MAS further tightens unsecured credit limit for those heavily in debt

SINGAPORE — To help borrowers avoid accumulating excessive unsecured debts, the Monetary Authority of Singapore (MAS) has announced a new measure which will cap the additional unsecured debt that a financial institution may extend to a borrower.

SINGAPORE — To help borrowers avoid accumulating excessive unsecured debts, the Monetary Authority of Singapore (MAS) has announced a new measure which will cap the additional unsecured debt that a financial institution may extend to a borrower.

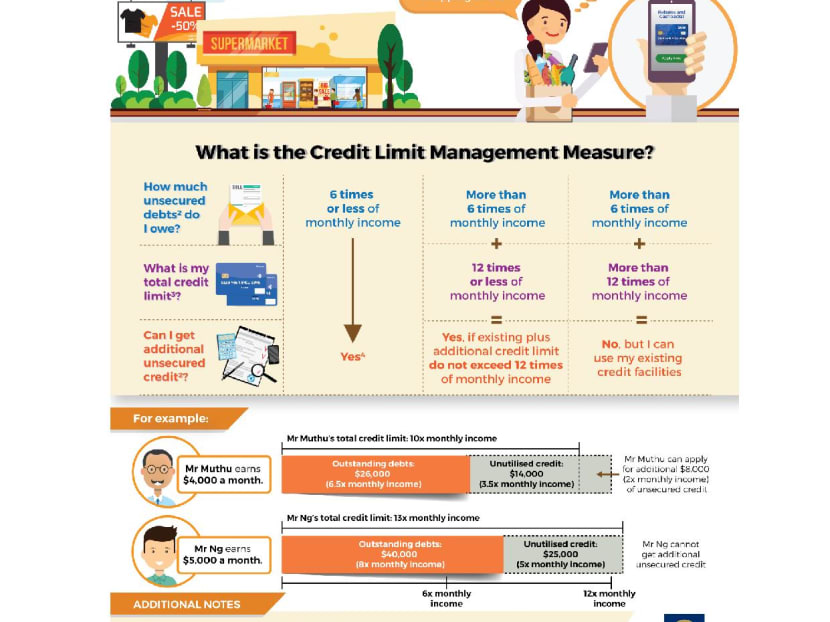

From Jan 1, for borrowers whose outstanding unsecured debts exceed six times his or her monthly income, financial institutions (FI) will not be allowed to grant any increase in credit limit or any new unsecured credit facilities that will cause the individual’s credit limit to exceed 12 times their monthly income.

For example, an individual who earns S$5,000 a month and has outstanding debts of S$40,000 (or eight times of monthly income), will not be able to get additional unsecured credit if his or her existing total credit limit exceeds S$60,000.

The escalating household debt problem in Singapore had prompted the MAS to intervene in 2015, introducing a limit capping unsecured loans to 24 times’ monthly income in June that year. The limit was reduced to 18 times’ monthly income from June this year, and will be tightened further to 12 times from June 2019.

The latest measure complements the existing industry-wide borrowing limit, the central bank said on Friday (Dec 15). The MAS said borrowers can continue to draw on their existing unsecured credit facilities that have not been used, and the new measure will not require borrowers to reduce the credit limit of their existing facilities.

The new measure targets borrowers with outstanding unsecured debts worth between six and 12 months of their monthly income. According to the MAS, there are an estimated 60,000 borrowers in this pool, or about 4 per cent of total unsecured credit users. “These borrowers will only be affected if they apply for new credit facilities or a credit limit increase, that will cause their total credit limit to exceed 12 times their monthly income. Thus, not all of the 60,000 borrowers will be affected by the new measure,” said MAS.

(Click to enlarge) Infographic: MAS

The move on Friday follows a public consultation conducted in September last year. MAS said it has taken the public feedback into consideration and “revised the proposals where appropriate”.

The MAS noted that the overall unsecured credit situation in Singapore “remains healthy,” but some of the borrowers “continue to increase their indebtedness”. Since January this year, an average of 4,000 borrowers per month have increased their unsecured debts to above 12 times their monthly income compared to the previous month.

In the MAS Financial Stability Review released last month, the central bank said the overall unsecured debt situation in Singapore has improved, sharing data from the Credit Bureau Singapore which showed that the growth in outstanding credit card balances extended by FIs has “eased considerably from the peak of 14 per cent year-on-year in the second quarter of 2012 to an average of 2.6 per cent on a year-on-year basis in the first nine months of this year.”

The review added that the financing situation for “highly-indebted borrowers” has also improved. As of August, there were 27,000 borrowers with outstanding unsecured debt exceeding 18 times their monthly income compared to 51,000 in February 2015, a decline of 47 per cent.

Since the introduction of the industry-wide borrowing limits in June 2015, the number of borrowers with outstanding unsecured debt exceeding their annual income has also come down by about 21,000, a decline from 5 per cent to below 4 per cent of total unsecured borrowers.

MAS assistant managing director (policy, risk & surveillance) Loo Siew Yee said the measure is “pre-emptive in nature” and “will help borrowers manage their unsecured debts early and avoid becoming highly indebted”.

She added: “We are making steady progress in helping borrowers manage their unsecured debts. The industry-wide borrowing limit has reduced the overall number of highly indebted borrowers.

“Several assistance schemes and repayment plans, such as the debt consolidation plan (DCP) launched earlier this year by The Association of Banks Singapore, are available to help these borrowers work down their existing debts.”

Launched in early 2017 through the coming together of 14 financial institutions, the DCP helps overextended borrowers reduce their debts in light of the impending borrowing limits. DCP is available to Singaporeans and permanent residents earning between S$20,000 and S$120,000 per annum with net personal assets of less than S$2 million.

The DBS, UOB, and OCBC banks are in support of the new MAS measure, as it will “help consumers” to manage their finances better and to spend only within their means as well as exercise prudence in credit management.

Mr Anthony Seow, head of cards & unsecured loans at DBS bank said the bank does not foresee much customer impact as “only a small percentage of customers will be affected by the new criteria.”

Mr Kenneth Tan, vice president, group lifestyle & payment products, OCBC Bank, said: “With the uncertainties in the employment market, consumers could lose their source of income and accumulate debts over time. Hence, reducing unnecessary expenses is key to maintaining good financial health.”