My brush with the Telegram underworld, where shady characters offer up to S$7,000 to buy Singpass login details

SINGAPORE — These days it is all too common to see news stories about people getting caught for letting money launderers or other criminals use their Singpass accounts illegally.

The Singpass app seen on a mobile phone.

- Money mules selling their Singpass account information have recently been on the rise, with strangers on Telegram offering up to S$7,000 for these accounts.

- These Singpass buyers are third parties who buy accounts for higher ups to use them to open up bank accounts for money laundering, online casino gambling, and trading purposes.

- TODAY spoke to criminal lawyers who affirm that it would be harder to get away with such offences under the newly tightened laws, excuses accepted in the past would not pass muster.

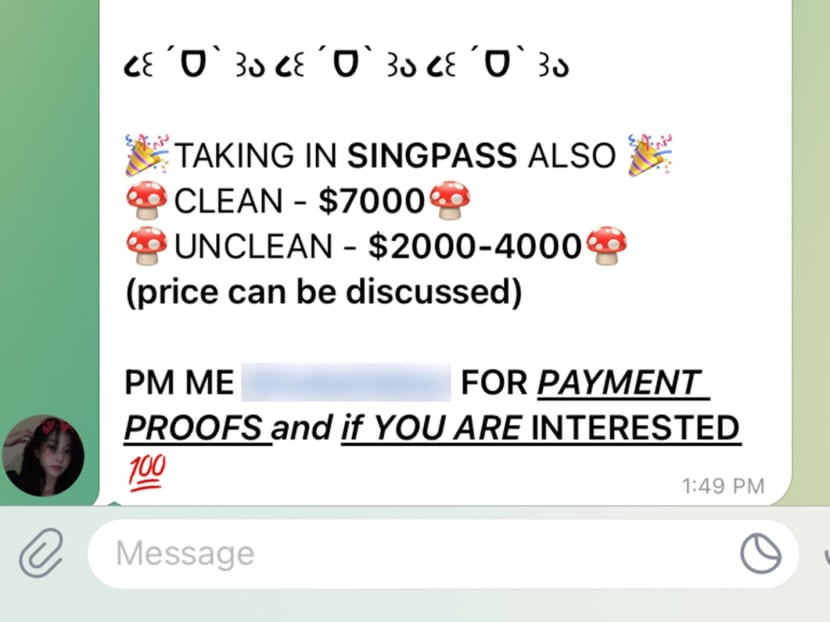

SINGAPORE — It took mere seconds. I opened up my Telegram app and after running a quick search of a few choice keywords, I was in a channel filled with advertisements offering me up to S$7,000 in exchange for my Singpass login details.

Curious, I approached some of the people who had put up these ads, asking them what the catch was.

There was none, they assured me. I kept pressing them: Isn't this illegal?

Yes, they admitted, but even then they insisted that none of the people who have transacted with them have been prosecuted, and that I should not worry about getting caught.

They even had "scripts" to share with me, that I could use if the police ever called me up for an investigation.

Rest assured, dear reader — I did not actually sell my Singpass login details to any crooks, nor was I even remotely interested in doing so. I wandered into the underbelly of Telegram in the name of journalism.

Nor was I fooled or comforted by their reassurances that these activities carry no risk.

These days it is all too common to see news stories about people getting caught for letting money launderers or other criminals use their Singpass or bank accounts illegally.

For a long time, I wondered why or how anyone would hand over their Singpass accounts to criminals, especially as it is something so personal and linked to so many services that we use in daily life.

I quickly found answers in the Telegram channel that was dedicated to quick money-making opportunities, where shady characters were offering anything between S$1,000 and S$7,000 for a Singpass account.

The amount that a seller receives largely depends on whether their account is “clean” — if they have never sold their credentials to anyone else before — or “dirty”.

After receiving the Singpass credentials, these buyers will then use the information to open up new bank accounts, and the more bank accounts that can be opened using the information, the higher the payout too.

Not going to lie, it sounded like very easy money. But obviously there is a big catch — this is highly illegal and the authorities are turning up the heat on people who sell their Singpass or bank accounts to criminals.

WHY DO THESE OPERATORS 'BUY' SINGPASS ACCOUNTS?

To find out more about how these shady characters operate, I approached six buyers and pretended I was considering making fast cash by selling my Singpass credentials.

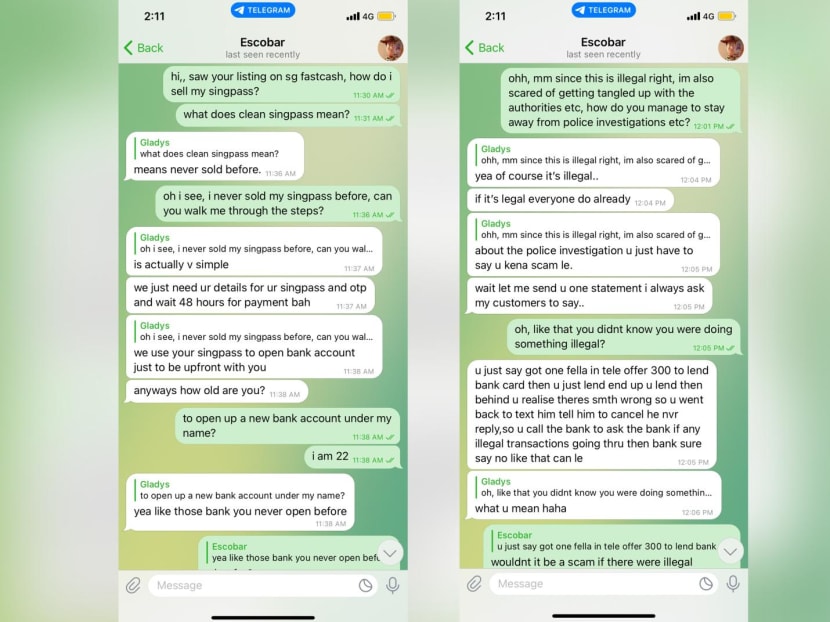

One operator said he would need my Singpass login details and the one-time-password, and he would pay me 48 hours later.

Another said he also wanted photos of the front and back of my identification card, and that he would pay me in two to three days, after waiting for approval from banks to open up new accounts using my identity.

I asked: What did they want these bank accounts for?

The answers ranged from the vague to the brazen: Some said they would be used for "investments" or "trading", while others said the bank accounts would be used by online casino gambling dens. One straight up told me he needed these accounts for money laundering.

They also reassured me that my Singpass would be "returned" to me after they had received the banks' approval for new accounts, and so I could still use my Singpass account for my own purposes afterwards.

THE BUYERS SAID I COULD EASILY EVADE THE LAW...

I also asked these buyers how long they had been in this "business" and how they managed to evade the law.

Most told me they had been doing this for up to three years and had lost count of the number of Singpass accounts they have bought from others, and that most of these sellers have not been charged for criminal activity even after being investigated by authorities.

One brushed off my questions about the risks entailed in these transactions, saying that among his clients who have been called up by the police, they "just went for investigation then end up nothing, police will just send letter saying ok blah blah".

Another assured me: "So far my customers all clear."

All of the six buyers I spoke to insisted that selling my Singpass account to them would entail “no risk” on my part, as they could provide their customers with scripts they could use to slip past the law, in the event that they are caught and investigated by the police.

"Let me send you one statement I always ask my customers to say," one of them told me. "You just say got one fella offer me $300 to lend bank card, end up you lend, then you realised there's something wrong so you went back to get him to cancel (but) he never reply."

Others told me that I could tell the police my account got hacked when I had clicked on phishing links, or that I did not know how I “kena scammed” (got scammed).

They also claimed that if I simply acted stupid and pretended not to know that my Singpass account was going to be used for criminal activity when I handed over my login details, I would not face any penalties even if caught.

Eventually, I revealed to all of these buyers that I was a journalist, and asked if they were willing to be formally interviewed for this story. None of them agreed. In fact, several cursed at me, and two threatened me, with one saying: "One day or another, u will think back and be sorry."

...BUT LAWYERS SAID IT IS NOT THAT EASY

While the tips and tricks these buyers offered me might have worked in the past, lawyers said that they are unlikely to save me anymore, as the laws were recently tightened to clamp down on people who abet criminal activity by giving up their Singpass or bank login details.

In May, Parliament passed amendments to the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act (CDSA) and the Computer Misuse Act, precisely to clamp down harder on money mules and those who sell Singpass accounts. The amendments have not taken effect.

Under the amended CDSA, a person can be liable for money laundering if they went ahead with transactions (such as selling their Singpass login details) and did not take “reasonable steps” to find out what exactly these transactions were for, despite suspicious indicators which would be noticeable by an ordinary person.

In short, the amendments target people who sell their bank accounts or Singpass login details to shady characters and later claim that they do not know these accounts would be used for criminal acts.

“The standard of proof makes it such that you cannot rely on your ignorance anymore," said Mr James Gomez Jovian Messiah, a criminal lawyer with Edmond Pereira Law Corporation.

And while it is not necessary for an accused person to know the specific nature of the offence which they are facilitating, "it is clear that contrived, coached excuses will not shield accused persons from potential liability” anymore, said Mr Ng Yuan Siang, a criminal lawyer with Eugene Thuraisingam LLP.

Despite this, the people offering me fast cash for my Singpass account seemed very confident they and their clients could continue slipping through legal loopholes.

One operator said that I would be untraceable as they could send me a new phone number and email address to use in my Singpass account after they were done opening bank accounts with my original information.

Another told me that “Telegram history is untraceable” and that I could simply tell authorities that I “did not receive any monetary reward” from giving my Singpass, to evade the law.

Mr Azri Imran Tan, a criminal defence lawyer with IRB Law, noted that it is open to every accused person to try to lie, deceive, and/or mislead the authorities in the course of investigations.

"However, in my experience as a former Deputy Public Prosecutor, the police conduct extremely robust investigations, which often involves the use of technology that can aid in the detection of offences and uncover damning evidence, even where accused persons lie or try to cover up their wrongdoing," he added.

Under the Criminal Procedure Code, the authorities are empowered to seize and access a person's electronic devices during the course of investigations.

In cases Mr Tan has dealt with, the authorities have been able to use forensic technology to retrieve messages, even ones that were deleted, from messaging apps.

So it is not at all true what the Singpass account buyers said, that the police would never be able to catch them, or me.

A quick scan of the news shows that people do get caught. More than 19,000 money mules were investigated by the police between 2020 and 2022, although fewer than 250 cases were eventually prosecuted. The recent tightening of the laws is aimed at increasing the prosecution rate.

Just last month, seven men were arrested for allegedly selling or renting bank accounts to criminal syndicates via Facebook and Telegram.

In May, a 48-year-old woman pleaded guilty to a single charge of disclosing her Singpass details to a friend for S$1,000 to help set up a company used to launder S$562,000 in criminal proceeds and was sentenced to three months' jail.

And in April, a woman and her son were jailed for agreeing to let strangers take over control of their bank accounts in exchange for money, which ended up helping a transnational crime syndicate launder at least S$1,595,000 in criminal proceeds from scams.