Medisave for IP premiums: New limits on withdrawals

SINGAPORE — Singaporeans above the age of 40 will be able to use more of their Medisave funds to pay for part of their Integrated Shield insurance premiums when MediShield Life kicks in at the end of the year.

SINGAPORE — Singaporeans above the age of 40 will be able to use more of their Medisave funds to pay for part of their Integrated Shield insurance premiums when MediShield Life kicks in at the end of the year.

Integrated Shield Plans (IPs) offer benefits over and above the coverage offered by MediShield Life, the basic universal scheme that will protect against large hospital bills.

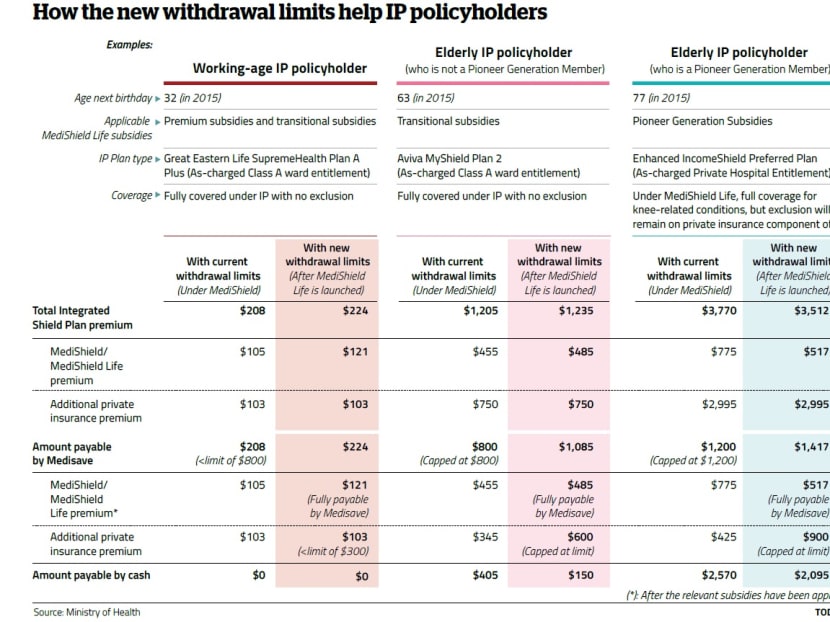

After announcing earlier this year that it would cap how much Medisave could be used to pay for the private-insurance portion of the IPs, the Ministry of Health (MOH) today (July 9) said the caps — called Additional Withdrawal Limits — will be S$300 per year for those below 40, S$600 for those turning 41 to 70, and S$900 for those turning 71 and above.

About 2.4 million Singaporeans — or more than six in 10 — own IPs. Just over half of them have plans that cover private hospital stays, while the rest are covered for B1 and A Class wards in public hospitals.

The MOH estimates that with the Additional Withdrawal Limits, 200,000 Integrated Shield policyholders (8.3 per cent) can use more Medisave to pay for the private-insurance component of their premiums, assuming they remain on the same plan and do not move into different age bands.

Integrated Shield Plans comprise the MediShield/MediShield Life component which is sufficient to cover B2 and C Class ward stays, as well as the private-insurance portion which is sized for stays in B1 and A Class wards and private hospitals.

There will be no Medisave withdrawal limit for MediShield Life premiums.

The Additional Withdrawal Limits are higher for older groups because their premiums are higher, Health Minister Gan Kim Yong told reporters today.

“With these changes, Singaporeans will be able to use the same or more Medisave for their private component of the IPs, and all of them will be able to use Medisave for the full amount of their Medishield Life premiums after all the subsidies,” he said.

During public engagement on MediShield Life, Integrated Shield policyholders wanted to use more from Medisave for their premiums; this was especially so for older people, according to the MOH.

Currently, Medisave withdrawal limits apply to the entire Integrated Shield premium payable, and range from S$800 to S$1,400 per year.

According to the ministry, the Additional Withdrawal Limits mean that those below 40 can use the same amount of Medisave to pay for the private-insurance component of their plans, while those turning 41 to 70 can use up to S$250 more from Medisave a year to pay for this component. Those older than 70 can use about S$400 to S$700 more of their Medisave for this purpose.

click to expand

In deriving the limits, the MOH tried to strike a balance between helping those who want to purchase private insurance plans, and ensuring people have enough Medisave for other healthcare needs, said Mr Gan.

On whether allowing more Medisave for the private-insurance components of IPs would encourage more people to buy them, Mr Gan advised Singaporeans to carefully consider two factors: If they needed to stay in higher class wards or private hospitals, and if they were prepared to pay higher premiums, especially in old age.

“These are, first of all, personal decisions,” he said.

The Government will review the Additional Withdrawal Limits to account for future changes in Integrated Shield premiums, while ensuring adequate Medisave balances for long-term healthcare needs.

“We will need to calibrate, we’ll need to assess when the time comes, whether or not we need to adjust the (limits),” said Mr Gan.

Last month, the five Integrated Shield insurers – AIA, Aviva, Great Eastern, NTUC Income and Prudential – pledged to freeze the private-insurance portion of premiums in the first year of MediShield Life. But they said premiums would go up in the long term due to rising healthcare costs, especially in private healthcare.