Millennials worry more about money, more likely to pay only minimum sum for credit card bills: Survey

SINGAPORE — Among working adults in Singapore, millennials — aged 21 to 39 — are the group most worried about money matters, such as not being able to take care of loved ones, afford a house or keep up with their peers. They are also less prudent with their spending.

The findings, part of the OCBC Financial Wellness Index, showed that millennials are the most worried about money, less prudent with their spending and want to grow their wealth.

- Millennials are the most worried about money, less prudent with their spending and want to grow their wealth

- The findings are part of the OCBC Financial Wellness Index, which fell slightly from the inaugural index last year

- OCBC attributed the dip to the Covid-19 economic downturn which had hurt people’s ability to pay housing loans, plan for retirement

- The survey also showed that fewer women than men invest, but those who are confident, seek advice and do research perform better

SINGAPORE — Among working adults in Singapore, millennials — aged 21 to 39 — are the group most worried about money matters, such as not being able to take care of loved ones, afford a house or keep up with their peers. They are also less prudent with their spending.

These findings were released on Monday (Nov 23) as part of the OCBC Financial Wellness Index, which was launched last year.

This year’s survey was conducted online in September and asked 2,000 working adults, Singaporeans and permanent residents aged 21 to 65, about their financial habits and attitudes.

The index was calculated using 10 criteria related to financial wellness, such as saving habits, regular investing and manageable debts. A score of 75 and above indicates that a respondent is on track to meet his financial targets.

The overall index dipped slightly from 63 in the inaugural index in 2019 to 61 this year, showing that Singaporeans are a little less financially healthy overall.

“We had hoped that the index would improve from 2019 or remain the same, but the financial impact of Covid-19 on Singaporeans was undoubtedly reflected in the drop in the index,” said Ms Koh Ching Ching, OCBC Bank’s head of group brand and communications.

The survey showed that Singaporeans are less able to pay off housing loans and plan for retirement, and have less regular passive income compared with last year.

On average, respondents underestimated the amount needed for retirement by 32 per cent, and three-quarters were not on track for retirement planning.

Among millennials, 57 per cent have retirement plans and 55 per cent have made arrangements for their loved ones’ finances after their death, compared to national averages of 63 per cent and 67 per cent respectively.

Nonetheless, the survey results showed that Singaporeans are still saving regularly, are more able to cover medical expenses and able to sustain themselves financially for six months if unemployed.

Ms Koh said that the index might rise next year once Singapore and the region have recovered from the pandemic.

“We do see that things should improve in the next index,” she said.

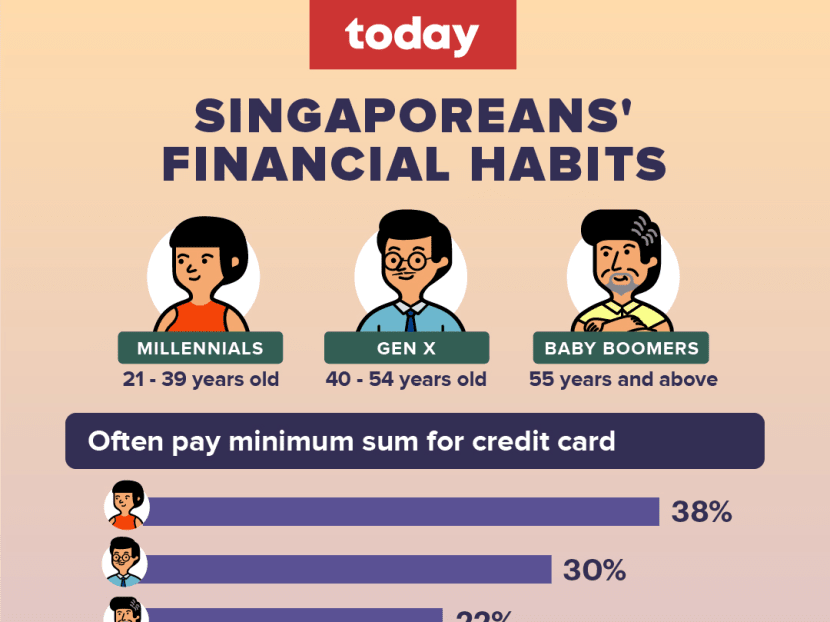

MILLENNIALS MOST WORRIED ABOUT MONEY, SPECULATE EXCESSIVELY

About half, or 49 per cent, of millennials were worried about money in the week prior to the survey

Among the various age brackets, millennials are least able to spend comfortably, with only 46 per cent able to do so

Almost four out of 10 millennials often pay only the minimum sum for their credit cards

They are more likely to borrow money from friends and relatives, with 15 per cent indicating that they often do so

39 per cent of millennial investors speculative excessively to try to make quick gains

Only 26 per cent seek professional advice when investing

The survey also found that millennials are more likely to do their own research before making financial decisions and seek online sources for information.

Millennials start investing earlier compared to older generations as their top priority is to grow their wealth, although 42 per cent do not know the best way to do so.

FEWER WOMEN INVEST, BUT CONFIDENT FEMALE INVESTORS DO BETTER THAN MEN

Only 60 per cent of women invest, compared to 75 per cent of men

Fewer than 20 per cent of women are on track with retirement planning

Almost four out of 10 women think that investing is gambling

Only 28 per cent of women feel confident and knowledgeable about investing, versus 48 per cent of men

However, the survey found that women who are confident and knowledgeable about investing tend to:

Do research and follow qualified financial representatives, with 88 per cent doing one or both, compared to 67 per cent of men

Have better investment performance if they seek expert advice and do research — 68 per cent meet or exceed their investment target, versus 59 per cent of men

The survey also found that more than half of married couples with investments, or 52 per cent, have husbands taking the sole active role when investing, versus only 31 per cent where it is wives taking this role.

Collaborative investment decisions are made by only 17 per cent of couples. In these situations, investment returns were almost double those involving couples with a single decision-maker.