Lower-income platform workers contributing more to CPF from 2024 to get 75% funding from Govt in first year

SINGAPORE — Details of transitional support for some lower-income platform workers who will soon be required to make Central Provident Fund (CPF) contributions were unveiled in Parliament on Wednesday (March 1).

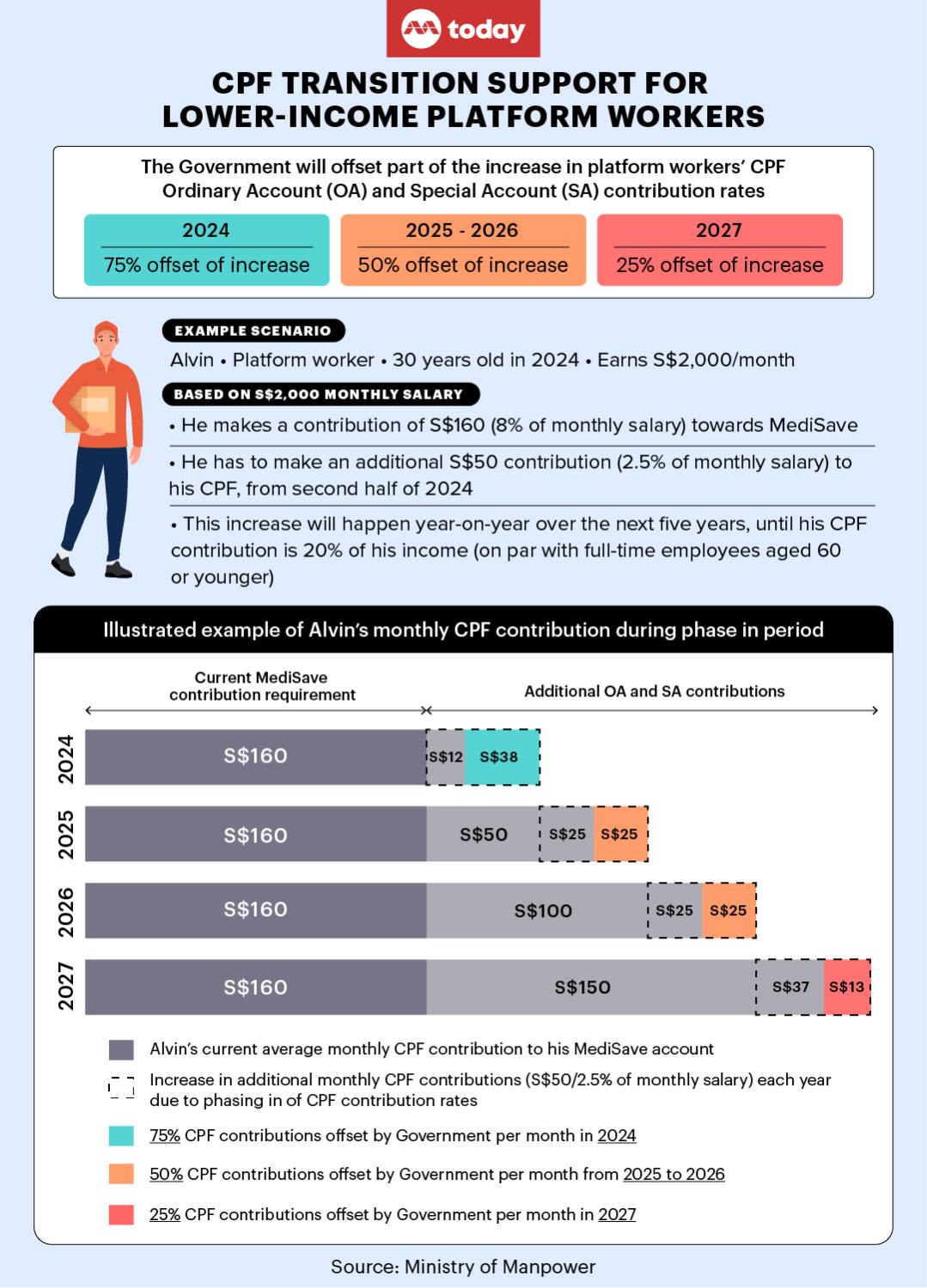

- Details were released on Wednesday (March 1) for the transitional support for those lower-income platform workers who will be required to make CPF contributions from the second half of 2024

- They will receive a 75 per cent offset to the increase in their CPF contributions from the Government for the first year they come under the CPF scheme

- Over the next three years, this will be gradually tapered down as the CPF contributions are phased in

- Workfare Income Supplement (WIS) payments will be permanently increased for platform workers once CPF contribution rates have been fully aligned with those of employees

SINGAPORE — Details of transitional support for some lower-income platform workers who will soon be required to make Central Provident Fund (CPF) contributions were unveiled in Parliament on Wednesday (March 1).

These "gig economy" workers, such as food delivery riders, will receive support from the Government in the form of a 75 per cent offset to the increase in their CPF contributions in the first year that they are phased into the CPF scheme.

Support for this group of platform workers will then be tapered down over the next three years that their additional CPF contributions are being phased in. The move to include them in the CPF scheme starts in the second half of 2024.

The Government decided to include platform workers aged under 30 under the CPF scheme after a committee recommended this step as a way to boost the financial security of these workers.

The change means that like employees, they will make CPF contributions while the platform companies they operate under will make the equivalent of CPF employer contributions.

Currently, platform workers already make a contribution of 8 to 10.5 per cent of their income to their CPF, in the form of MediSave, but do not make contributions to their Ordinary and Special accounts.

The details of the transitional support for platform workers earning S$2,500 or less a month were announced by Senior Minister of State for Manpower Koh Poh Koon on Wednesday.

Dr Koh was speaking in Parliament in the debate on his ministry's budget, with several Members of Parliament (MPs) raising concerns that low-wage platform workers' take-home pay will be reduced if they need to make CPF contributions.

HOW SUPPORT FOR PLATFORM WORKERS' CPF INCREASES WORKS

All platform workers currently contribute 8 to 10.5 per cent of their income into the MediSave component of their CPF.

For a platform worker who is 30 in 2024, earns S$2,000 a month and is eligible for CPF transitional support, he already pays about S$160 a month towards MediSave.

Under the changes, he will make Ordinary Account and Special Account contributions, which he previously did not make.

From the second half of 2024, he has to start making additional S$50 contributions a month, or 2.5 per cent of his monthly salary, to his CPF.

Of this, the Government will offset 75 per cent, or S$38 a month. The worker thus pays an additional S$12, and so he pays S$172 a month in CPF for the first year when taking into account MediSave.

In 2025, he will be paying another additional S$50 to his CPF. The Government will offset 50 per cent, or S$25 of this increase.

He will no longer receive an offset for the first increment in 2024. Thus, he will be setting aside S$160 in MediSave, S$50 for the first year of increase and S$25 for the second year, which is S$235 a month into his CPF.

This increase will happen year-on-year over the next five years, until his CPF contributions are on par with what full-time employees currently contribute, which is 20 per cent of their income for workers aged 60 or younger.

At the same time, platform companies will also make contributions into the workers’ CPF account, starting with a 3.5 per cent contribution in 2024, with about a 3.5 per cent increment every year.

For platform workers aged 60 or younger, companies will eventually contribute 17 per cent of the worker’s monthly pay to their CPF by 2028.

The Government announced last month that platform workers aged under 30 will be required to come under the CPF scheme, while older workers can opt in to make additional contributions to their CPF.

Under the changes, the additional CPF contributions will be phased in evenly across five years, at around 2.5 percentage points per year for platform workers and 3.5 percentage points per year for platform companies.

For a worker who is aged 60 or younger, it will bring their CPF contributions up to 20 per cent of the worker's income for employees, and 17 per cent of the income for employers.

When the move kicks in in the second half of 2024, workers will get an initial 75 per cent offset from their increase in CPF contribution, which will be tapered down to 50 per cent between 2025 and 2026, and then down to 25 per cent in 2027.

TODAY asked the Ministry of Manpower how much of its budget had been set aside to provide this transition support, and the ministry said that it is unable to share further details.

PLATFORM WORKERS TO BE UNDER WORKFARE INCOME SUPPLEMENT SCHEME

Dr Koh said that once the CPF contribution rates of platform workers have been fully aligned with those of employees, payments under the Workfare Income Supplement (WIS) scheme will be permanently increased for platform workers to match those of employees:

- Eligible platform workers could receive up to S$4,200 per year, an increase from S$2,800 per year today

- They will receive 40 per cent in cash, while the rest will go into their CPF, compared to 10 per cent in cash and 90 per cent into CPF currently

- The increase in Workfare payments will be fully in cash

These Workfare payments for platform workers will kick in in the second half of 2024, where all platform workers eligible for WIS will receive monthly instead of yearly WIS payments.

"The above measures will mitigate the concerns in take-home pay while ensuring platform workers receive a significant boost in their retirement savings," said Dr Koh.

For example, based on the Ministry of Manpower's estimates, a median income platform worker who turns 30 in 2024 and opts in from the start for the CPF contributions can use about S$450,000 in CPF savings by age 65 for his housing and retirement needs.

OLDER WORKERS WHO OPT IN CANNOT OPT OUT

Addressing questions from MPs about whether older platform workers born before 1995 who opt into contributing to CPF can later opt out, Dr Koh said that the decision to opt in would not be reversible.

"Platform workers today have a concession to opt in for CPF, which is a choice that employees do not have," said Dr Koh.

"In discussion with platform companies, it would be complex and add to compliance cost if platform workers are allowed to opt out after opting in," he said.

He encouraged older platform workers to opt in to making CPF contributions.

“We strongly recommend that older cohorts of platform workers opt in, as they can similarly benefit from having additional contributions by the platform companies to build up their retirement nest egg.Senior Minister of State for Manpower Koh Poh Koon”

"We strongly recommend that older cohorts of platform workers opt in, as they can similarly benefit from having additional contributions by the platform companies to build up their retirement nest egg," he said.

Dr Koh added that in his engagements with platform workers, they had also raised concerns about platform companies discriminating against those who opted for CPF, by assigning fewer jobs to them.

He said that a recently released interim report by the Tripartite Committee on Workplace Fairness has recommended that the fair employment practice guidelines be enhanced to "provide clarity that intermediaries, such as platform companies, should treat contracted workers fairly".

"What this means is that platform companies must not discriminate when assigning work," said Dr Koh, adding that MOM will investigate any unfair practices.

WORKER REPRESENTATION

The ability for platform workers to represent themselves and negotiate for their interests is also critical as the industry continues to evolve and business models continue to change, said Dr Koh.

Other than discrimination on earnings, platform workers have also raised concerns about issues such as working conditions, safety at work and the need for timely dispute resolution with customers.

"A prevalent sentiment among many of them is that they are often not accorded due recognition on their feedback and concerns," he said.

In Singapore, there are currently associations that represent these platform workers, but they are not formally recognised within the industrial relations framework and therefore lack the mandate to negotiate on their behalf.

"While other jurisdictions have taken the approach of allowing platform workers to unionise in the same way that employees do, we recognise that the platform sector is distinct from traditional employment sectors," he said.

For instance, unlike employees, platform employees work on different app platforms and are more geographically dispersed and transient.

"This has implications on how they can organise themselves and how their representatives are chosen," said Dr Koh.

A work group comprising the Government, representatives of platform companies and existing platform worker associations is thus currently in discussions to determine how a representative body can formally seek mandate to represent platform workers collectively, said Dr Koh.