Income inequality in Singapore drops to its lowest since 2001

SINGAPORE — The income gap in Singapore has reduced to its narrowest since 2001, with the wages of Singapore’s lowest earners rising at a faster pace than those of the highest earners.

Figures from the Key Household Income Trends 2019 released by SingStat on Thursday show that the Gini coefficient, before accounting for government transfers and taxes, dropped to 0.452 in 2019, the lowest since 2001.

SINGAPORE — The income gap in Singapore has reduced to its narrowest since 2001, with the wages of Singapore’s lowest earners rising at a faster pace than those of the highest earners.

The Gini coefficient based on household income from work per household member dropped from 0.458 in 2018 to 0.452 in 2019, before accounting for government transfers and taxes.

The Gini coefficient measures income inequality as a ratio from one to zero where the higher the number, the greater the degree of income inequality.

The last time the Gini coefficient saw a drop almost as sharp was from 2015 to 2016 where it dropped from 0.463 to 0.458.

The 2019 figure is also the lowest since 2001 when it stood at 0.454.

After adjusting for government transfers and taxes, the Gini coefficient in 2019 fell from 0.452 to 0.398.

The Singapore Department of Statistics (SingStat), which released these figures in its annual report on Key Household Income Trends on Thursday (Feb 20), attributed the drop to the redistributive effect of Government transfers in the form of various schemes such as Workfare Income Supplement and rebates on utilities, service and conservancy charges among others.

INCREASE IN REAL GROWTH FOR THOSE IN BOTTOM 10TH DECILE

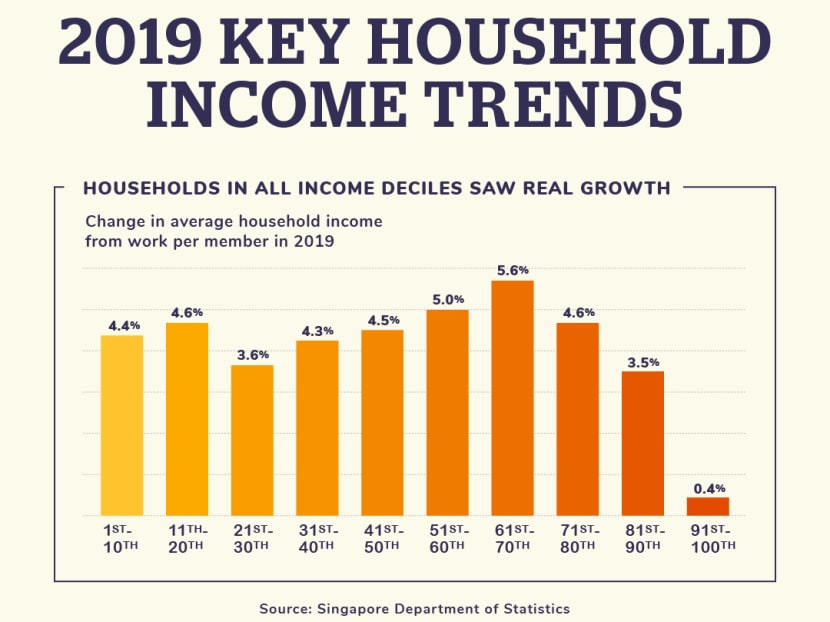

Those in the bottom 10th decile saw an increase in their real growth in average household income per member over the last 10 years.

This figure stood at 4.2 per cent for the bottom 10th decile between 2014 to 2019, a one percentage point increase from the real grwoth in 2009 to 2014.

This increase is higher than the real growth seen by those in the 91st to 100th decile.

The highest earners saw their real growth in average household income per member drop from 2.8 per cent from 2009 to 2014, to 2.5 per cent between 2014 and 2019.

The real growth in average household income per member in 2019 for those in the 1st to 10th percentile was 4.4 per cent while those in the 11th to 20th percentile was 4.6 per cent.

The group that registered the highest growth last year was those in the 61st to 70th percentile, at 5.6 per cent.

The growth registered by those in the bottom 20th decile was significantly higher than the real growth in terms of average household income per member of 0.4 per cent seen by households in the top 10 per cent income group.

Overall, resident employed households across all income groups showed real growth in their average household income from work per household member, with those in the 1st to 90st percentile income groups registering a real growth of between 3.5 per cent to 5.6 per cent in 2019.

GROWTH IN MEDIAN HOUSEHOLD INCOME FROM WORK

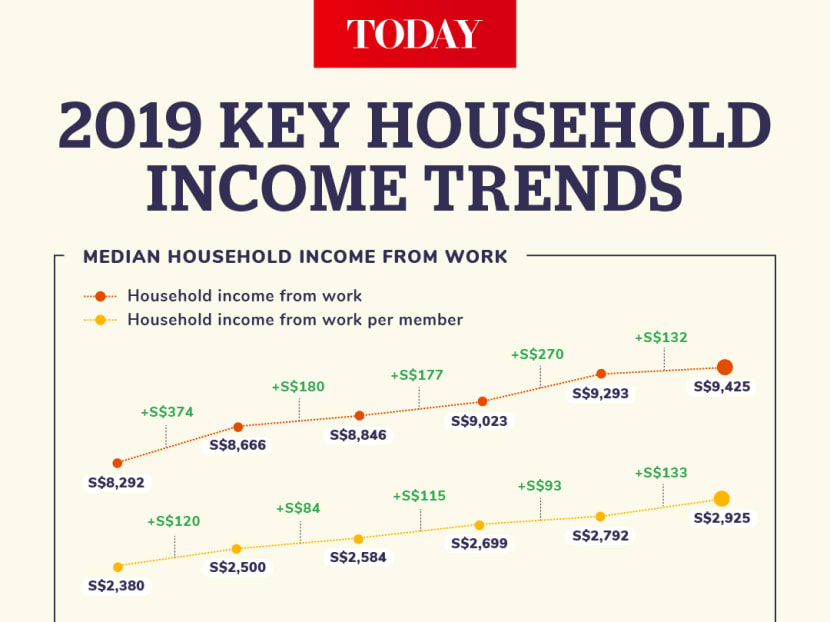

The median monthly household income from work among resident employed households grew by 1.4 per cent in nominal terms, or 1 per cent in real terms, from S$9,293 in 2018 to S$9,425 in 2019.

Resident employed households refers to a household headed by a Singaporean citizen or permanent resident with at least one working person.

Over the last five years, the median monthly household income from work of resident employed households increased by 13 per cent cumulatively or 2.5 per cent per annum in real terms.

MORE GOVERNMENT TRANSFERS FOR THOSE IN ONE AND TWO-ROOM HDB FLATS

Resident households in one and two room Household Development Board (HDB) flats received S$10,548 per household member on average in 2019.

This was more than double the amount of transfers received by resident households staying in other dwelling types such as HDB four or five-room flats and condominiums.

On average, resident households, which includes households with no working person, received S$4,628 per household member from various Government schemes such as the Merdeka Generation Package and Bicentennial Bonus in 2019.

GROWTH IN WAGES OF TOP EARNERS HIT BY POOR ECONOMY

Experts TODAY spoke to said that the poor economy had affected the incomes of top earners here, leading to a narrowing gap between top and bottom earners.

DBS Bank senior economist Irvin Seah said that the growth in real incomes of higher earners, which consist of high-paying executives and business owners, has taken a hit.

High-paying executives have seen their bonuses reduced as a result of the poor economy last year while business owners have taken pay cuts to avoid retrenching their workers, said Mr Seah.

Likewise, Ms Selena Ling, head of treasury research and strategy at OCBC Bank, said that the growth in incomes of those in the top 10th percentile has not kept pace with those in the other income groups due to the unfavourable financial environment.

“Financial market volatility due to the trade tensions and geopolitical uncertainties, coupled with very low interest rate environments do not favour wealth accumulation,” she said.

This, together with a bias by Governments to tax high income households following the global financial crisis may have led to the wages of high earners stagnating, said Ms Ling.

However, experts differed on whether the Government should focus its attention on higher earners in light of their slowing growth in real incomes.

Dr Chua Hak Bin, a senior economist at Maybank Kim Eng Group in Singapore, said that in addition to its focus on the lower-income group, the Government should also pay attention to professionals, managers, executives and technicians (PMETs).

If those in the PMET group were hit by the poor economy, this could have a trickle-down effect on those from lower-income groups. For instance, top-earners may cut back on their spending, impacting the businesses that lower-income workers are involved in, said Dr Chua.

However, Mr Seah disagreed, saying that top earners “can take care of themselves” and that it is the Government’s responsibility to take care of the bulk of the population.

Mr Zainal Sapari, the assistant secretary-general of the National Trades Union Congress (NTUC), said that the lowering of the Gini coefficient was good as it signalled the narrowing gap between top and bottom earners.

However, he added that more long-term measures, such as training and upgrading workers, were needed to ensure that workers could earn a better income.

Such measures, said Mr Zainal who is also the Member of Parliament for Pasir Ris-Punggol Group Representation Constituency, will ensure that the drop in the Gini coefficient sustains in future years.

On the rise in real median household income per household member last year, Mr Seah said this was partly due to the shrinking household size in Singapore.

Based on the latest official statistics, the average household size in Singapore is 3.24 as of 2018, down from 3.5 in 2010.