MediShield Life: One-off Covid-19 subsidy for all S'poreans to cushion impact of higher proposed premiums

SINGAPORE — To cushion the impact of proposed increases to MediShield Life insurance premiums, the Government will offer a one-off Covid-19 subsidy for all Singapore citizens.

A one-off Covid-19 subsidy for all Singaporeans will cost the Government about S$360 million in the next two years.

- S$2.2 billion will go into helping citizens and permanent residents with MediShield Life premiums over the next three years

- It includes a one-off Covid-19 subsidy for citizens to cushion the impact of higher proposed insurance premiums

- Net premium increases for citizens will be kept to about 10 per cent in the first year

SINGAPORE — To cushion the impact of proposed increases to MediShield Life insurance premiums, the Government will offer a one-off Covid-19 subsidy for all Singapore citizens.

This comes after a major review of the basic hospitalisation insurance scheme called for expanded coverage and higher premiums.

In all, over the next three years, the Government will channel about S$2.2 billion to help citizens and permanent residents (PRs) with their MediShield Life premiums, the Ministry of Health (MOH) said on Tuesday (Sept 29).

Part of the S$2.2 billion will go to the one-off Covid-19 subsidy that will fund 70 per cent of the net increase in premiums for citizens in the first year — after taking into account existing subsidies — followed by a 30 per cent subsidy in the second year.

This will cost about S$360 million in the next two years.

Along with existing measures to help Singaporeans with premiums, the subsidy will keep net premium increases for this group to about 10 per cent in the first year, MOH said.

Health Minister Gan Kim Yong said that Singaporeans who still face difficulties with their premiums despite the various measures may apply for more help.

“No one will lose MediShield Life coverage due to financial difficulties,” he said.

MediShield Life is a basic health insurance plan under the Central Provident Fund (CPF) Board, which helps to pay for large hospital bills and selected costly outpatient treatments, such as chemotherapy for cancer.

While PRs are not eligible for the Covid-19 subsidy, they will still be able to receive half the rates of other premium subsidies applicable to citizens, such as those meant for lower-income and middle-income households.

MOH’s announcement comes as a set of recommendations was put forth on Tuesday to improve MediShield Life coverage for citizens and PRs who are covered under the scheme, such as raising the policy-year claim limit from S$100,000 to S$150,000, and lowering the deductible for day surgeries paid out of pocket by older patients before MediShield Life payouts start.

The MediShield Life Council, which oversees the administration of the scheme, is also suggesting expanding it to cover those seeking treatments arising from attempted suicide, intentional self-injury, drug addiction and alcoholism.

With the expanded coverage, the council is also calling for higher premiums to keep the scheme sustainable.

It is launching a public consultation to gather views on these proposals from Tuesday to Oct 20, with changes to the scheme expected to take effect early next year.

The council said that MediShield Life payouts have increased by nearly 40 per cent over the last four years, and the number of claimants has climbed by almost 30 per cent.

Premiums, therefore, have to be adjusted to ensure that the scheme continues to be sustainable, and to take into account the previous benefit enhancements.

Mrs Fang Ai Lian, chairperson of the MediShield Life Council, said: “We have to periodically review and update the scheme benefits and premiums to keep pace with evolving medical practice, healthcare cost inflation and actual claims experience, so that it continues to provide assurance for Singaporeans while remaining sustainable.”

The council is recommending raising premiums by between 11.5 per cent and 34.3 per cent, depending on a person’s age, before subsidies.

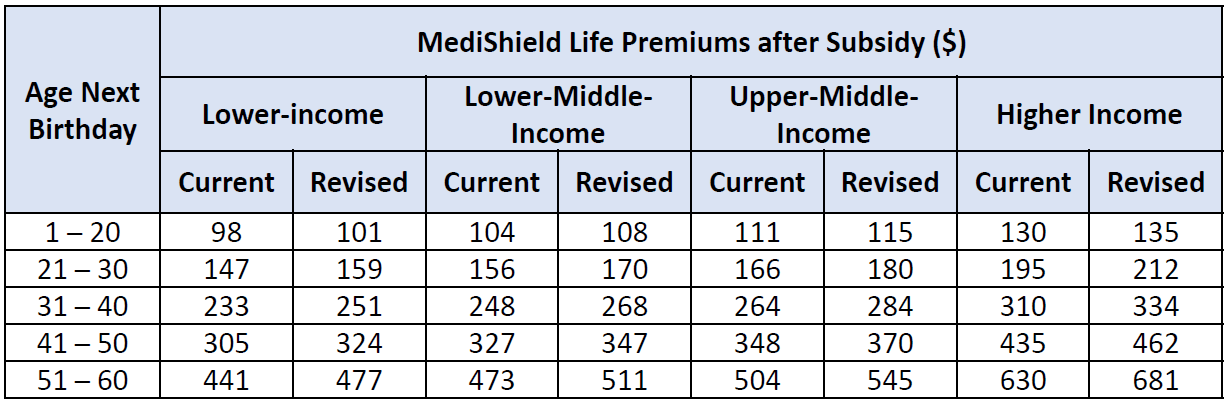

Premium subsidies applied are for Singapore citizens living in properties with an annual value of S$13,000 or less. Figures, shown here for Singaporeans aged 1 to 60, are rounded up to the nearest dollar. Source: Ministry of Health

KEEPING PREMIUMS AFFORDABLE

Since 2015, the Government has been rolling out measures to keep MediShield Life premiums affordable for Singaporeans.

These include premium subsidies for lower-income to middle-income citizens and extra subsidies for Singaporeans born in the 1950s, dubbed the Merdeka Generation.

Over the past four years, S$3.1 billion has been spent to help citizens and PRs with their premiums, MOH said.

The Government will continue to provide help over the next three years, to the tune of an estimated S$1.8 billion, after taking into account the proposed premium increases.

This sum will go towards:

Premium subsidies of up to 50 per cent for lower-income to middle-income Singaporeans

Extra Merdeka Generation subsidies of 5 per cent or 10 per cent

Special subsidies of between 40 and 60 per cent for the Pioneer Generation (those born in 1949 or earlier)

Added support to help needy individuals pay their premiums

Those from the Pioneer and Merdeka Generation may also use their yearly CPF MediSave top-ups to pay for their MediShield Life premiums.

From 2019 to 2023, indiciduals from the Merdeka Generation will receive S$200 in yearly top-ups. Pioneer Generation seniors get S$200 to S$800 every year, for life.