Explainer: Why MAS is trialling a digital Singapore dollar and how you can use it

SINGAPORE — A new form of digital Singapore dollar which can be programmed and used for specific purposes will be tested at the Singapore Fintech Festival (SFF) this week.

- Purpose-bound money (PBM) in the form of commercial digital vouchers will be distributed to 5,000 selected participants at the Singapore Fintech Festival

- They can use these vouchers to make purchases from participating merchants

- This is the first of several trials the Monetary Authority of Singapore (MAS) will be rolling out to test the usage of PBM

- PBM allows money to be programmed and used for specific purposes

- It can also be used to digitalise vouchers, which in turn could be used to support government payouts, said MAS

SINGAPORE — A new form of digital Singapore dollar which can be programmed and used for specific purposes will be tested at the Singapore Fintech Festival (SFF) this week.

This is the first of four trials being rolled out by the Monetary Authority of Singapore (MAS) in conjunction with government agencies and private firms to issue "purpose-bound money" (PBM) in the form of commercial digital vouchers to make purchases from participating merchants.

Mr Sopnendu Mohanty, the Chief FinTech Officer at MAS, said the introduction of e-money in recent years had provided the ability to store value electronically and carry it around.

But digital currencies go beyond that, as they allow money to be programmed and used for specific purposes only. All they would need to make the purchases is their preferred wallet application.

On Monday (Oct 31), MAS released a 55-page report detailing its findings of the use of PBM here and proposals for potential use cases.

The report does not mention cryptocurrencies directly but it does examine digital forms of currency that are broadly analogous to cryptocurrencies.

Cryptocurrencies such as bitcoin and ethereum operate on a global basis outside government regulatory frameworks.

MAS has consistently warned Singaporeans about the dangers of buying cryptocurrencies and is looking to have consumers pass a test before doing so.

TODAY takes a look at the findings in the MAS report and what this means for the future of finance.

WHAT IS PURPOSE-BOUND MONEY?

PBM allows senders to embed rules when making transfers in digital dollars. This means the transaction will go through only when the conditions such as the validity period and type of merchant are fulfilled.

MAS said PBM can be used to digitalise vouchers, which in turn can be used to support government payouts and schemes. Among the trials that will be rolled out is by the United Overseas Bank and SkillsFuture Singapore, which is looking into using PBM to improve the current credit disbursement process.

The central bank's report noted that voucher schemes today often operate on separate distribution channels with distinct features for different schemes.

For example, the Community Development Council (CDC) vouchers are claimed through the RedeemSG system, while digital Grab vouchers are redeemed via the Grab mobile application.

“Participating merchants would have to train their retail staff to be able to handle and accept different vouchers. This could be onerous, and there could be mistakes made due to unfamiliarity,” the report read.

HOW DO YOU USE IT?

Essentially, consumers will still use PBM the same way they use electronic money now. The only difference is that their funds are powered by smart contracts, which means the funds can only be used when eligibility conditions are met.

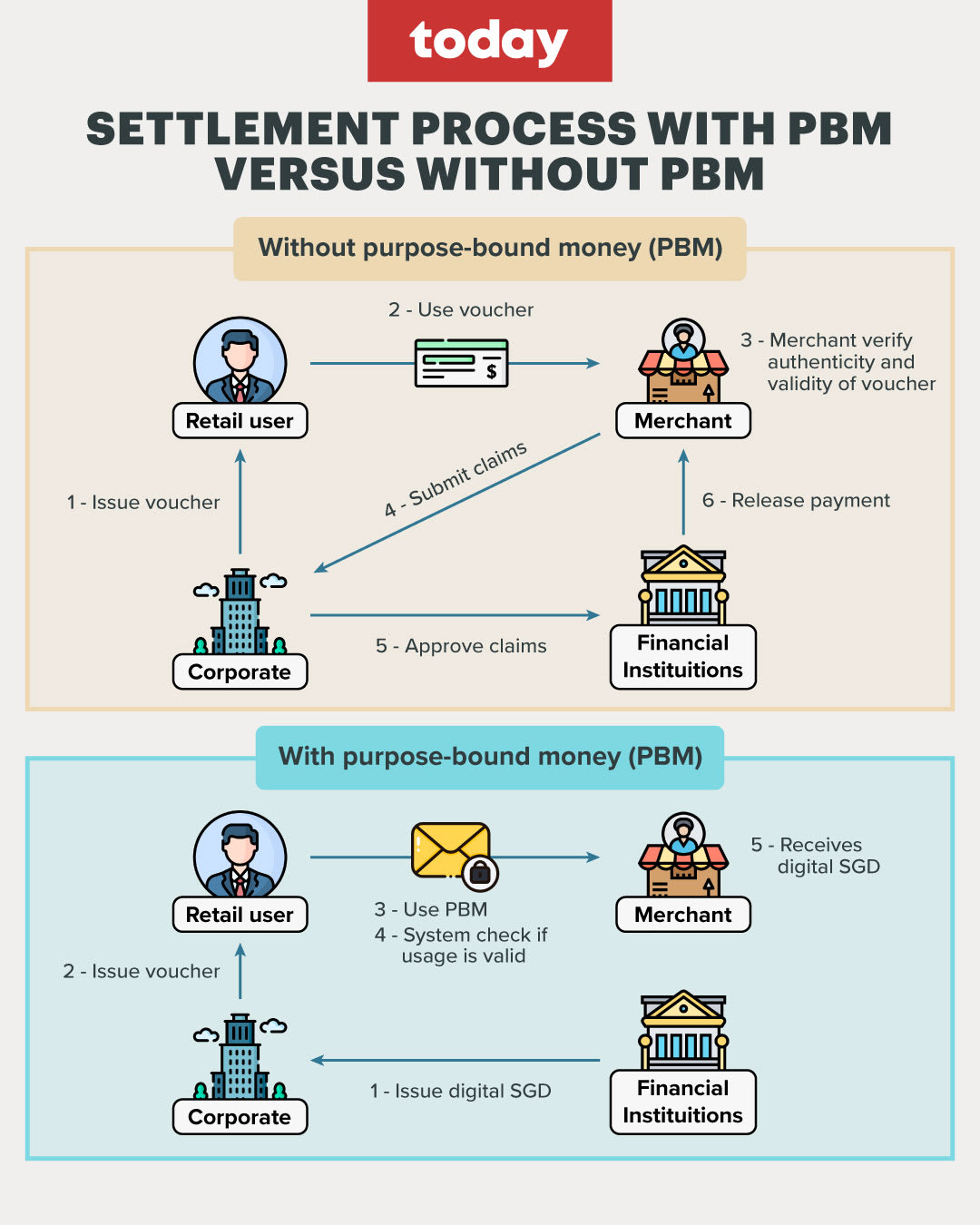

For merchants, the use of PBM means they will be able to receive their payout immediately after the transaction is made.

This is in comparison to the current process merchants undertake to claim a voucher, which includes ensuring the amount received from the voucher issuer is equal to the amount of vouchers they collected from the customer.

Additionally, the voucher issuer’s bank also needs to ensure that the cash settlement from their bank to all the merchants’ banks are accurate. The whole process usually takes one to two days of processing time.

DBS Bank, in a separate media release announcing its first PBM trial on Monday, said that although a majority of these vouchers are digital vouchers, it involves some backend administration for the merchant.

“However, with PBM vouchers, merchants will be able to be paid instantly, doing away with backend reconciliation, increasing productivity and efficiency,” it added.

WHAT’S NEXT?

MAS said the release of the report marked the completion of phase one of “Project Orchid”, which aims to develop the technology infrastructure and technical competencies necessary to issue a digital Singapore dollar should the need arise.

Following this, future research areas will focus on improving the user experience, strengthening security and privacy capabilities, and increasing accessibility to the broad population, it added.

It can also be used to support the delivery of more targeted social assistance, the report said, as the programmability feature of PBM allows government agencies to have greater flexibility in defining conditions for how and where the funds distributed could be used.

For example, conditions such as spending only at specific merchants such as at supermarkets or shops outside the city centre can be set to ensure the recipient spends their digital vouchers based on the intended objectives.