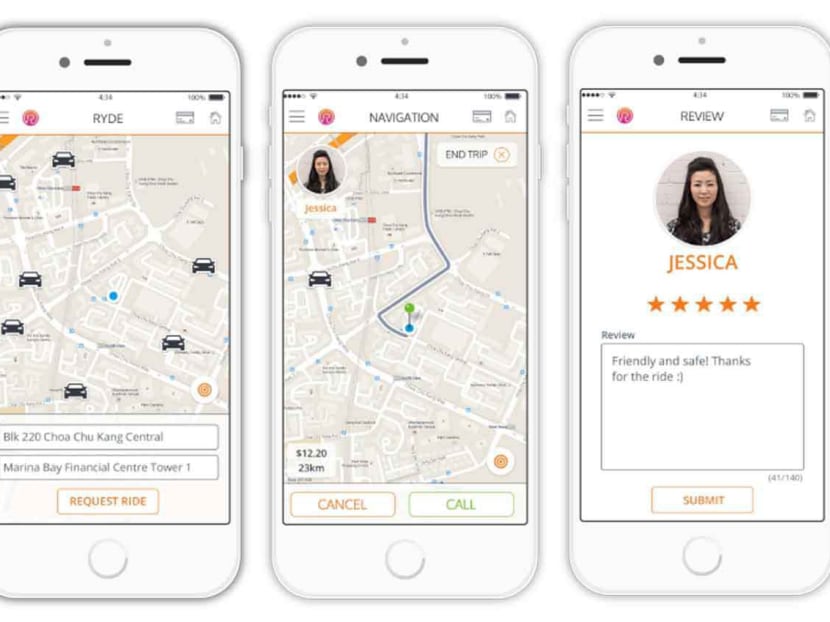

Homegrown app Ryde plans to launch private-hire service in coming weeks

SINGAPORE — Amid concerns that Grab’s recent acquisition of Uber’s regional business could pave the way for a monopoly in the private-hire car and taxi industries, homegrown carpooling app Ryde Technologies announced on Wednesday (March 28) it would launch a new private-hire car service in a few weeks.

SINGAPORE — Amid concerns that Grab’s recent acquisition of Uber’s regional business could pave the way for a monopoly in the private-hire car and taxi industries, homegrown carpooling app Ryde Technologies announced on Wednesday (March 28) it would launch a new private-hire car service in a few weeks.

While plans to expand beyond carpooling and taxi-booking services have been in the works for months, Ryde’s founder and chief executive Terence Zou told TODAY the Grab-Uber merger gave it an “opportune time” to enter and fill a gap in the market.

“We are of the view that the market needs competition, and we have been waiting for the right time to enter the market and this is it,” said Mr Zou.

“We need at least two to three ride-hailing platforms for commuters to choose (from) and competition would be good for the companies.”

Under its ride-hailing service called RydeX – which could feature scheduled services allowing users to book rides in advance – the firm said that it will take a smaller commission of 10 per cent from drivers, instead of the 20 to 30 per cent charged by other players.

The savings will be passed on to commuters in the form of lower fares and higher earnings for drivers, he said.

“We want to build a transparent and equitable model rather than slashing prices because that will not be sustainable,” said Mr Zou, adding that there is a need to ensure the model is “robust”.

Charging a lower commission does not mean that the firm is employing a price-slashing strategy to compete with Grab, said Mr Zou, who hopes about 5,000 private-hire drivers will sign up in the coming weeks for “critical mass” before the service is launched.

The company plans to run a marketing campaign and Mr Zou said those keen to sign up could do so through its app.

According to him, Ryde has over 55,000 drivers, including 15,000 ComfortDelGro taxi drivers, to cater to the daily commute of over 300,000 passengers in Singapore.

Last May, Ryde announced it was teaming up with ComfortDelGro – the largest taxi operator – to offer a new taxi-booking service after it received the Third Party Taxi Booking certificate from the Land Transport Authority.

Transport analysts said Ryde’s plan was hardly surprising.

But the company will have a “tough fight” on its hands to challenge the dominance of Grab, which had personnel fanning out to hawker centres and other locations islandwide in the early days to get taxi drivers, users and others to sign up.

There are more than 42,000 chauffeured private-hire cars in Singapore, while the five taxi operators partnering Grab for its JustGrab platform have a combined fleet of nearly 10,000.

On Monday, Singapore-based Grab announced it had acquired rival Uber’s operations in South-east Asia, including in Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam.

As part of the deal, Grab will be integrating Uber’s ride-sharing and food delivery business into its platforms, and Uber will take a 27.5 per cent stake in Grab.

Singapore University of Social Sciences (SUSS) transport economist Walter Theseira said that Ryde is hoping to “pick up some drivers and commuters from Uber” but how it executes its plan remains to be seen.

Ryde’s backers will needs to have deep pockets to challenge Grab, which is bankrolled by some of the world’s biggest funders, said Dr Theseira.

“Without such funding, it’s easy to make pronouncements about fighting in the market but (it will be) impossible to back it up,” he said.

Mr Zou acknowledged it does not have the deep pockets of its competitor and declined to elaborate on the company’s investors. He would only say Ryde had “secured a significant round of funding”.

With Uber’s drivers absorbed into Grab’s fleet through the acquisition, transport expert at SUSS Park Byung Joon said Ryde will have to add value to its partners.

Ryde needs to find a niche to stand out and sustain operations, and will only “bleed money” if it competes head-on with Grab, said Dr Park. “And to compete, they must find something other than price. If reducing fares is their strategy, I don’t see how they can sustain.”

Ryde’s entry into the private-hire market does not preclude a monopolistic situation, said Dr Park. In places such as the United States and Europe, competition watchdogs look at the market share of the dominant company and not only the number of competitors present.

Unless a new entrant proves that its business is economically viable, the “possibility of entry alone wouldn’t offset the anti-trust concerns”, said Dr Theseira.

In the wake of Grab and Uber’s announcement, the Land Transport Authority said it would ensure no single market player dominates the sector. The Competition Commission of Singapore has the power to review mergers or acquisitions.

“It is important that the Government look into regulations to ensure the market remains open and contestable,” said Mr Zou.